Does Paying A Car Loan Build Credit

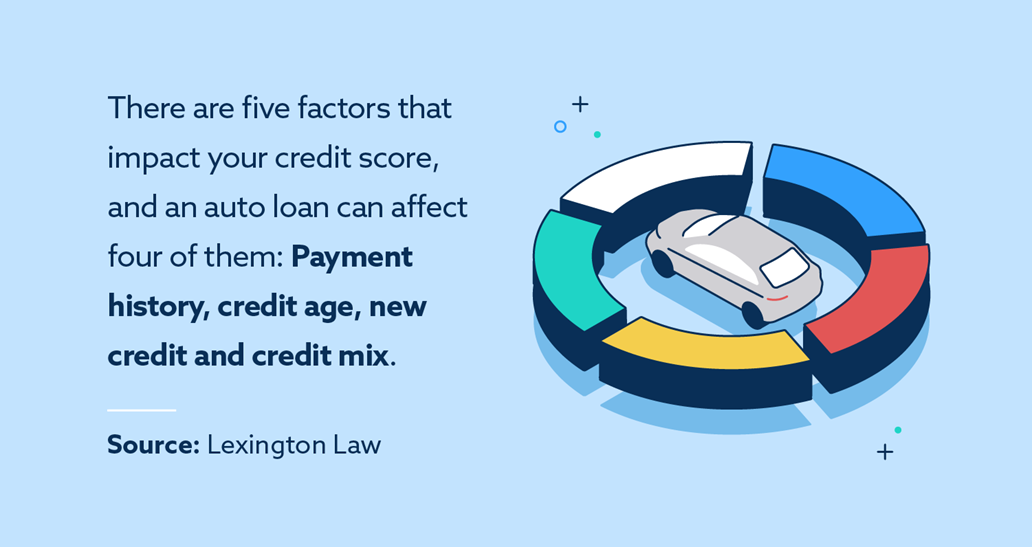

Does Paying A Car Loan Build Credit - But you’re also wondering, “does paying a car loan build credit?” the answer is a resounding yes, but there’s more to it than just making your payments on time. Do car payments build credit? Like any form of credit, an auto loan offers both. Military borrowers pay higher rates over longer terms: What credit score you need to. What is a credit builder loan and how does it work?. In fact, there’s no real minimum credit score needed for an auto loan. Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment. Does financing a car build credit? People with poor credit scores — or no credit history at all — can and do get qualified for auto loans. Otherwise, you risk repeating the cycle, even after you. What is a credit builder loan and how does it work?. Taking out a car loan can affect your credit in several ways. One of the primary factors that determines your credit score is your payment history. Military borrowers pay higher rates over longer terms: Leasing a car and credit. As mentioned previously, a hard inquiry appears on your report every time a lender. Our experts recently evaluated the top 5 credit repair companies. Here are our best tips to build credit for a car loan so you can save more for other things in your life. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. Things to consider before financing. How financing affects your credit score. New inquiries:the first ding to your credit rating happens before you even open a credit account. You can actually build your credit with a car loan. Here are our best tips to build credit for a car loan so you can save more for other things in your life. What credit score you need to. When you sign up for a new car loan, it may probably hurt your credit score at first. Things to consider before financing. You can actually build your credit with a car loan. The credit builder plus membership costs $19.99 per month, plus a separate loan payment if you have an active credit builder. Your credit score shows how well you can manage the money you’ve borrowed. New inquiries:the first ding to your credit rating happens before you even open a credit account. The answer is yes—taking out a car loan can positively affect your credit score, but only if you manage it responsibly. The main difference between the two is that paying off. Paying off a lease doesn't automatically make you a vehicle owner. Need help fixing your credit? But that negative impact may be only temporary. Read more to understand how car loans affect your credit score. Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment. Our experts recently evaluated the top 5 credit repair companies. In fact, there’s no real minimum credit score needed for an auto loan. Done correctly, auto loans can help build your credit in the long term. How financing affects your credit score. What credit score you need to. Paying off a lease doesn't automatically make you a vehicle owner. What is a credit builder loan and how does it work?. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. When you sign up for a new car loan, it may probably hurt your credit score at first. A car loan does build. As mentioned previously, a hard inquiry appears on your report every time a lender. New york fed consumer credit panel/equifax, using philadelphia fed auto loan tradeline data. When you sign up for a new car loan, it may probably hurt your credit score at first. Military borrowers pay higher rates over longer terms: One of the primary factors that determines. If your credit utilization ratio is above that, paying off revolving balances can reinvigorate your credit score. What credit score you need to. New inquiries:the first ding to your credit rating happens before you even open a credit account. When you sign up for a new car loan, it may probably hurt your credit score at first. Our experts recently. The most important step is to understand how you got into debt in the first place. What credit score do you need to buy a car? A car loan does build credit, only if you make the monthly payments on time. But you’re also wondering, “does paying a car loan build credit?” the answer is a resounding yes, but there’s. People with poor credit scores — or no credit history at all — can and do get qualified for auto loans. The credit builder plus membership costs $19.99 per month, plus a separate loan payment if you have an active credit builder loan. What credit score you need to. If you don’t borrow anything to pay for your new car. Taking out a loan and paying it back on time and in full can do wonders for. Discover the impact of financing a car on credit building. Your score will increase as it satisfies all of the factors the contribute to a credit score, adding to your payment. Here are our best tips to build credit for a car loan so you can save more for other things in your life. Benefits of financing a car. People with poor credit scores — or no credit history at all — can and do get qualified for auto loans. Read more to understand how car loans affect your credit score. Taking out a car loan can affect your credit in several ways. The answer is yes—taking out a car loan can positively affect your credit score, but only if you manage it responsibly. Military borrowers pay higher rates over longer terms: The credit builder plus membership costs $19.99 per month, plus a separate loan payment if you have an active credit builder loan. One of the primary factors that determines your credit score is your payment history. Our experts recently evaluated the top 5 credit repair companies. The good news is that a car loan can help you boost your credit in the long term. Here’s what happens to your credit when you get a new car loan: The main difference between the two is that paying off a car loan gives you ownership of the vehicle.Does a Car Loan Build Your Credit Score? Lexington Law

Does a Car Loan Build Credit?

Car Loans 101 How To Calculate Your Monthly Payment in Seconds Li

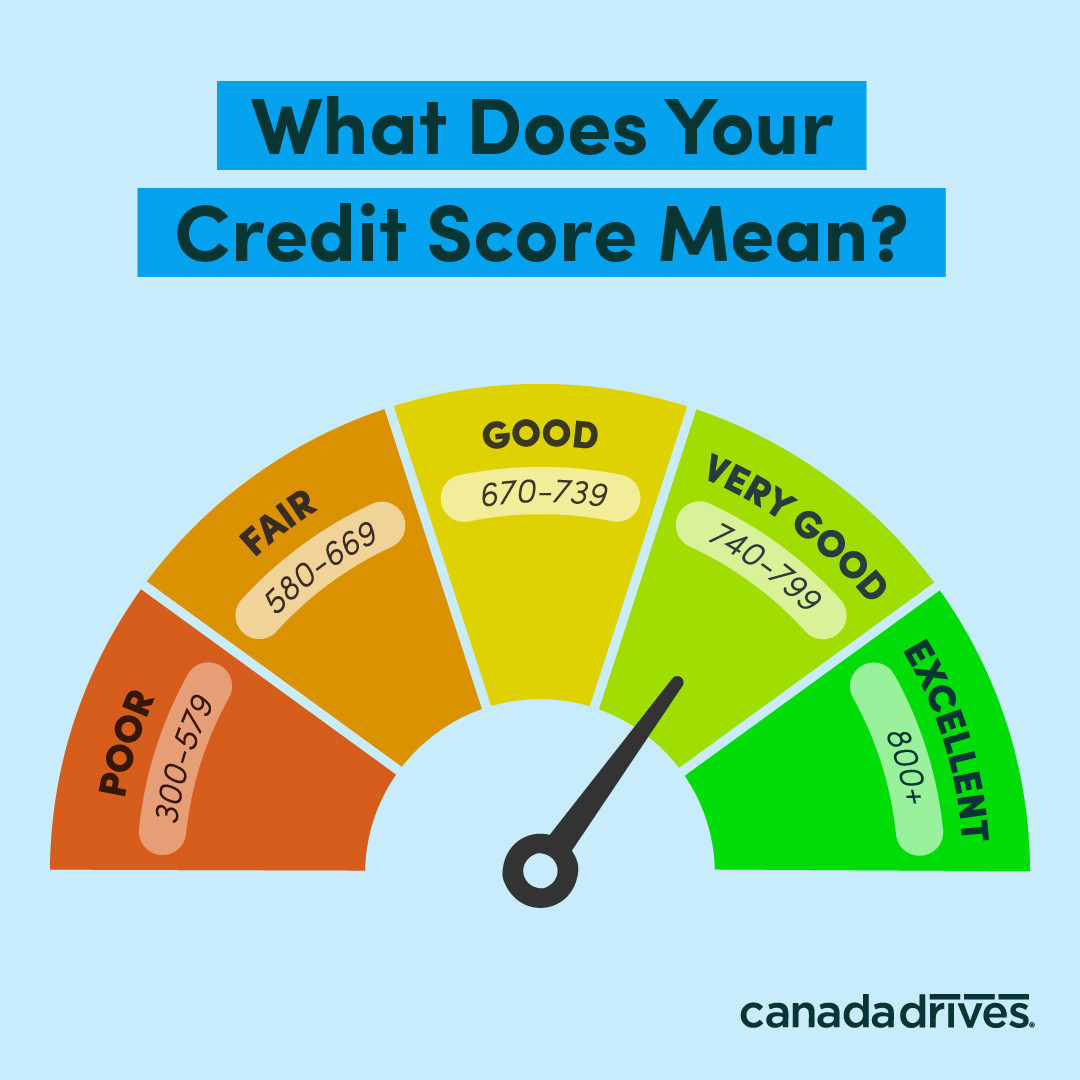

What Credit Score Is Used for Car Loans? Self. Credit Builder.

