Farm Building Depreciation

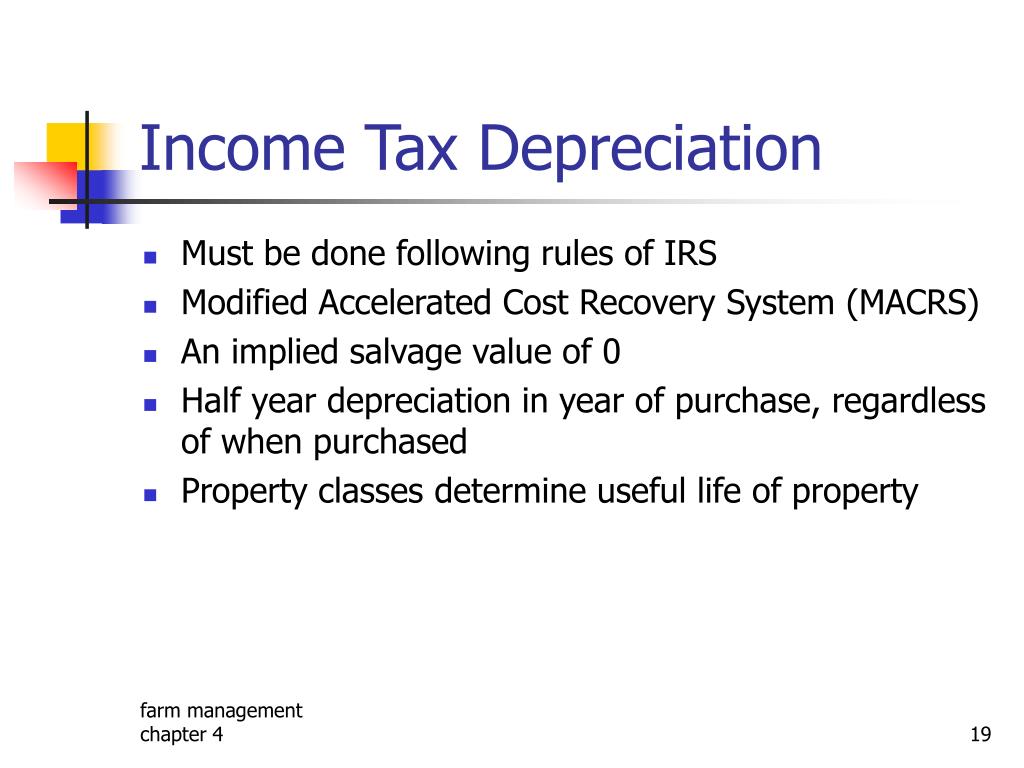

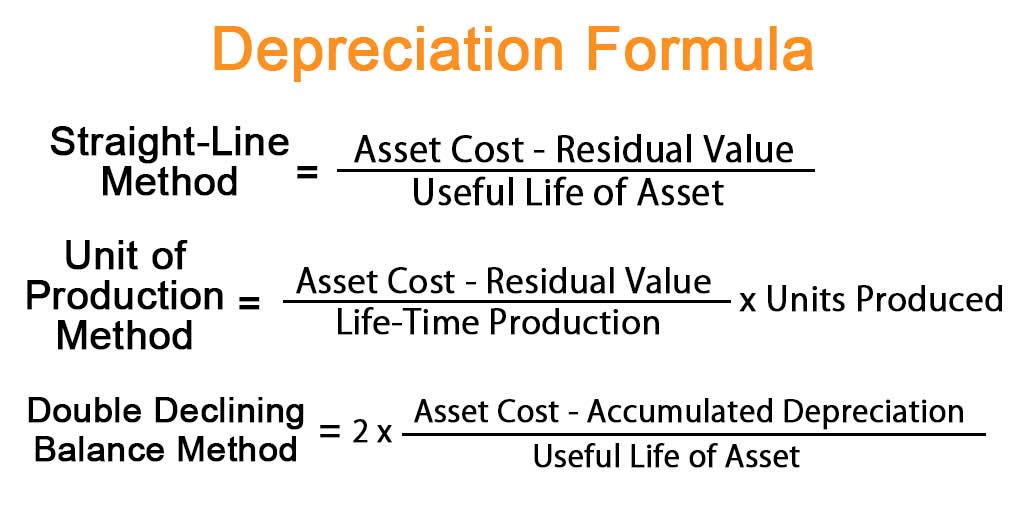

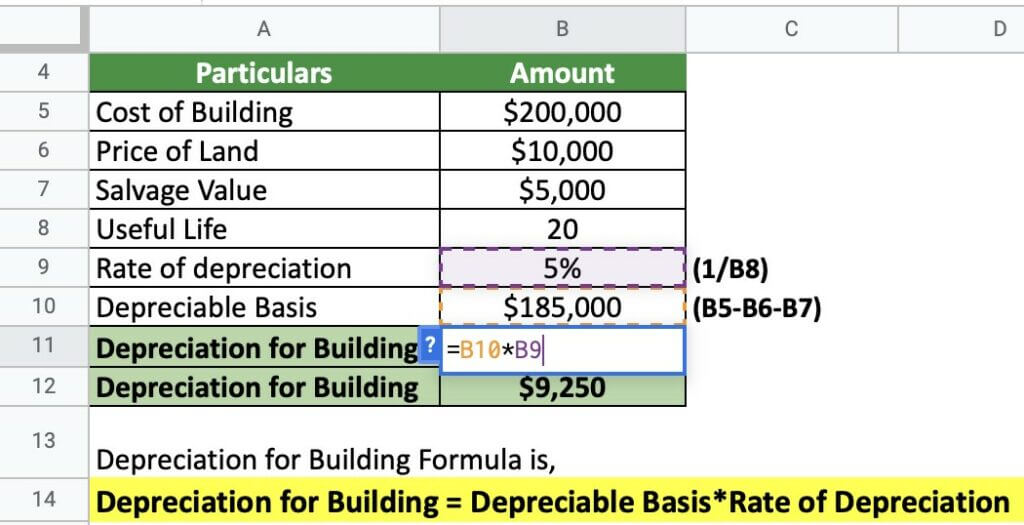

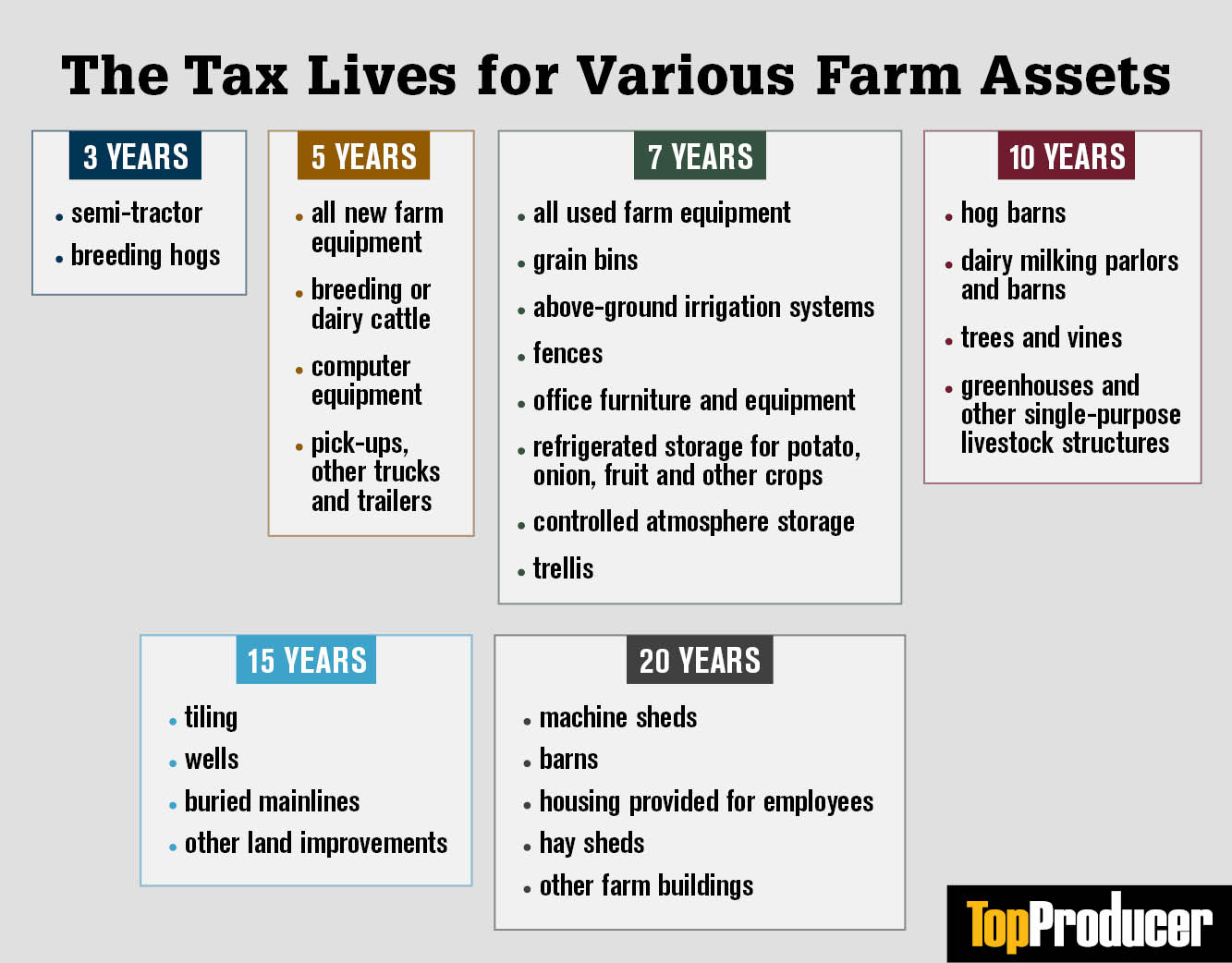

Farm Building Depreciation - Bonus depreciation of $240,000 (2023) +$2,250 regular. The service’s faq on depreciation states: Let's take a look at. Be property to which macrs applies with an applicable recovery period of 20. Calculating land and building values for tax purposes is a critical step toward maximizing your available tax deductions from depreciation. ¶435 depreciation of farm property new law explained farming machinery depreciated over five years; Generally, the loan structure should. If you own real estate, one of the big benefits is that it is a depreciable asset. 200 percent db method allowed; Selecting the right depreciation method affects financial statements, tax obligations, and cash flow. So just what is a “farm building”? This is because the law says you. What is the appropriate tax treatment of these items for depreciation purposes? The method should align with the tractor’s. Learn how it affects your finances and the best practices for managing it. For 2023, only 80% bonus depreciation is available. Bonus depreciation of $240,000 (2023) +$2,250 regular. Considering the different depreciation methods, section 179 expense deduction, bonus depreciation, and consulting with a tax professional are all essential steps in effectively. Starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. Ads required if farming business elects out of. The service’s faq on depreciation states: Certain longer term assets (that typically do not apply to farm buildings) would have an. Learn how it affects your finances and the best practices for managing it. Starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. Calculating land and building values for tax purposes is a. This is because the law says you. “land can never be depreciated. Since land cannot be depreciated, you need to allocate the original purchase price between land and. Starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. So just what is a “farm building”? What is depreciable farm real property? Selecting the right depreciation method affects financial statements, tax obligations, and cash flow. Ads required if farming business elects out of. Generally, the loan structure should. Explore our comprehensive guide on understanding depreciation in farm equipment and buildings. Explore the essentials of depreciation for farm equipment and buildings. Certain longer term assets (that typically do not apply to farm buildings) would have an. Table 1 illustrates macrs gds and. Ads required if farming business elects out of. Generally, the loan structure should. Learn how the tax root can help you maximize your agricultural tax. The service’s faq on depreciation states: 200 percent db method allowed; Ads required if farming business elects out of. To qualify the property must: Starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. What is depreciable farm real property? Bonus depreciation of $240,000 (2023) +$2,250 regular. The method should align with the tractor’s. Selecting the right depreciation method affects financial statements, tax obligations, and cash flow. Table 1 illustrates macrs gds and. For 2023, only 80% bonus depreciation is available. This means that you can record an expense each year for the wear and tear on your building. Learn how it affects your finances and the best practices for managing it. While there are various methods for separating out the land value from the building value,. Table 1 illustrates macrs gds and. The method should align with the tractor’s. For 2023, only 80% bonus depreciation is available. This means that you can record an expense each year for the wear and tear on your building. ¶435 depreciation of farm property new law explained farming machinery depreciated over five years; The method should align with the tractor’s. What is depreciable farm real property? ¶435 depreciation of farm property new law explained farming machinery depreciated over five years; Selecting the right depreciation method affects financial statements, tax obligations, and cash flow. Calculating land and building values for tax purposes is a critical step toward maximizing your available tax deductions from depreciation. Table 1 illustrates macrs gds and. Selecting the right depreciation method affects financial statements, tax obligations, and cash flow. Generally, the loan structure should. Learn how it affects your finances and the best practices for managing it. Explore our comprehensive guide on understanding depreciation in farm equipment and buildings. Be property to which macrs applies with an applicable recovery period of 20. Selecting the right depreciation method affects financial statements, tax obligations, and cash flow. 200 percent db method allowed; Explore the essentials of depreciation for farm equipment and buildings. The method should align with the tractor’s. For 2023, only 80% bonus depreciation is available. Explore our comprehensive guide on understanding depreciation in farm equipment and buildings. This means that you can record an expense each year for the wear and tear on your building. If you own real estate, one of the big benefits is that it is a depreciable asset. Table 1 illustrates macrs gds and. Considering the different depreciation methods, section 179 expense deduction, bonus depreciation, and consulting with a tax professional are all essential steps in effectively. ¶435 depreciation of farm property new law explained farming machinery depreciated over five years; “land can never be depreciated. Learn how it affects your finances and the best practices for managing it. The service’s faq on depreciation states: Calculating land and building values for tax purposes is a critical step toward maximizing your available tax deductions from depreciation.PPT Farm Management PowerPoint Presentation, free download ID805758

Straight Line Depreciation Method Online Accounting

Depreciation for Building Definition, Formula, and Excel Examples

Using Percentage Tables to Calculate Depreciation Center for

Depreciating Farm Property with a FiveYear Recovery Period Center

Depreciation for Building Definition, Formula, and Excel Examples

Tax Issues for Farmers Depreciation Tools YouTube

Line 14 Depreciation and Section 179 Expense Center for

The Farm CPA Depreciation, Depreciation, Depreciation AgWeb

Depreciation Examples Property Ally

Bonus Depreciation Of $240,000 (2023) +$2,250 Regular.

Learn How The Tax Root Can Help You Maximize Your Agricultural Tax.

What Is Depreciable Farm Real Property?

It Will Decrease 20% Each Year.

Related Post: