Energy Efficient Commercial Buildings Tax Deduction

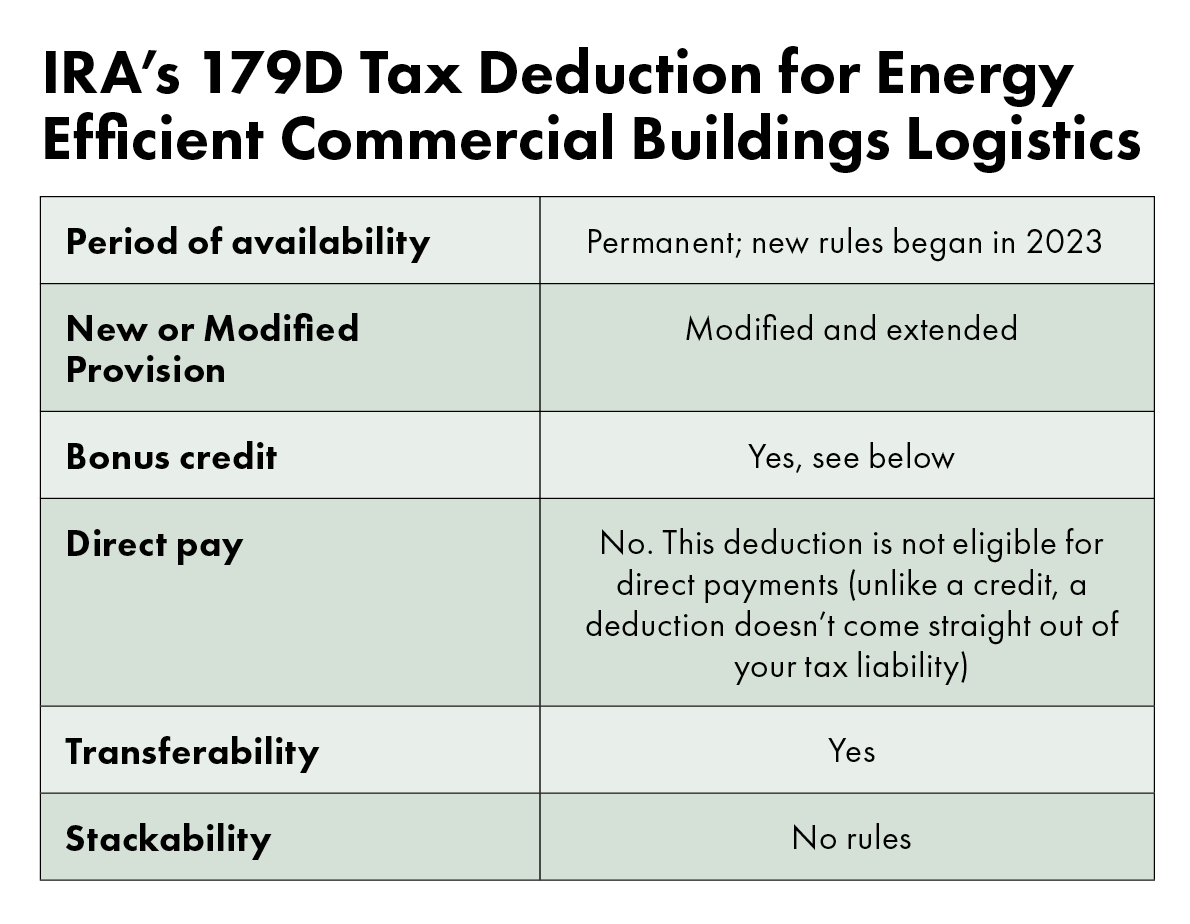

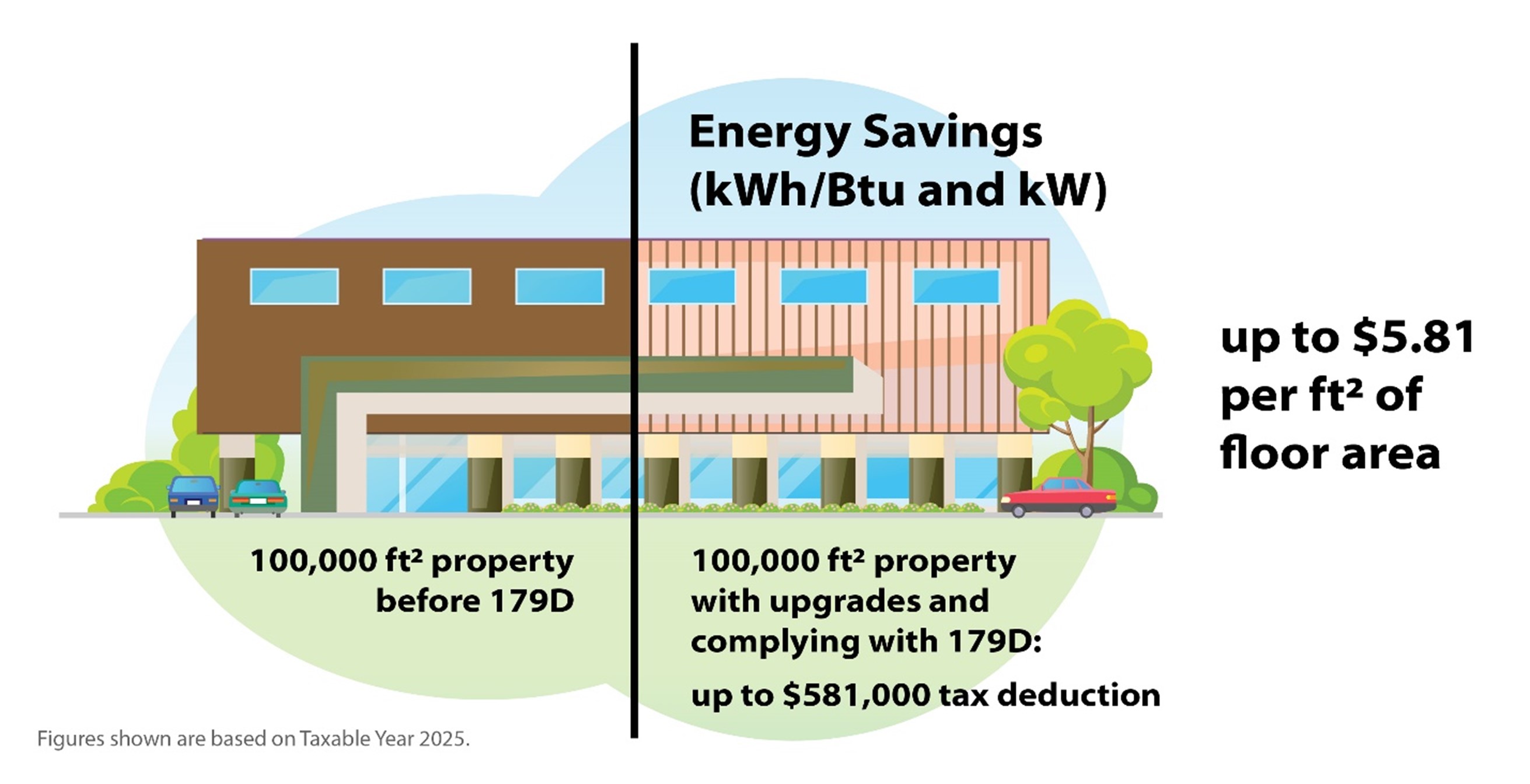

Energy Efficient Commercial Buildings Tax Deduction - For class 4 and above (over. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. An increased deduction may be available for increased energy savings or meeting. It’s not just homeowners who can benefit. § 179d (a), is for energy efficient commercial building property (eecbp). Exterior doors must be energy star certified to qualify for the 25c federal tax credit. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial building retrofit property (eebrp) may be able to claim a tax deduction. Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; Department of energy (doe) today released the 179d portal, which hosts two free tools to estimate potential federal tax deductions for installing eligible energy. Not sure if you qualify?. Building owners who place in service energy eficient commercial building property (eecbp) or energy eficient building retrofit property (eebrp) may be able to claim a tax deduction. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial building retrofit property (eebrp) may be able to claim a tax deduction. Offers tax credits for investments in eligible renewable energy projects and facilities that generate clean electricity and energy storage. Not sure if you qualify?. Through 2032, federal income tax credits are available to homeowners, that will allow up to $3,200 annually to lower the cost of energy efficient home upgrades by up to 30 percent. There are two options for a deduction under i.r.c. Efficient air conditioners* 30% of cost, up to $600 : The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Now with the changes brought forth in the ira, the maximum deduction increased to $5.00 per square foot for an eligible building. The general deduction, found under i.r.c. As environmental sustainability gains importance, leveraging. The general deduction, found under i.r.c. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. An increased deduction may be available for increased energy savings or meeting. Eligibility for more than $5.00 per square foot in. Eligibility for more than $5.00 per square foot in deductions is possible if the business contributed to the design of hvac, interior lighting, or the building envelope. What is section 179d energy efficient commercial building tax deduction (section 179d)? Here are some tips to help. Qualifying expenditures and credit amount; An increased deduction may be available for increased energy savings. Offers commercial property tax deductions for energy. What is section 179d energy efficient commercial building tax deduction (section 179d)? Efficient air conditioners* 30% of cost, up to $600 : § 179d (a), is for energy efficient commercial building property (eecbp). Department of energy (doe) today released the 179d portal, which hosts two free tools to estimate potential federal tax deductions. What is section 179d energy efficient commercial building tax deduction (section 179d)? Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial building retrofit property (eebrp) may be able to claim a tax deduction. Here are some tips to help. § 179d (a), is for energy efficient commercial building property (eecbp). Section 179d of. Not sure if you qualify?. For class 4 and above (over. As environmental sustainability gains importance, leveraging. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial building retrofit property (eebrp) may be able to claim a tax deduction. Efficient heating equipment* efficient water heating equipment* 30% of cost, up to $600 : It’s not just homeowners who can benefit. Offers tax credits for investments in eligible renewable energy projects and facilities that generate clean electricity and energy storage. Department of energy (doe) today released the 179d portal, which hosts two free tools to estimate potential federal tax deductions for installing eligible energy. For class 4 and above (over. Through 2032, federal income. The section 179d deduction allows building owners or designers of such. Offers commercial property tax deductions for energy. Here are some tips to help. Through 2032, federal income tax credits are available to homeowners, that will allow up to $3,200 annually to lower the cost of energy efficient home upgrades by up to 30 percent. There are two options for. Follow these 3 steps to determine if the door (s) you purchased are eligible: Efficient air conditioners* 30% of cost, up to $600 : Department of energy (doe) today released the 179d portal, which hosts two free tools to estimate potential federal tax deductions for installing eligible energy. Building solar, wind and battery installations buys time while utilities and other. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. Not sure if you qualify?. For class 4 and above (over. Now with the changes brought forth in the ira, the maximum deduction increased to $5.00 per square foot for an eligible building.. The i nflation reduction act of 2022 amended the credits available for energy efficient home improvements and residential clean energy property. Building solar, wind and battery installations buys time while utilities and other companies reopen shuttered nuclear power plants, deploy geothermal energy and build. Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed. Not sure if you qualify?. Building solar, wind and battery installations buys time while utilities and other companies reopen shuttered nuclear power plants, deploy geothermal energy and build. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. Now with the changes brought forth in the ira, the maximum deduction increased to $5.00 per square foot for an eligible building. It’s not just homeowners who can benefit. What is section 179d energy efficient commercial building tax deduction (section 179d)? § 179d (a), is for energy efficient commercial building property (eecbp). The general deduction, found under i.r.c. Through 2032, federal income tax credits are available to homeowners, that will allow up to $3,200 annually to lower the cost of energy efficient home upgrades by up to 30 percent. The section 179d deduction allows building owners or designers of such. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial building retrofit property (eebrp) may be able to claim a tax deduction. Calculate and claim the deduction under section 179d for qualifying energy efficient commercial building property placed in service during the tax year; Follow these 3 steps to determine if the door (s) you purchased are eligible: Efficient heating equipment* efficient water heating equipment* 30% of cost, up to $600 : Building owners who place in service energy eficient commercial building property (eecbp) or energy eficient building retrofit property (eebrp) may be able to claim a tax deduction. There are two options for a deduction under i.r.c.IRA’s 179D Tax Deduction for Energy Efficient Commercial Buildings

Section 179D Tax Deductions Energy Efficient Buildings BRS Business

179D Energy Efficient Commercial Building Deduction NELSON

How EnergyEfficient Building Deductions Can Save Money for Contractors

179D Energy Efficient Commercial Buildings Tax Deduction alliantgroup

IRS Releases Updated Practice Unit for Auditing the 179D Energy

179D Energy Efficient Commercial Buildings Tax Deduction Department

IRSnews on Twitter "Energy Efficient Commercial Building Deduction

179D Energy Efficient Commercial Buildings Tax Deduction alliantgroup

Deduction for EnergyEfficient Commercial BuildingsWalz Group CPA

Qualifying Expenditures And Credit Amount;

As Environmental Sustainability Gains Importance, Leveraging.

Exterior Doors Must Be Energy Star Certified To Qualify For The 25C Federal Tax Credit.

An Increased Deduction May Be Available For Increased Energy Savings Or Meeting.

Related Post: