Does Taking Out A Loan Build Credit

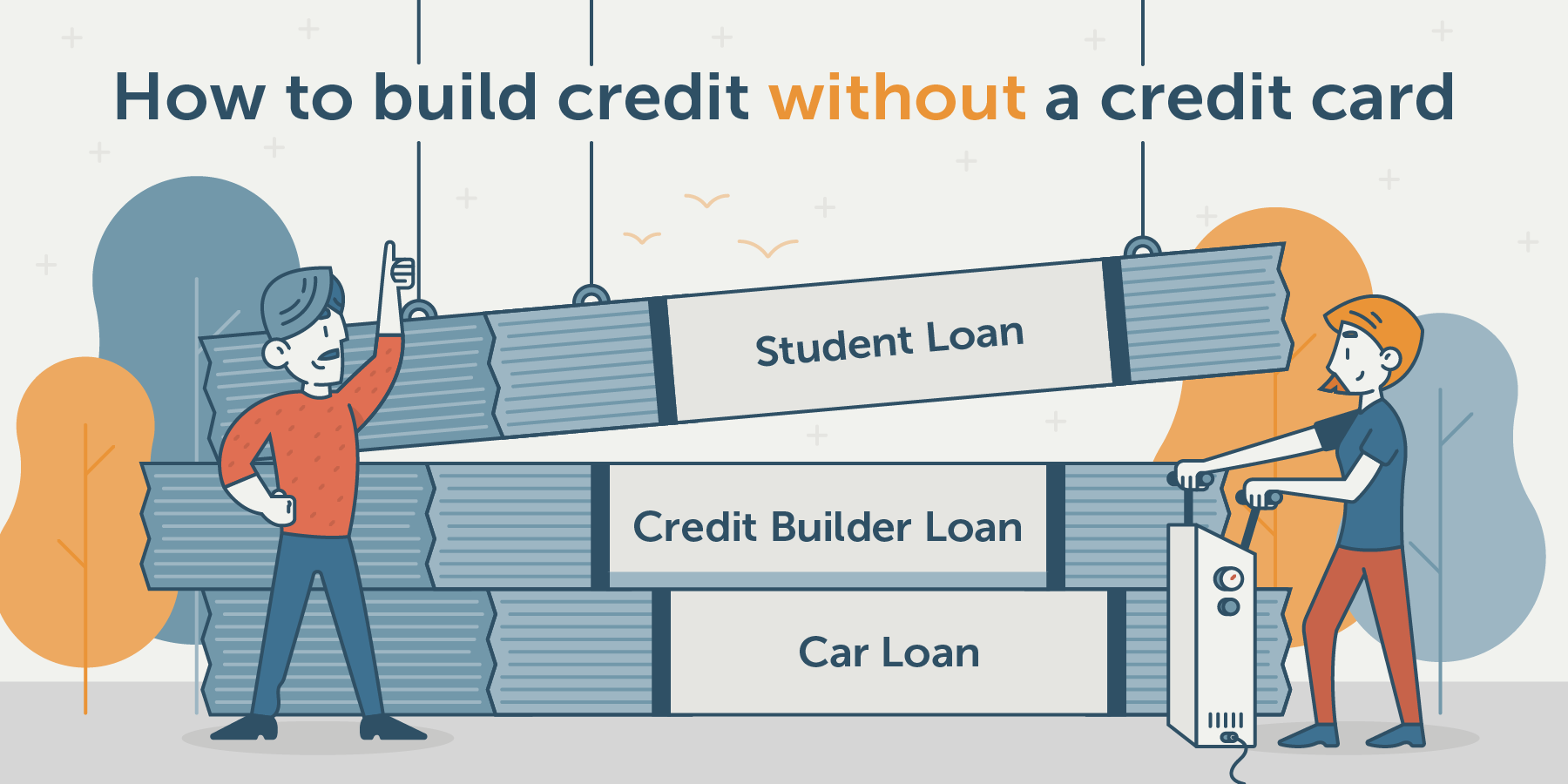

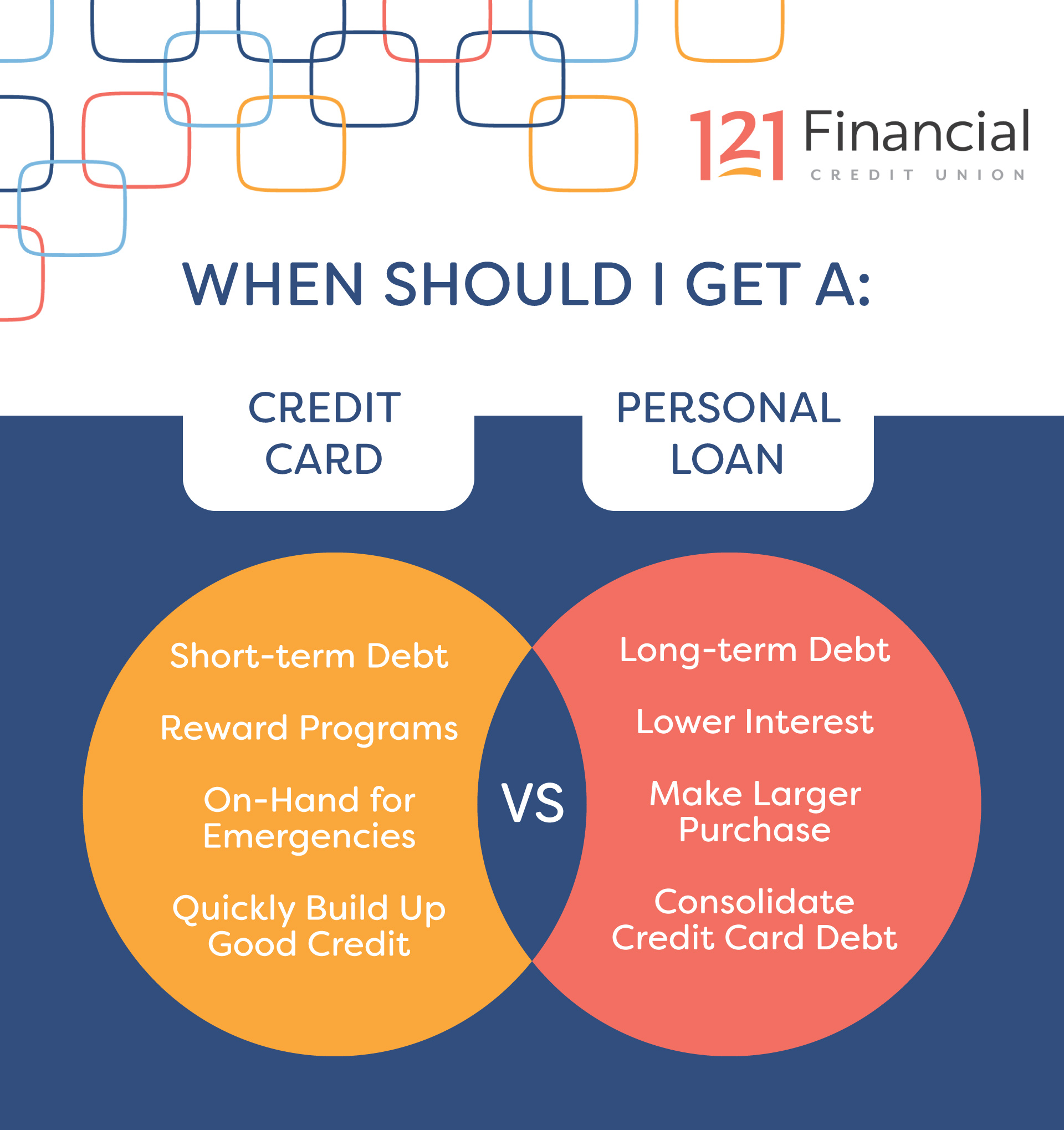

Does Taking Out A Loan Build Credit - This can include everything from credit card. Can they improve your credit score? Taking out a personal loan can help you build credit — if you do a good job repaying the loan. Over time, regular payments help you establish a. You’ll borrow a fixed amount of money from a lender, which you’ll then pay back in intervals over the course of the loan term, with interest. The plan won’t work for everyone. Stop worrying about debt, spend. Credit builder loans are installment loans that are specifically designed to help people with poor credit build or rebuild credit history. Taking out a loan and paying it back on time and in full can do wonders for. Credit history accounts for about 15% of your credit score. A longer credit history can be beneficial, while opening. Understanding interest rates helps you assess how much a loan or line of credit could cost you. Making timely payments on a personal loan may have a positive effect on a person’s credit score. Yes, getting a personal loan can build credit, but only if the lender reports your payments to the credit bureaus. Yes, but only if you do it right. Loans can impact your credit score in multiple ways. This can include everything from credit card. Credit builder loans are installment loans that are specifically designed to help people with poor credit build or rebuild credit history. On the other hand, if you are late. Making monthly payments on time can strengthen your credit score. Loans can impact your credit score in multiple ways. So, do personal loans build credit? Paying off a loan can positively or negatively impact your credit scores in the short term, depending on your mix of account types, account balances and other factors. The plan won’t work for everyone. Let’s examine how a personal loan. However, to secure a personal. Stop worrying about debt, spend. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. Yes, getting a personal loan can build credit, but only if the lender reports your payments to the credit bureaus. Debt consolidation is when a borrower takes out a new loan. Over time, regular payments help you establish a. Understanding interest rates helps you assess how much a loan or line of credit could cost you. Taking out a loan and paying it back on time and in full can do wonders for. You’ll borrow a fixed amount of money from a lender, which you’ll then pay back in intervals over. A longer credit history can be beneficial, while opening. Stop worrying about debt, spend. The plan won’t work for everyone. Taking out a loan and paying it back on time and in full can do wonders for. Credit builder loans are installment loans that are specifically designed to help people with poor credit build or rebuild credit history. Let’s take a look at what factors go into calculating a credit score and. Build a positive repayment history: Interest rates can be simple or compound as well as fixed or variable over the. Let’s examine how a personal loan. A longer credit history can be beneficial, while opening. Over time, regular payments help you establish a. Credit builder loans are installment loans that are specifically designed to help people with poor credit build or rebuild credit history. Take out a credit builder loan. Understanding interest rates helps you assess how much a loan or line of credit could cost you. So, do personal loans build credit? Let’s take a look at what factors go into calculating a credit score and. Interest rates can be simple or compound as well as fixed or variable over the. Credit history accounts for about 15% of your credit score. A longer credit history can be beneficial, while opening. How loans impact your credit score. Build a positive repayment history: Stop worrying about debt, spend. Over time, regular payments help you establish a. Yes, but only if you do it right. Debt consolidation is when a borrower takes out a new loan and then uses the loan proceeds to pay off their other individual debts. Yes, getting a personal loan can build credit, but only if the lender reports your payments to the credit bureaus. So, do personal loans build credit? Interest rates can be simple or compound as well as fixed or variable over the. There are three main ways a personal loan can benefit your credit: On the other hand, if you are late. Dana miranda is a certified educator in personal finance®, creator of the healthy rich newsletter and author of you don't need a budget: Taking out a loan and paying it back on time and in full can do wonders for. However, to secure a personal. Paying off a loan can positively or negatively impact your credit scores in the short. Paying off a loan can positively or negatively impact your credit scores in the short term, depending on your mix of account types, account balances and other factors. Build a positive repayment history: Over time, regular payments help you establish a. Yes, but only if you do it right. You’ll borrow a fixed amount of money from a lender, which you’ll then pay back in intervals over the course of the loan term, with interest. On the other hand, if you are late. Understanding interest rates helps you assess how much a loan or line of credit could cost you. How loans impact your credit score. Credit history accounts for about 15% of your credit score. Interest rates can be simple or compound as well as fixed or variable over the. This can include everything from credit card. Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first $750,000 of their mortgage debt, or mortgage debt up to. Stop worrying about debt, spend. It is possible for installment loans to build credit, although there may be a small dip in your score when you first borrow. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. Making monthly payments on time can strengthen your credit score.Does paying a student loan build credit?

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

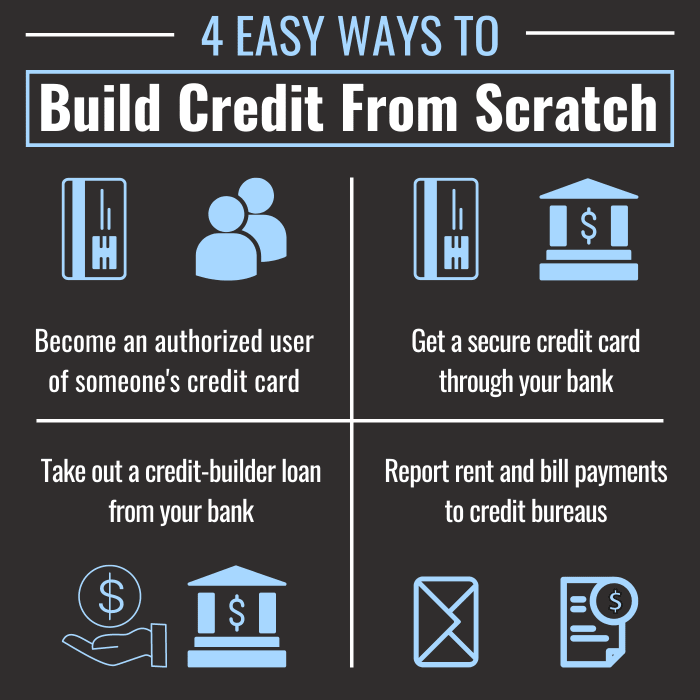

4 Ways to Safely Build Credit When You Have None TheStreet

Credit Builder Loan What They Are and How They Work

How to Build Credit

How to Build Credit if You Have Low or No Credit Three Easy Tips!

Is getting a personal loan good for credit? Leia aqui Does a personal

Can a Personal Loan Build Your Credit? How Borrowing Can Boost Your

How to Build Credit Self. Credit Builder. (2024)

How to Build Credit The 7Step Guide Chime

Taking Out A Personal Loan Can Help You Build Credit — If You Do A Good Job Repaying The Loan.

Let’s Take A Look At What Factors Go Into Calculating A Credit Score And.

Making Timely Payments On A Personal Loan May Have A Positive Effect On A Person’s Credit Score.

Take Out A Credit Builder Loan.

Related Post: