Does Pay In 4 Build Credit

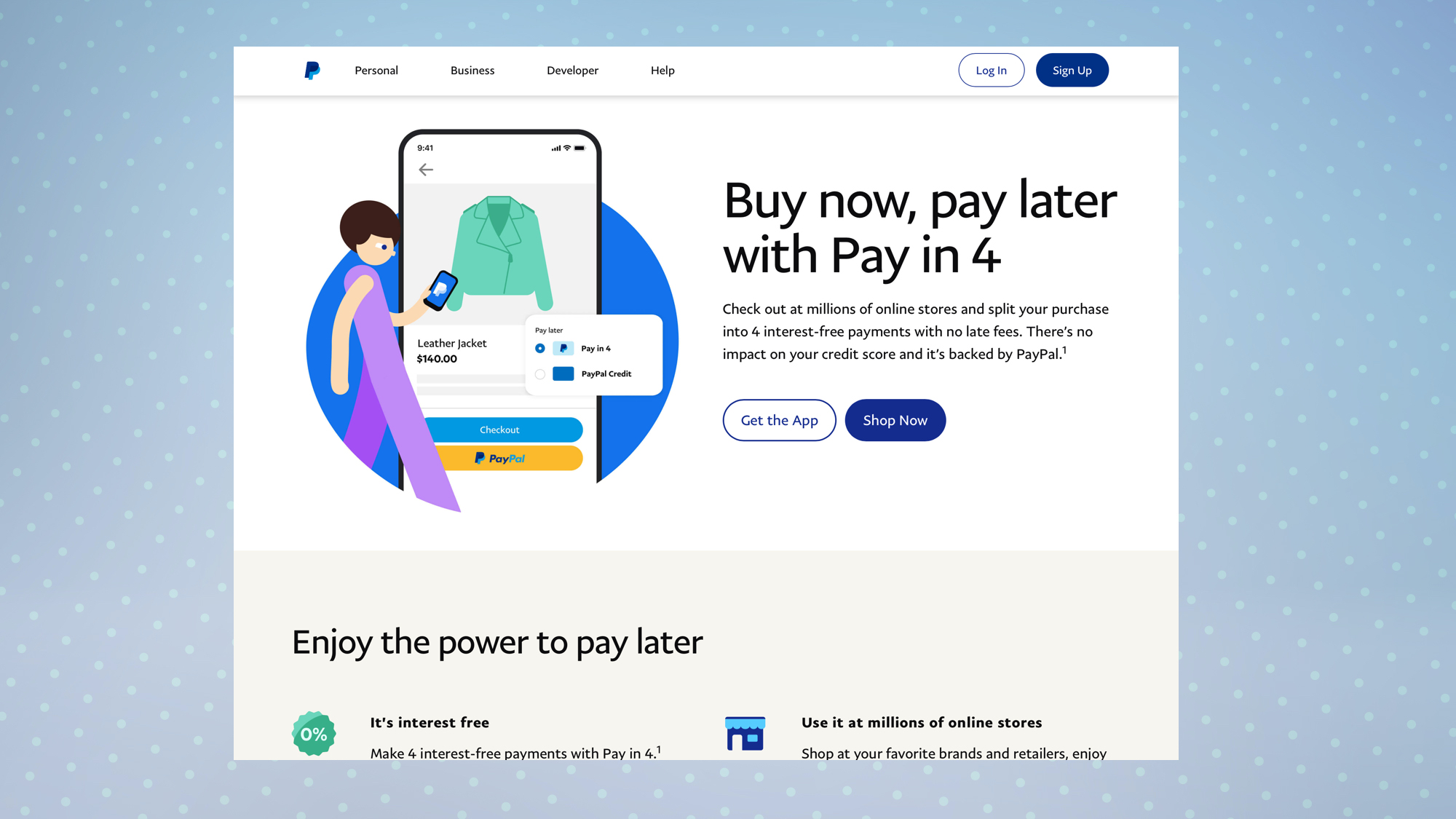

Does Pay In 4 Build Credit - Find out if you’re approved in seconds. Paypal pay in 4 itself does not affect your credit score as it doesn’t involve a traditional credit check. Paypal pay in 4 lets you split up your purchase into four equal payments with no interest or fees. I'm using this service from paypal for this sole purpose as to hopefully build credit for myself. Selected applicants may qualify for credit toward annual leave accrual, based on prior [work experience] or military service experience. Keeping your credit utilization ratio low raises your credit score, helping you qualify for some of the best credit cards on the market. Learn more on how you can pay later with this debit card feature. It’s designed to be a convenient payment option without delving into. Paypal pay in 4 is the online payment system’s buy now, pay later program. You'll pay less in interest Now, let’s answer the main question: Paypal pay in 4 generally does not affect your credit score. Receiving service credit or earning. And no, you don't have to go into debt, and you don't have to. Applying for a paypal pay in 4 loan will not impact your credit score. Paypal’s pay in 4 is a consumer financing option, not a traditional credit product. You'll pay less in interest Preapproval isn't guaranteed & amount may change. Like many “buy now, pay later” companies, pay in 4 splits your loan amount into four equal installments. Paypal pay in 4 is the online payment system’s buy now, pay later program. Paypal pay in 4 lets you split up your purchase into four equal payments with no interest or fees. Does using pay in 4 build credit? Paypal pay in 4 is the online payment system’s buy now, pay later program. And no, you don't have to go into debt, and you don't have to. Paypal’s pay in 4 program allows. Selected applicants may qualify for credit toward annual leave accrual, based on prior [work experience] or military service experience. Considering it checks your credit in order for you to be able to do it, it makes me think it might build credit in a slight way. The company performs a soft credit check during the application. Paypal pay in 4. Find out if you’re approved in seconds. You'll pay less in interest No impact on credit score. I'm using this service from paypal for this sole purpose as to hopefully build credit for myself. Does using pay in 4 build credit? Receiving service credit or earning. Preapproval isn't guaranteed & amount may change. Pay in 4 evaluates applications based on provided info & paypal usage history. Paypal’s pay in 4 is a consumer financing option, not a traditional credit product. Paypal pay in 4 itself does not affect your credit score as it doesn’t involve a traditional credit check. If it does it's probably not a lot, but still cool if. Does paypal pay in 4 affect your credit? Best net 30 vendors for building business credit. It’s designed to be a convenient payment option without delving into. Paypal’s pay in 4 is a consumer financing option, not a traditional credit product. Best net 30 vendors for building business credit. You’ll need to pay the first installment, or a down payment, immediately. If it does it's probably not a lot, but still cool if. Paypal’s pay in 4 is a consumer financing option, not a traditional credit product. Find out if you’re approved in seconds. Best net 30 vendors for building business credit. Paypal pay in 4 itself does not affect your credit score as it doesn’t involve a traditional credit check. With chase pay in 4℠, split eligible debit card purchases and pay in 4 equal payments, interest free. Paypal pay in 4 lets you split up your purchase into four equal payments with. You’ll need to pay the first installment, or a down payment, immediately. Like many “buy now, pay later” companies, pay in 4 splits your loan amount into four equal installments. And no, you don't have to go into debt, and you don't have to. You'll pay less in interest Learn how it works and whether you should consider using it. If it does it's probably not a lot, but still cool if. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. Keeping your credit utilization ratio low raises your credit score, helping you qualify for some of the best credit cards on the market. Does using pay in 4 build credit?. Learn more on how you can pay later with this debit card feature. Considering it checks your credit in order for you to be able to do it, it makes me think it might build credit in a slight way. With chase pay in 4℠, split eligible debit card purchases and pay in 4 equal payments, interest free. And no,. Does using pay in 4 build credit? Paypal’s pay in 4 is a consumer financing option, not a traditional credit product. I just need some confirmation for it as there doesn't seem to be a clear answer for. Preapproval isn't guaranteed & amount may change. Then pick the plan that works best for. No impact on credit score. The company performs a soft credit check during the application. And no, you don't have to go into debt, and you don't have to. It’s designed to be a convenient payment option without delving into. Learn how it works and whether you should consider using it. Applying for a paypal pay in 4 loan will not impact your credit score. Selected applicants may qualify for credit toward annual leave accrual, based on prior [work experience] or military service experience. Like many “buy now, pay later” companies, pay in 4 splits your loan amount into four equal installments. You’ll need to pay the first installment, or a down payment, immediately. Find out if you’re approved in seconds. Paypal pay in 4 is the online payment system’s buy now, pay later program.PayPal Pay in 4 Retravision

Collage paypal pay in 4 venmo

PayPal's Pay in 4 Feature Tips and Tricks HQ

PayPal Pay In 4 Right Merchant Maverick

PayPal Pay in 4 Reviews Pros and Cons in 2025 The Money Manual

What is PayPal Pay in 4? A Review and Guide for 2023 5 Incredible

What Is PayPal Pay In 4? Merchant Maverick

What is PayPal Pay in 4? Tom's Guide

PayPal Pay in 4 Reviews Pros and Cons in 2025 The Money Manual

PAYPAL PAY IN 4, BUY NOW PAY LATER, CREDIT REQUIREMENTS, PAYPAL STORES

Paypal Pay In 4 Is Paypal’s Buy Now, Pay Later (Bnpl).

I'm Using This Service From Paypal For This Sole Purpose As To Hopefully Build Credit For Myself.

Best Net 30 Vendors For Building Business Credit.

Paypal Pay In 4 Lets You Split Up Your Purchase Into Four Equal Payments With No Interest Or Fees.

Related Post: