Does Leasing Build Credit

Does Leasing Build Credit - Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. The good news is that leasing a car can build your credit score just like financing. A lease will be reported as an. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score and even help you rebuild your credit. When considering whether leasing a car can build credit, it's important to understand how the payments are reported to credit bureaus. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. To get credit, you need to have established credit. Financing a car can help you build credit, as long as you manage the loan responsibly and the loan’s activity is reported to one of the major credit bureaus. Leasing a car can be a more economical option for many, but can it help improve your credit score or build your credit? Yes, leasing a car does impact your credit, and in turn, your credit score. Most leasing companies report the monthly lease. Leasing a car can help you build credit just as an auto loan can. On your credit report, it will look like the creditor. Learn more about how leasing a car can affect your credit history. When your car lease is paid off, it does affect your credit score by being reported to the credit bureaus as a closed account. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Leasing a car could also help you build your credit if you make your payments on time. Does leasing build your credit? Leasing a car gives you the opportunity to build credit. You can gain credit by taking out an auto lease. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. Leasing a car could also help you build your credit if you make your payments on time. Most leasing companies report the monthly lease. However, while auto loans are accessible to consumers across the credit spectrum, it can. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Leasing a car could also help you build your credit if you make your payments on time. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar.. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. The good news is that leasing a car. Leasing a car can be a more economical option for many, but can it help improve your credit score or build your credit? To get credit, you need to have established credit. Yes, leasing can affect your credit score, since activity is usually reported to the major credit bureaus in a very similar way to an auto loan. If your. A lease will be reported as an. Leasing a car can help you build credit just as an auto loan can. To get credit, you need to have established credit. You can gain credit by taking out an auto lease. A reputable credit repair specialist will tell you that leasing a car can. Does leasing build your credit? Leasing a car could also help you build your credit if you make your payments on time. On your credit report, it will look like the creditor. Most leasing companies report the monthly lease. Learn more about how leasing a car can affect your credit history. Learn more about how leasing a car can affect your credit history. Financing a car can help you build credit, as long as you manage the loan responsibly and the loan’s activity is reported to one of the major credit bureaus. The good news is that leasing a car can build your credit score just like financing. You can gain. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. Your payment history has a big impact on your credit scores. A reputable credit repair specialist will tell you that leasing a car can. Yes, leasing can affect your credit. Your payment history is the most important factor in determining your credit score, so if. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Leasing a car gives you the opportunity to build credit. Yes, leasing a car does impact your credit, and in turn, your credit score. To anyone asking, ”does leasing a car build. Learn more about how leasing a car can affect your credit history. Your payment history has a big impact on your credit scores. Leasing a car gives you the opportunity to build credit. A lease will be reported as an. The good news is that leasing a car can build your credit score just like financing. A lease will be reported as an. Your payment history is the most important factor in determining your credit score, so if. The good news is that leasing a car can build your credit score just like financing. Yes, leasing a car does impact your credit, and in turn, your credit score. Financing a car can help you build credit, as long as you manage the loan responsibly and the loan’s activity is reported to one of the major credit bureaus. To anyone asking, ”does leasing a car build credit?” the answer is that leasing a vehicle can positively impact your credit score and even help you rebuild your credit. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. When your car lease is paid off, it does affect your credit score by being reported to the credit bureaus as a closed account. Most leasing companies report the monthly lease. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. Yes, leasing can affect your credit score, since activity is usually reported to the major credit bureaus in a very similar way to an auto loan. When considering whether leasing a car can build credit, it's important to understand how the payments are reported to credit bureaus. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Leasing a car gives you the opportunity to build credit. It requires you to make monthly payments, expanding your payment history. Leasing a car could also help you build your credit if you make your payments on time.Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Chase

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

How do I build credit with an EIN? Leia aqui Can I build credit with

Does Leasing Furniture Build Credit?

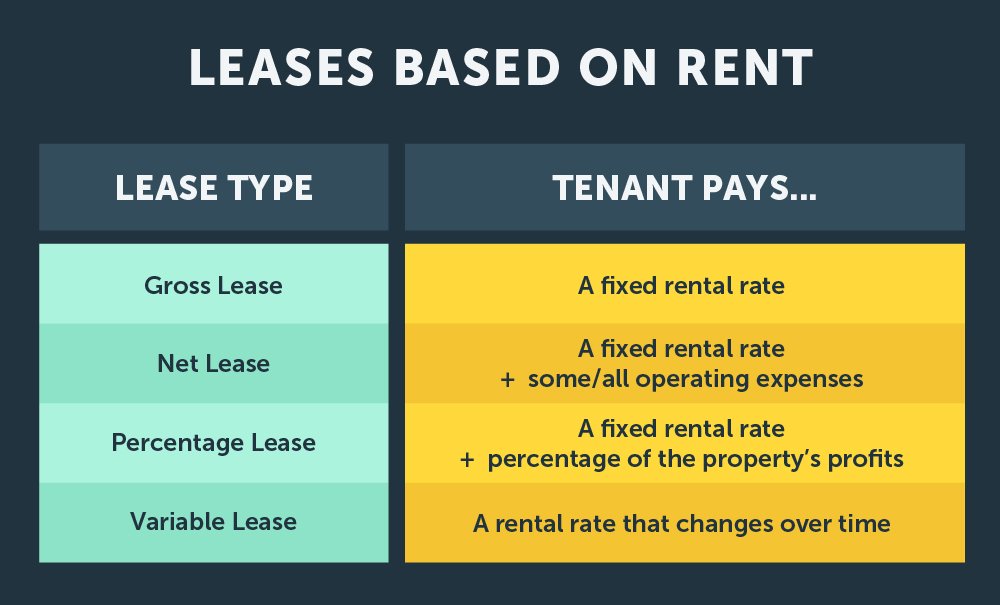

Which Type of Credit Is Used to Lease a Building DesiraehasFisher

Can a Personal Loan Build Your Credit? How Borrowing Can Boost Your

Does Leasing Furniture Build Credit? An Authentic Guide

Does Leasing a Car Build Credit? Credello

If Your Leasing Company Reports To All.

Learn More About How Leasing A Car Can Affect Your Credit History.

To Get Credit, You Need To Have Established Credit.

Leasing A Car Can Help You Build Credit Just As An Auto Loan Can.

Related Post: