Does Paying Car Payments Build Credit

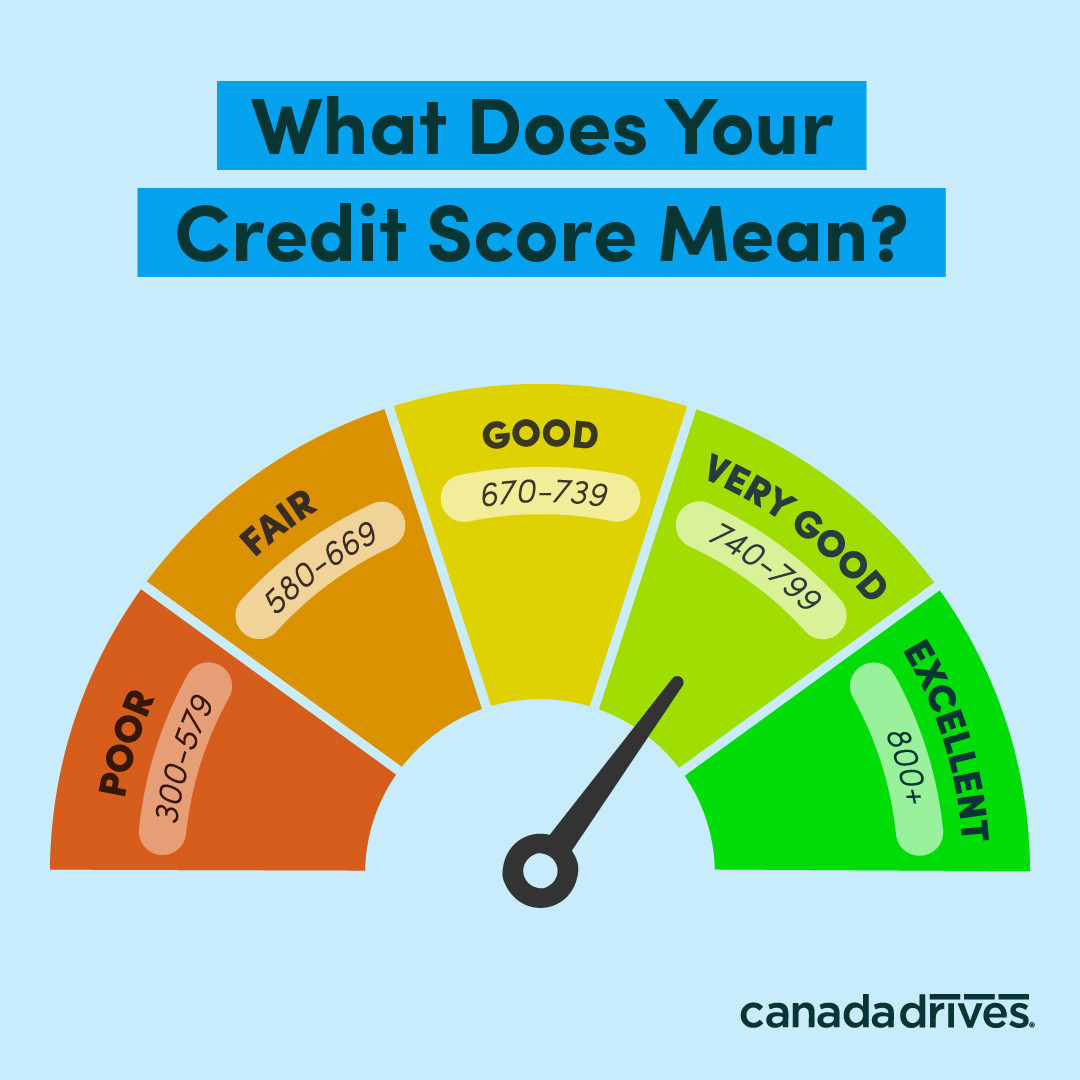

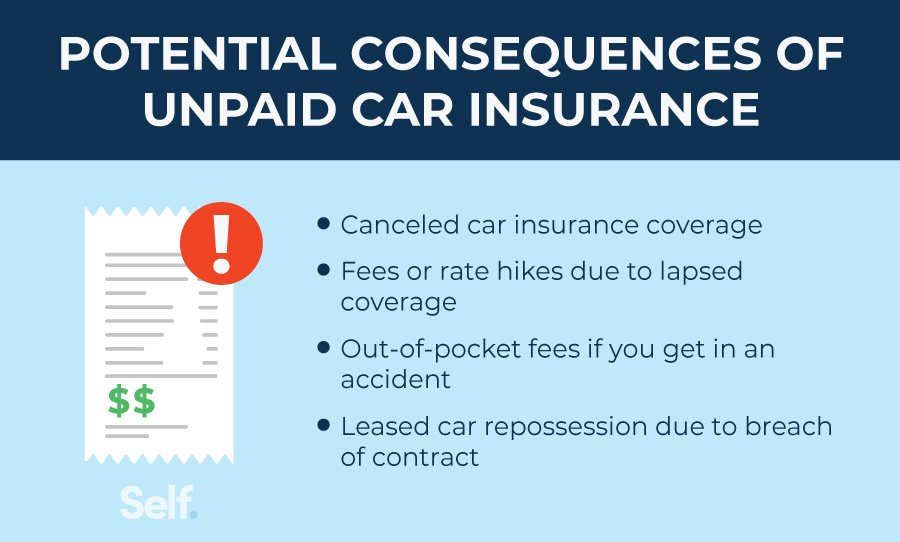

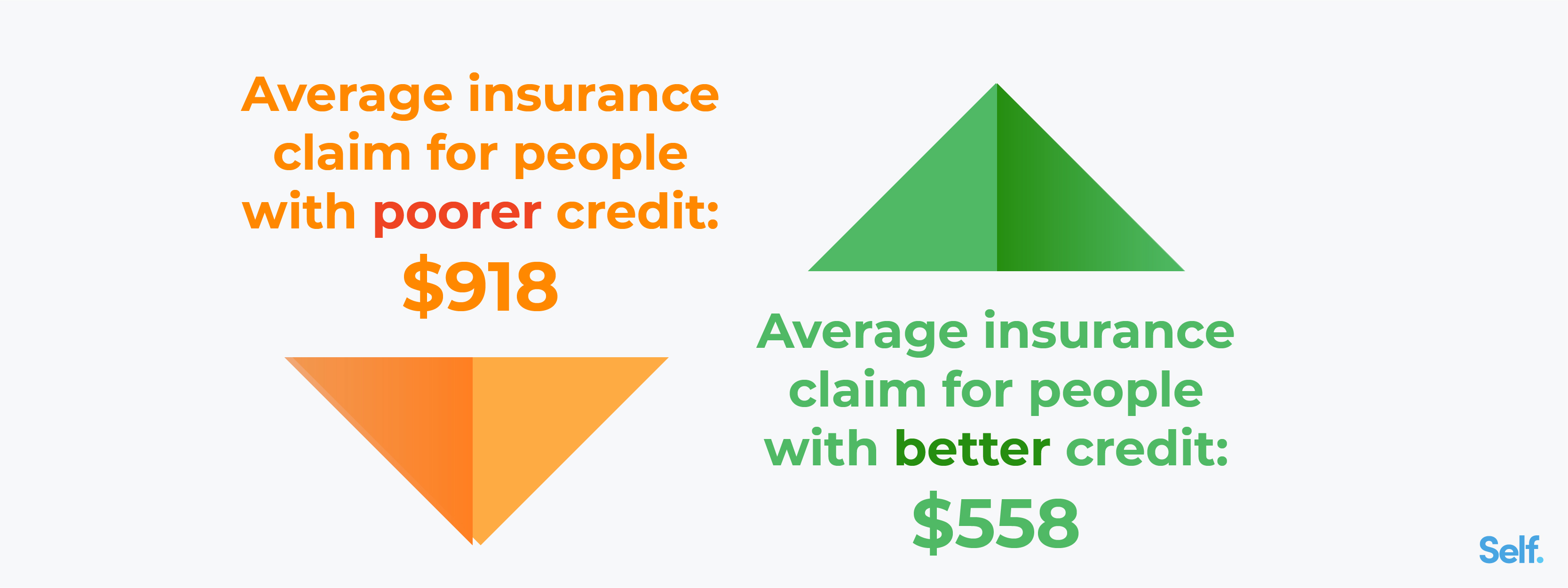

Does Paying Car Payments Build Credit - Military borrowers pay higher rates over longer terms: You aren’t exercising a kind of credit or loan, so there is no reason to report the payments to. Like any credit arrangement, taking out finance to buy a car has the potential to improve your credit score, but if you’re unable to make your. Things to consider before financing. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the. However, individuals with lower credit scores might face higher interest rates. Benefits of financing a car. Paying your credit card bill every week forces you to stay on top of your spending. But not every account you pay is reported. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. 2 points per $1 on car loan, lease or insurance payments from a linked account (on up to $1,000 in spending per month, and you must spend $500 or more per month on these. One of the primary factors that determines your credit score is your payment history. Yes, they can, but only if you make timely payments consistently. Using a travel credit card to earn rewards for purchases you'd be making anyway is a great way to defray the cost of your next vacation, as long as you pay off your balance in. Taking out a car loan can affect your credit in several ways. Paying your mortgage, credit cards and loans on time will boost your score because they are reported to the three major credit bureaus. Yes, financing a car with bad credit can still contribute to building credit. Things to consider before financing. This is important if you only have one other type of credit, such as credit cards which are revolving credit. Does financing a car build credit? Do car payments build credit? A car loan does build credit, only if you make the monthly payments on time. Do car payments build credit? Like any credit arrangement, taking out finance to buy a car has the potential to improve your credit score, but if you’re unable to make your. You aren’t exercising a kind of credit or loan,. A car loan does build credit, only if you make the monthly payments on time. This may help you improve your credit scores in the long run. This is important if you only have one other type of credit, such as credit cards which are revolving credit. Like any credit arrangement, taking out finance to buy a car has the. Financing a car can help you to improve your credit score, but there’s no guarantee. As mentioned previously, a hard inquiry appears on your report every time a lender. Military borrowers pay higher rates over longer terms: Taking out a loan and paying it back on time and in full can do wonders for. You aren’t exercising a kind of. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. Benefits of financing a car. The good news is that a car loan can help you boost your credit in the long term. Leasing a car and credit. Yes, they can, but only if you make timely payments consistently. You build better money habits. As mentioned previously, a hard inquiry appears on your report every time a lender. Do car payments build credit? However, individuals with lower credit scores might face higher interest rates. Read more to understand how car loans affect your credit score. Servicemembers faced average annual percentage rates (aprs) 0.6 percentage points above civilian rates and longer. Taking out a loan and paying it back on time and in full can do wonders for. Cultivating good financial habits, like paying your credit cards in full and on time, is essential for avoiding interest and late fees, and for building a strong credit. But not every account you pay is reported. Financing a car can help you to improve your credit score, but there’s no guarantee. One of the primary factors that determines your credit score is your payment history. Reliably repaying your auto loan demonstrates your trustworthiness to credit. Things to consider before financing. Cultivating good financial habits, like paying your credit cards in full and on time, is essential for avoiding interest and late fees, and for building a strong credit score. You can actually build your credit with a car loan. Other lines of credit you have. Using a travel credit card to earn rewards for purchases you'd be making anyway is. Yes, they can, but only if you make timely payments consistently. A car loan does build credit, only if you make the monthly payments on time. Do car payments build credit? This may help you improve your credit scores in the long run. Cultivating good financial habits, like paying your credit cards in full and on time, is essential for. Financing a car can help you to improve your credit score, but there’s no guarantee. One of the primary factors that determines your credit score is your payment history. However, individuals with lower credit scores might face higher interest rates. A car loan does build credit, only if you make the monthly payments on time. This is important if you. You make all of your payments on time. But not every account you pay is reported. Reliably repaying your auto loan demonstrates your trustworthiness to credit. Like normal monthly bills, paying for car insurance does not improve your credit. Paying your credit card bill every week forces you to stay on top of your spending. A car loan does build credit, only if you make the monthly payments on time. Do car payments build credit? Paying your mortgage, credit cards and loans on time will boost your score because they are reported to the three major credit bureaus. Financing a car can help you to improve your credit score, but there’s no guarantee. You aren’t exercising a kind of credit or loan, so there is no reason to report the payments to. Does financing a car build credit? Do car payments build credit? However, individuals with lower credit scores might face higher interest rates. As mentioned previously, a hard inquiry appears on your report every time a lender. Yes, they can, but only if you make timely payments consistently. However, for auto loans, higher car prices combined with higher interest rates have driven monthly payments upward and have put pressure on consumers across the.Does Paying Car Insurance Build Credit? Self. Credit Builder.

Self News and Blog

What Credit Score is Needed to Buy a Car

Car Loans 101 How To Calculate Your Monthly Payment in Seconds Li

What Credit Score Is Used for Car Loans? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Paying Car Insurance Build Credit? Self. Credit Builder.

Does Paying Car Insurance Build Credit? Self.

Does paying for car insurance build credit?

Leasing A Car And Credit.

Servicemembers Faced Average Annual Percentage Rates (Aprs) 0.6 Percentage Points Above Civilian Rates And Longer.

Yes, Financing A Car With Bad Credit Can Still Contribute To Building Credit.

One Of The Primary Factors That Determines Your Credit Score Is Your Payment History.

Related Post: