Does Step Card Build Credit

Does Step Card Build Credit - When your kid uses their. This means that teens can. The card is backed by a deposit account, which acts as your kid’s spending limit. The first step to mastering how to use a credit card to build credit is to locate your card. The step card processes like a credit card. You can work on building your credit. Step combines an allowance app, a mobile banking solution, and a secured credit card for kids. But step is built around the fact that going straight from a debit card to a credit card can be risky for some, but that a good credit score is necessary in the modern world. Step’s card is a secured card that helps kids build a credit history. Step is the safe and easy way to build credit history, even before you turn 18. Parents aren’t lacking options when it comes to spending cards for their children, but step’s visa card offers something no rival card can: Step helps families safely build credit, grow savings, and create a solid financial foundation at any age. This means that teens can. The card is backed by a deposit account, which acts as your kid’s spending limit. Choose the right credit card. The step card processes like a credit card. Step combines an allowance app, a mobile banking solution, and a secured credit card for kids. Step banking—and its secured credit card, the step card—is similar to many of my favorite debit cards for kids in that it not only allows kids to spend, but it acts as an educational. Step gives you a free plastic card with your account. This allows users to build credit. Step gives you a free plastic card with your account. But unlike a credit card, money is withdrawn directly from your step account for each transaction. The card is backed by a deposit account, which acts as your kid’s spending limit. When your kid uses their. Step helps families safely build credit, grow savings, and create a solid financial foundation. The card is backed by a deposit account, which acts as your kid’s spending limit. Step is the safe and easy way to build credit history, even before you turn 18. Each time you deposit money into your step account, you are setting your own limit on how much you can spend that is independent of a credit limit. We've. Get a free fdic insured bank account & step visa card with no subscription fees. Each time you deposit money into your step account, you are setting your own limit on how much you can spend that is independent of a credit limit. You don't have to get the black card you can just get the regular step card. But. You don't have to get the black card you can just get the regular step card. Step helps families safely build credit, grow savings, and create a solid financial foundation at any age. But unlike a credit card, money is withdrawn directly from your step account for each transaction. Once you have vendor accounts reporting positive payments, the next step. Step gives you a free plastic card with your account. Step is the safe and easy way to build credit history, even before you turn 18. This allows users to build credit. This means that teens can. Once you have vendor accounts reporting positive payments, the next step is getting a business credit card. Choose the right credit card. But unlike a credit card, money is withdrawn directly from your step account for each transaction. The $100 card is just a paid option for more perks. Step is the safe and easy way to build credit history, even before you turn 18. Step’s card is a secured card that helps kids build a credit. Get a free fdic insured bank account & step visa card with no subscription fees. This means that teens can. You don't have to get the black card you can just get the regular step card. Step banking—and its secured credit card, the step card—is similar to many of my favorite debit cards for kids in that it not only. Step helps families safely build credit, grow savings, and create a solid financial foundation at any age. The card is backed by a deposit account, which acts as your kid’s spending limit. The step card processes like a credit card. This means that teens can. Once you have vendor accounts reporting positive payments, the next step is getting a business. Step is the safe and easy way to build credit history, even before you turn 18. Certain cards are designed to assist people in. Parents aren’t lacking options when it comes to spending cards for their children, but step’s visa card offers something no rival card can: The $100 card is just a paid option for more perks. The step. Once you have vendor accounts reporting positive payments, the next step is getting a business credit card. Step banking—and its secured credit card, the step card—is similar to many of my favorite debit cards for kids in that it not only allows kids to spend, but it acts as an educational. Step is the safe and easy way to build. But step is built around the fact that going straight from a debit card to a credit card can be risky for some, but that a good credit score is necessary in the modern world. Each time you deposit money into your step account, you are setting your own limit on how much you can spend that is independent of a credit limit. You don't have to get the black card you can just get the regular step card. Choose the right credit card. But unlike a credit card, money is withdrawn directly from your step account for each transaction. This allows users to build credit. Once you have vendor accounts reporting positive payments, the next step is getting a business credit card. Get a free fdic insured bank account & step visa card with no subscription fees. Step gives you a free plastic card with your account. Step banking—and its secured credit card, the step card—is similar to many of my favorite debit cards for kids in that it not only allows kids to spend, but it acts as an educational. The step card processes like a credit card. There’s no credit check and you don’t need to have a credit score of any kind to sign up. The card is backed by a deposit account, which acts as your kid’s spending limit. Step’s card is a secured card that helps kids build a credit history. Step helps families safely build credit, grow savings, and create a solid financial foundation at any age. The step black card sees your potential, not your past.How to Build Credit The 7Step Guide Chime

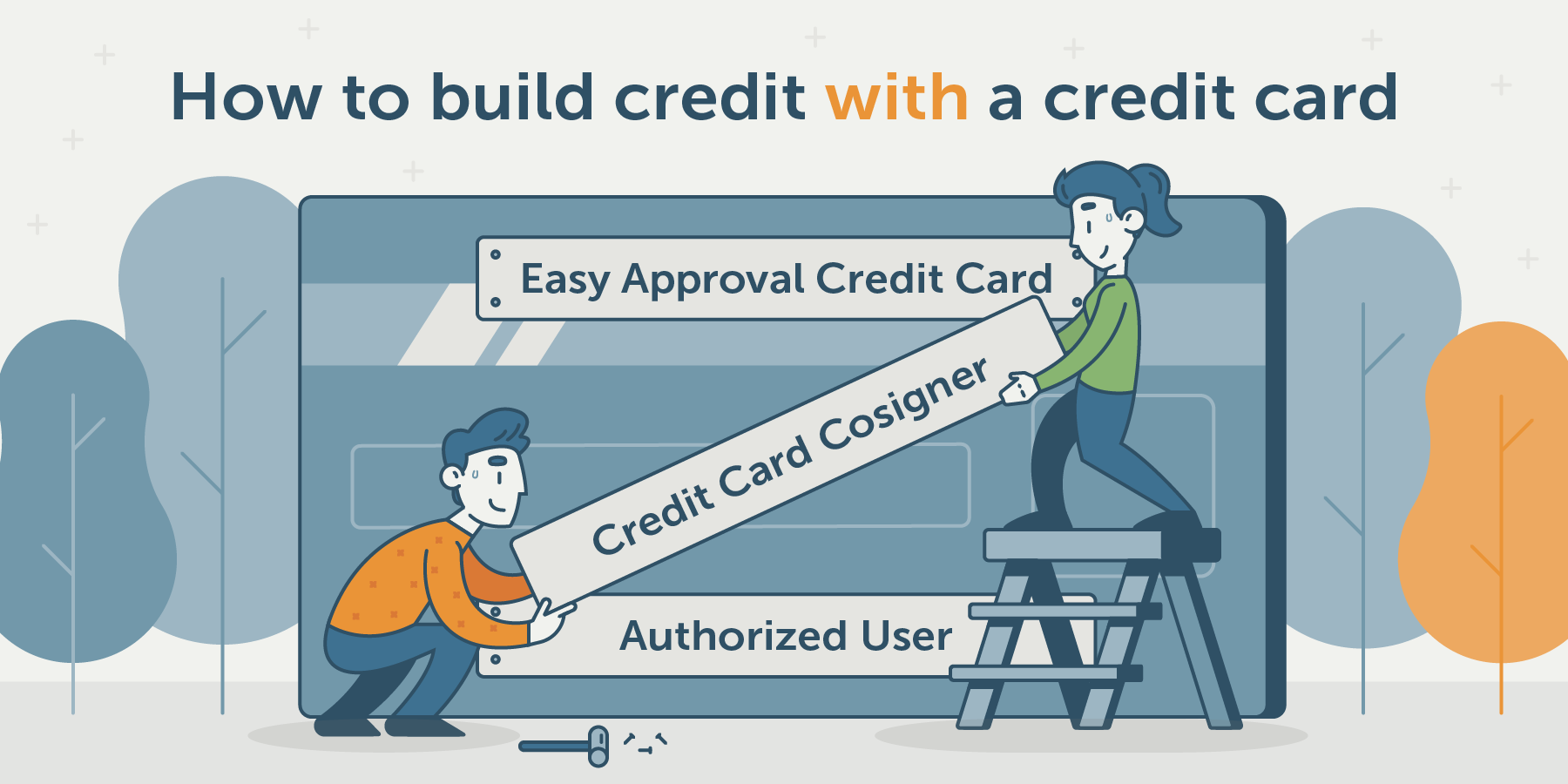

How to Use a Credit Card to Build Credit in 2023? Best Guide

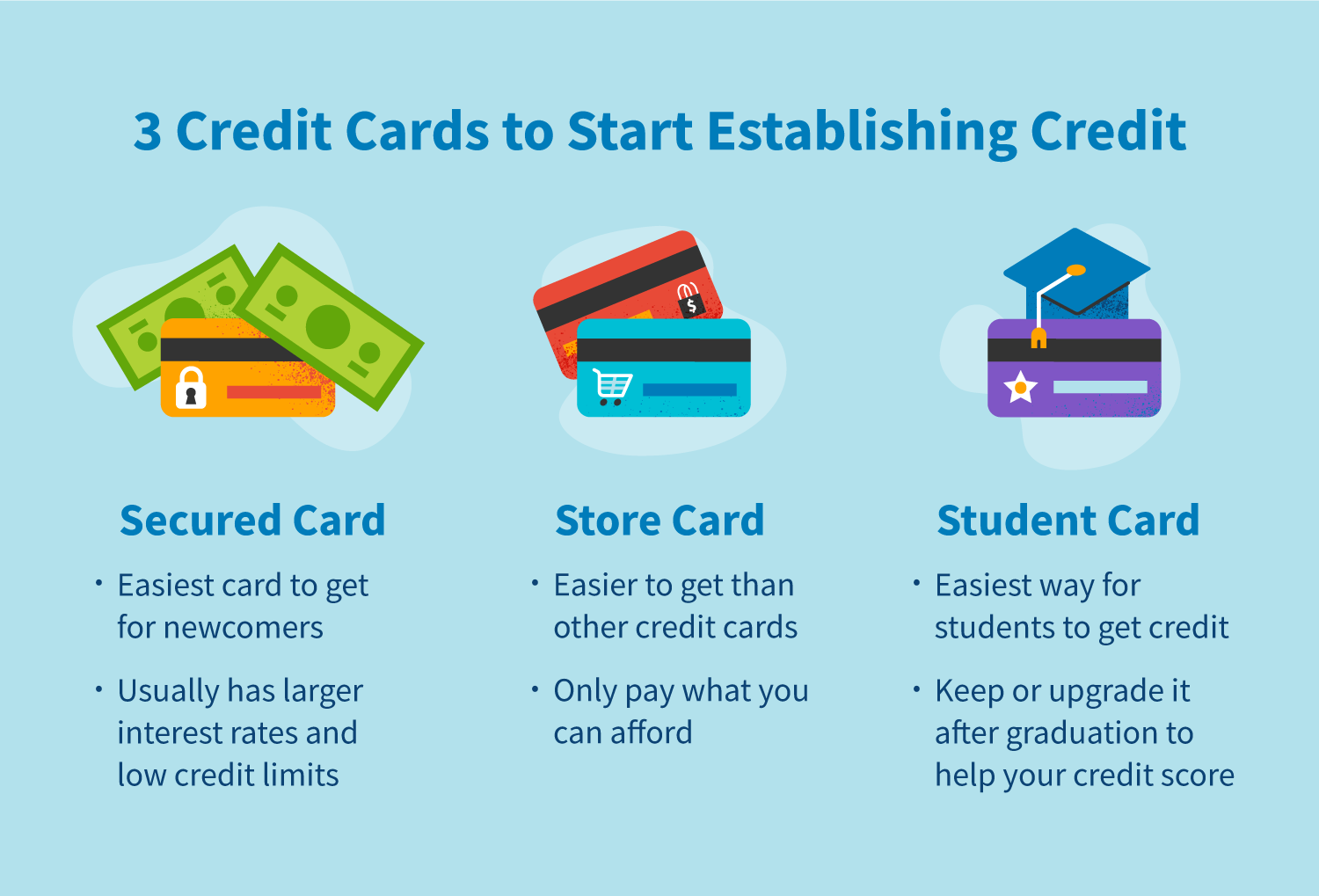

4 Ways to Establish Credit

How to use credit card step by step? Leia aqui How to use a credit

How quickly will a secured card build credit? Leia aqui How long does

How to build credit in 6 easy steps Artofit

Does The Step Card Build Credit

Does Step Card Build Credit

How to Build Credit

5 Best Credit Cards for Teens [Build Credit in 2024]

Step Is The Safe And Easy Way To Build Credit History, Even Before You Turn 18.

Certain Cards Are Designed To Assist People In.

When Your Kid Uses Their.

We've Built The Step Card This Way To Help.

Related Post:

![5 Best Credit Cards for Teens [Build Credit in 2024]](https://youngandtheinvested.com/wp-content/uploads/step-signup-new-nocode.jpg)