Energy Efficient Commercial Building Deduction

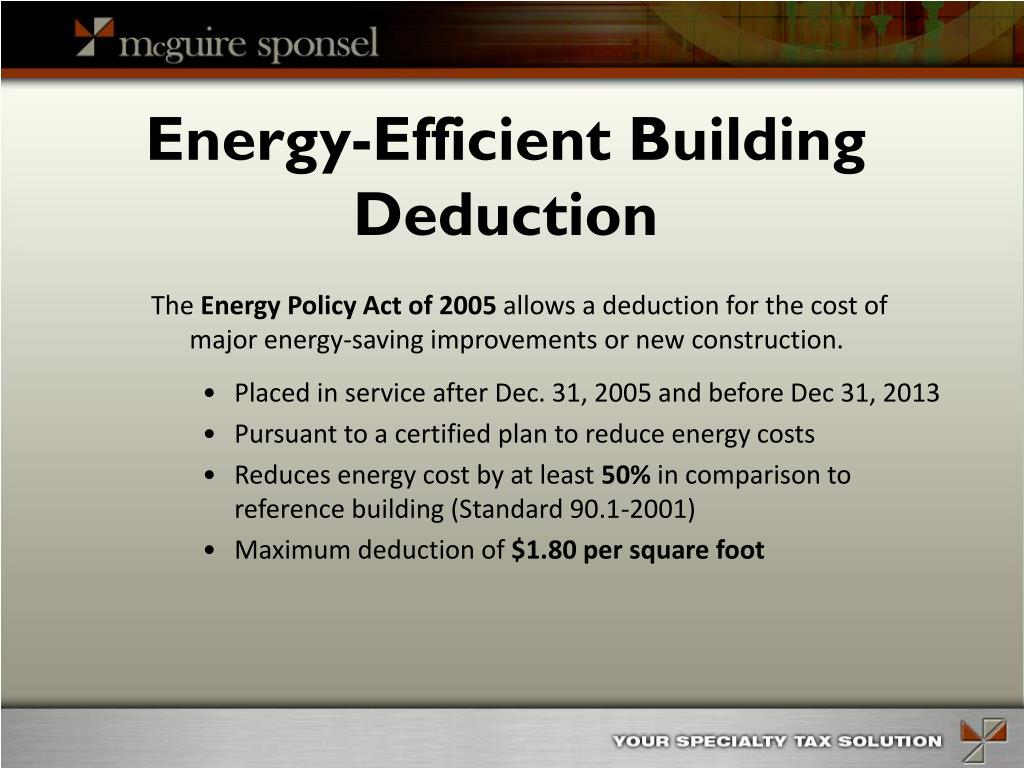

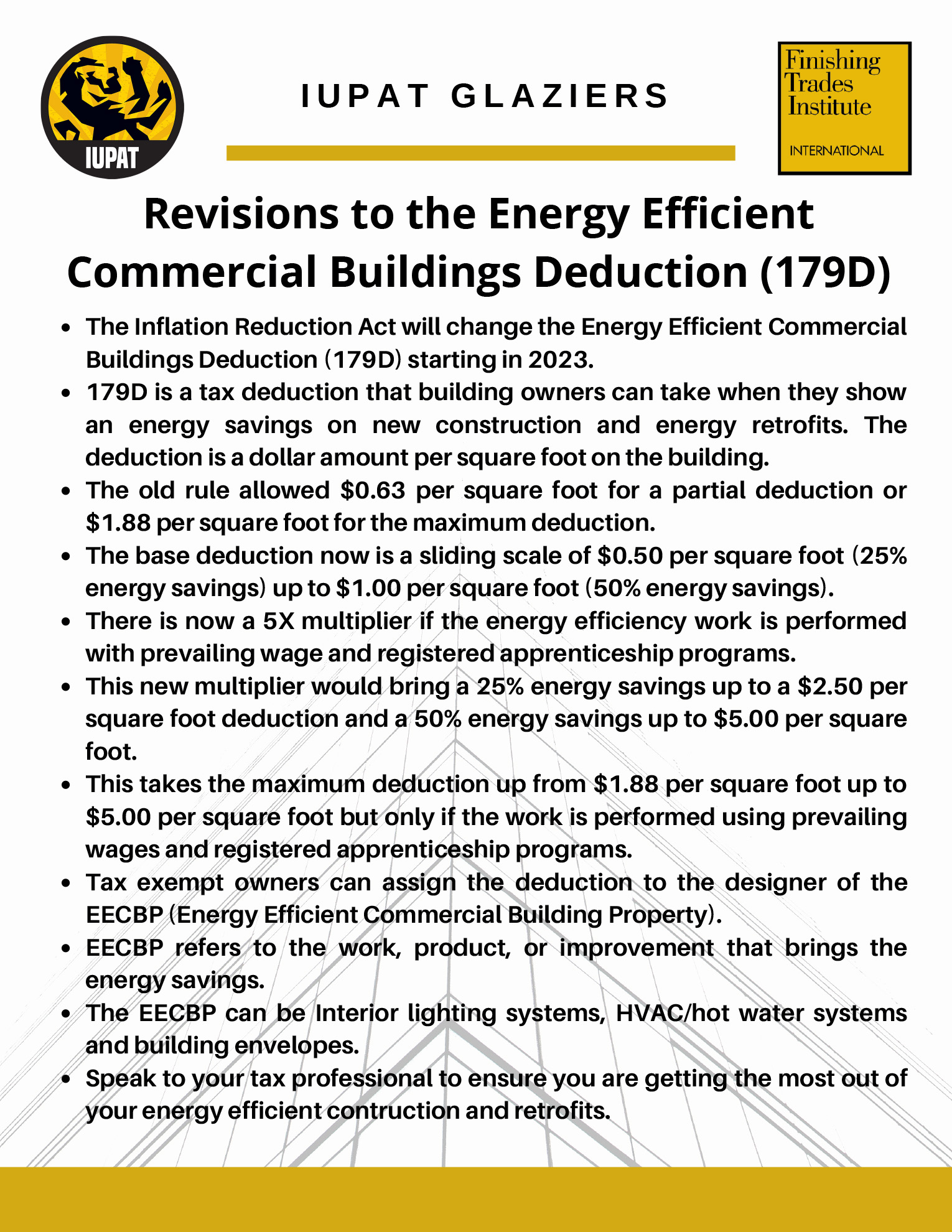

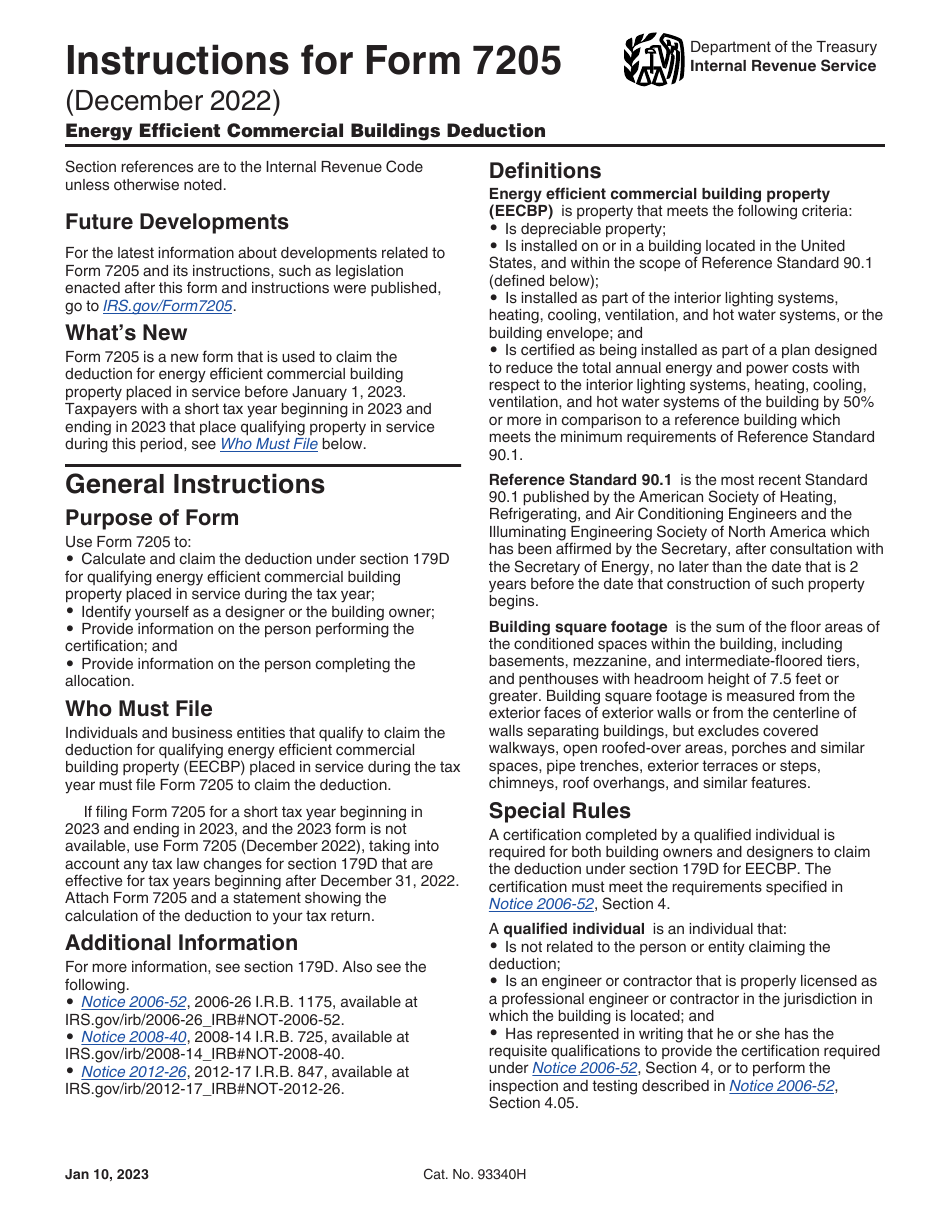

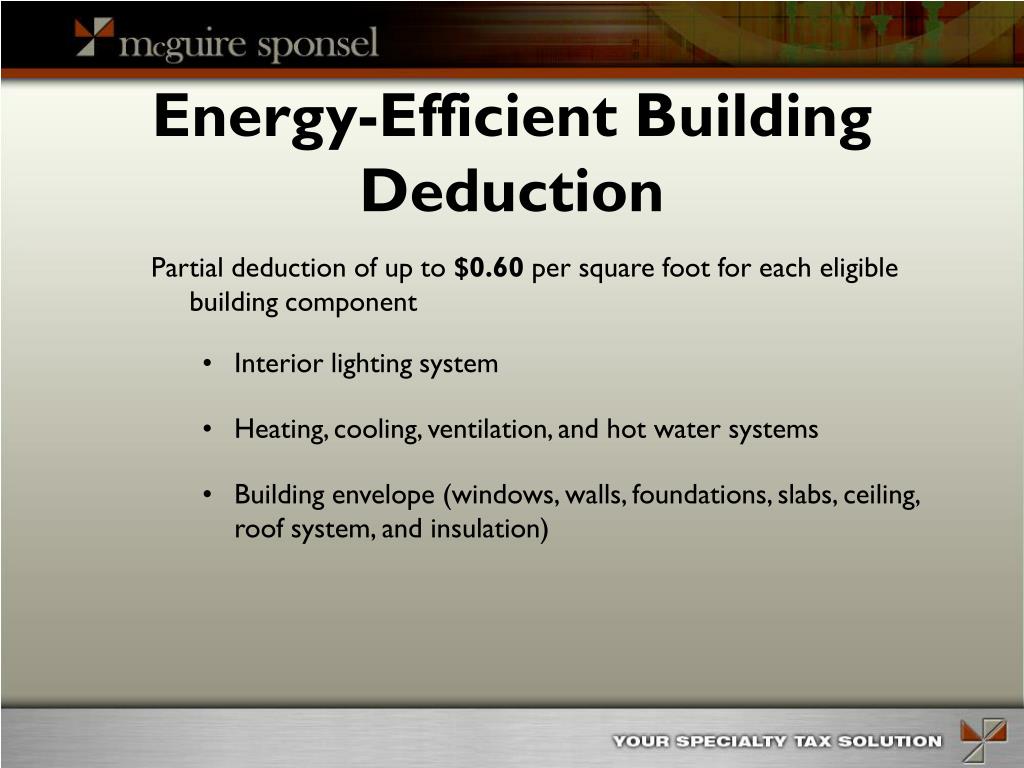

Energy Efficient Commercial Building Deduction - Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; There are two options for a deduction under i.r.c. Learn how to claim a tax deduction for installing energy efficient property or retrofitting existing buildings. The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Eligible costs include energy efficiency, sustainability and renewable energy infrastructure deployed in new. Identify yourself as a designer or the. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient building retrofit property (eebrp) may be able to claim a tax deduction. Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; Efficient heating equipment* efficient water heating equipment* 30% of cost, up to $600 : This deduction is available to building owners. There are two options for a deduction under i.r.c. The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Here are some tips to help. Efficient air conditioners* 30% of cost, up to $600 : Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient building retrofit property (eebrp) may be able to claim a tax deduction. Identify yourself as a designer or the. The general deduction, found under i.r.c. The 2022 code will result in an approximately 40% improvement in. To have work completed and receive commonwealth edison rebates from the program, you must find a qualified comed service provider to assess your building, recommend energy efficiency. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. There shall be allowed as a deduction an amount equal to the cost of energy efficient commercial building property placed in service. Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; § 179d (a), is for energy efficient commercial building property (eecbp). To have work completed and. There shall be allowed as a deduction an amount equal to the cost of energy efficient commercial building property placed in service. Eligible costs include energy efficiency, sustainability and renewable energy infrastructure deployed in new. Efficient heating equipment* efficient water heating equipment* 30% of cost, up to $600 : Calculate and claim the deduction under section 179d for qualifying energy. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient building retrofit property (eebrp) may be able to claim a tax deduction. Here are some tips to help. The i nflation reduction act of 2022 amended the credits available for energy efficient home improvements and residential clean energy property. There are two options for a. There are two options for a deduction under i.r.c. Efficient air conditioners* 30% of cost, up to $600 : The 2022 code will result in an approximately 40% improvement in. The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Eligible costs include energy efficiency, sustainability and. Efficient air conditioners* 30% of cost, up to $600 : Efficient heating equipment* efficient water heating equipment* 30% of cost, up to $600 : Learn how to claim a tax deduction for installing energy efficient property or retrofitting existing buildings. There shall be allowed as a deduction an amount equal to the cost of energy efficient commercial building property placed. The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Energy efficient commercial buildings deduction. The i nflation reduction act of 2022 amended the credits available for energy efficient home improvements and residential clean energy property. Building owners who place in service energy efficient commercial building property. There shall be allowed as a deduction an amount equal to the cost of energy efficient commercial building property placed in service. Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; The 2022 code will result in an approximately 40% improvement in. Efficient heating equipment* efficient water. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. To have work completed and receive commonwealth edison rebates from the program, you must find a qualified comed service provider to assess your building, recommend energy efficiency. Efficient heating equipment* efficient water heating. Efficient air conditioners* 30% of cost, up to $600 : The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. This deduction is available to building owners. Energy efficient commercial buildings deduction. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing. Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; Learn how to claim a tax deduction for installing energy efficient property or retrofitting existing buildings. Efficient heating equipment* efficient water heating equipment* 30% of cost, up to $600 : Calculate and claim the deduction under section 179d. Eligible costs include energy efficiency, sustainability and renewable energy infrastructure deployed in new. Find out the eligibility, requirements, amounts, and standards for 2023 and before. There are two options for a deduction under i.r.c. Here are some tips to help. Energy efficient commercial buildings deduction. There shall be allowed as a deduction an amount equal to the cost of energy efficient commercial building property placed in service. Efficient air conditioners* 30% of cost, up to $600 : Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. This deduction is available to building owners. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient building retrofit property (eebrp) may be able to claim a tax deduction. Identify yourself as a designer or the. Efficient heating equipment* efficient water heating equipment* 30% of cost, up to $600 : The 2022 code will result in an approximately 40% improvement in. Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building.PPT 179D Energy Efficient Commercial Building Tax Deduction

What is The Energy Efficient Commercial Buildings Deduction?

Recent changes to the Sec. 179D energyefficient commercial buildings

179D Commercial Building Energy Efficient Tax Deduction PPT

179D Energy Efficient Commercial Building Deduction NELSON

PPT Energy and R&D Tax Credits for Businesses PowerPoint Presentation

IRSnews on Twitter "Energy Efficient Commercial Building Deduction

Revisions to the Energy Efficient Commercial Buildings Deduction (179D

Download Instructions for IRS Form 7205 Energy Efficient Commercial

PPT 179D Energy Efficient Commercial Building Tax Deduction

The I Nflation Reduction Act Of 2022 Amended The Credits Available For Energy Efficient Home Improvements And Residential Clean Energy Property.

The General Deduction, Found Under I.r.c.

§ 179D (A), Is For Energy Efficient Commercial Building Property (Eecbp).

To Have Work Completed And Receive Commonwealth Edison Rebates From The Program, You Must Find A Qualified Comed Service Provider To Assess Your Building, Recommend Energy Efficiency.

Related Post: