Does Self Credit Builder Give You Money

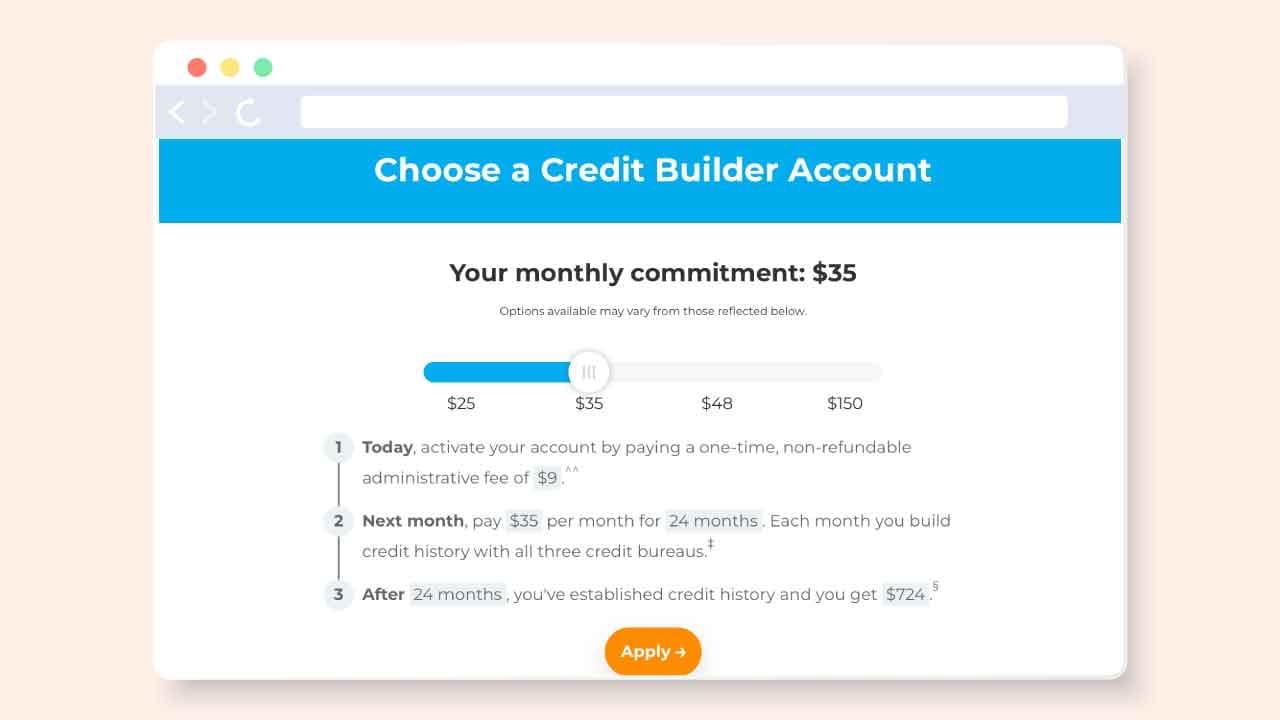

Does Self Credit Builder Give You Money - Self financial levels the playing field for consumers who want to build their credit. You do not receive funds until after your loan matures. The answer, put simply, is yes — self should help your credit scores as long as your credit builder account (and any other credit accounts in your name) is managed responsibly. Self credit builder account can help you improve your credit health or build credit while you also save money. You would then need to make at least three monthly payments on time, save a minimum of $100,. As you make payments on time and in full, you will qualify for the self visa® credit card, and self will. Self offers a full suite of credit building tools and services. Unlike other traditional personal loans, you do not receive the money from your self credit builder account up front. It does not require you to make a large, upfront deposit. To earn the credit card, you must first open a self credit builder account. It requires no credit card or check,. You do not receive funds until after your loan matures. Learn how to get your money back from your self credit builder account at the end of the term or when you close it. To earn the credit card, you must first open a self credit builder account. Self offers a full suite of credit building tools and services. If you don't have the money to open a secured credit card, self may offer the lower cost way to build your credit. Unlike other traditional personal loans, you do not receive the money from your self credit builder account up front. Make sure before you take this option that you can afford the. As you make payments on time and in full, you will qualify for the self visa® credit card, and self will. Building an excellent credit score allows you to borrow money, secure rental leases, and pay lower insurance. If someone has earned more than £1,000 from their side hustle in a tax year, they may need to complete a self assessment tax return. It does not require you to make a large, upfront deposit. Unlike other traditional personal loans, you do not receive the money from your self credit builder account up front. You do not receive funds. Building an excellent credit score allows you to borrow money, secure rental leases, and pay lower insurance. It requires no credit card or check,. It does not require you to make a large, upfront deposit. Self credit builder account can help you improve your credit health or build credit while you also save money. This only applies to people who. Self credit builder is a service from self inc., focused on improving credit scores by reporting rent payments to all three major credit bureaus within 72 hours. Unlike some other credit builder loans, the self credit builder account is available online or via our mobile app in all 50 states. Unlike other traditional personal loans, you do not receive the. The answer, put simply, is yes — self should help your credit scores as long as your credit builder account (and any other credit accounts in your name) is managed responsibly. Building an excellent credit score allows you to borrow money, secure rental leases, and pay lower insurance. Self financial levels the playing field for consumers who want to build. You would then need to make at least three monthly payments on time, save a minimum of $100,. Compare direct deposit and paper check options, fees, and tips to avoid delays or issues. If someone has earned more than £1,000 from their side hustle in a tax year, they may need to complete a self assessment tax return. Make sure. Unfortunately, the self credit builder account isn’t free. Unlike other traditional personal loans, you do not receive the money from your self credit builder account up front. If you don't have the money to open a secured credit card, self may offer the lower cost way to build your credit. The answer, put simply, is yes — self should help. It does not require you to make a large, upfront deposit. While you won’t get access to the funds upfront, you’ll pay an. Unlike some other credit builder loans, the self credit builder account is available online or via our mobile app in all 50 states. This only applies to people who are. To earn the credit card, you must. Unlike other traditional personal loans, you do not receive the money from your self credit builder account up front. The answer, put simply, is yes — self should help your credit scores as long as your credit builder account (and any other credit accounts in your name) is managed responsibly. Self helps you build credit by reporting your monthly payments. To earn the credit card, you must first open a self credit builder account. Learn how to get your money back from your self credit builder account at the end of the term or when you close it. Make sure before you take this option that you can afford the. Self helps you build credit by reporting your monthly payments. Self credit builder works by issuing a loan to be paid off over 24 months. Learn how to get your money back from your self credit builder account at the end of the term or when you close it. Unfortunately, the self credit builder account isn’t free. To earn the credit card, you must first open a self credit builder. You would then need to make at least three monthly payments on time, save a minimum of $100,. The answer, put simply, is yes — self should help your credit scores as long as your credit builder account (and any other credit accounts in your name) is managed responsibly. While you won’t get access to the funds upfront, you’ll pay an. Self credit builder works by issuing a loan to be paid off over 24 months. Unlike other traditional personal loans, you do not receive the money from your self credit builder account up front. Learn how to get your money back from your self credit builder account at the end of the term or when you close it. Self financial levels the playing field for consumers who want to build their credit. This only applies to people who are. It does not require you to make a large, upfront deposit. Self credit builder account can help you improve your credit health or build credit while you also save money. If you don't have the money to open a secured credit card, self may offer the lower cost way to build your credit. Self credit builder is a service from self inc., focused on improving credit scores by reporting rent payments to all three major credit bureaus within 72 hours. Self offers a full suite of credit building tools and services. Building an excellent credit score allows you to borrow money, secure rental leases, and pay lower insurance. Make sure before you take this option that you can afford the. As you make payments on time and in full, you will qualify for the self visa® credit card, and self will.What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

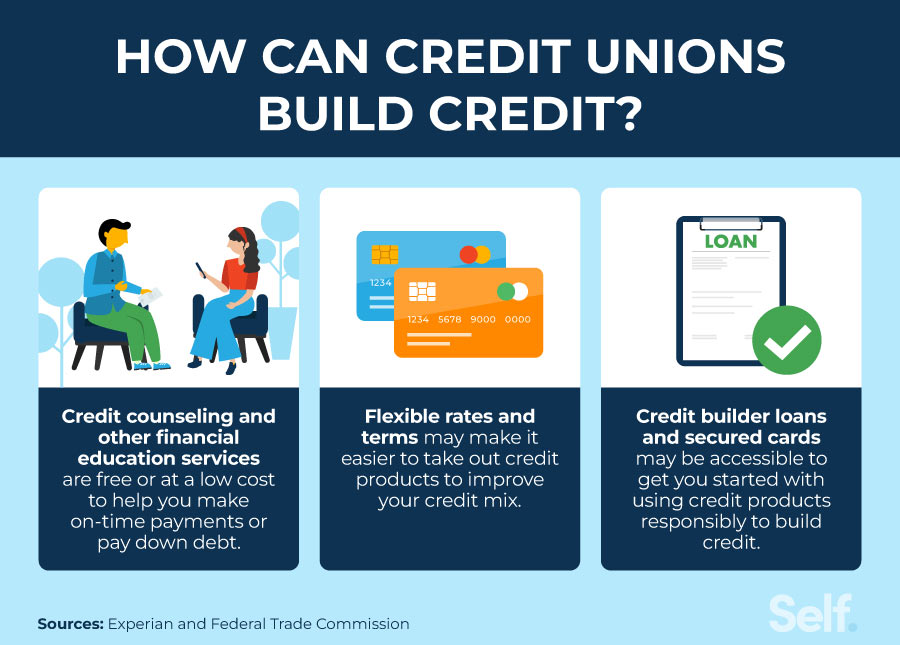

Do Credit Unions Help Build Credit? Self. Credit Builder.

Self Credit Builder Loan Review 2024 No Credit Check

Self Credit Builder Review How Does Self Work? Is Self Legit?

How Does Self Credit Builder Work? The Big Picture Credit Secrets

Self Credit Builder Review What Is it and How Does It Work?

What is Self and How does it work? CREDIT BUILDER account & secured

Self Credit Builder Review What Is it and How Does It Work?

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

It Requires No Credit Card Or Check,.

Compare Direct Deposit And Paper Check Options, Fees, And Tips To Avoid Delays Or Issues.

Unfortunately, The Self Credit Builder Account Isn’t Free.

Unlike Some Other Credit Builder Loans, The Self Credit Builder Account Is Available Online Or Via Our Mobile App In All 50 States.

Related Post: