Fha Loan To Build

Fha Loan To Build - There are two types of fha construction loans: “the flexible credit, down payment, and dti requirements in particular make fha loans highly accessible. An fha construction loan offers a path to homeownership with unique advantages for those looking to build from scratch. Fha 203(k) loan see more Fha 203(k) rehabilitation loans, also known as fha 203(k) loan renovation loans, allow borrowers to buy and repair an existing home. An fha construction loan offers a pathway to turn those dreams into reality, with easier. An upfront premium due before the construction begins, and an annual premium fee. There are two types of fha construction loans borrowers can choose from: An fha construction loan is a mortgage that allows you to roll in the costs of building a home or renovating an existing property. These loans are popular for their flexible credit requirements and low down payment options, which make homeownership more accessible. An fha construction loan can help buyers with lower credit and cash reserves finance new construction. However, there are also fha loans out there that can assist you if you’re. To qualify for an fha construction loan, you must work with a builder who is approved by the fha. Building a dream home can be daunting, especially when it comes to financing. There are two types of fha new construction loans. An fha construction loan is a mortgage that allows you to roll in the costs of building a home or renovating an existing property. Fha building construction loans cover all costs associated with construction on your property: If your home needs repairs to make it more livable, an fha title 1 loan could help. This article will break down the ins and. Fha 203(k) loan see more An upfront premium due before the construction begins, and an annual premium fee. Fha 203(k) loan see more Yes, fha loans are commonly leveraged by those who are looking to buy an existing home. An fha construction loan is a type of fha loan that covers the cost of building a home, including the land or lot purchase, building materials.. The federal housing administration (fha) insures loans from approved mortgage lenders,. The builder must be registered with the fha and meet specific criteria. Fha 203(k) loan see more Yes, fha loans are commonly leveraged by those who are looking to buy an existing home. What is an fha construction loan and how does it work? Current florida fha loan rates. “the flexible credit, down payment, and dti requirements in particular make fha loans highly accessible. There are two types of fha construction loans borrowers can choose from: Just be prepared for the additional paperwork and mortgage. An fha construction loan offers a path to homeownership with unique advantages for those looking to build from scratch. The land purchase, plans, permits, approved fees, labor and materials. There are two types of fha construction loans borrowers can choose from: Fha construction loans come with two types of mortgage insurance: “the flexible credit, down payment, and dti requirements in particular make fha loans highly accessible. This article will break down the ins and. There are two types of fha construction loans: These loans are popular for their flexible credit requirements and low down payment options, which make homeownership more accessible. Fha 203(k) rehabilitation loans, also known as fha 203(k) loan renovation loans, allow borrowers to buy and repair an existing home. For many, purchasing a mobile or manufactured home is an affordable, flexible. However, there are also fha loans out there that can assist you if you’re. An upfront premium due before the construction begins, and an annual premium fee. Just be prepared for the additional paperwork and mortgage. An fha construction loan is a mortgage that allows you to roll in the costs of building a home or renovating an existing property.. These loans are popular for their flexible credit requirements and low down payment options, which make homeownership more accessible. An fha construction loan offers a pathway to turn those dreams into reality, with easier. However, the calculator also highlights. For many, purchasing a mobile or manufactured home is an affordable, flexible way to achieve homeownership, and an fha loan can. If your home needs repairs to make it more livable, an fha title 1 loan could help. An fha construction loan can help buyers with lower credit and cash reserves finance new construction. Fha loans are accessible for borrowers with fair credit and offer down payments as low as 3.5%, which aligns with her available funds. The builder must be. The federal housing administration (fha) insures loans from approved mortgage lenders,. An fha construction loan can help buyers with lower credit and cash reserves finance new construction. Current florida fha loan rates. An upfront premium due before the construction begins, and an annual premium fee. The land purchase, plans, permits, approved fees, labor and materials. The land purchase, plans, permits, approved fees, labor and materials. If your home needs repairs to make it more livable, an fha title 1 loan could help. Fha 203(k) loan see more Just be prepared for the additional paperwork and mortgage. There are two types of fha construction loans: There are two types of fha new construction loans. What is an fha construction loan and how does it work? However, there are also fha loans out there that can assist you if you’re. Fha building construction loans cover all costs associated with construction on your property: An upfront premium due before the construction begins, and an annual premium fee. An fha construction loan can help buyers with lower credit and cash reserves finance new construction. However, the calculator also highlights. The land purchase, plans, permits, approved fees, labor and materials. An fha construction loan offers a pathway to turn those dreams into reality, with easier. Just be prepared for the additional paperwork and mortgage. What is an fha construction loan? For many, purchasing a mobile or manufactured home is an affordable, flexible way to achieve homeownership, and an fha loan can make this dream even more attainable. An fha construction loan offers a path to homeownership with unique advantages for those looking to build from scratch. An fha construction loan is a mortgage that allows you to roll in the costs of building a home or renovating an existing property. Building a dream home can be daunting, especially when it comes to financing. An fha construction loan might be able to help.Can You Build a Home with an FHA Loan? Craig Sharp Homes

FHA and VA Construction Loans Construction loans, Construction, Fha

Incredible Fha Loan To Buy Apartment Building Simple Ideas Luxury

The Ultimate Guide to FHA Home Construction Loans Everything You Need

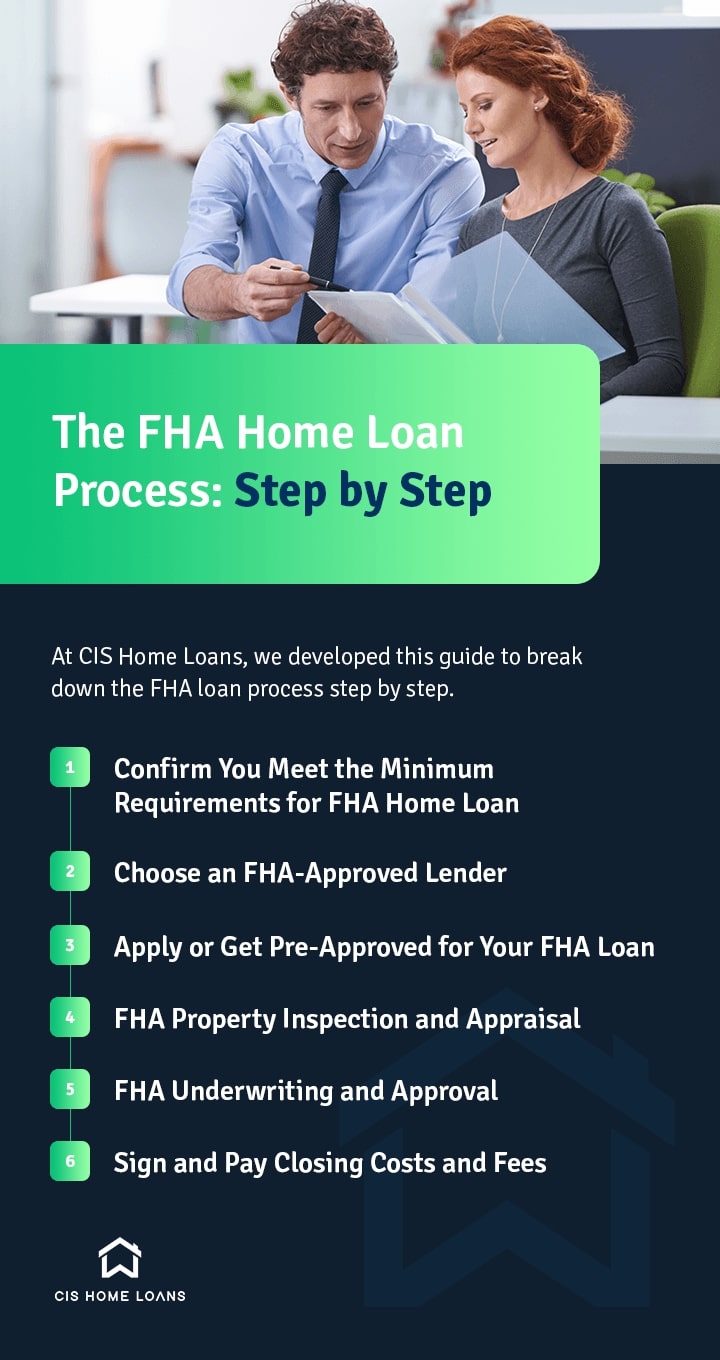

The FHA Home Loan Process Step by Step CIS Home Loans

Build On Your Own Lot in with an FHA / VA Construction Loan

What Is an FHA Loan? FHA Loans Explained

Buying Land With Your Next Construction FHA Loan CMS

Build your dream home with FHA Construction to Permanent Loan Guide

FHA Construction Loan for 2025 One Time Close FHA Lenders

Fha 203(K) Rehabilitation Loans, Also Known As Fha 203(K) Loan Renovation Loans, Allow Borrowers To Buy And Repair An Existing Home.

Yes, Fha Loans Are Commonly Leveraged By Those Who Are Looking To Buy An Existing Home.

Current Florida Fha Loan Rates.

These Loans Are Popular For Their Flexible Credit Requirements And Low Down Payment Options, Which Make Homeownership More Accessible.

Related Post: