Downpayment To Build A House

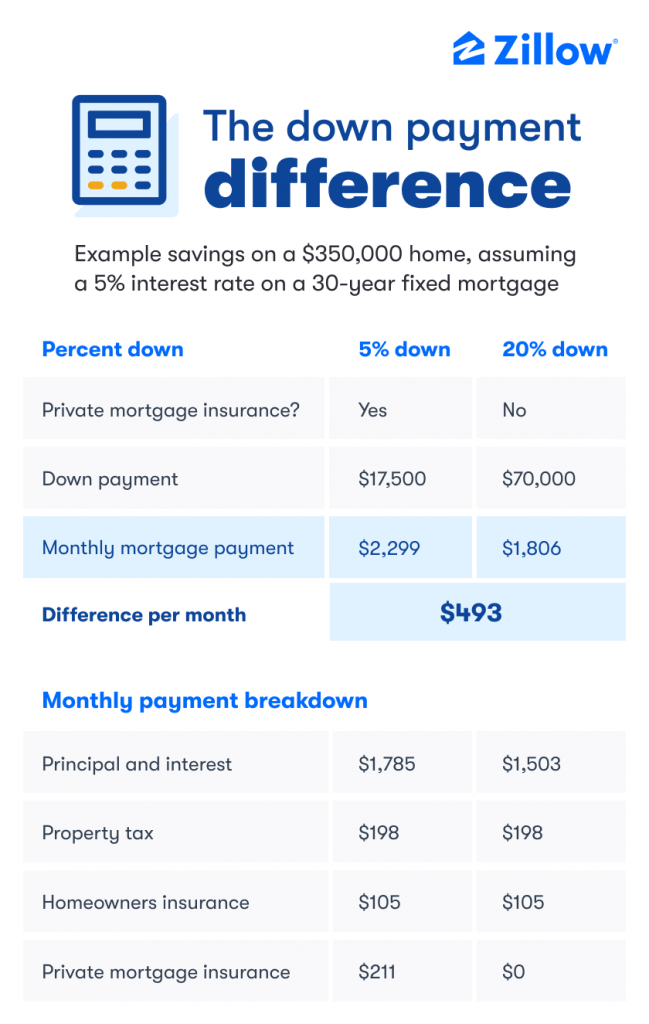

Downpayment To Build A House - Cons of a 20% down payment saving up can be tough in the example we used earlier, you’d need to have $71,752 saved up to put down 20% on a home that costs the. As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000. These loans typically require a 20% down payment and a strong credit score. There are many methods for hitting your down payment goal, though, and some are surprisingly easy. * payments include an estimated monthly escrow payment of $400. There's no right amount to put down on a home, but there are some guidelines to consider. How much of your own cash you'll be bringing to the transaction. Often, a down payment for a home is expressed as a percentage of the purchase price. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. Here, we’ll break down the average cost of building a home by component, examining the essential stages of new construction and how they all contribute to the. * payments include an estimated monthly escrow payment of $400. As with the purchase of a resale home, the down payment is due when you close on your new home. While some general contractors like to get a substantial deposit before starting a project, construction lenders do not do business this way and nor should you. A down payment is a portion of the cost of a home that you pay up front. Cons of a 20% down payment saving up can be tough in the example we used earlier, you’d need to have $71,752 saved up to put down 20% on a home that costs the. Determine what your ideal down payment amount should be. As such, you will typically need to make a down payment. How to calculate a down payment amount. Often, a down payment for a home is expressed as a percentage of the purchase price. A down payment on a house may be as low as 3%, or even 0%, depending on the loan type. Before your down payment is due, however, you will have to put some money. Buying a home is probably one of the biggest purchases you'll ever make, and while most people use a loan to buy a home, you'll still likely need to bring some cash of your. As such, you will typically need to make a down payment. How. As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000. When working with a custom home builder, the down payment is often divided into several installments, known as “draws,” which are disbursed at different stages of the construction. Before your down payment is due, however, you will have to put some money.. If you decide to buy a home with no down payment, it’s important to consider the downsides as well: As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000. Almost all mortgage options require a down payment, which is the sum of money you pay up front to make up the difference. There are many methods for hitting your down payment goal, though, and some are surprisingly easy. When working with a custom home builder, the down payment is often divided into several installments, known as “draws,” which are disbursed at different stages of the construction. Here, we’ll break down the average cost of building a home by component, examining the essential. As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000. How much down payment on a new construction home? There's no right amount to put down on a home, but there are some guidelines to consider. Before your down payment is due, however, you will have to put some money. A down. If you decide to buy a home with no down payment, it’s important to consider the downsides as well: How much of your own cash you'll be bringing to the transaction. While some general contractors like to get a substantial deposit before starting a project, construction lenders do not do business this way and nor should you. These loans typically. A down payment is a portion of the cost of a home that you pay up front. Determine what your ideal down payment amount should be. Often, a down payment for a home is expressed as a percentage of the purchase price. * payments include an estimated monthly escrow payment of $400. As with the purchase of a resale home,. How to calculate a down payment amount. How much down payment on a new construction home? When working with a custom home builder, the down payment is often divided into several installments, known as “draws,” which are disbursed at different stages of the construction. While some general contractors like to get a substantial deposit before starting a project, construction lenders. How to calculate a down payment amount. As an example, for a $250,000 home, a down payment of 3.5% is $8,750, while 20% is $50,000. When working with a custom home builder, the down payment is often divided into several installments, known as “draws,” which are disbursed at different stages of the construction. There are many methods for hitting your. These loans typically require a 20% down payment and a strong credit score. A down payment is a portion of the cost of a home that you pay up front. * payments include an estimated monthly escrow payment of $400. The down payment required on a new construction home is a minimum of 20% of the purchase price, including the. Determine what your ideal down payment amount should be. There's no right amount to put down on a home, but there are some guidelines to consider. Often, a down payment for a home is expressed as a percentage of the purchase price. For the past few years, however, that same 20% down. As with the purchase of a resale home, the down payment is due when you close on your new home. Before your down payment is due, however, you will have to put some money. A down payment is a portion of the cost of a home that you pay up front. * payments include an estimated monthly escrow payment of $400. As such, you will typically need to make a down payment. Home prices rounded to nearest $100 and assume a down payment of 5%. A down payment on a house may be as low as 3%, or even 0%, depending on the loan type. What you put down depends on your monthly housing budget, your loan program,. Construction loans are considered riskier than standard home loans, since no house exists that the lender can secure as collateral. The down payment required on a new construction home is a minimum of 20% of the purchase price, including the cost of the. There are many methods for hitting your down payment goal, though, and some are surprisingly easy. Home construction loans are generally tougher to qualify for than traditional mortgages.Buying A Home? What You Need To Know About Down Payments

Down payment 400k house RehanSanaya

Down Payment

Typical Down Payment On A House Quadwalls

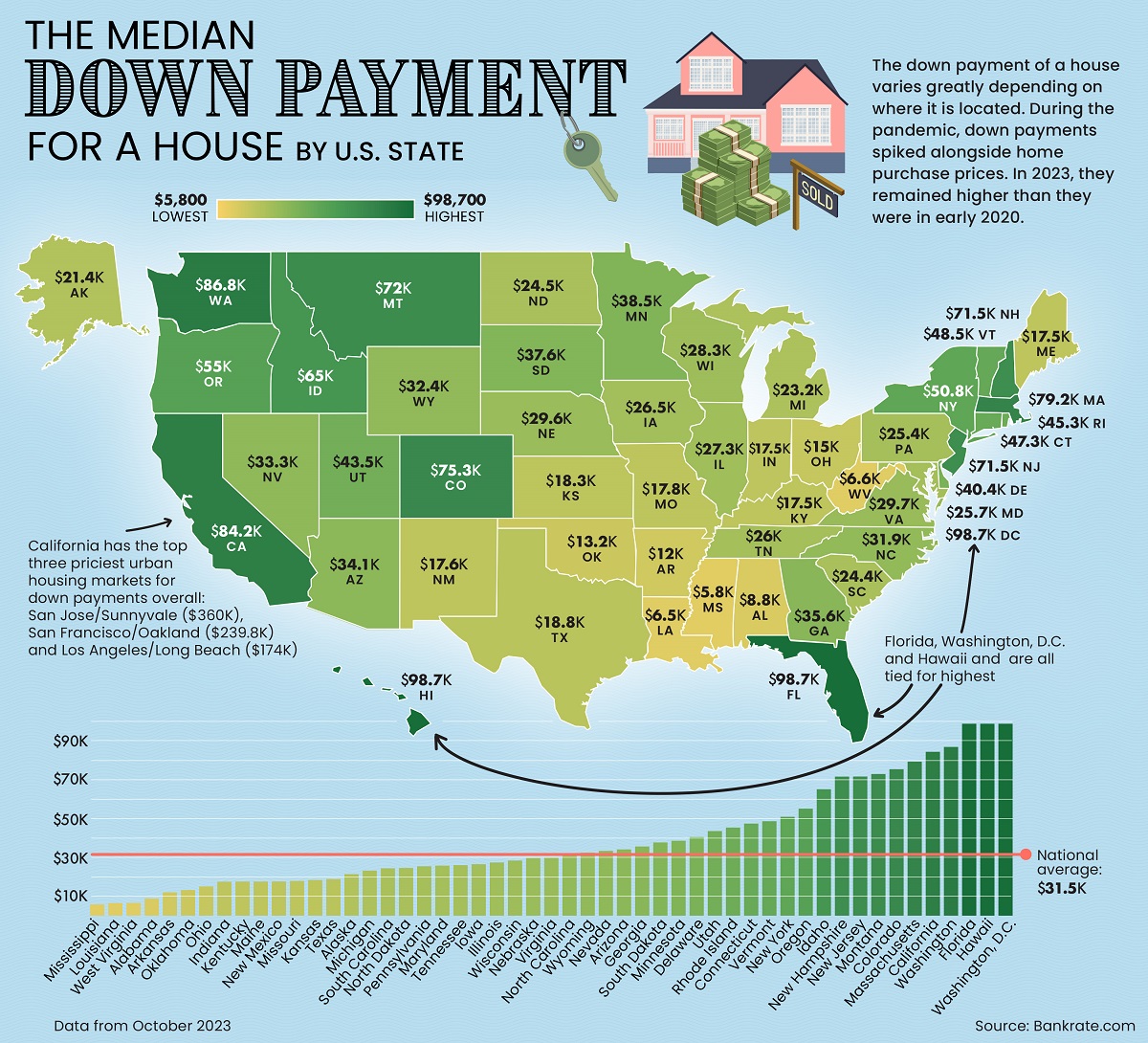

The Median Down Payment For A House, By US State Digg

Saving for a Downpayment on a House Buying first home, First home

Do I Have To Put A Downpayment On A House House Poster

How Much Down Payment Do You Need to Build a New House? Buildable

What Is The Minimum Down Payment For A House? Dwellics Blog

What Is A Downpayment? Real Estate Blog Finch & Gable Real Estate Co

How Much Down Payment On A New Construction Home?

Cons Of A 20% Down Payment Saving Up Can Be Tough In The Example We Used Earlier, You’d Need To Have $71,752 Saved Up To Put Down 20% On A Home That Costs The.

These Loans Typically Require A 20% Down Payment And A Strong Credit Score.

If You Decide To Buy A Home With No Down Payment, It’s Important To Consider The Downsides As Well:

Related Post: