Down Payment To Build A House

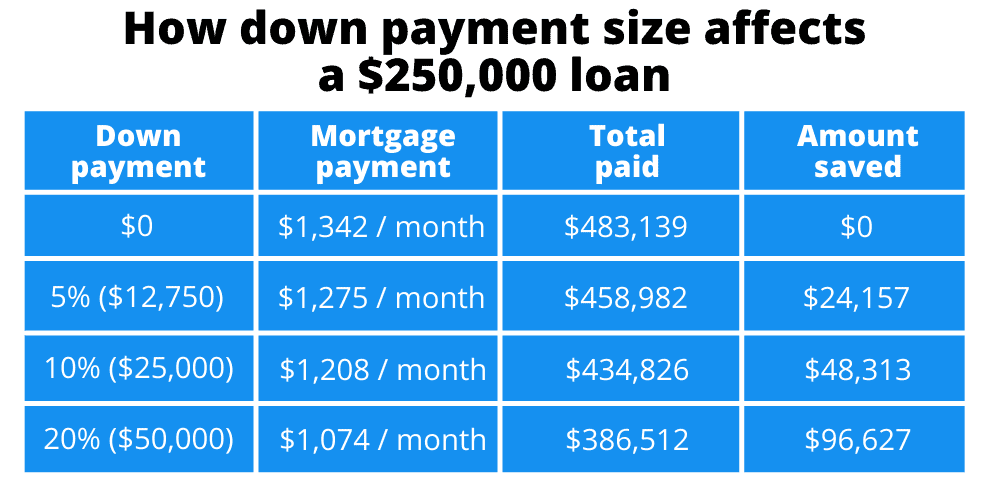

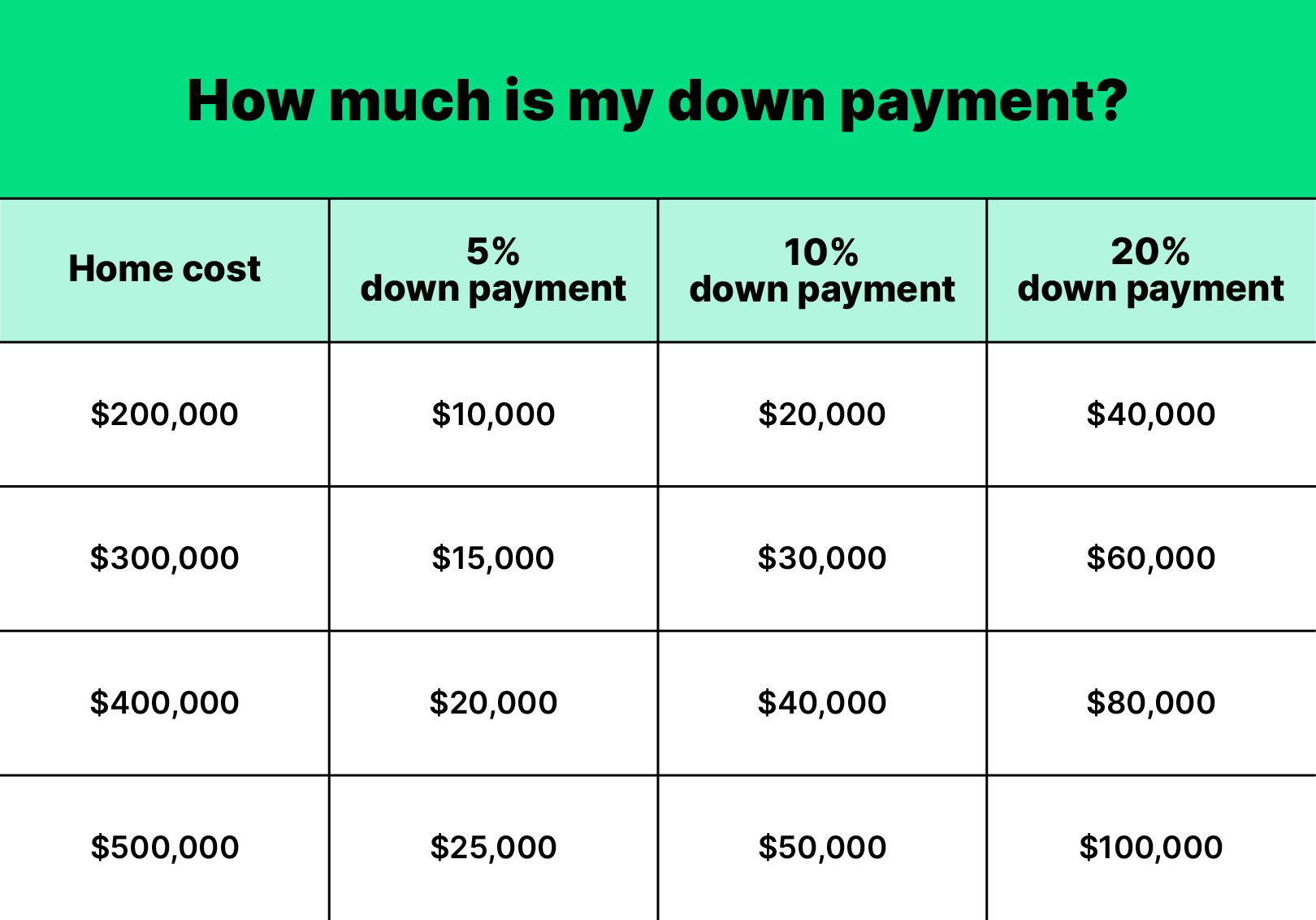

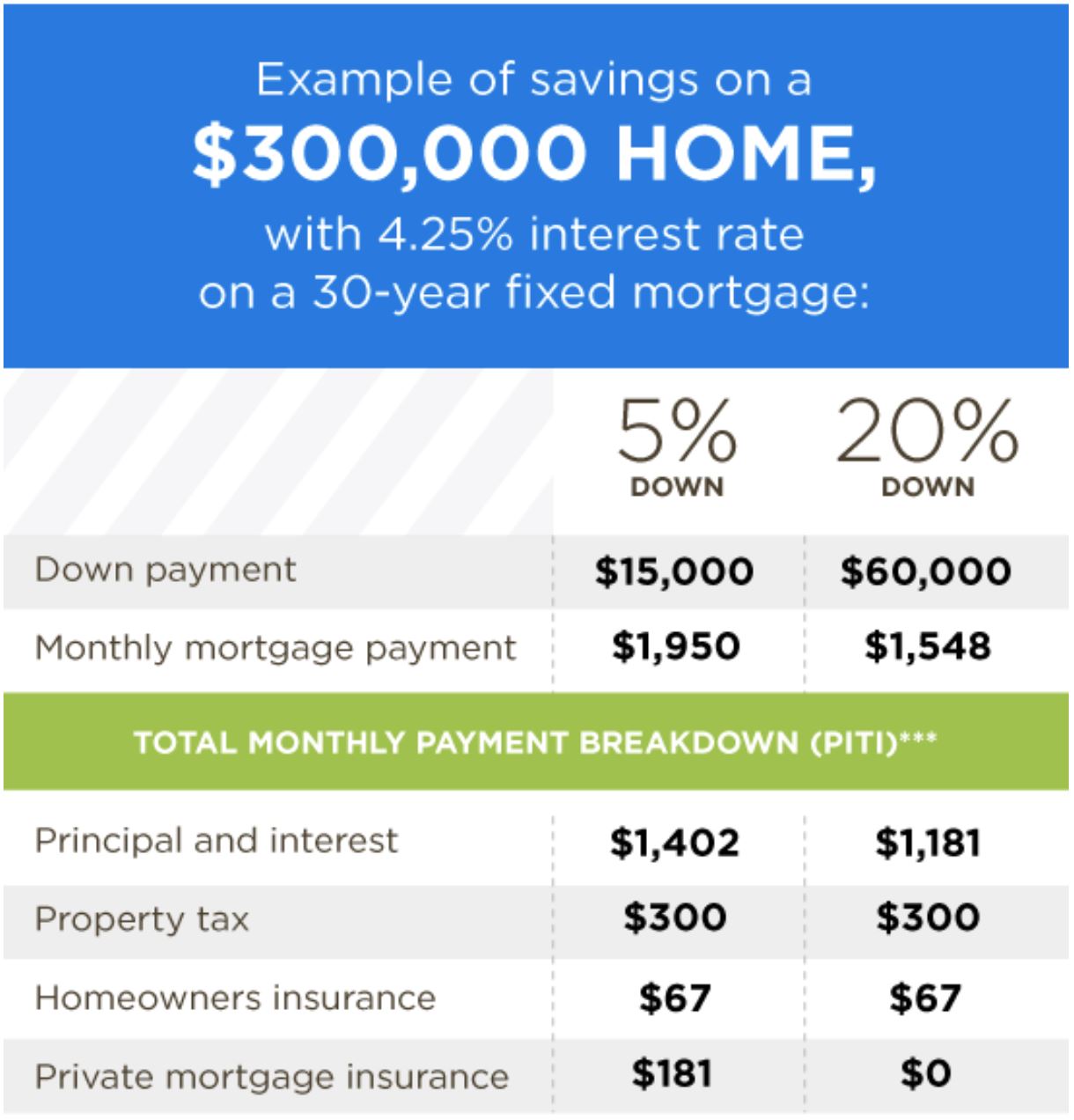

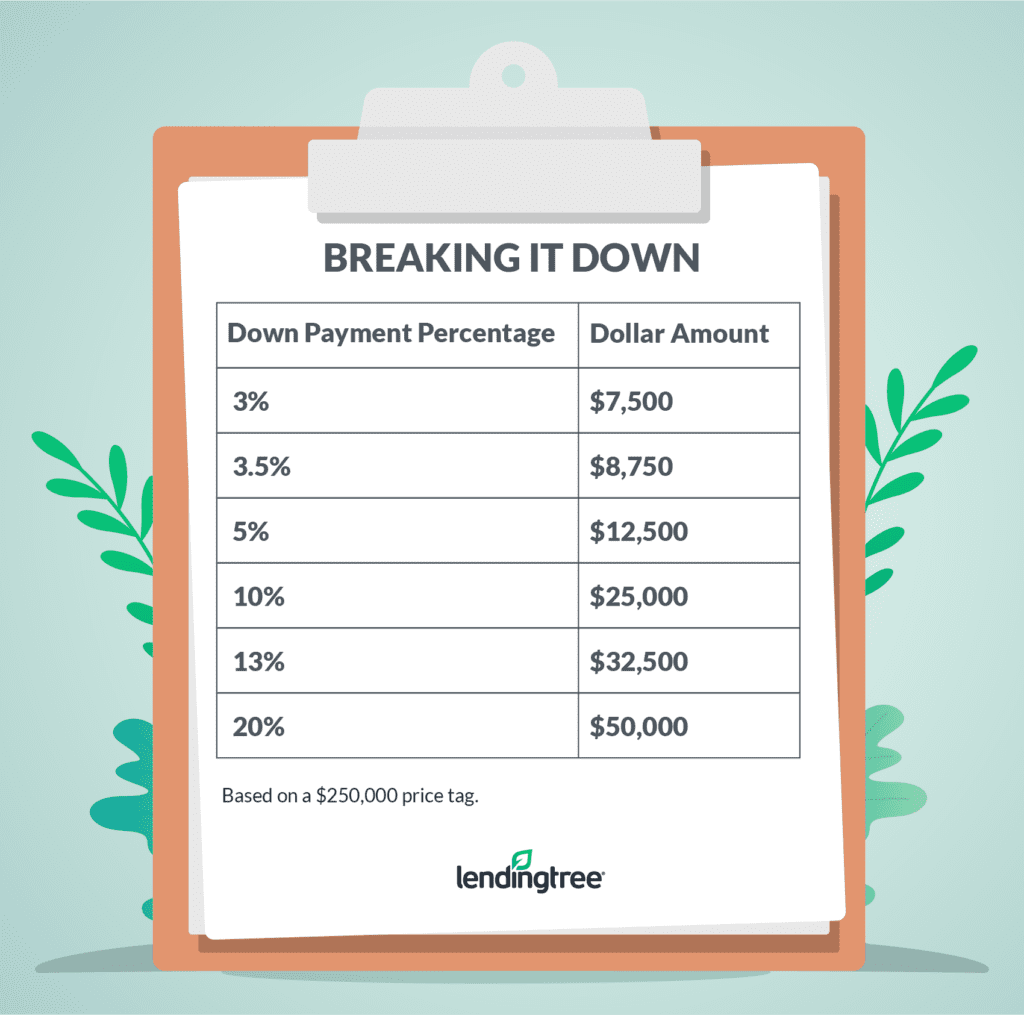

Down Payment To Build A House - In this article, we will explore the timeline for down payments on new construction homes, the various types of payment schedules, and tips for successfully managing your finances. Fortunately, we offer several strong construction to permanent bank products to meet. There are three numbers that you’ll need to figure out in order to determine the down payment needed for your particular construction loan. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. Read more on construction loans. Actually, current landowners may build a home with no down payment by using lot equity. To finance this build, you’ll need to know about construction loans. Unlike an existing home, where you have a traditional mortgage with a down payment due at closing, new construction homes rely on different types of financing to get the. Here, we’ll break down the average cost of building a home by component, examining the essential stages of new construction and how they all contribute to the. Before your down payment is due, however, you will have to put some money. * payments include an estimated monthly escrow payment of $400. There are many methods for hitting your down payment goal, though, and some are surprisingly easy. There are three numbers that you’ll need to figure out in order to determine the down payment needed for your particular construction loan. What is a construction loan? This down payment is based on the combined cost of the land and estimated construction costs. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. Understanding the down payment for new construction loan requirements is vital for successfully financing your new construction home. Here, we’ll break down the average cost of building a home by component, examining the essential stages of new construction and how they all contribute to the. Construction loans pay for home building or renovation and are paid in full or converted to permanent mortgages when the work is completed. Read more on construction loans. In this article, we will explore the timeline for down payments on new construction homes, the various types of payment schedules, and tips for successfully managing your finances. Read more on construction loans. As with the purchase of a resale home, the down payment is due when you close on your new home. Still, depending on your situation, it’s actually. What is a construction loan? As such, you will typically need to make a down payment of at least 20%. * payments include an estimated monthly escrow payment of $400. Still, depending on your situation, it’s actually a possibility. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. Fortunately, we offer several strong construction to permanent bank products to meet. What is a construction loan? Actually, current landowners may build a home with no down payment by using lot equity. The cost of construction is easy to. This down payment is based on the combined cost of the land and estimated construction costs. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. Here, we’ll break down the average cost of building a home by component, examining the essential stages of new construction and how they all contribute to the. Before your down payment is due, however, you will have to put. As with the purchase of a resale home, the down payment is due when you close on your new home. Fortunately, we offer several strong construction to permanent bank products to meet. Construction loans pay for home building or renovation and are paid in full or converted to permanent mortgages when the work is completed. For the past few years,. Agree to a reasonable down payment, but reduce the first one or two progress payments to avoid getting too far ahead on your payments. Construction loans pay for home building or renovation and are paid in full or converted to permanent mortgages when the work is completed. In the 1990s, a 20% down payment on the average home sale was. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. What is a construction loan? Here, we’ll break down the average cost of building a home by component, examining the essential stages of new construction and how they all contribute to the. Construction loans pay for home building or. As with the purchase of a resale home, the down payment is due when you close on your new home. In this article, we will explore the timeline for down payments on new construction homes, the various types of payment schedules, and tips for successfully managing your finances. Still, depending on your situation, it’s actually a possibility. For the past. Buying a new house without a down payment might sound like a dream scenario that’s almost too good to be true. Fortunately, we offer several strong construction to permanent bank products to meet. The cost of construction is easy to. Before your down payment is due, however, you will have to put some money. To finance this build, you’ll need. There are many methods for hitting your down payment goal, though, and some are surprisingly easy. For the past few years, however, that same 20% down. Before your down payment is due, however, you will have to put some money. Unlike an existing home, where you have a traditional mortgage with a down payment due at closing, new construction homes. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. Home prices rounded to nearest $100 and assume a down payment of 5%. To finance this build, you’ll need to know about construction loans. For the past few years, however, that same 20% down. Still, depending on your situation, it’s actually a possibility. As with the purchase of a resale home, the down payment is due when you close on your new home. Buying a new house without a down payment might sound like a dream scenario that’s almost too good to be true. This down payment is based on the combined cost of the land and estimated construction costs. The cost of construction is easy to. Understanding the down payment for new construction loan requirements is vital for successfully financing your new construction home. Unlike an existing home, where you have a traditional mortgage with a down payment due at closing, new construction homes rely on different types of financing to get the. In this article, we will explore the timeline for down payments on new construction homes, the various types of payment schedules, and tips for successfully managing your finances. Actually, current landowners may build a home with no down payment by using lot equity. Fortunately, we offer several strong construction to permanent bank products to meet. Agree to a reasonable down payment, but reduce the first one or two progress payments to avoid getting too far ahead on your payments. * payments include an estimated monthly escrow payment of $400.What Is A Down Payment On A House?

Understanding Down Payments How Much Should You Put Down? Autos Blog

What Is the Average Down Payment on a House? SoFi

Average Down Payment On A House In Arizona Payment Poin

Average House Down Payment 2024 Nadia Valaree

How Much Should You Put Down on a House? LendingTree

Buying A Home? What You Need To Know About Down Payments

How much is the down payment for a house in Texas?

Saving for a Downpayment on a House Buying first home, First home

Free Real Estate Downpayment Receipt Word PDF eForms

Here, We’ll Break Down The Average Cost Of Building A Home By Component, Examining The Essential Stages Of New Construction And How They All Contribute To The.

Whether You’re Just Starting To Save For A Down Payment, Or You’re Calculating How Much You Need For.

There Are Many Methods For Hitting Your Down Payment Goal, Though, And Some Are Surprisingly Easy.

Read More On Construction Loans.

Related Post: