Does Paypal Pay In 4 Build Credit

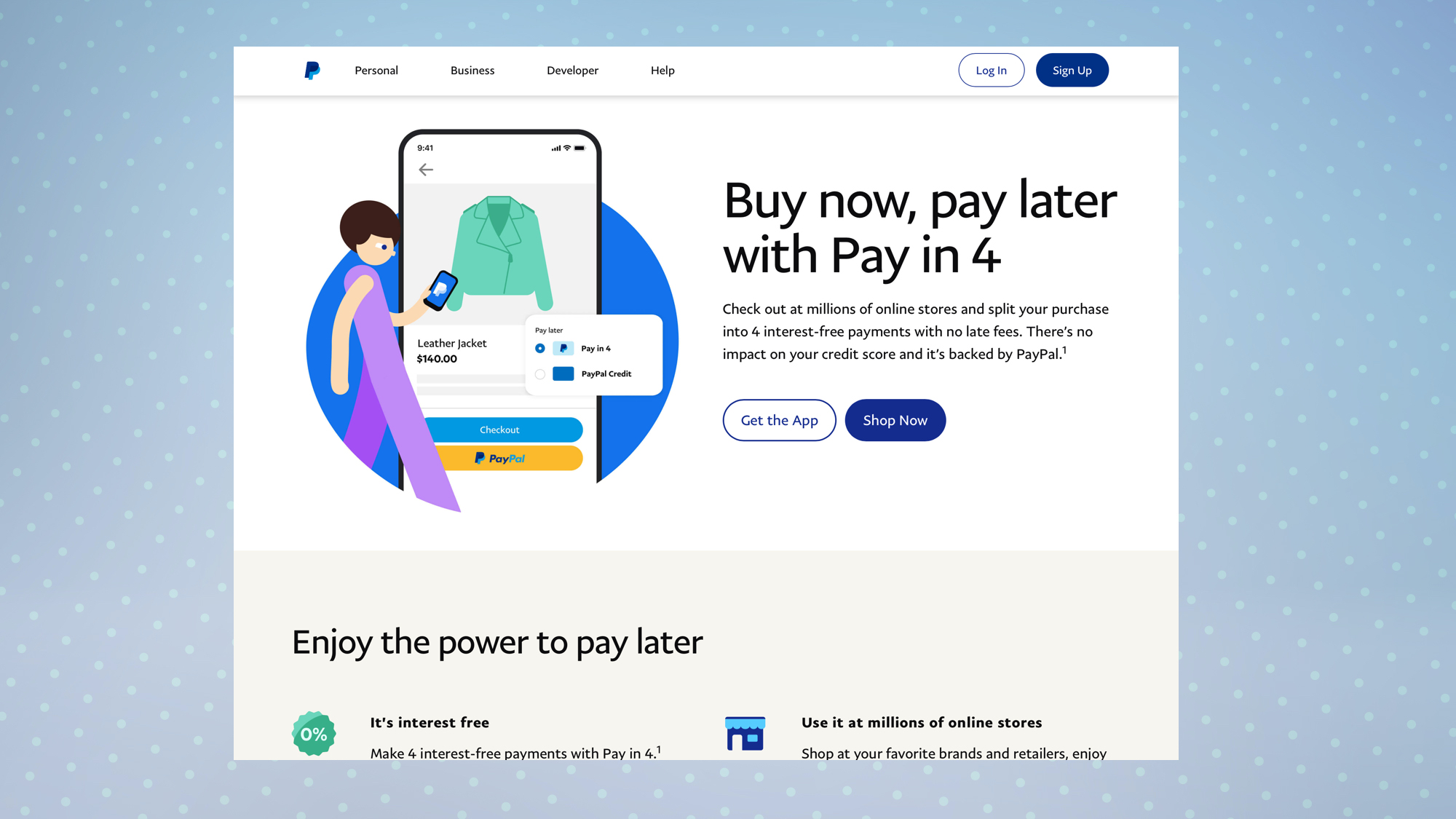

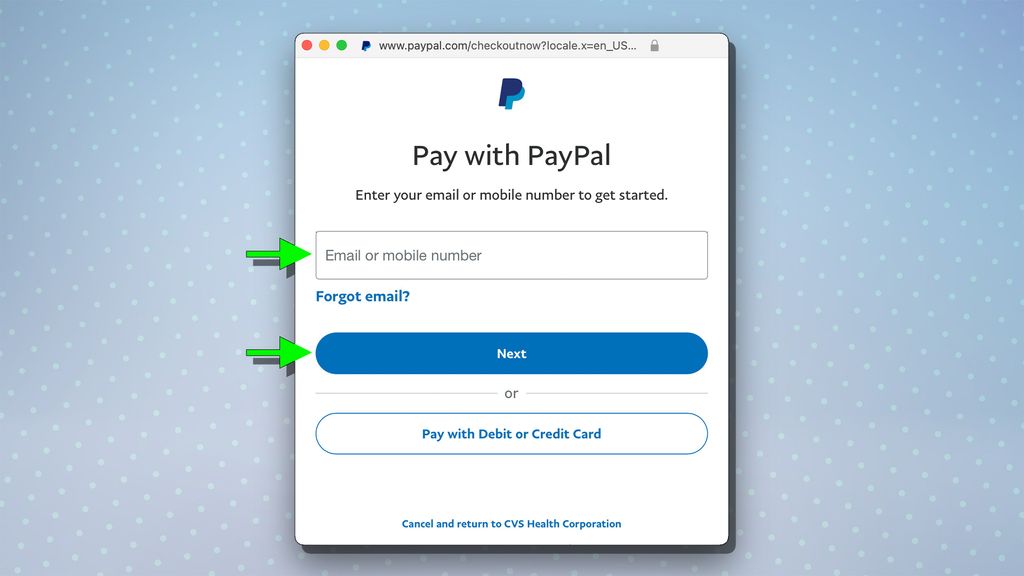

Does Paypal Pay In 4 Build Credit - We'll explain how pay in 4 works. Pay in 4 evaluates applications based on provided info & paypal usage history. Paypal pay in 4 is paypal’s buy now, pay later (bnpl) service for online shoppers. Applying for a paypal pay in 4 loan will not impact your credit score. No impact on credit score. Does paypal pay in 4 affect your credit? Paypal may perform a credit check, though it doesn’t disclose a specific minimum credit score requirement. Applying for a paypal pay in 4 loan will not impact your credit score. The first payment is due at. Pay in 4 is paypal's buy now, pay later service, also known as an installment or point of sale loan. We'll explain how pay in 4 works. Paypal pay in 4 is a payment option that lets you split purchases you make at participating online stores into four payments. How much does paypal pay in 4 cost? Applying for a paypal pay in 4 loan will not impact your credit score. Now, let’s answer the main question: Paypal pay in 4 generally does not affect your credit score. The first payment is due at. You pay a down payment at the time of sale and. Preapproval isn't guaranteed & amount may change. Does using pay in 4 build credit? Preapproval isn't guaranteed & amount may change. The company performs a soft credit check during the application. Pay in 4 evaluates applications based on provided info & paypal usage history. Paypal pay in 4 is paypal’s buy now, pay later (bnpl) service for online shoppers. You pay a down payment at the time of sale and. Does paypal pay in 4 affect your credit? You pay a down payment at the time of sale and. You can use this plan on items priced. Applying for a paypal pay in 4 loan will not impact your credit score. Paypal’s pay in 4 is a consumer financing option, not a traditional credit product. Paypal pay in 4 generally does not affect your credit score. Paypal pay in 4 is paypal’s buy now, pay later (bnpl) service for online shoppers. Applying for a paypal pay in 4 loan will not impact your credit score. Does using pay in 4 build credit? You can use this plan on items priced. The first payment is due at. Paypal pay in 4 is a payment option that lets you split purchases you make at participating online stores into four payments. The company performs a soft credit check during the application. Applying for a paypal pay in 4 loan will not impact your credit score. Preapproval isn't guaranteed & amount may change. There are no fees to use paypal pay. Paypal pay in 4 is paypal’s buy now, pay later (bnpl) service for online shoppers. Does using pay in 4 build credit? Pay in 4 is paypal's buy now, pay later service, also known as an installment or point of sale loan. Applying for a paypal pay in 4 loan will not. How much does paypal pay in 4 cost? Applying for a paypal pay in 4 loan will not impact your credit score. Paypal has entered the fray with a feature called “pay in 4,” which allows shoppers to finance their purchases in four smaller installments. Applying for a paypal pay in 4 loan will not impact your credit score. Now,. Applying for a paypal pay in 4 loan will not impact your credit score. Paypal pay in 4 is paypal’s buy now, pay later (bnpl) service for online shoppers. You pay a down payment at the time of sale and. You can use this plan on items priced. Paypal’s pay in 4 is a consumer financing option, not a traditional. Does paypal pay in 4 affect your credit? Does paypal pay in 4 affect your credit? Paypal pay in 4 generally does not affect your credit score. How much does paypal pay in 4 cost? Applying for a paypal pay in 4 loan will not impact your credit score. Pay in 4 is paypal's buy now, pay later service, also known as an installment or point of sale loan. Preapproval isn't guaranteed & amount may change. The company performs a soft credit check during the application process. Applying for a paypal pay in 4 loan will not impact your credit score. Paypal pay in 4 is paypal’s buy now,. The company performs a soft credit check during the application process. Paypal may perform a credit check, though it doesn’t disclose a specific minimum credit score requirement. Applying for a paypal pay in 4 loan will not impact your credit score. Paypal pay in 4 is paypal’s buy now, pay later (bnpl) service for online shoppers. The company performs a. Paypal’s pay in 4 is a consumer financing option, not a traditional credit product. How much does paypal pay in 4 cost? Does paypal pay in 4 affect your credit? The first payment is due at. Applying for a paypal pay in 4 loan will not impact your credit score. We'll explain how pay in 4 works. You can use this plan on items priced. Paypal pay in 4 is a payment option that lets you split purchases you make at participating online stores into four payments. The company performs a soft credit check during the application process. Applying for a paypal pay in 4 loan will not impact your credit score. Paypal may perform a credit check, though it doesn’t disclose a specific minimum credit score requirement. The company performs a soft credit check during the application. Pay in 4 evaluates applications based on provided info & paypal usage history. Does paypal pay in 4 affect your credit? Does using pay in 4 build credit? Paypal pay in 4 generally does not affect your credit score.What is PayPal Pay in 4? Tom's Guide

What is PayPal Pay in 4? A Review and Guide for 2023 5 Incredible

What is PayPal Pay in 4? Tom's Guide

PayPal Pay in 4 Reviews Pros and Cons in 2025 The Money Manual

PAYPAL PAY IN 4, BUY NOW PAY LATER, CREDIT REQUIREMENTS, PAYPAL STORES

PayPal Pay In 4 Right Merchant Maverick

Announcing PayPal’s Pay in 4 integration The Jotform Blog

PayPal Pay in 4 Reviews Pros and Cons in 2025 The Money Manual

How does Paypal Pay in 4 Work?

PayPal's Pay in 4 Feature Tips and Tricks HQ

Paypal Pay In 4 Is Paypal’s Buy Now, Pay Later (Bnpl) Service For Online Shoppers.

You Pay A Down Payment At The Time Of Sale And.

Pay In 4 Is Paypal's Buy Now, Pay Later Service, Also Known As An Installment Or Point Of Sale Loan.

The Company Performs A Soft Credit Check During The Application Process.

Related Post: