Does Paying My Credit Card Early Build Credit

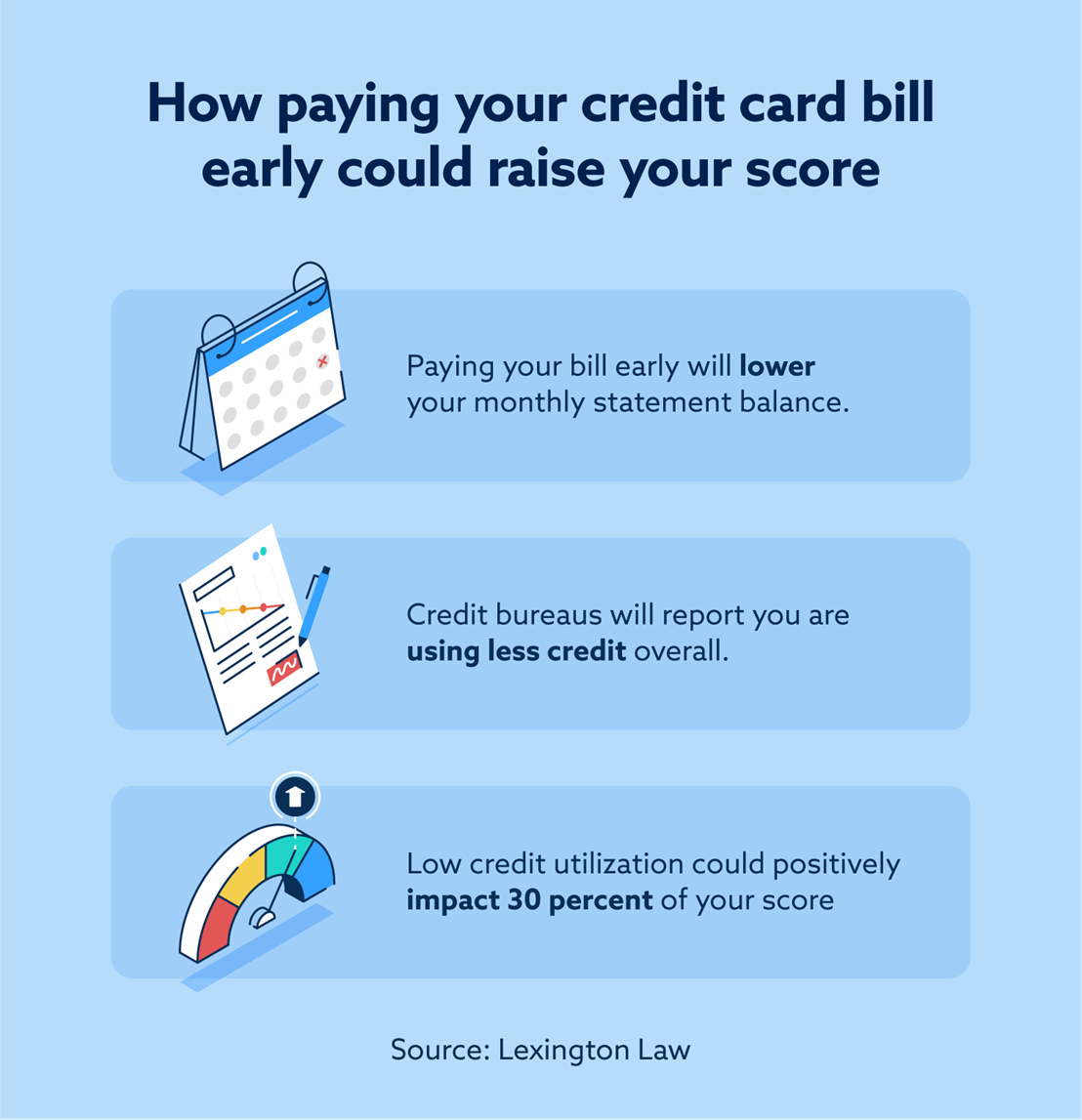

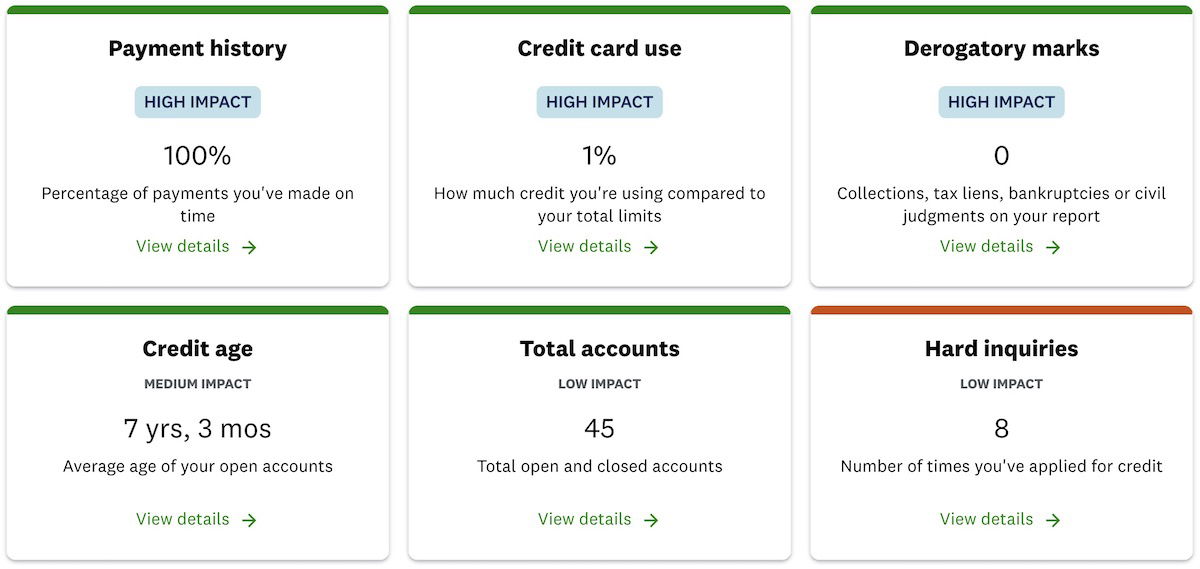

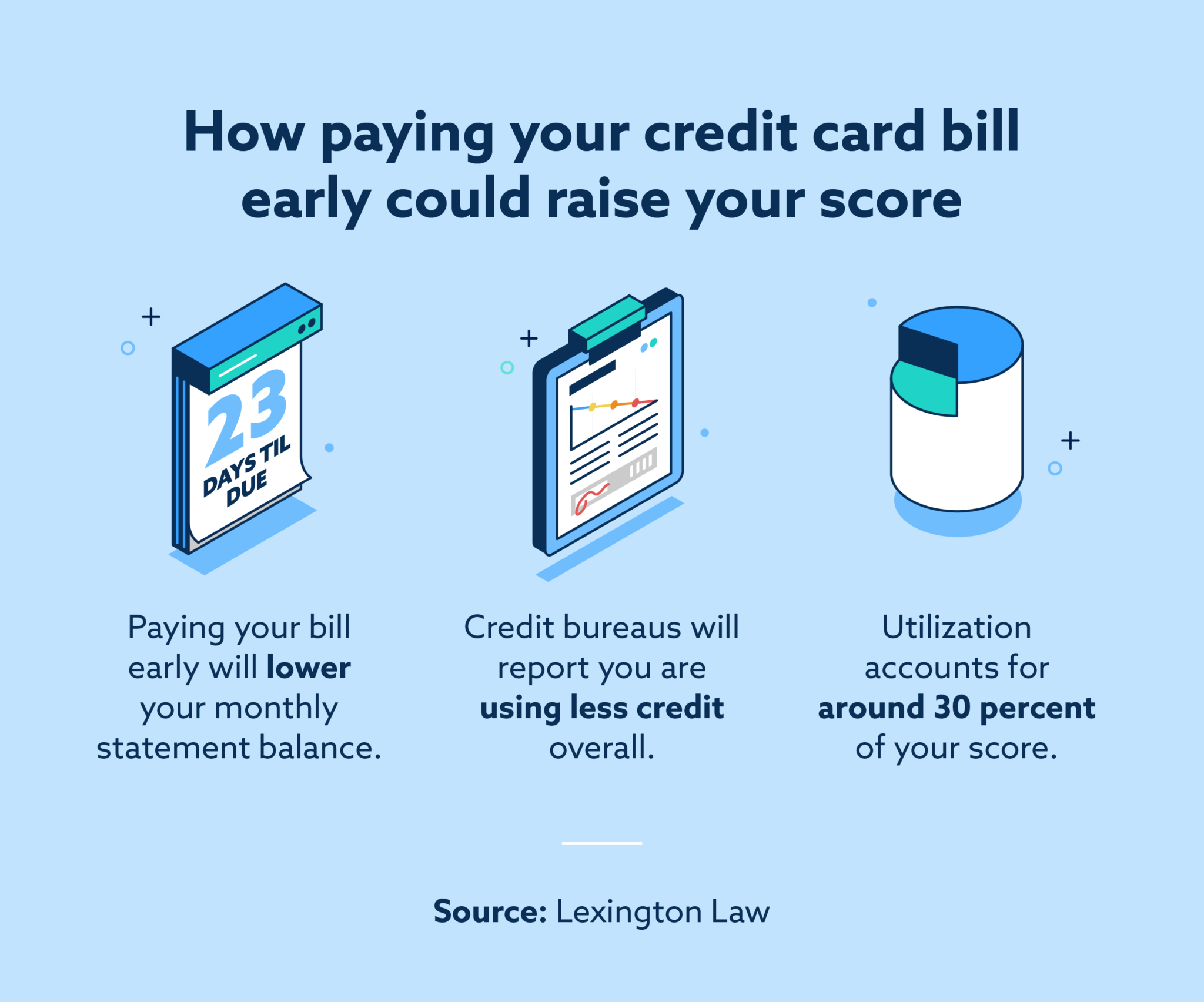

Does Paying My Credit Card Early Build Credit - Paying your credit card bill early, however, could possibly give your credit score an added boost, too. Paying the minimum amount due on your credit card is all you need to do to keep your account in good standing,. Ask for a credit limit increase after 6 months. Paying your credit card bill when the monthly statement comes is a pillar of responsible credit card use. When you pay your credit card bill before your billing cycleends, the balance amount your card issuer reports to the credit bureaus may be lower than if you paid after your statement closing date. Does paying bills early build credit? You build better money habits. Paying your credit card bill early could simply mean making your monthly payment before the due date. Check out our list of the best travel rewards credit cards now. Paying your credit card early can help you keep your credit usage down and avoid any extra fees. Here are some best practices to keep. 10 things to know about credit card minimum payments. It’s good to keep your current balance at $0 if you have the extra money to make full. Paying your credit card bill early, however, could possibly give your credit score an added boost, too. Paying your credit card early can help you keep your credit usage down and avoid any extra fees. Manipulate utilization when you want to apply for a second card but otherwise don't bother. Sending your credit card payment early is a way to ensure your payments arrive on time. It can also help lower your credit utilization ratio, which may. Every credit card bill has a monthly payment due date. Once you understand your debt situation, it’s time to choose a repayment strategy that aligns with your financial goals. Paying your credit card early can help you keep your credit usage down and avoid any extra fees. Some of the advantages of paying off a credit card balance early can. This date is when your card issuer prepares your bill and typically reports your credit card information to the credit bureaus. Called help for hustles, it is urging people. Paying your credit card bill early could simply mean making your monthly payment before the due date. Manipulate utilization when you want to apply for a second card but otherwise don't bother. Paying your credit card’s full statement balance early can be a great strategy that could help you save on interest. Sending your credit card payment early is a. Ask for a credit limit increase after 6 months. Paying your credit card early can help you keep your credit usage down and avoid any extra fees. Paying your credit card early can save money, free up your available credit for other purchases and provide peace of mind that your bill is paid well before your due date. Should you. But you're not limited to a single monthly payment. When it comes to managing your finances, conventional wisdom advocates paying off credit card debt promptly to enhance your credit score and overall credit history. Or it could also mean making an extra payment each month. Sending your credit card payment early is a way to ensure your payments arrive on. Every credit card bill has a monthly payment due date. 10 things to know about credit card minimum payments. Cultivating good financial habits, like paying your credit cards in full and on time, is essential for avoiding interest and late fees, and for building a strong credit score. You build better money habits. Paying your credit card’s full statement balance. “credit card late fees — which are. Cultivating good financial habits, like paying your credit cards in full and on time, is essential for avoiding interest and late fees, and for building a strong credit score. Paying your credit card’s full statement balance early can be a great strategy that could help you save on interest. Weekly payments can be. But you're not limited to a single monthly payment. One of the most noticeable benefits of paying your credit card bill early is. Every credit card bill has a monthly payment due date. Paying your credit card early can help you keep your credit usage down and avoid any extra fees. It's best to pay off your credit card's entire. Called help for hustles, it is urging people to. Ask for a credit limit increase after 6 months. Here are some best practices to keep. Paying the minimum amount due on your credit card is all you need to do to keep your account in good standing,. Paying your credit card bill early, however, could possibly give your credit score. Called help for hustles, it is urging people to. Weekly payments can be a. One of the most noticeable benefits of paying your credit card bill early is. Paying the minimum amount due on your credit card is all you need to do to keep your account in good standing,. Paying your credit card bill early, however, could possibly give. Check out our list of the best travel rewards credit cards now. Weekly payments can be a. It's best to pay off your credit card's entire balance every month to avoid paying interest charges and to prevent debt from building up. Do you need to pay your credit card bill weekly? It’s good to keep your current balance at $0. Ask for a credit limit increase after 6 months. Paying your credit card bill early, however, could possibly give your credit score an added boost, too. Hide your cards as you pay them off to avoid the temptation of. Paying the minimum amount due on your credit card is all you need to do to keep your account in good standing,. Pay it off by the due date or as needed. Some of the advantages of paying off a credit card balance early can. Or it could also mean making an extra payment each month. Paying your credit card bill early could simply mean making your monthly payment before the due date. Here are some best practices to keep. Weekly payments can be a. Do you need to pay your credit card bill weekly? But you're not limited to a single monthly payment. You build better money habits. Called help for hustles, it is urging people to. It can also help lower your credit utilization ratio, which may. But, be careful that you don't send your payment too early.Is it OK to pay credit card early? Leia aqui Does it hurt credit to

Do you build credit if you pay in full? Leia aqui Should I pay my

When Should I Pay My Credit Card Bill? Lexington Law

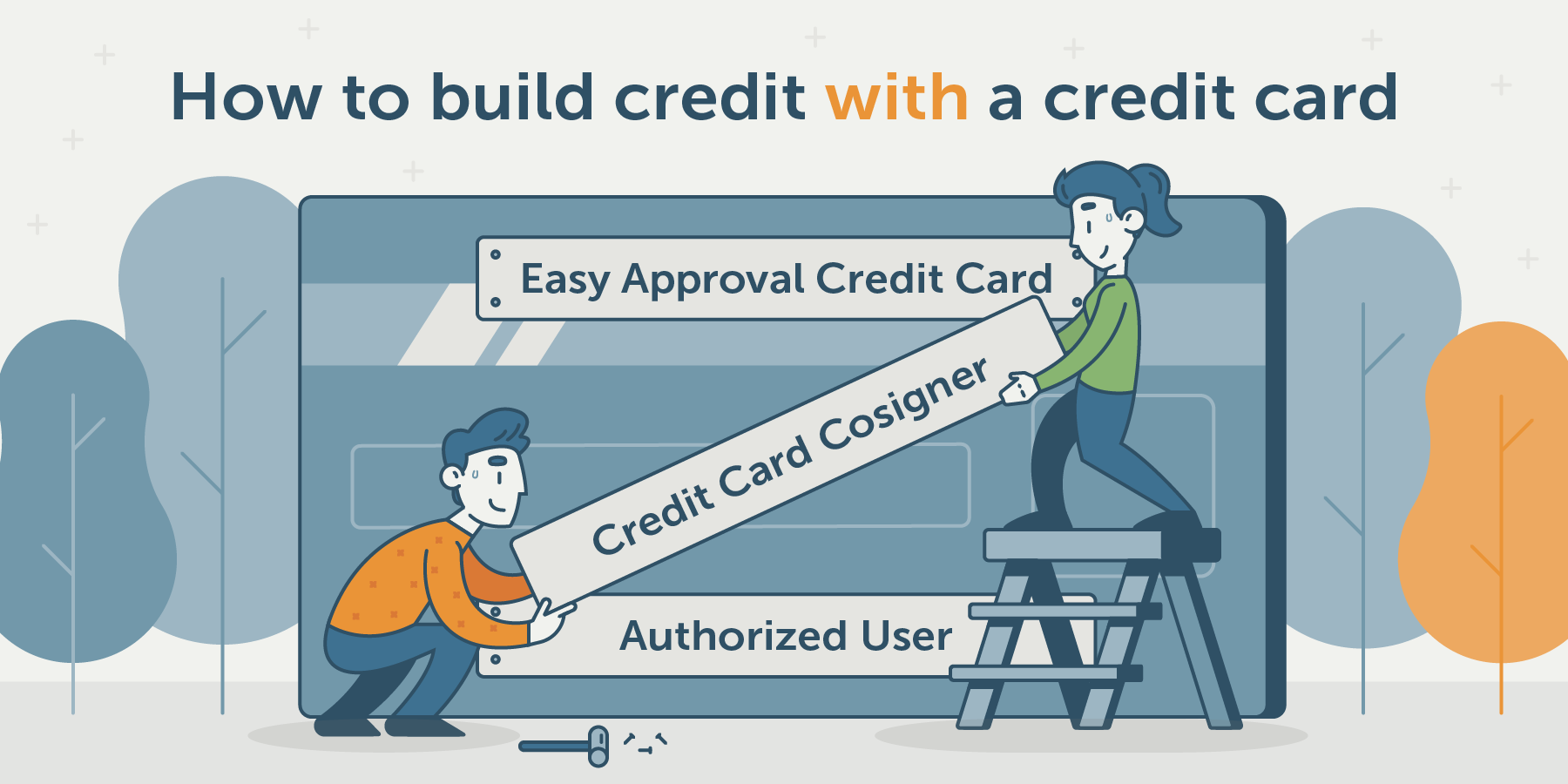

How to Build Credit

Why I Pay Off My Credit Card Bill (Way) Early One Mile at a Time

Paying Your Credit Card Early Does It Help? Lexington Law

How Much Will My Credit Score Increase After Paying Off Credit Cards

How to build a credit history kobo building

How many days before my due date should I pay my credit card? Leia aqui

Paying With Credit Card

Manipulate Utilization When You Want To Apply For A Second Card But Otherwise Don't Bother.

Strategies To Pay Off Credit Card Debt.

Should You Pay Your Credit Card Balance In Full Each Month To Build Credit?

When It Comes To Managing Your Finances, Conventional Wisdom Advocates Paying Off Credit Card Debt Promptly To Enhance Your Credit Score And Overall Credit History.

Related Post: