Energyefficient Commercial Buildings Tax Deduction

Energyefficient Commercial Buildings Tax Deduction - The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. Offers commercial property tax deductions for energy. Exterior residential windows or skylights must meet the energy star most efficient criteria to be eligible for the 25c federal tax credit. The federal clean energy tax credits are direct investments in good jobs, reliable energy, lower costs of housing, and thriving american communities.” “energy tax credits are. Offers tax credits for investments in eligible renewable energy projects and facilities that generate clean electricity and energy storage. Through claiming a section 179d deduction, taxpayers can receive as much as $1.80 per square foot when making efficiency improvements above certain energy thresholds. Energy efficiency incentives improving your business performance §45l energy efficient home tax credit §179d energy efficient commercial building property tax. More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals, building contractors, and others. To qualify for the 179d tax deduction, a building must meet specific energy efficiency standards outlined in the energy policy act of. It’s not just homeowners who can benefit. Offers tax credits for investments in eligible renewable energy projects and facilities that generate clean electricity and energy storage. What is section 179d energy efficient commercial building tax deduction (section 179d)? Energy efficiency incentives improving your business performance §45l energy efficient home tax credit §179d energy efficient commercial building property tax. The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial building retrofit property (eebrp) may be able to claim a tax. Section 179d of the internal revenue code (hereafter referred to as 179d) provides federal tax deductions for placing in service (installing) eligible energy efficient property in commercial. They aim to reduce energy use, water use, and greenhouse gas. The i nflation reduction act of 2022 amended the credits available for energy efficient home improvements and residential clean energy property. Through 2032, federal income tax credits are available to homeowners, that will allow up to $3,200 annually to lower the cost of energy efficient home upgrades by up to 30 percent. Through 2032, federal income tax credits are available to homeowners, that will allow up to $3,200 annually to lower the cost of energy efficient home upgrades by up to 30 percent. The section 179d deduction allows building owners or designers of such. To qualify for the 179d tax deduction, a building must meet specific energy efficiency standards outlined in the. Eligibility criteria for 179d deduction. Here are some tips to help. Sustainable building technologies include solar panels, energy efficient windows, and low emission materials. To qualify for the 179d tax deduction, a building must meet specific energy efficiency standards outlined in the energy policy act of. Section 179d of the internal revenue code (hereafter referred to as 179d) provides federal. Exterior residential windows or skylights must meet the energy star most efficient criteria to be eligible for the 25c federal tax credit. The i nflation reduction act of 2022 amended the credits available for energy efficient home improvements and residential clean energy property. It’s not just homeowners who can benefit. Here are some tips to help. Eligibility criteria for 179d. More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals, building contractors, and others. The federal clean energy tax credits are direct investments in good jobs, reliable energy, lower costs of housing, and thriving american communities.” “energy tax credits are. Building owners who place in service energy efficient commercial building. The section 179d deduction allows building owners or designers of such. The i nflation reduction act of 2022 amended the credits available for energy efficient home improvements and residential clean energy property. More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals, building contractors, and others. They aim to reduce. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. Eligibility criteria for 179d deduction. Form 7205 is used by qualified business entities and individuals to calculate and claim the deduction under section 179d for qualifying energy efficient commercial building. Exterior residential windows. Exterior residential windows or skylights must meet the energy star most efficient criteria to be eligible for the 25c federal tax credit. Here are some tips to help. Building owners who place in service energy efficient commercial building property (eecbp) or energy efficient commercial building retrofit property (eebrp) may be able to claim a tax. Cost segregation studies may help. Offers tax credits for investments in eligible renewable energy projects and facilities that generate clean electricity and energy storage. Form 7205 is used by qualified business entities and individuals to calculate and claim the deduction under section 179d for qualifying energy efficient commercial building. They aim to reduce energy use, water use, and greenhouse gas. The i nflation reduction act. More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals, building contractors, and others. The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Section 179d of the internal revenue code (hereafter referred to as 179d) provides. Section 179d of the internal revenue code (179d) provides a federal tax deduction for placing in service energy efficient commercial building property (eecbp) or energy efficient building. Offers commercial property tax deductions for energy. Energy efficiency incentives improving your business performance §45l energy efficient home tax credit §179d energy efficient commercial building property tax. More information on the energy efficient. Offers tax credits for investments in eligible renewable energy projects and facilities that generate clean electricity and energy storage. The federal clean energy tax credits are direct investments in good jobs, reliable energy, lower costs of housing, and thriving american communities.” “energy tax credits are. The i nflation reduction act of 2022 amended the credits available for energy efficient home improvements and residential clean energy property. Building owners who place in service energy eficient commercial building property (eecbp) or energy eficient building retrofit property (eebrp) may be able to claim a tax deduction. The section 179d deduction allows building owners or designers of such. It’s not just homeowners who can benefit. Cost segregation studies may help identify prior and current expenditures related to heating and cooling, ventilation, hot. Through claiming a section 179d deduction, taxpayers can receive as much as $1.80 per square foot when making efficiency improvements above certain energy thresholds. Form 7205 is used by qualified business entities and individuals to calculate and claim the deduction under section 179d for qualifying energy efficient commercial building. They aim to reduce energy use, water use, and greenhouse gas. To qualify for the 179d tax deduction, a building must meet specific energy efficiency standards outlined in the energy policy act of. Follow these 3 steps to determine if the windows. The 179d commercial buildings energy efficiency tax deduction is a permanent tax deduction for making energy efficiency improvements to interior lighting, heating, cooling,. Understanding the depreciation rate helps property owners claim tax. Here are some tips to help. Exterior residential windows or skylights must meet the energy star most efficient criteria to be eligible for the 25c federal tax credit.179D Energy Efficient Commercial Buildings Tax Deduction alliantgroup

179D Energy Efficient Commercial Buildings Tax Deduction alliantgroup

179D Energy Efficient Commercial Building Deduction NELSON

Section 179D Tax Deductions Energy Efficient Buildings BRS Business

IRS Releases Updated Practice Unit for Auditing the 179D Energy

Deduction for EnergyEfficient Commercial BuildingsWalz Group CPA

IRSnews on Twitter "Energy Efficient Commercial Building Deduction

Section 179D Congress Enhances Tax Deduction for EnergyEfficient

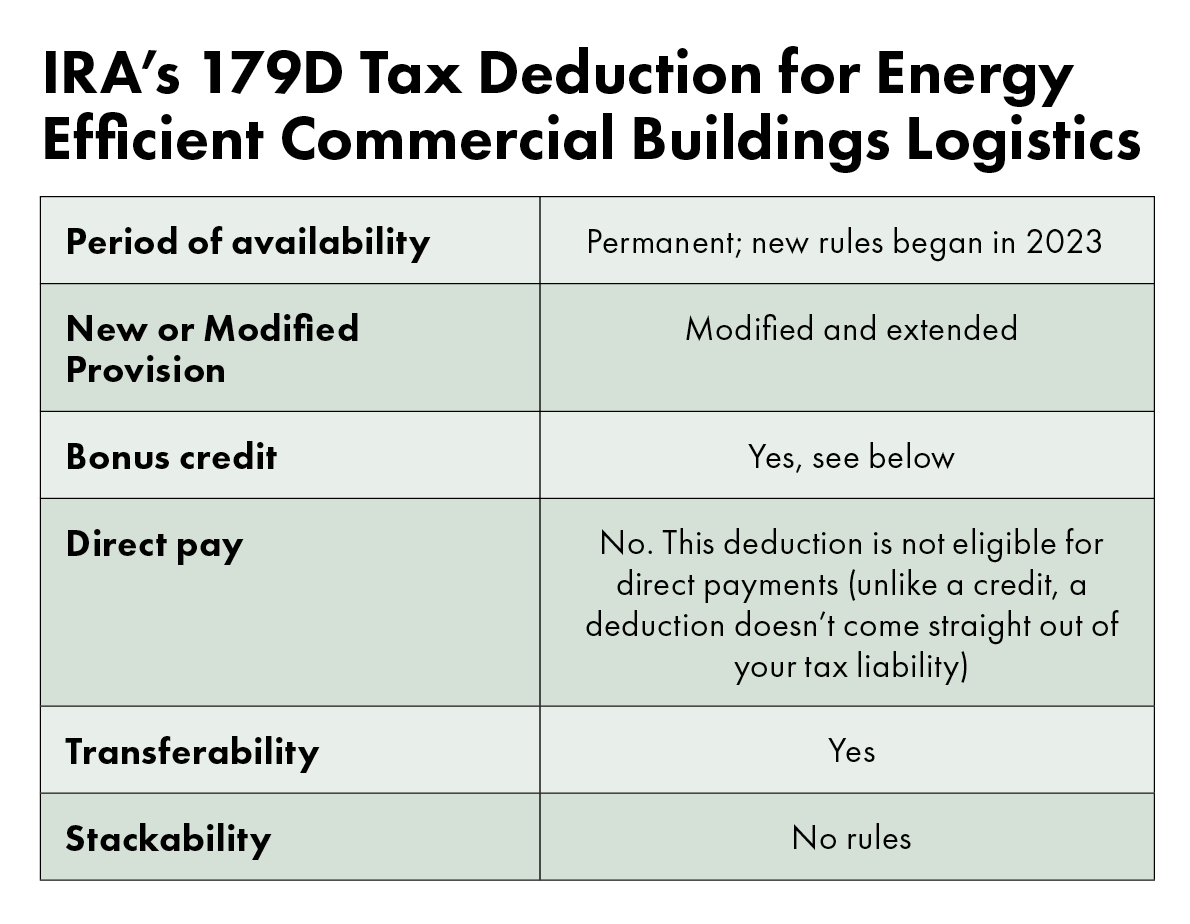

IRA’s 179D Tax Deduction for Energy Efficient Commercial Buildings

How EnergyEfficient Building Deductions Can Save Money for Contractors

Sustainable Building Technologies Include Solar Panels, Energy Efficient Windows, And Low Emission Materials.

Building Owners Who Place In Service Energy Efficient Commercial Building Property (Eecbp) Or Energy Efficient Commercial Building Retrofit Property (Eebrp) May Be Able To Claim A Tax.

Offers Commercial Property Tax Deductions For Energy.

More Information On The Energy Efficient Home Improvement Credit And Residential Clean Energy Property Credit Is Available For Tax Professionals, Building Contractors, And Others.

Related Post: