Eligible Building Envelope Components

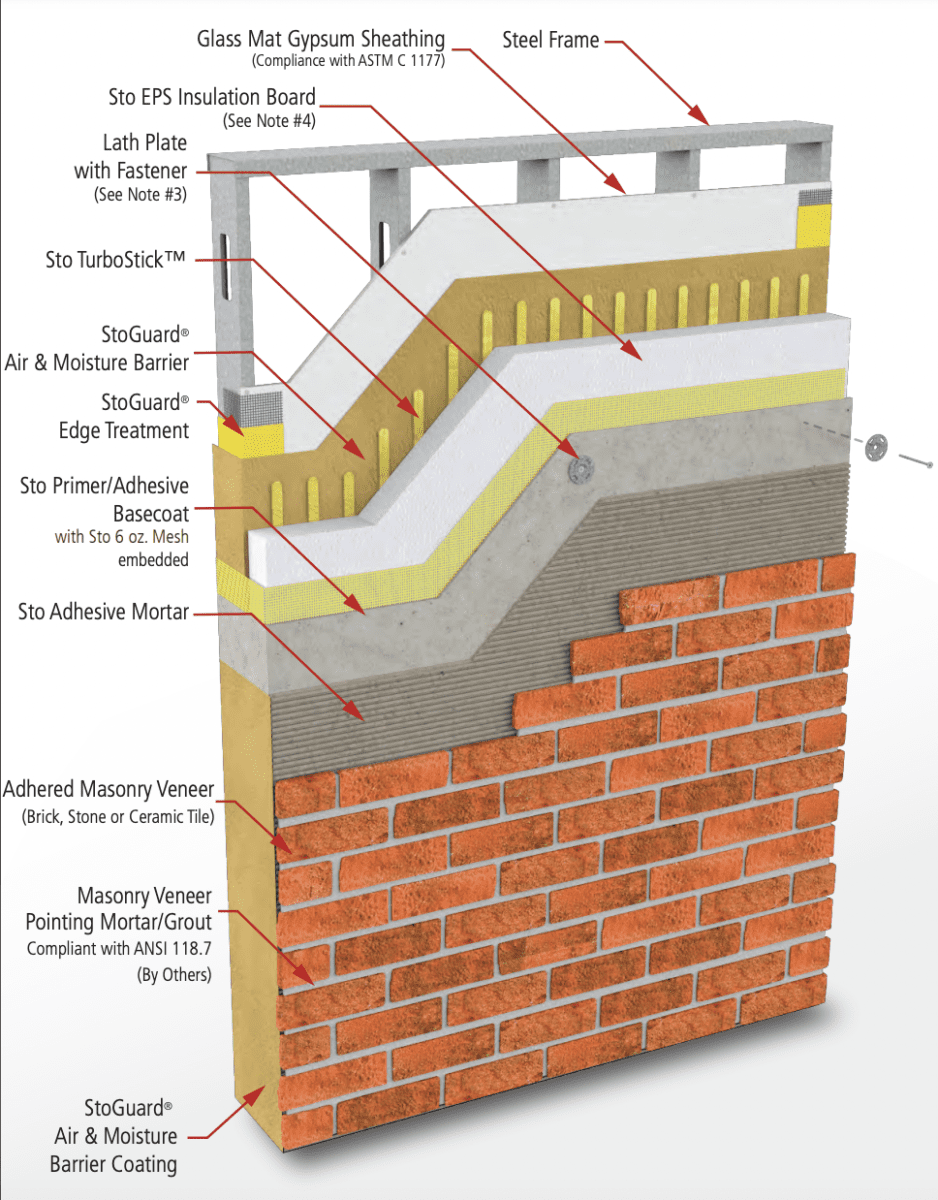

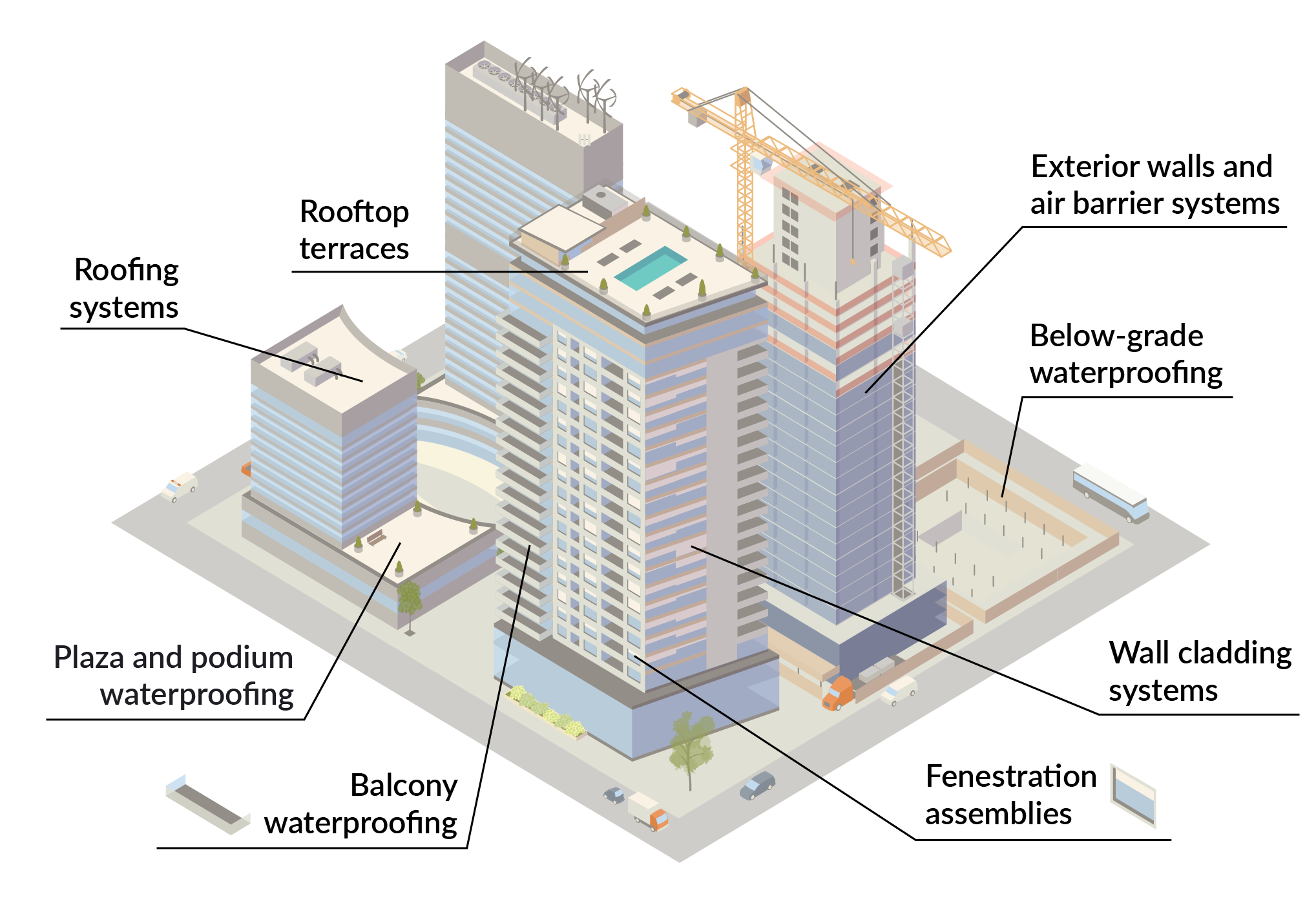

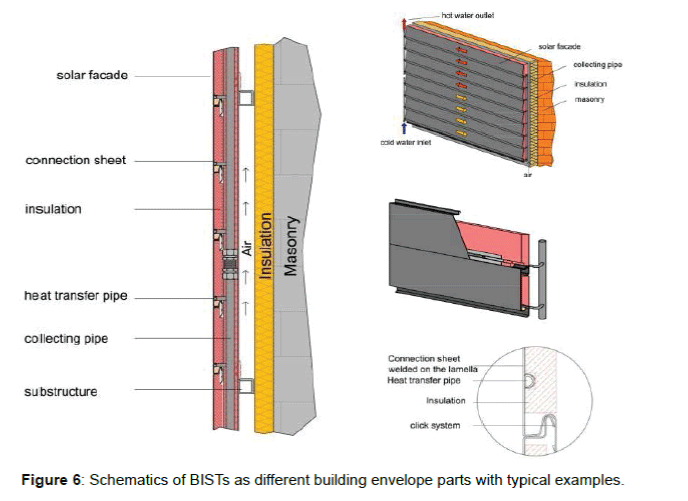

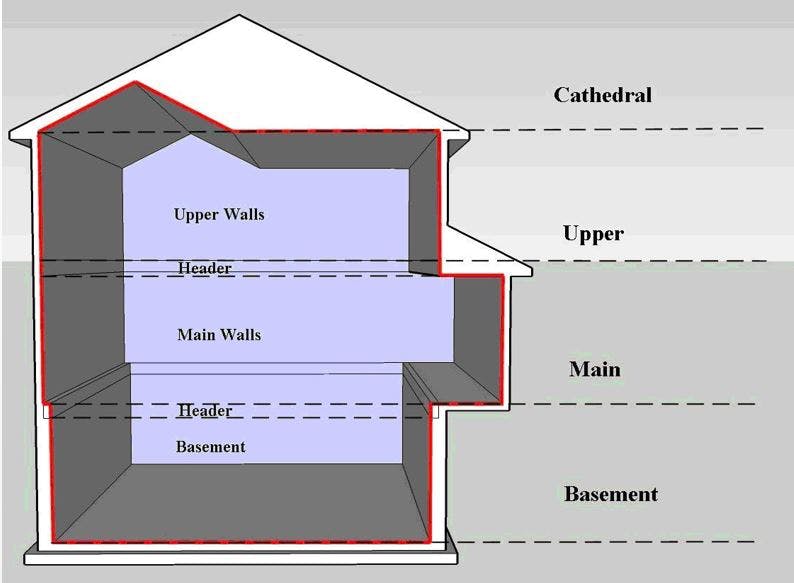

Eligible Building Envelope Components - Total annual credit capped at. To be eligible energy efficient building envelope components for purposes of the credit, however, the materials installed in each year must meet the applicable iecc. The law divides the items eligible for the credit into three categories, each of which includes credit caps: Chapter 4 provides requirements for the thermal envelope of a building, including minimum insulation values for walls, ceiling and floors; For building envelope components (insulation, doors, windows, skylights), only the purchase price can be claimed. The iecc allows for three different methods to gain approval for the building envelope. Walker’s building envelope experts bring a practical consulting approach to each unique project and client. Additionally, these components need to meet applicable energy certification. Qualified energy efficiency improvements are the following building envelope components installed on or in your main home that you owned during 2023 located in the. Efficient building envelope components including a qualifying insulation material or system, exterior window, skylight, exterior door, or roof. Total annual credit capped at. There is a $1,200 aggregate yearly tax credit maximum for all building envelope components, home energy audits, and energy property. Electric or natural gas heat pump water heaters,. The envelope includes the building’s foundation, walls, roof and entry points. Efficient heating and cooling equipment; The most common improvements claimed in 2023 were the. Thus, for an energy efficient building envelope. The law divides the items eligible for the credit into three categories, each of which includes credit caps: The iecc allows for three different methods to gain approval for the building envelope. To qualify, building envelope components must have an expected lifespan of at least 5 years. For building envelope components (insulation, doors, windows, skylights), only the purchase price can be claimed. Total annual credit capped at. Efficient heating and cooling equipment; To be eligible energy efficient building envelope components for purposes of the credit, however, the materials installed in each year must meet the applicable iecc prescriptive criteria for. Chapter 4 provides requirements for the thermal. Those components also play critical roles in the structural integrity. Whether it be cracking in masonry, spalling of concrete, fogging of windows, water. Electric or natural gas heat pump water heaters,. Efficient building envelope components including a qualifying insulation material or system, exterior window, skylight, exterior door, or roof. The iecc allows for three different methods to gain approval for. To qualify, building envelope components must have an expected lifespan of at least 5 years. Walker’s building envelope experts bring a practical consulting approach to each unique project and client. There is a $1,200 aggregate yearly tax credit maximum for all building envelope components, home energy audits, and energy property. Total annual credit capped at. Those components also play critical. Chapter 4 provides requirements for the thermal envelope of a building, including minimum insulation values for walls, ceiling and floors; To be eligible energy efficient building envelope components for purposes of the credit, however, the materials installed in each year must meet the applicable iecc prescriptive criteria for. Thus, for an energy efficient building envelope. Those components also play critical. The following energy efficient home improvements are eligible for the credit. Up to $600 for “energy property,” e.g. To qualify, all building envelope components must have an expected lifespan of at least 5 years. We installed a new roof on our existing home in 2017, which the manufacture certified the roofing product are eligible building envelope components as defined under.. Per irs, the credit for building envelope components (exterior doors, windows and skylights, insulation, air sealing) is only available for primary residences and is not eligible. The law divides the items eligible for the credit into three categories, each of which includes credit caps: Chapter 4 provides requirements for the thermal envelope of a building, including minimum insulation values for. Building envelope design impacts the following: The law divides the items eligible for the credit into three categories, each of which includes credit caps: This includes insulation and air sealing criteria. Up to $600 for “energy property,” e.g. For building envelope components (insulation, doors, windows, skylights), only the purchase price can be claimed. Efficient building envelope components including a qualifying insulation material or system, exterior window, skylight, exterior door, or roof. The iecc allows for three different methods to gain approval for the building envelope. To qualify, all building envelope components must have an expected lifespan of at least 5 years. The law divides the items eligible for the credit into three categories,. Per irs, the credit for building envelope components (exterior doors, windows and skylights, insulation, air sealing) is only available for primary residences and is not eligible. Chapter 4 provides requirements for the thermal envelope of a building, including minimum insulation values for walls, ceiling and floors; Additionally, these components need to meet applicable energy certification. “qualified energy efficiency improvements” consisting. Thus, for an energy efficient building envelope. Chapter 4 provides requirements for the thermal envelope of a building, including minimum insulation values for walls, ceiling and floors; The iecc allows for three different methods to gain approval for the building envelope. Those components also play critical roles in the structural integrity. Qualified energy efficiency improvements are the following building envelope. Additionally, these components need to meet applicable energy certification. The envelope includes the building’s foundation, walls, roof and entry points. Chapter 4 provides requirements for the thermal envelope of a building, including minimum insulation values for walls, ceiling and floors; Qualified energy efficiency improvements are the following building envelope components installed on or in your main home that you owned during 2023 located in the. To qualify, building envelope components must have an expected lifespan of at least 5 years. Per irs, the credit for building envelope components (exterior doors, windows and skylights, insulation, air sealing) is only available for primary residences and is not eligible. The most common improvements claimed in 2023 were the. To be eligible energy efficient building envelope components for purposes of the credit, however, the materials installed in each year must meet the applicable iecc prescriptive criteria for. To be eligible energy efficient building envelope components for purposes of the credit, however, the materials installed in each year must meet the applicable iecc. There is a $1,200 aggregate yearly tax credit maximum for all building envelope components, home energy audits, and energy property. We installed a new roof on our existing home in 2017, which the manufacture certified the roofing product are eligible building envelope components as defined under. Efficient building envelope components including a qualifying insulation material or system, exterior window, skylight, exterior door, or roof. The iecc allows for three different methods to gain approval for the building envelope. $250 per door, $500 total for doors; This includes insulation and air sealing criteria. For building envelope components (insulation, doors, windows, skylights), only the purchase price can be claimed.Building Envelope Systems & Design What Are They?

Qualified energy efficiency building envelope component wolfaholic

An Introduction to the Building Envelope Products & Systems IKO

Building Envelope Walker Consultants

What Is a Building Envelope and Why Is It Beneficial? BigRentz

Components of building envelope kizasalon

Building Envelope

An Introduction to the Building Envelope Products & Systems IKO

The Building Envelope Building Science Fundamentals on Guides

What Is a Building Envelope and Why Is It Beneficial? BigRentz

Those Components Also Play Critical Roles In The Structural Integrity.

The Law Divides The Items Eligible For The Credit Into Three Categories, Each Of Which Includes Credit Caps:

To Qualify, All Building Envelope Components Must Have An Expected Lifespan Of At Least 5 Years.

Electric Or Natural Gas Heat Pump Water Heaters,.

Related Post: