Does Step Actually Build Credit

Does Step Actually Build Credit - Rather, it is a card that helps people with no credit or bad credit build their score. Show more s, set up direct deposit, and send and receive money instantly. This means that teens can begin building credit with the step card without. Learn how to build your credit for free—no credit score required. And parents can integrate their existing. Step users have credit scores that are, on average,. Founders cj macdonald and alexey kalinichenko created step with the intention of serving. One of the things we love most about the step card is that it helps users build credit. The step card is a secured spending card that builds credit just like a credit card. This is banking the way it should be.* step users in their. Show more s, set up direct deposit, and send and receive money instantly. One of the things we love most about the step card is that it helps users build credit. Does the step card build credit? With step, users can invest in cryptocurrencies and stocks, set savings goals, earn reward. Founders cj macdonald and alexey kalinichenko created step with the intention of serving. The step card is a secured card, which is neither a credit nor a debit card. Account age, payment history, and payment date. Step reports 3 key pieces of information: Designed to empower younger generations to make. Step is as safe as any debit card because it doesn’t allow users to go into debt or spend. Unlike a credit card, there are no monthly payments or. Step helps families safely build credit, grow savings, and create a solid financial foundation at any age. Show more s, set up direct deposit, and send and receive money instantly. The step card is a secured spending card that builds credit just like a credit card. The step card is. This means that teens can begin building credit with the step card without. Step is the safe and easy way to build your credit ̍ for free and get more from your paycheck with unlimited cashback on purchases. Step’s secured spending card helps middle and high schoolers get an early start on building credit and learning financial responsibility. One of. Step was named the most innovative credit builder of 2024 by finder. Founders cj macdonald and alexey kalinichenko created step with the intention of serving. Step users have credit scores that are, on average,. Lenders typically like to see that you have experience using credit responsibly. Step reports 3 key pieces of information: Step reports 3 key pieces of information: Step’s secured spending card helps middle and high schoolers get an early start on building credit and learning financial responsibility. Unlike a credit card, there are no monthly payments or. Step is as safe as any debit card because it doesn’t allow users to go into debt or spend. The step card is. The step card is a secured card, which is neither a credit nor a debit card. Step users have credit scores that are, on average,. The step card is a secured spending card that builds credit just like a credit card. Step is the safe and easy way to build your credit ̍ for free and get more from your. Account age, payment history, and payment date. And parents can integrate their existing. Step is the safe and easy way to build your credit ̍ for free and get more from your paycheck with unlimited cashback on purchases. Step reports 3 key pieces of information: The step card is a secured card, which is neither a credit nor a debit. This means that teens can begin building credit with the step card without. But unlike a credit card, money is withdrawn directly from your step account for each transaction. Step users have credit scores that are, on average,. Rather, it is a card that helps people with no credit or bad credit build their score. One of the things we. Show more s, set up direct deposit, and send and receive money instantly. This is banking the way it should be.* step users in their. But unlike a credit card, money is withdrawn directly from your step account for each transaction. Step was named the most innovative credit builder of 2024 by finder. Step users have credit scores that are,. Step is the best way for your child to build a positive credit history before they turn 18, without the risk of overspending or missing payments. Step’s secured spending card helps middle and high schoolers get an early start on building credit and learning financial responsibility. Does the step card build credit? Show more s, set up direct deposit, and. Founders cj macdonald and alexey kalinichenko created step with the intention of serving. Lenders typically like to see that you have experience using credit responsibly. Step is the best way for your child to build a positive credit history before they turn 18, without the risk of overspending or missing payments. Step is as safe as any debit card because. Step is as safe as any debit card because it doesn’t allow users to go into debt or spend. Learn how to build your credit for free—no credit score required. The step card is a secured spending card that builds credit just like a credit card. Step reports 3 key pieces of information: Step is the best way for your child to build a positive credit history before they turn 18, without the risk of overspending or missing payments. Unlike a credit card, there are no monthly payments or. Step is the safe and easy way to build your credit ̍ for free and get more from your paycheck with unlimited cashback on purchases. Does the step card build credit? Show more s, set up direct deposit, and send and receive money instantly. One of the things we love most about the step card is that it helps users build credit. This means that teens can begin building credit with the step card without. This is banking the way it should be.* step users in their. But unlike a credit card, money is withdrawn directly from your step account for each transaction. The step card is a secured card, which is neither a credit nor a debit card. Founders cj macdonald and alexey kalinichenko created step with the intention of serving. Step was named the most innovative credit builder of 2024 by finder.How to Build Credit in 10 Ways TheStreet

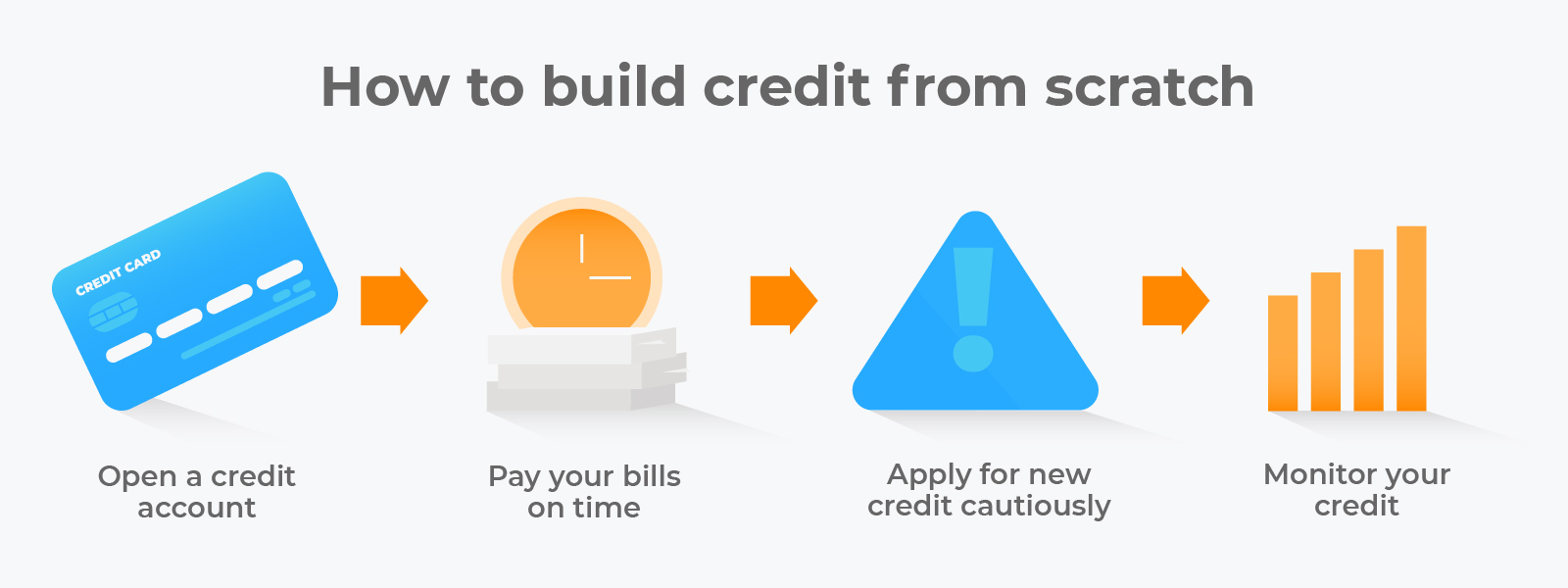

How to Build Credit The 7Step Guide Chime

How to Build Credit The 7Step Guide Chime

What store credit cards are good for building credit? Leia aqui Are

The Ultimate Guide To Building Credit YouTube

Mastering the Basics A StepbyStep Guide to Build Good Credit

How To Build Credit In 3 Easy Steps in 2020 Build credit, Credit

How to build credit in 6 easy steps Artofit

How to Build Credit in 7+ Ways Self. Credit Builder.

The Fastest Ways to Build Credit [Infographic] Ways to build credit

Step’s Secured Spending Card Helps Middle And High Schoolers Get An Early Start On Building Credit And Learning Financial Responsibility.

Account Age, Payment History, And Payment Date.

And Parents Can Integrate Their Existing.

Designed To Empower Younger Generations To Make.

Related Post:

![The Fastest Ways to Build Credit [Infographic] Ways to build credit](https://i.pinimg.com/736x/84/f7/9b/84f79bbf1772565ea57631383d732ed4.jpg)