Domestic Building Insurance

Domestic Building Insurance - Builders are required to purchase dbi. It has a moneygeek score of 92 and an average annual premium of $979 for $100k dwelling. Domestic building insurance is a mandatory requirement prescribed by the building act 1993 (vic), and ministerial orders published. The domestic building contracts act 1993 (vic). In victoria it is mandatory for builders to purchase domestic building insurance (dbi) for all domestic building projects, where the contract price is over $16,000. Domestic building insurance (dbi) provides some protection to homeowners in the event that their building project cannot be completed or has. Allstate offers the most affordable home insurance in chicago, at just $1,243 per year. This compares favorably to the city’s average homeowners premium of $1,620. Domestic building insurance (dbi) is required to be provided by a builder when the cost of building work under the contract with the builder is more than $16,000, including labour and material. We looked at average costs, customer service ratings, and policy options from multiple top insurers to find the best and cheapest home insurance companies in chicago. Dbi protects homeowners in the event that their building project. What is domestic building insurance (dbi)? State farm is the best and cheapest home insurance provider in chicago, illinois. Domestic building insurance (dbi) is required for all domestic building projects, where the contract price is over $16,000. Domestic building insurance (dbi) is a statutory product, compulsory under relevant building legislation in most states for builders carrying out. What is domestic building insurance? Domestic building insurance (dbi) is required to be provided by a builder when the cost of building work under the contract with the builder is more than $16,000, including labour and material. Domestic building insurance, previously called ‘builder’s warranty insurance’ is the insurance provided by your builder for works that exceed $16,000 (for both labour and. In victoria it is mandatory for builders to purchase domestic building insurance (dbi) for all domestic building projects, where the contract price is over $16,000. It has a moneygeek score of 92 and an average annual premium of $979 for $100k dwelling. Domestic building insurance, previously called ‘builder’s warranty insurance’ is the insurance provided by your builder for works that exceed $16,000 (for both labour and. Allstate offers the most affordable home insurance in chicago, at just $1,243 per year. What is domestic building insurance? In victoria it is mandatory for builders to purchase domestic building insurance (dbi) for all domestic building. In victoria it is mandatory for builders to purchase domestic building insurance (dbi) for all domestic building projects, where the contract price is over $16,000. Allstate offers the most affordable home insurance in chicago, at just $1,243 per year. Domestic building insurance (dbi) provides cover for homeowners who are building or renovating in victoria. Explains when domestic building insurance is. Domestic building insurance (dbi) is required to be provided by a builder when the cost of building work under the contract with the builder is more than $16,000, including labour and material. Explains when domestic building insurance is required in victoria, what it covers and where builders can obtain this insurance. What is domestic building insurance? This compares favorably to. State farm is the best and cheapest home insurance provider in chicago, illinois. What is domestic building insurance (dbi)? Explains when domestic building insurance is required in victoria, what it covers and where builders can obtain this insurance. Builders are required to purchase dbi. Domestic building insurance is a mandatory requirement prescribed by the building act 1993 (vic), and ministerial. Domestic building insurance (dbi) provides cover for homeowners who are building or renovating in victoria. Domestic building insurance (dbi) is required for all domestic building projects, where the contract price is over $16,000. Domestic building insurance is a mandatory requirement prescribed by the building act 1993 (vic), and ministerial orders published. Domestic building insurance (dbi) is required to be provided. We looked at average costs, customer service ratings, and policy options from multiple top insurers to find the best and cheapest home insurance companies in chicago. Domestic building insurance is a mandatory requirement prescribed by the building act 1993 (vic), and ministerial orders published. Domestic building insurance (dbi) provides some protection to homeowners in the event that their building project. We looked at average costs, customer service ratings, and policy options from multiple top insurers to find the best and cheapest home insurance companies in chicago. State farm is the best and cheapest home insurance provider in chicago, illinois. Domestic building insurance is a mandatory requirement prescribed by the building act 1993 (vic), and ministerial orders published. Domestic building insurance. What is domestic building insurance (dbi)? Allstate offers the most affordable home insurance in chicago, at just $1,243 per year. Domestic building insurance, previously called ‘builder’s warranty insurance’ is the insurance provided by your builder for works that exceed $16,000 (for both labour and. It has a moneygeek score of 92 and an average annual premium of $979 for $100k. The domestic building contracts act 1993 (vic). What is domestic building insurance (dbi)? We looked at average costs, customer service ratings, and policy options from multiple top insurers to find the best and cheapest home insurance companies in chicago. State farm is the best and cheapest home insurance provider in chicago, illinois. Domestic building insurance (dbi) provides some protection to. This compares favorably to the city’s average homeowners premium of $1,620. Domestic building insurance (dbi) provides cover for homeowners who are building or renovating in victoria. Domestic building insurance (dbi) is required to be provided by a builder when the cost of building work under the contract with the builder is more than $16,000, including labour and material. It has. Domestic building insurance (dbi) provides cover for homeowners who are building or renovating in victoria. Domestic building insurance is a mandatory requirement prescribed by the building act 1993 (vic), and ministerial orders published. Domestic building insurance (dbi) is required for all domestic building projects, where the contract price is over $16,000. Dbi protects homeowners in the event that their building project. Builders are required to purchase dbi. Explains when domestic building insurance is required in victoria, what it covers and where builders can obtain this insurance. Domestic building insurance (dbi) is a statutory product, compulsory under relevant building legislation in most states for builders carrying out. What is domestic building insurance (dbi)? Domestic building insurance (dbi) is required to be provided by a builder when the cost of building work under the contract with the builder is more than $16,000, including labour and material. What is domestic building insurance (dbi)? The domestic building contracts act 1993 (vic). Allstate offers the most affordable home insurance in chicago, at just $1,243 per year. Domestic building insurance, previously called ‘builder’s warranty insurance’ is the insurance provided by your builder for works that exceed $16,000 (for both labour and. This compares favorably to the city’s average homeowners premium of $1,620. State farm is the best and cheapest home insurance provider in chicago, illinois. Domestic building insurance (dbi) provides some protection to homeowners in the event that their building project cannot be completed or has.Domestic Building Insurance Assetinsure

Domestic Building Insurance Explained Sherbrooke Constructions

What is Domestic Building Insurance?

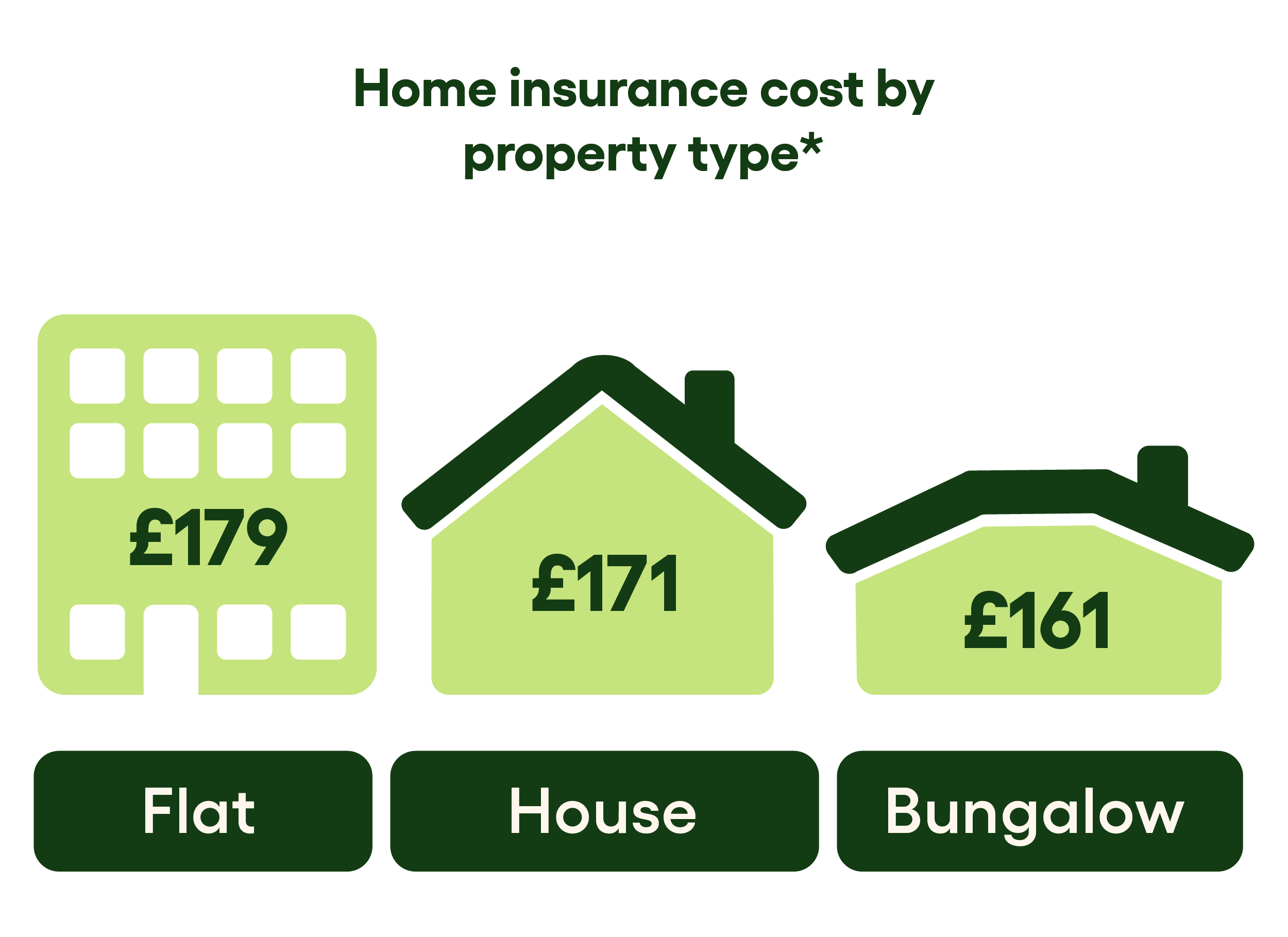

How much does home insurance cost?

Domestic Building Insurance Assetinsure

Domestic Building Insurance Explained Sherbrooke Constructions

Domestic Building Insurance Assetinsure

The Beginner’s Guide To Home Building Insurance Home Building Australia

Domestic Building Insurance Requirements in Victoria

Understanding Domestic Building Insurance (DBI) Master Builders

We Looked At Average Costs, Customer Service Ratings, And Policy Options From Multiple Top Insurers To Find The Best And Cheapest Home Insurance Companies In Chicago.

What Is Domestic Building Insurance?

It Has A Moneygeek Score Of 92 And An Average Annual Premium Of $979 For $100K Dwelling.

In Victoria It Is Mandatory For Builders To Purchase Domestic Building Insurance (Dbi) For All Domestic Building Projects, Where The Contract Price Is Over $16,000.

Related Post: