Does Sezzle Help Build Credit

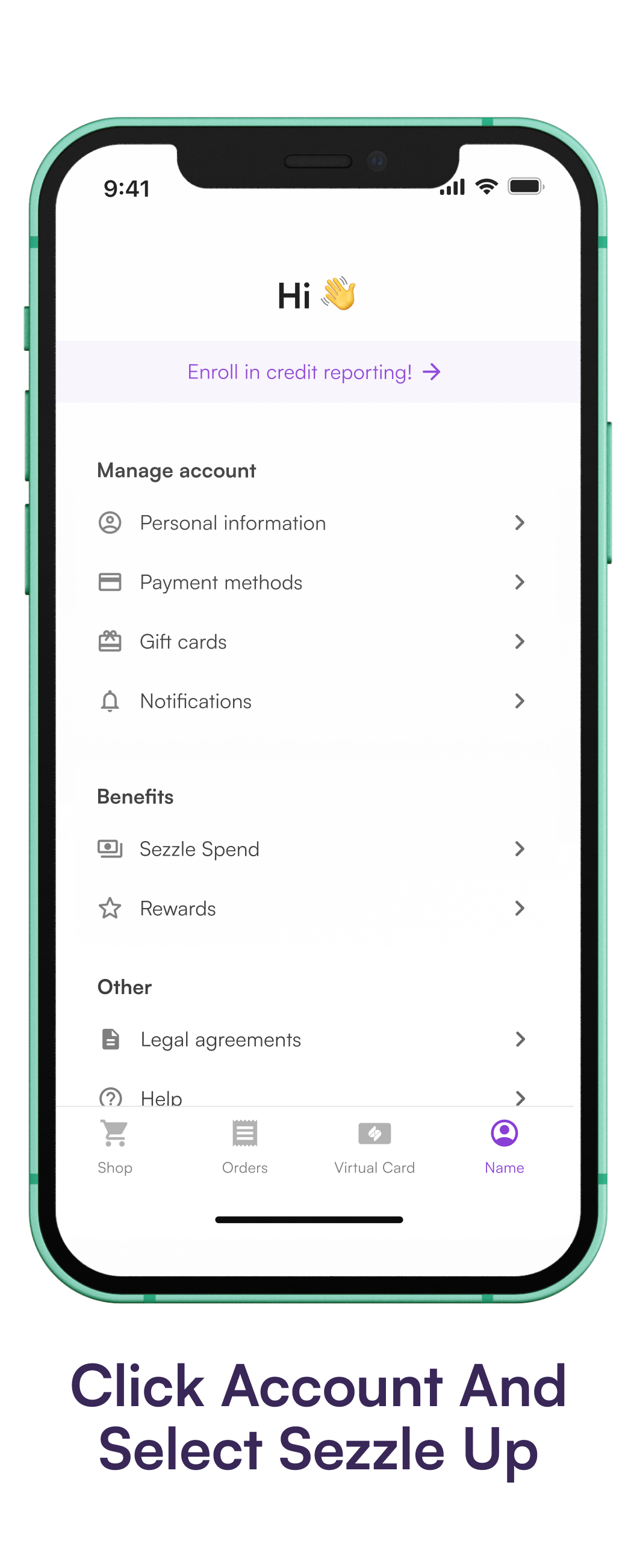

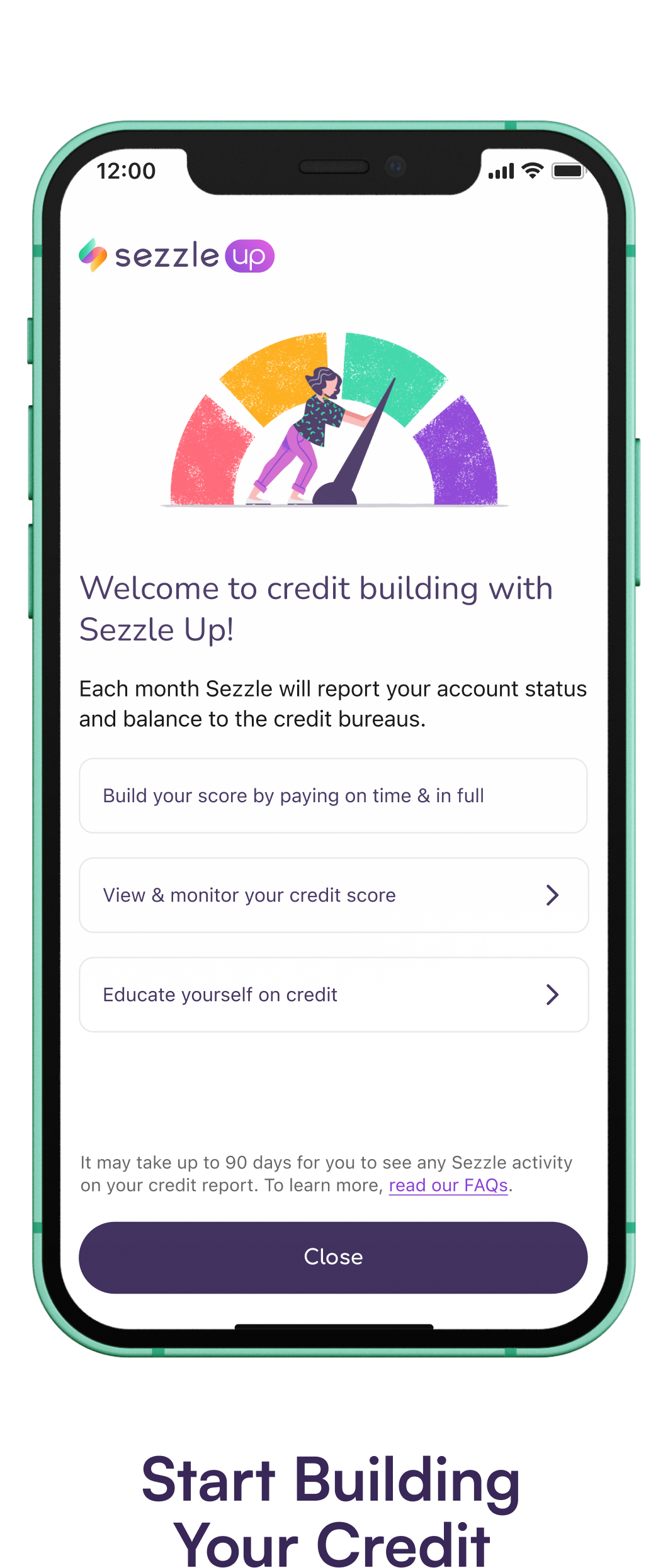

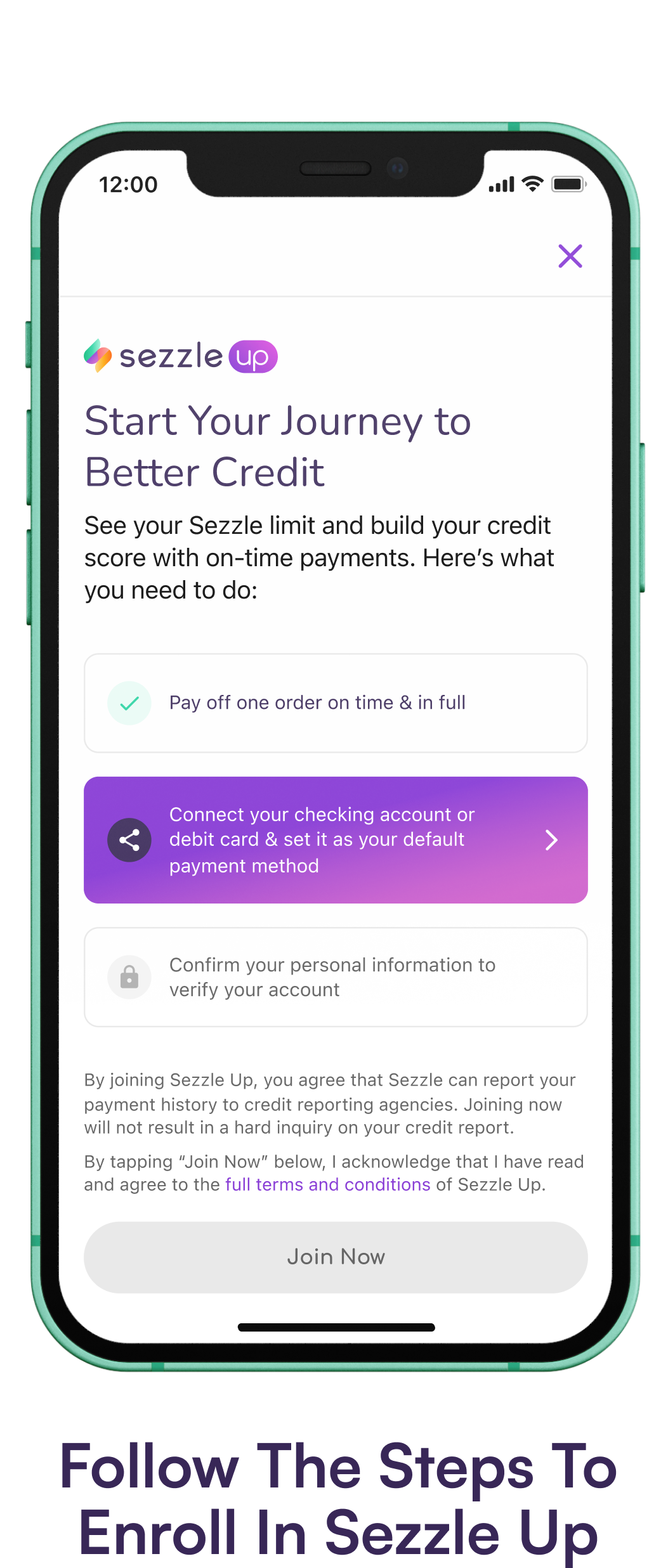

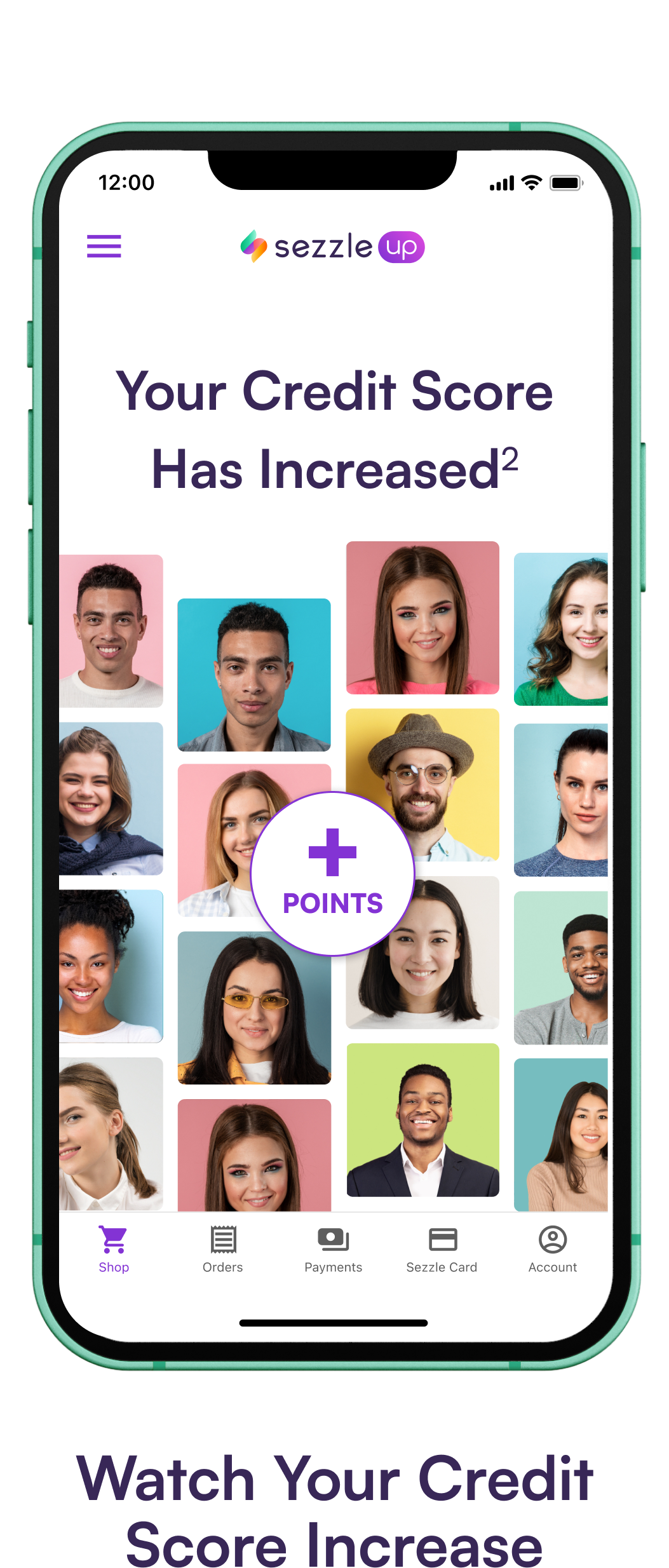

Does Sezzle Help Build Credit - While sezzle does perform a soft credit check, the purpose is not to determine your creditworthiness or approval for using the service. As you navigate the financial world, understanding how tools like sezzle impact your credit score is crucial. The potential benefits of sezzle up for building credit. Pay off one order on time & in full. If you miss the deadline,. Spending more doesn't build credit. But can it really help you build credit? For sezzle's standard service, there is no credit reporting involved., but if you want to use the program to build your credit history, you can sign up for sezzle up’s revolving line of. Sezzle offers a convenient way to spread out payments without incurring interest, but what does this mean for your credit score? In fact, as you already discovered, the more you spend the more it dings your scores. As you navigate the financial world, understanding how tools like sezzle impact your credit score is crucial. Sezzle is expected to grow revenue at a strong pace of 34.5% in 2025. Sezzle is a buy now, pay later app that makes it convenient to shop and pay for purchases in installments. The potential benefits of sezzle up for building credit. Sezzle up is the buy now, pay later option that works with you to help build your credit history. Sezzle is now trading below the credit services industry's forward sales ratio of 5.07x. In addition, sezzle will report your. In terms of credit impact, sezzle can help build credit by reporting payments to credit bureaus, whereas klarna does not help build credit, except for certain financing. But can it really help you build credit? Instead, the soft credit check helps sezzle. Sezzle will run a soft credit check when you apply for a loan, but your credit doesn’t factor into its decision as much as with regular lenders. When you upgrade to sezzle up, you enable us to report your payment history to the credit bureaus. Here’s another way to look at sezzle’s offering, which gets mixed user reviews online. Sezzle. Instead, the soft credit check helps sezzle. The potential benefits of sezzle up for building credit. If you miss the deadline,. Sezzle is expected to grow revenue at a strong pace of 34.5% in 2025. Pay off one order on time & in full. There’s no hard credit inquiry for the basic payment plans, making it accessible for a broad range of users. But if building credit is your top priority, there are better. Sezzle will run a soft credit check when you apply for a loan, but your credit doesn’t factor into its decision as much as with regular lenders. In terms of. As you navigate the financial world, understanding how tools like sezzle impact your credit score is crucial. In fact, as you already discovered, the more you spend the more it dings your scores. Credit cards now carry an average annual interest rate of 21.5% (though people with. Sezzle up is the buy now, pay later option that works with you. But if building credit is your top priority, there are better. But beyond the convenience of spreading out payments, you might be wondering if sezzle can actually help build your credit. Sezzle may help build credit if you opt into sezzle up, which reports your payment history to the three main credit bureaus. There’s no hard credit inquiry for the. Sezzle offers a convenient way to spread out payments without incurring interest, but what does this mean for your credit score? Sezzle will run a soft credit check when you apply for a loan, but your credit doesn’t factor into its decision as much as with regular lenders. Sezzle may help build credit if you opt into sezzle up, which. Spending more doesn't build credit. Pay off one order on time & in full. Sezzle offers a convenient way to spread out payments without incurring interest, but what does this mean for your credit score? Sezzle is expected to grow revenue at a strong pace of 34.5% in 2025. Sezzle is now trading below the credit services industry's forward sales. But if building credit is your top priority, there are better. The potential benefits of sezzle up for building credit. Sezzle is expected to grow revenue at a strong pace of 34.5% in 2025. Credit cards now carry an average annual interest rate of 21.5% (though people with. Understanding the impact of sezzle on your credit. The potential benefits of sezzle up for building credit. Sezzle will run a soft credit check when you apply for a loan, but your credit doesn’t factor into its decision as much as with regular lenders. But can it really help you build credit? Sezzle may help build credit if you opt into sezzle up, which reports your payment history. How do i enroll in sezzle up? Pay off one order on time & in full. Instead, the soft credit check helps sezzle. The potential benefits of sezzle up for building credit. For the best possible scores you want one account to report a small. Pay off one order on time & in full. Understanding how sezzle interacts with your. Sezzle is a buy now, pay later app that makes it convenient to shop and pay for purchases in installments. In fact, as you already discovered, the more you spend the more it dings your scores. Sezzle up is the buy now, pay later option that works with you to help build your credit history. The sezzle app is highly rated, scoring 4.9 out of 5 stars on the app. But beyond the convenience of spreading out payments, you might be wondering if sezzle can actually help build your credit. Sezzle is expected to grow revenue at a strong pace of 34.5% in 2025. Sezzle will run a soft credit check when you apply for a loan, but your credit doesn’t factor into its decision as much as with regular lenders. For sezzle's standard service, there is no credit reporting involved., but if you want to use the program to build your credit history, you can sign up for sezzle up’s revolving line of. If your payment fails, sezzle allows you 48 hours to correct it. Credit cards now carry an average annual interest rate of 21.5% (though people with. How do i enroll in sezzle up? If you miss the deadline,. There’s no hard credit inquiry for the basic payment plans, making it accessible for a broad range of users. Sezzle may help build credit if you opt into sezzle up, which reports your payment history to the three main credit bureaus.Tools to Help You Build & Monitor Your Credit Sezzle

Does Sezzle Report to Credit Bureaus? Info on the BuyNowPayLater

How Does Sezzle Work? Where Can I Use Sezzle Payments?

How Does Sezzle Work? Where Can I Use Sezzle Payments?

How Does Sezzle Work? Where Can I Use Sezzle Payments?

How Does Sezzle Work? Where Can I Use Sezzle Payments?

How do I build my credit with Sezzle Up? Sezzle

Buy Now, Pay Later With Sezzle Eyce Molds

How Does Sezzle Work? Where Can I Use Sezzle Payments?

How hard is it to get approved by Sezzle? Leia aqui What credit score

But If Building Credit Is Your Top Priority, There Are Better.

Spending More Doesn't Build Credit.

Sezzle Offers A Convenient Way To Spread Out Payments Without Incurring Interest, But What Does This Mean For Your Credit Score?

The Potential Benefits Of Sezzle Up For Building Credit.

Related Post: