Does Rent To Own Build Credit

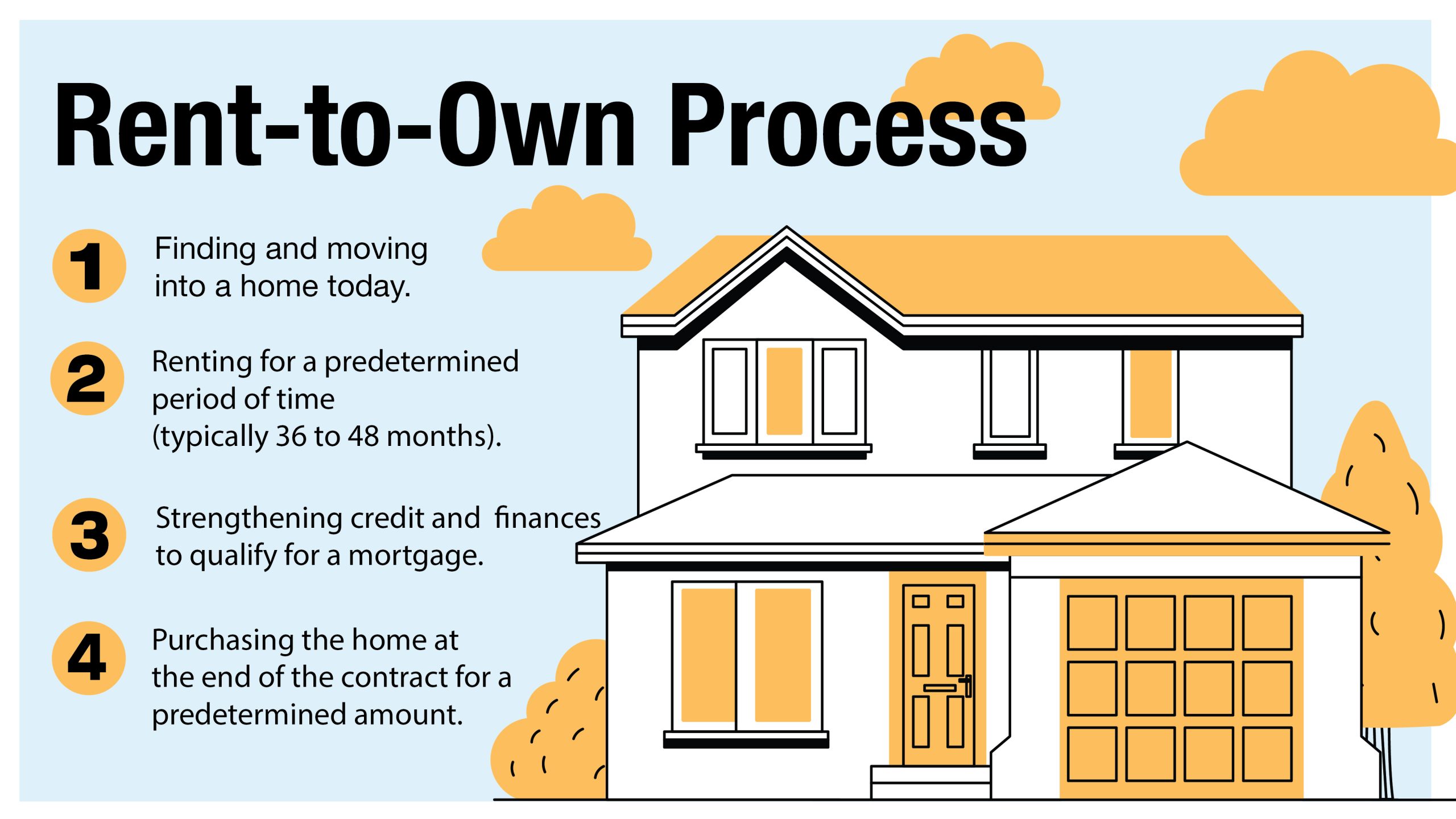

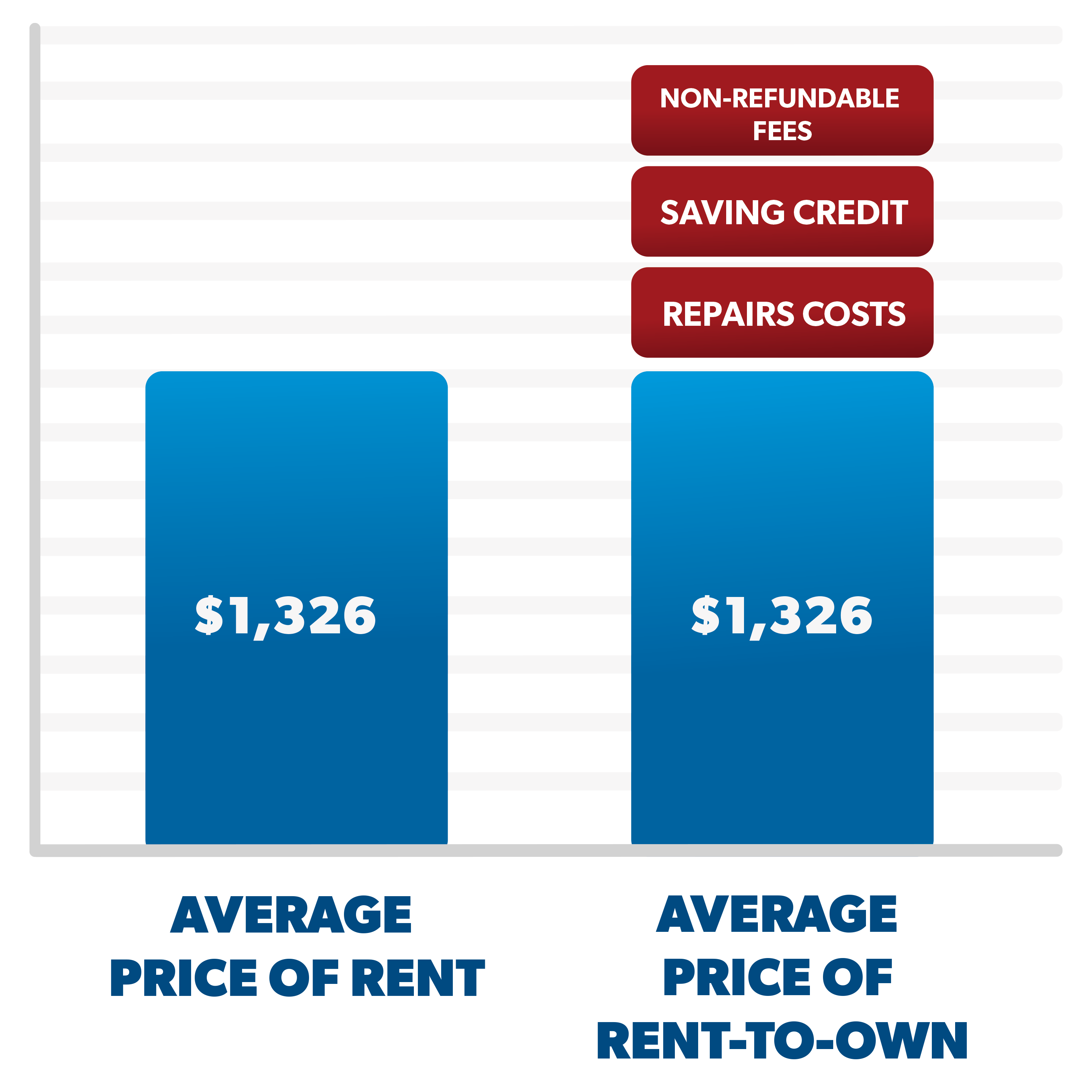

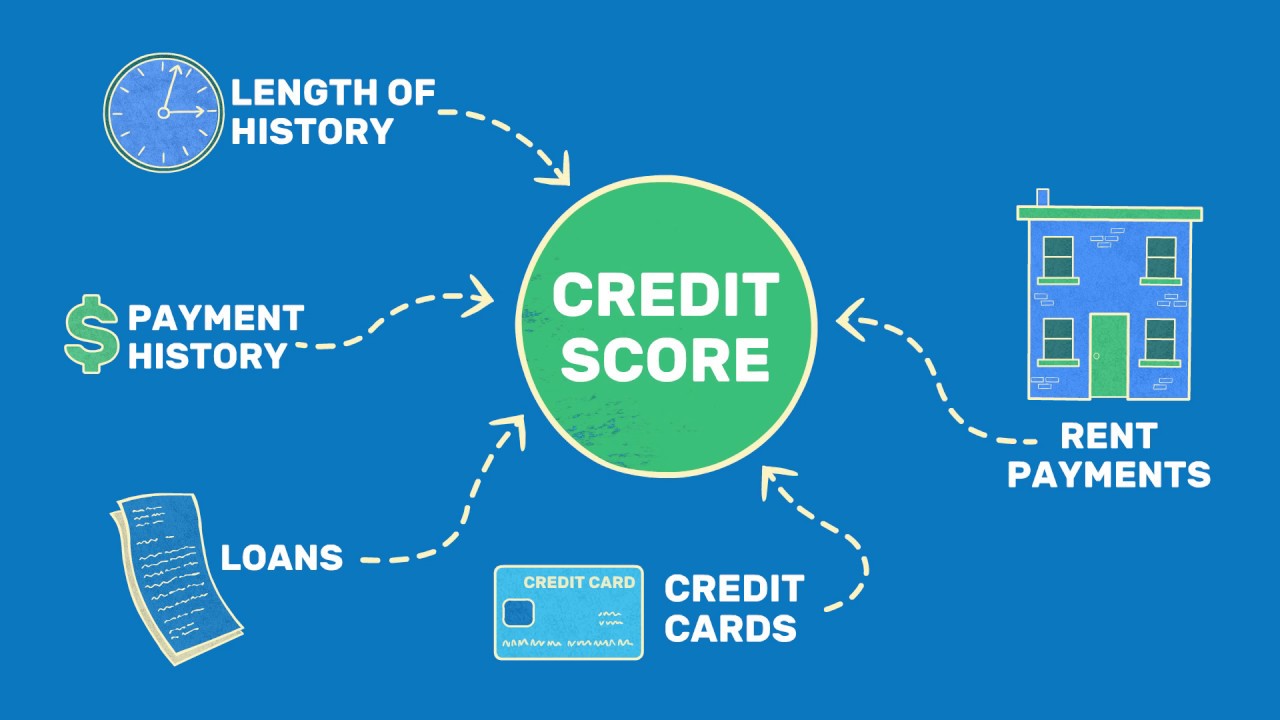

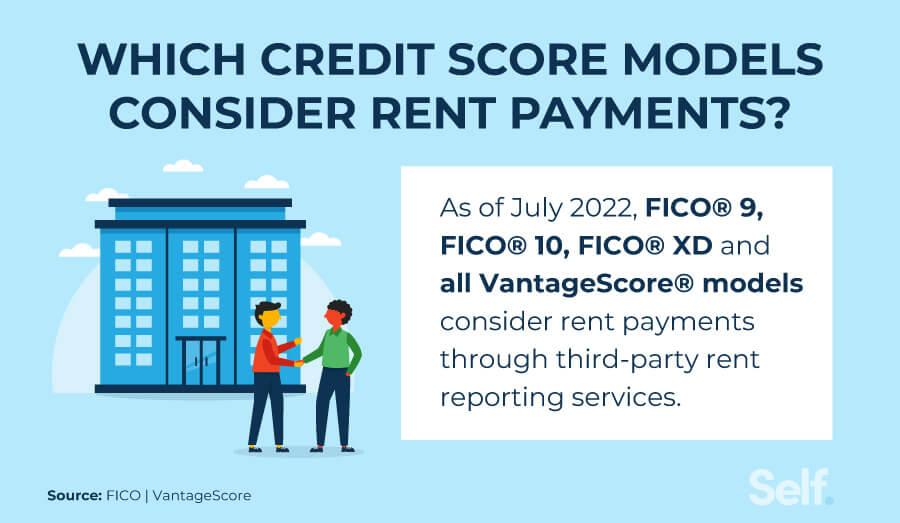

Does Rent To Own Build Credit - This makes it much easier to qualify for if your credit is poor. Generally even a subprime loan. It’s the steps you take throughout the term of the lease that will help to boost. He offers three key recommendations for building credit:. A portion of the rent paid during the lease term can be applied to the purchase price. In addition, there are some federally funded programs which are available to select homebuyers able to meet a list of qualifications. The potential buyer enters into an arrangement where they lease the home for. Does rent to own hurt or build credit? For example, landlords can never use the credit for homes they rent out but do not use as a residence themselves. It’s often easier to rent to own than it is to purchase a home with bad credit. Does rent to own directly build credit? You’ll lock in the purchase price when you sign the. He offers three key recommendations for building credit:. Generally even a subprime loan. Does rent to own hurt or build credit? Abbey explains, adding that his own journey for good credit started with a bad experience with a predatory lender. This makes it much easier to qualify for if your credit is poor. It’s often easier to rent to own than it is to purchase a home with bad credit. It’s the steps you take throughout the term of the lease that will help to boost. For more information about a taxpayer’s use of a home as a. Depending on your situation and the severity of your credit problems, you might not be able to qualify for a mortgage without first working to improve your credit. What is rent to own? It’s often easier to rent to own than it is to purchase a home with bad credit. This makes it much easier to qualify for if your. It’s often easier to rent to own than it is to purchase a home with bad credit. Since rent to own payments aren’t reported to the credit bureaus, they won’t hurt your credit. In addition, there are some federally funded programs which are available to select homebuyers able to meet a list of qualifications. Depending on your situation and the. A portion of the rent paid during the lease term can be applied to the purchase price. What is rent to own? He offers three key recommendations for building credit:. Abbey explains, adding that his own journey for good credit started with a bad experience with a predatory lender. Check out chicago, il rent to own homes for sale, which. In addition, there are some federally funded programs which are available to select homebuyers able to meet a list of qualifications. This makes it much easier to qualify for if your credit is poor. Does rent to own hurt or build credit? This is great news for shoppers who might be. For more information about a taxpayer’s use of a. For example, landlords can never use the credit for homes they rent out but do not use as a residence themselves. In addition, there are some federally funded programs which are available to select homebuyers able to meet a list of qualifications. Since rent to own payments aren’t reported to the credit bureaus, they won’t hurt your credit. The potential. This makes it much easier to qualify for if your credit is poor. Does rent to own hurt or build credit? Generally even a subprime loan. Check out chicago, il rent to own homes for sale, which. In addition, there are some federally funded programs which are available to select homebuyers able to meet a list of qualifications. In addition, there are some federally funded programs which are available to select homebuyers able to meet a list of qualifications. Depending on your situation and the severity of your credit problems, you might not be able to qualify for a mortgage without first working to improve your credit. Does rent to own hurt or build credit? A portion of. You’ll lock in the purchase price when you sign the. In addition, there are some federally funded programs which are available to select homebuyers able to meet a list of qualifications. This is great news for shoppers who might be. The potential buyer enters into an arrangement where they lease the home for. Generally even a subprime loan. For example, landlords can never use the credit for homes they rent out but do not use as a residence themselves. What is rent to own? Depending on your situation and the severity of your credit problems, you might not be able to qualify for a mortgage without first working to improve your credit. Since rent to own payments aren’t. A portion of the rent paid during the lease term can be applied to the purchase price. For example, landlords can never use the credit for homes they rent out but do not use as a residence themselves. Depending on your situation and the severity of your credit problems, you might not be able to qualify for a mortgage without. It’s the steps you take throughout the term of the lease that will help to boost. Depending on your situation and the severity of your credit problems, you might not be able to qualify for a mortgage without first working to improve your credit. Abbey explains, adding that his own journey for good credit started with a bad experience with a predatory lender. What is rent to own? Since rent to own payments aren’t reported to the credit bureaus, they won’t hurt your credit. For more information about a taxpayer’s use of a home as a. In addition, there are some federally funded programs which are available to select homebuyers able to meet a list of qualifications. Generally even a subprime loan. Looooong views of the pond behind this home make you feel like you're in a private oasis of your own, but you're still centrally located to jacksonville, st augustine, and everything good. This makes it much easier to qualify for if your credit is poor. The potential buyer enters into an arrangement where they lease the home for. He offers three key recommendations for building credit:. You’ll lock in the purchase price when you sign the. Does rent to own hurt or build credit? This is great news for shoppers who might be. Check out chicago, il rent to own homes for sale, which.RenttoOwn Homes How the Process Works

Do Rent to Own (RTO) Payments Help Build My Credit? The Renters Best

RenttoOwn Homes How Do They Work and Are They a Good Idea? Ramsey

Trio Review How Does Rent To Own, Lease Purchase Work? Build Wealth

How To Build Credit Quickly By Reporting Your Rent YouTube

What does your credit score have to be to do a rent to own? Leia aqui

Does Paying Rent Build Credit? Self. Credit Builder.

How Does RenttoOwn Work [2024]

What is RenttoOwn Housing? JAAG Properties

The Renters Journey Step 2 Your First Month in a New Rental The

Does Rent To Own Directly Build Credit?

To Find Out About All Of The Available Assistance Programs.

It’s Often Easier To Rent To Own Than It Is To Purchase A Home With Bad Credit.

For Example, Landlords Can Never Use The Credit For Homes They Rent Out But Do Not Use As A Residence Themselves.

Related Post:

:max_bytes(150000):strip_icc()/rent-to-own-homes-final-819c3b46e7094aa4b78f9ad90c05e2ad.png)

![How Does RenttoOwn Work [2024]](https://res.cloudinary.com/apartmentlist/image/fetch/f_auto,q_auto,t_renter_life_article/https://images.ctfassets.net/jeox55pd4d8n/4O77KmEwr1C0h4Cf46w4dR/49fe73c306d688981bebc0815c90ad2e/How_to_Handle_The_Rent-to-Own_Process.png)