Does Paying A Car Note Build Credit

Does Paying A Car Note Build Credit - You can check your credit score online through the main credit bureaus. Financing a car can help you to improve your credit score, but there’s no guarantee. A car loan does build credit, only if you make the monthly payments on time. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. Ideally, you’ll want a credit score of 660 or higher to get a favorable interest rate, but did you know that having a car loan may also help improve your credit? If you need a new car, leasing can be a viable option. Whether to free up your. You can actually build your credit with a car loan. Does financing a car build credit? So if you don’t already have an installment loan, adding a car loan can raise your credit score. A car loan has two common effects on credit: You can actually build your credit with a car loan. To find out if paying off your loan will boost your score, we’ll have to take. Are you thinking about paying off your car loan early? Yes, financing a car with bad credit can still contribute to building credit. And no, you don't have to go into debt, and you don't have to. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. Paying off your car loan can lower your credit score, but the effects are usually temporary. Other lines of credit you have. Ideally, you’ll want a credit score of 660 or higher to get a favorable interest rate, but did you know that having a car loan may also help improve your credit? Yes, financing a car with bad credit can still contribute to building credit. Looking to help your credit and in the market for a car? Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in.. Looking to help your credit and in the market for a car? Read more to understand how car loans affect your credit score. A car loan does build credit, only if you make the monthly payments on time. Financing a car can help you to improve your credit score, but there’s no guarantee. A car loan has two common effects. Yes, financing a car with bad credit can still contribute to building credit. Ultimately, a car loan does not build credit; So if you don’t already have an installment loan, adding a car loan can raise your credit score. Read more to understand how car loans affect your credit score. Do car payments build credit? Generally speaking, paying off debts will usually improve your credit score. Looking to help your credit and in the market for a car? If you need a new car, leasing can be a viable option. Ideally, you’ll want a credit score of 660 or higher to get a favorable interest rate, but did you know that having a car loan. To find out if paying off your loan will boost your score, we’ll have to take. You can actually build your credit with a car loan. Ideally, you’ll want a credit score of 660 or higher to get a favorable interest rate, but did you know that having a car loan may also help improve your credit? However, you can. Other lines of credit you have. However, individuals with lower credit scores might face higher interest rates. Ultimately, a car loan does not build credit; A car loan has two common effects on credit: Ideally, you’ll want a credit score of 660 or higher to get a favorable interest rate, but did you know that having a car loan may. Other lines of credit you have. Does financing a car build credit? However, individuals with lower credit scores might face higher interest rates. So if you don’t already have an installment loan, adding a car loan can raise your credit score. Ideally, you’ll want a credit score of 660 or higher to get a favorable interest rate, but did you. Ideally, you’ll want a credit score of 660 or higher to get a favorable interest rate, but did you know that having a car loan may also help improve your credit? When you finance a car, most of the time it will appear on your. You can actually build your credit with a car loan. Ultimately, a car loan does. Looking to help your credit and in the market for a car? When you finance a car, most of the time it will appear on your. A car loan has two common effects on credit: Ultimately, a car loan does not build credit; However, you can use the car loan to help increase your score. Paying off your car loan can lower your credit score, but the effects are usually temporary. Yes, financing a car with bad credit can still contribute to building credit. Generally speaking, paying off debts will usually improve your credit score. Looking to help your credit and in the market for a car? Other lines of credit you have. It's essential to make timely payments and. Ideally, you’ll want a credit score of 660 or higher to get a favorable interest rate, but did you know that having a car loan may also help improve your credit? When you finance a car, most of the time it will appear on your. So if you don’t already have an installment loan, adding a car loan can raise your credit score. You can check your credit score online through the main credit bureaus. However, individuals with lower credit scores might face higher interest rates. Read more to understand how car loans affect your credit score. A car loan has two common effects on credit: Ultimately, a car loan does not build credit; However, you can use the car loan to help increase your score. You can actually build your credit with a car loan. Do car payments build credit? And no, you don't have to go into debt, and you don't have to. Financing a car can help you to improve your credit score, but there’s no guarantee. If you need a new car, leasing can be a viable option. Are you thinking about paying off your car loan early?How To Pay Car Note With Credit Card LiveWell

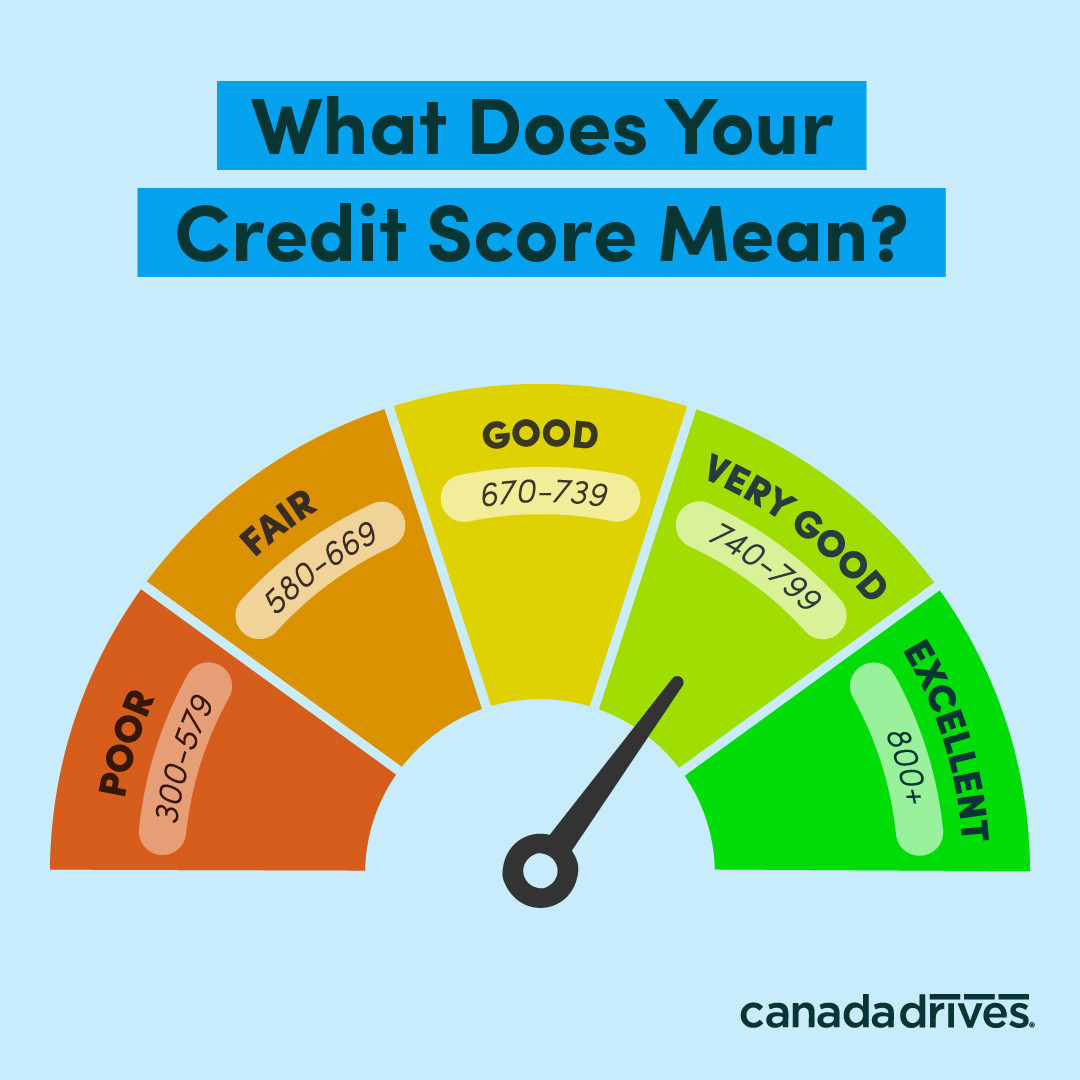

What Credit Score is Needed to Buy a Car

Car Loans 101 How To Calculate Your Monthly Payment in Seconds Li

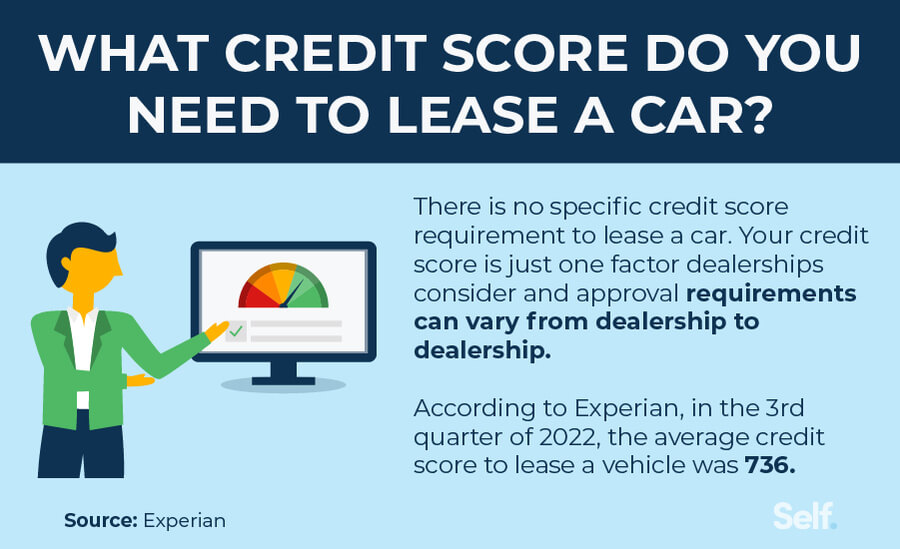

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

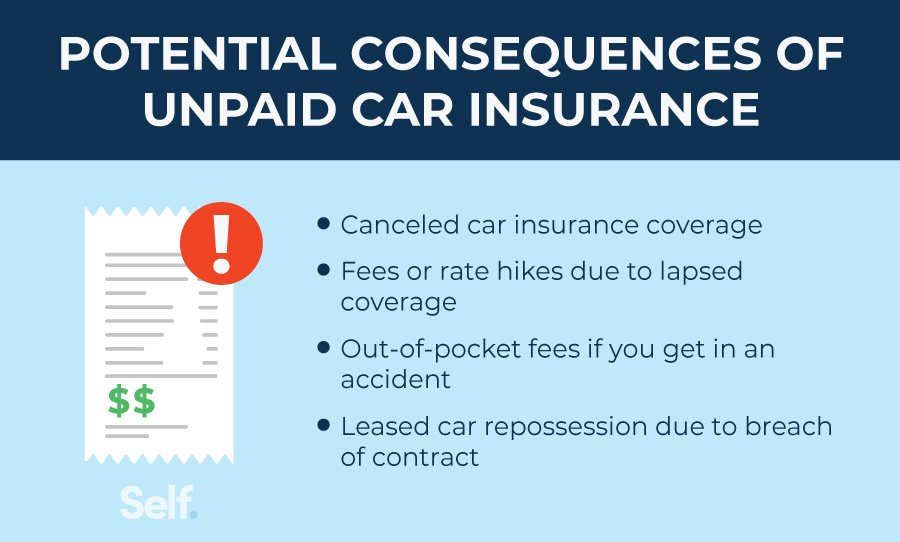

Does Paying Car Insurance Build Credit? Self. Credit Builder.

Does paying for car insurance build credit?

What Credit Score Is Used for Car Loans? Self. Credit Builder.

Do You Need Great Credit To Lease A Car Car Retro

How To Pay Car Note With Credit Card LiveWell

Using A Travel Credit Card To Earn Rewards For Purchases You'd Be Making Anyway Is A Great Way To Defray The Cost Of Your Next Vacation, As Long As You Pay Off Your Balance In.

To Find Out If Paying Off Your Loan Will Boost Your Score, We’ll Have To Take.

Other Lines Of Credit You Have.

Does Financing A Car Build Credit?

Related Post: