Does Leasing An Apartment Build Credit

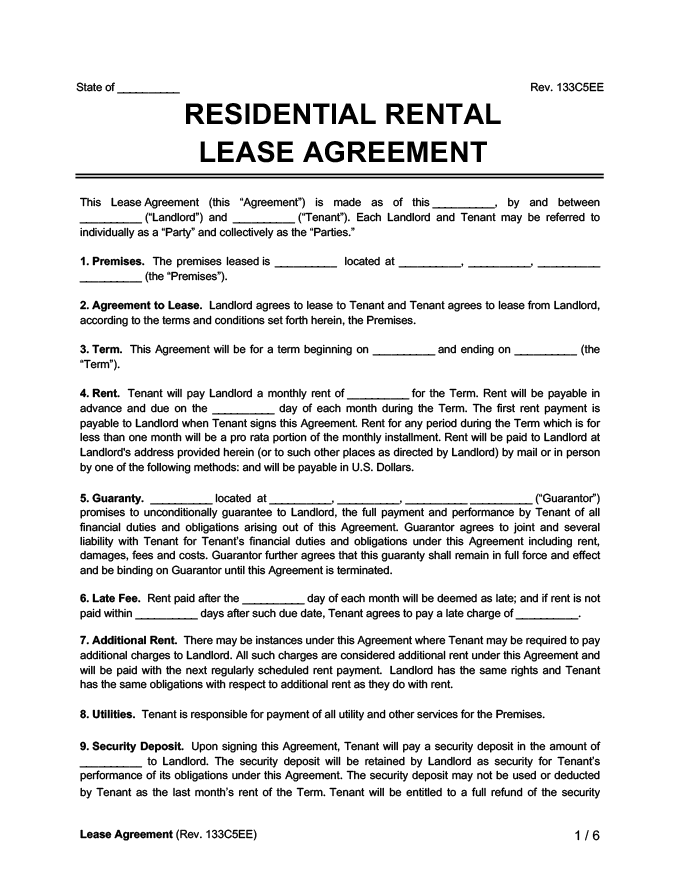

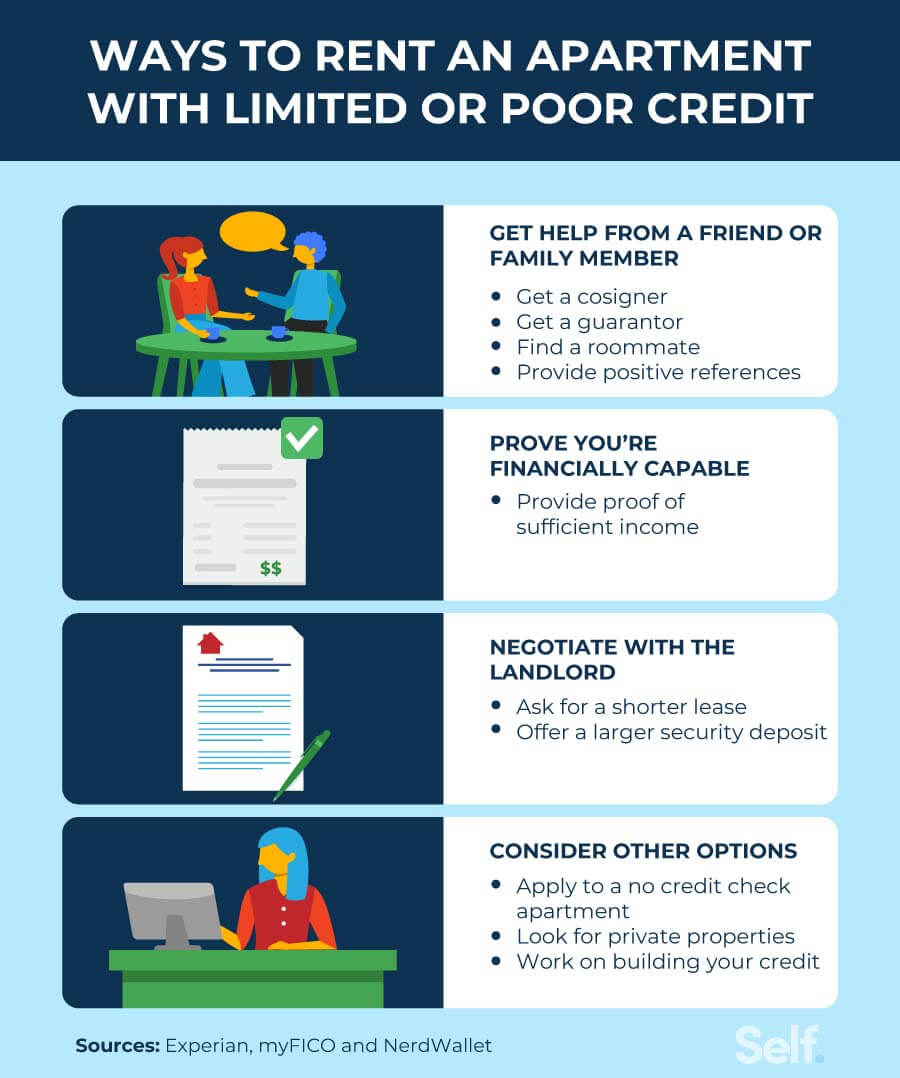

Does Leasing An Apartment Build Credit - But negative credit history or no credit. Simply paying your rent will not help you build credit, unless you pay with your credit card. By itself, leasing an apartment doesn’t necessarily help your credit score. Does renting an apartment build credit? There are services you can use to add your rent to your credit score to boost your score, but only if the apartment management company will participate. Boost your credit score let's say you, like the image above, have a credit score of 575. Based on the question of the day, you're more likely to secure an. Having good credit can help you rent an apartment, and paying rent on time can help you build good credit. Does paying rent build credit? Renting an apartment can help you build your credit if your landlord reports your rent payments to one or more of the three main. Renting an apartment can help you build your credit if your landlord reports your rent payments to one or more of the three main. Having good credit can help you rent an apartment, and paying rent on time can help you build good credit. Your credit score is made up of five key aspects of your credit report: By itself, leasing an apartment doesn’t necessarily help your credit score. There are a couple companies who will. Learn more about when your rent may be reported to credit bureaus. Simply paying your rent will not help you build credit, unless you pay with your credit card. Leasing an apartment has benefits but those do not include a positive effect on your credit. This is important if you only have one other type of credit, such as. You may be able to build credit by paying your rent on time, but it’s not as common as you might think. If you don’t pay your rent on time, it is becoming more common for. Does paying rent build credit? But negative credit history or no credit. However, by paying your rent with a credit card you might run the risk of high. That doesn't mean that leasing an apartment never affects. Your credit score is made up of five key aspects of your credit report: A car lease is adding an installment loan to your credit mix. Renting an apartment can help you build your credit if your landlord reports your rent payments to one or more of the three main. Based on the question of the day, you're more likely. Having good credit can help you rent an apartment, and paying rent on time can help you build good credit. This may help you improve your credit scores in the long run. To learn more, sign up for a free. Renting an apartment can help you build your credit if your landlord reports your rent payments to one or more. But negative credit history or no credit. If you don’t pay your rent on time, it is becoming more common for. Paying your rent on time usually doesn't increase your credit score the way that a mortgage in good standing might. This may help you improve your credit scores in the long run. Simply paying your rent will not help. Paying rent can be a great way for active renters to build a positive credit history. That doesn't mean that leasing an apartment never affects. Based on the question of the day, you're more likely to secure an. That’s because fico scores don’t include rental payment. There are services you can use to add your rent to your credit score. Simply paying your rent will not help you build credit, unless you pay with your credit card. If you don’t pay your rent on time, it is becoming more common for. There are services you can use to add your rent to your credit score to boost your score, but only if the apartment management company will participate. Renting an. Positive credit history may make it easier for you to lease an apartment, and it might save you money on your security deposit too. This may help you improve your credit scores in the long run. Renting an apartment can help you build your credit if your landlord reports your rent payments to one or more of the three main.. You may be able to build credit by paying your rent on time, but it’s not as common as you might think. A car lease is adding an installment loan to your credit mix. Simply paying your rent will not help you build credit, unless you pay with your credit card. That’s because fico scores don’t include rental payment. Does. Leasing an apartment has benefits but those do not include a positive effect on your credit. Does paying rent build credit? That’s because fico scores don’t include rental payment. Paying your rent on time usually doesn't increase your credit score the way that a mortgage in good standing might. This may help you improve your credit scores in the long. That’s because fico scores don’t include rental payment. There are a couple companies who will. You may be able to build credit by paying your rent on time, but it’s not as common as you might think. Leasing an apartment has benefits but those do not include a positive effect on your credit. Does paying rent build credit? Does paying rent build credit? There are services you can use to add your rent to your credit score to boost your score, but only if the apartment management company will participate. A car lease is adding an installment loan to your credit mix. Paying rent can be a great way for active renters to build a positive credit history. You may be able to build credit by paying your rent on time, but it’s not as common as you might think. Renting an apartment can help you build your credit if your landlord reports your rent payments to one or more of the three main. But negative credit history or no credit. Your credit score is made up of five key aspects of your credit report: Does renting an apartment build credit? However, by paying your rent with a credit card you might run the risk of high. If you don’t pay your rent on time, it is becoming more common for. Having good credit can help you rent an apartment, and paying rent on time can help you build good credit. There are a couple companies who will. Paying your rent on time usually doesn't increase your credit score the way that a mortgage in good standing might. Positive credit history may make it easier for you to lease an apartment, and it might save you money on your security deposit too. The answer is yes, but it requires intentional action.Housing Guide The Basics of Interpreting and Signing a Lease Agreement

10 Ways to Rent an Apartment with No Credit History Self. Credit Builder.

PPT Syndication Leasing Structures PowerPoint Presentation, free

RenttoOwn Homes How The Process Works Lease To Own Home Agreement

Free Apartment Lease Template & FAQs Rocket Lawyer

Does Renting An Apartment Build Credit? MoneyLion

Guide Renting Your First Apartment & Building Credit

Understanding Letters of Credit A Commercial Leasing Guide Occupier

How to Start a Credit Repair Business in 14 Steps (InDepth Guide)

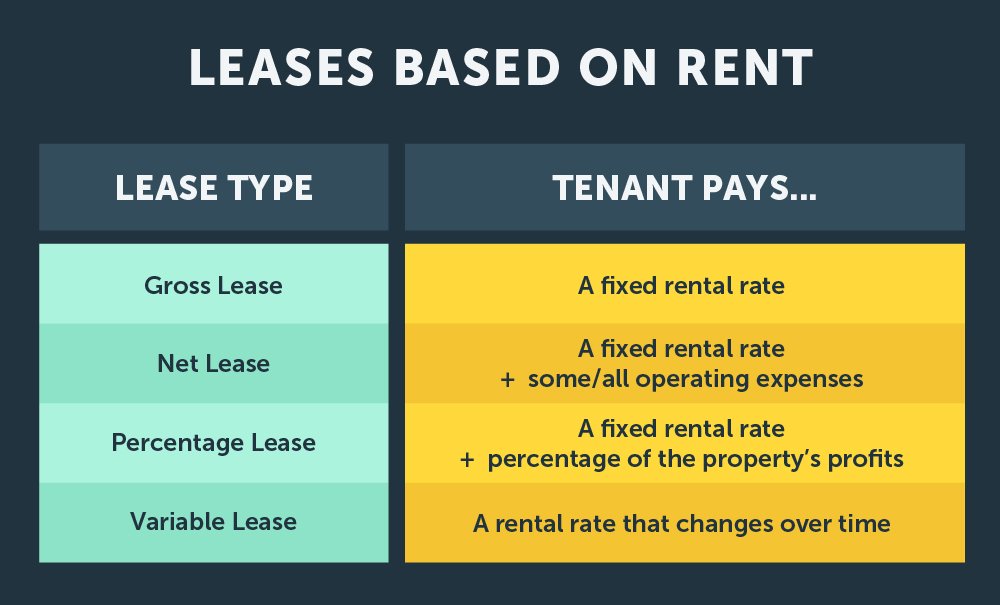

Which Type of Credit Is Used to Lease a Building DesiraehasFisher

This May Help You Improve Your Credit Scores In The Long Run.

To Learn More, Sign Up For A Free.

Boost Your Credit Score Let's Say You, Like The Image Above, Have A Credit Score Of 575.

There’s No Universal Credit Score Requirement For Renting An Apartment.

Related Post:

:max_bytes(150000):strip_icc()/rent-to-own-homes-final-819c3b46e7094aa4b78f9ad90c05e2ad.png)