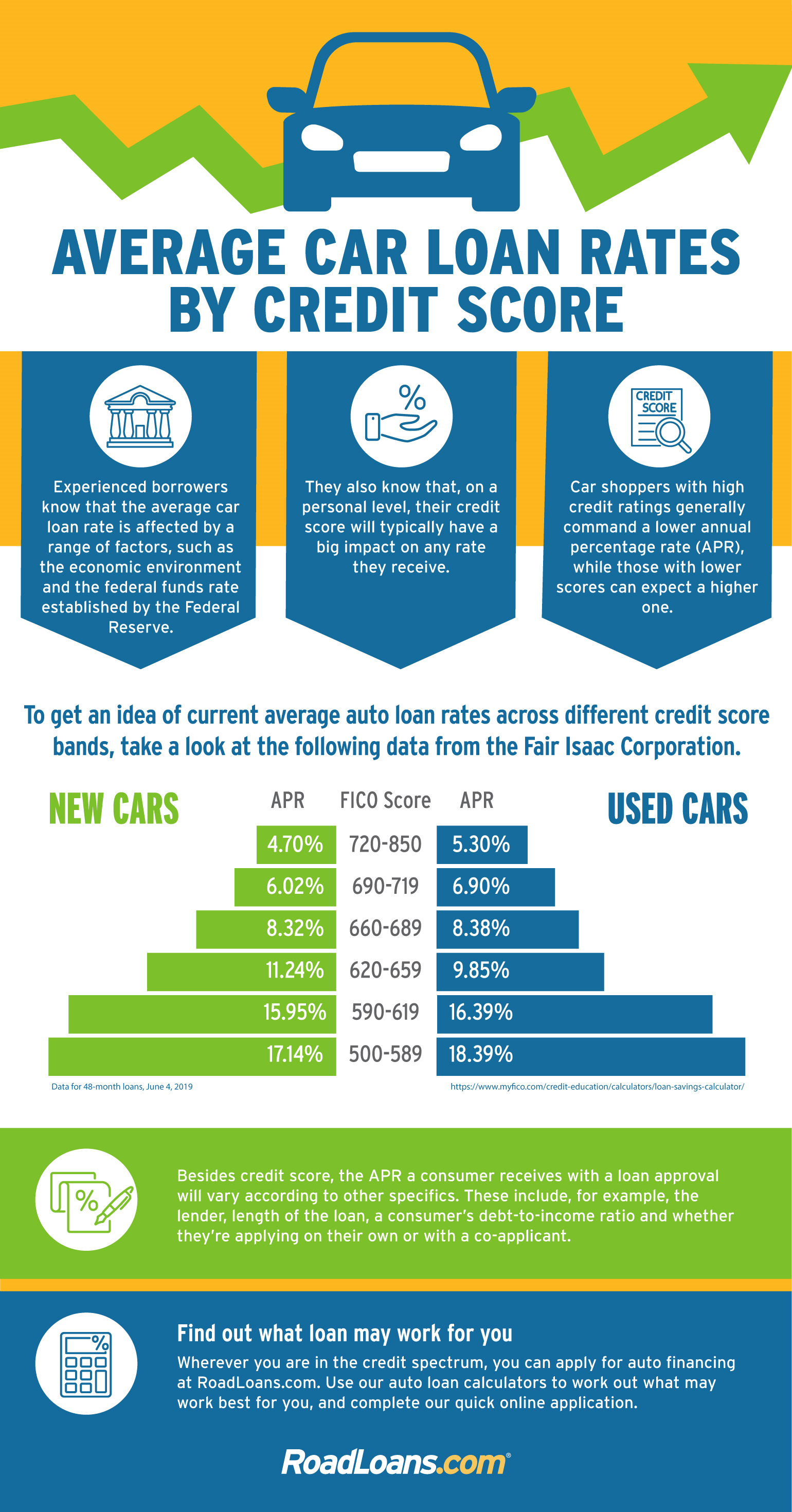

Check out average auto loan rates according to credit score RoadLoans

Self News and Blog

Understanding The Pros And Cons Of Building Credit With An Auto Loan

Does Financing a Car Build Credit? Voss Honda

Average Car Loan Interest Rates by Credit Score (June 2023)

Does a Car Loan Build Your Credit Score? Lexington Law

Like Any Form Of Credit, An Auto Loan Offers Both.

Need Help Fixing Your Credit?

A Car Loan Can Help You Rebuild Your Credit Because It Adds Weight To Certain Factors In Your Credit.

If Your Credit Utilization Ratio Is Above That, Paying Off Revolving Balances Can Reinvigorate Your Credit Score.

Related Post: