Does Paying Car Note Build Credit

Does Paying Car Note Build Credit - If you need a new car, leasing can be a viable option. When you finance a car, you're taking on an installment loan. Explore how having a car on finance can build and improve your credit score and how it might damage your credit rating if you’re not careful. To find out if paying off your loan will boost your score, we’ll have to take. It causes a hard inquiry to be. Read more to understand how car loans affect your credit score. Generally speaking, paying off debts will usually improve your credit score. Paying off your car loan can lower your credit score, but the effects are usually temporary. While paying off a car loan can have a positive impact on your credit score, the extent of the improvement will depend on various factors. A car loan has two common effects on credit: And no, you don't have to go into debt, and you don't have to. Read more to understand how car loans affect your credit score. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. Getting rid of your car payment can definitely free up some cash every month, but it might hurt your credit score. When you finance a car, you're taking on an installment loan. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. Do car payments build credit? If you need a new car, leasing can be a viable option. To find out if paying off your loan will boost your score, we’ll have to take. Ultimately, a car loan does not build credit; Credit scores play a significant role. And no, you don't have to go into debt, and you don't have to. The amount you owe is the second largest category. Paying off your car loan can lower your credit score, but the effects are usually temporary. Read more to understand how car loans affect your credit score. To a large degree, your credit score reflects how well you repay your debt, so timely payments on a car loan can be an effective way to build. When you finance a car, you're taking on an installment loan. It causes a hard inquiry to be. Credit cards are convenient and secure, they help build credit, they make budgeting easier,. Ultimately, a car loan does not build credit; Generally speaking, paying off debts will usually improve your credit score. When you finance a car, you're taking on an installment loan. Paying off your car loan can lower your credit score, but the effects are usually temporary. If you need a new car, leasing can be a viable option. Paying off your car loan can lower your credit score, but the effects are usually temporary. When you finance a car, you're taking on an installment loan. A car loan does build credit, only if you make the monthly payments on time. Explore how having a car on finance can build and improve your credit score and how it might. Paying off your car loan can lower your credit score, but the effects are usually temporary. The amount you owe is the second largest category. Whether to free up your. One of the primary factors that determines your credit score is your payment history. A car loan does build credit, only if you make the monthly payments on time. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. One of the primary factors that determines your credit score is your payment history. Getting rid of your car payment can definitely free up some. To a large degree, your credit score reflects how well you repay your debt, so timely payments on a car loan can be an effective way to build. Read more to understand how car loans affect your credit score. Whether to free up your. Generally speaking, paying off debts will usually improve your credit score. A car loan does build. Are you thinking about paying off your car loan early? Paying your bills on schedule helps your score, while late payments and accounts in collection hurt your score. Explore how having a car on finance can build and improve your credit score and how it might damage your credit rating if you’re not careful. The good news is that a. Paying off your car loan can lower your credit score, but the effects are usually temporary. Paying your bills on schedule helps your score, while late payments and accounts in collection hurt your score. Generally speaking, paying off debts will usually improve your credit score. And no, you don't have to go into debt, and you don't have to. When. The good news is that a car loan can help you boost your credit in the long term. A car loan does build credit, only if you make the monthly payments on time. It causes a hard inquiry to be. To find out if paying off your loan will boost your score, we’ll have to take. However, you can use. Getting rid of your car payment can definitely free up some cash every month, but it might hurt your credit score. The good news is that a car loan can help you boost your credit in the long term. Do car payments build credit? One of the primary factors that determines your credit score is your payment history. And no, you don't have to go into debt, and you don't have to. Ultimately, a car loan does not build credit; A car loan has two common effects on credit: Generally speaking, paying off debts will usually improve your credit score. Credit scores play a significant role. If you need a new car, leasing can be a viable option. To find out if paying off your loan will boost your score, we’ll have to take. The amount you owe is the second largest category. Explore how having a car on finance can build and improve your credit score and how it might damage your credit rating if you’re not careful. To a large degree, your credit score reflects how well you repay your debt, so timely payments on a car loan can be an effective way to build. A car loan does build credit, only if you make the monthly payments on time. Read more to understand how car loans affect your credit score.Promissory Note For Car Template Business

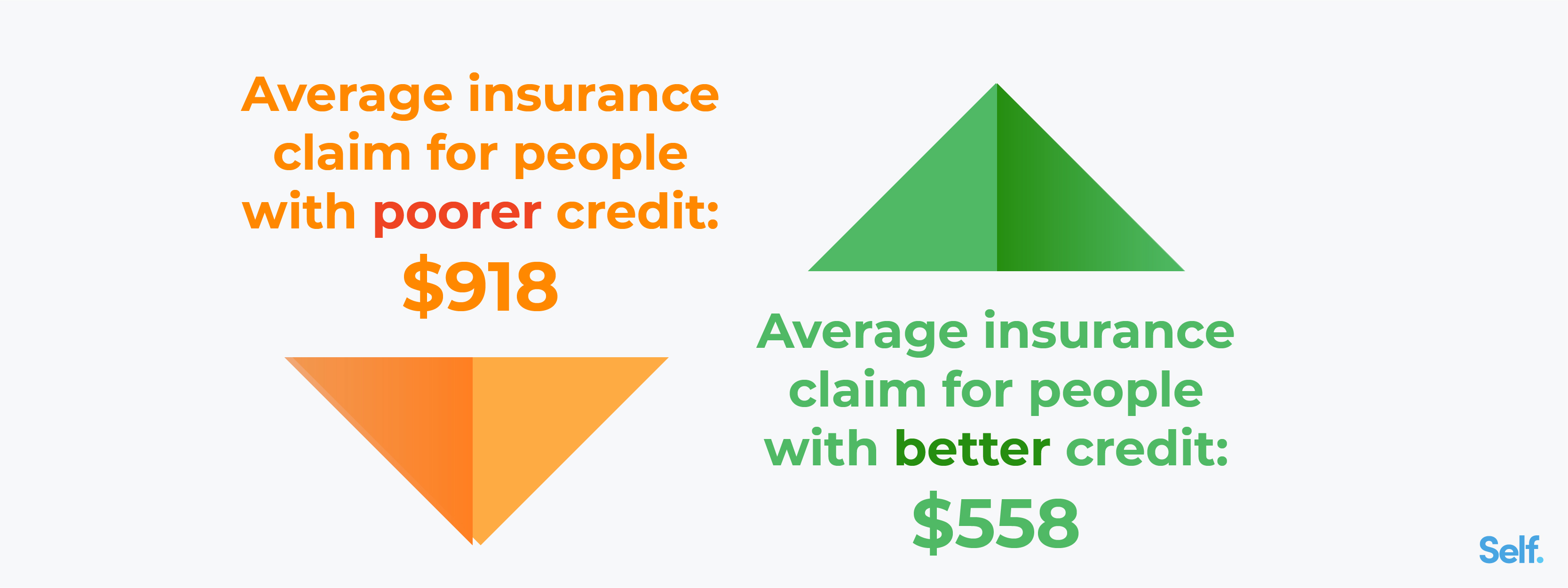

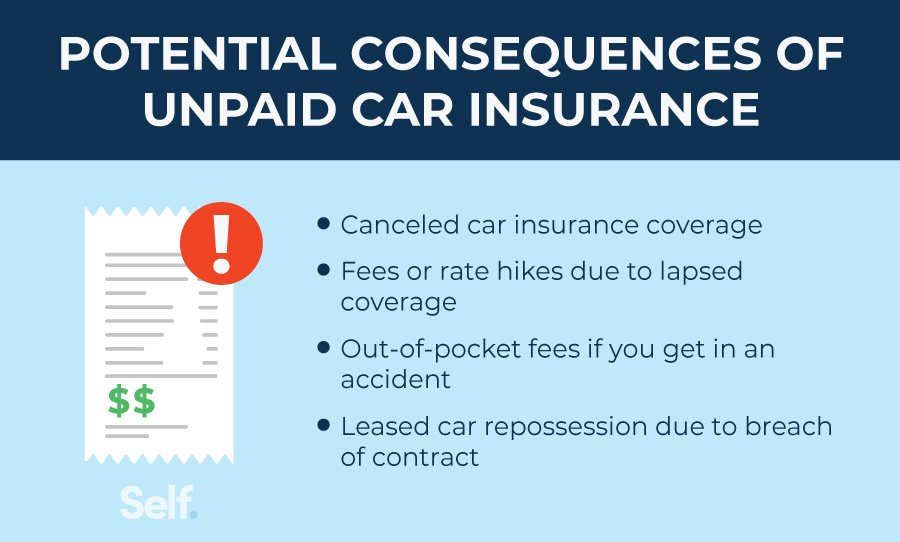

Does Paying Car Insurance Build Credit? Self.

What Credit Score is Needed to Buy a Car

Does Paying Car Insurance Build Credit? Self. Credit Builder.

Does paying for car insurance build credit?

How do you build credit for insurance? Leia aqui How to build

How To Pay Car Note With Credit Card LiveWell

How To Pay Car Note With Credit Card LiveWell

Does Paying Car Insurance Build Credit? Self. Credit Builder.

How to Determine the Total Interest Paid on a Car Loan YourMechanic

While Paying Off A Car Loan Can Have A Positive Impact On Your Credit Score, The Extent Of The Improvement Will Depend On Various Factors.

Credit Cards Are Convenient And Secure, They Help Build Credit, They Make Budgeting Easier, And They Earn Rewards.

Whether To Free Up Your.

It Causes A Hard Inquiry To Be.

Related Post: