Financial Steps To Building A House

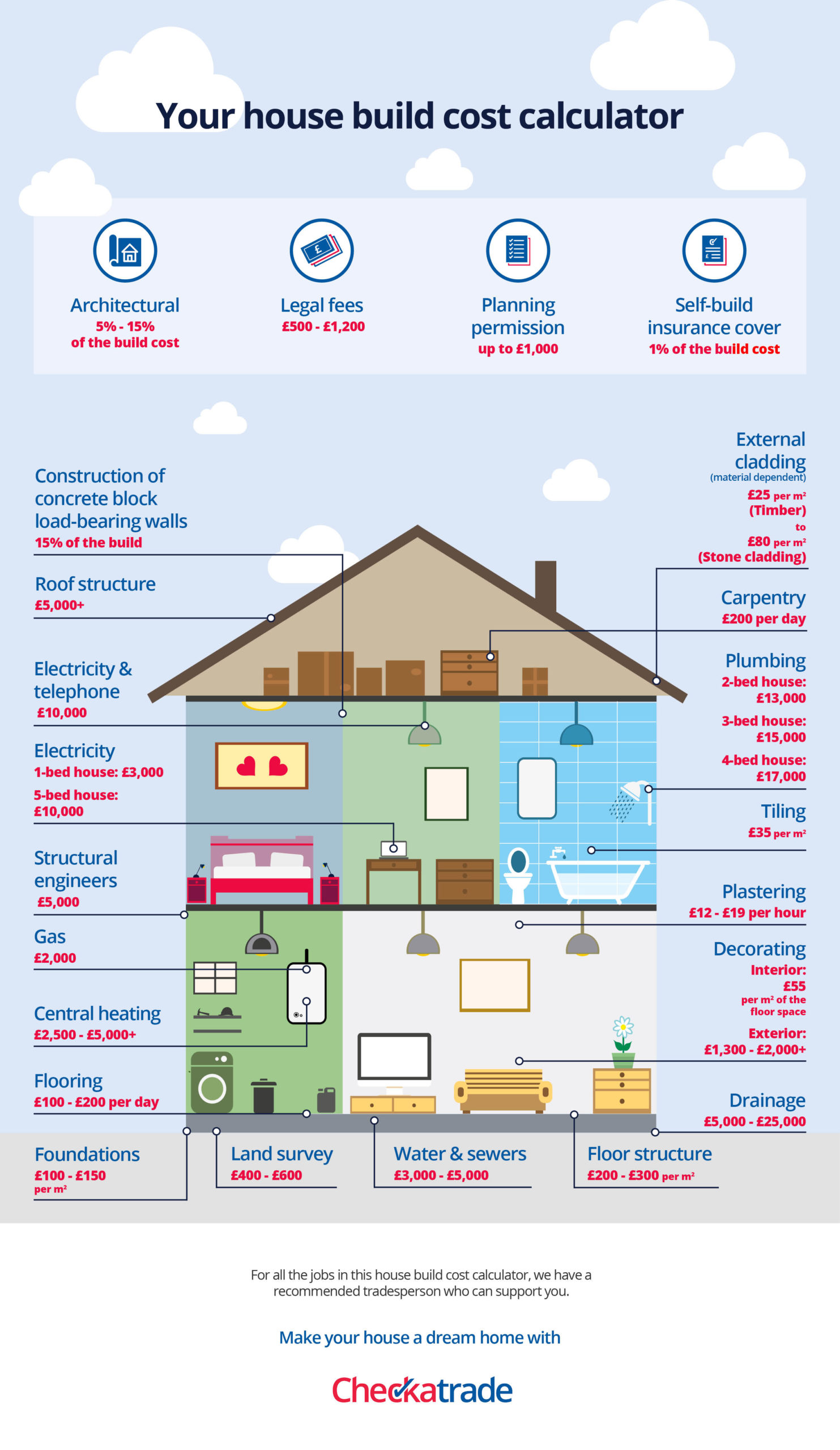

Financial Steps To Building A House - The financing process encompasses various avenues, from engaging with. To help you decide whether you want to build or buy, we’ll break. Here are some of the key financial steps to consider when building a house and how redstone bank is here to help you navigate this significant investment with confidence. Building a house has many advantages, but it also has its drawbacks. Evaluate your current savings, income, and any available financing. All jokes aside, take your researched and calculated savings goal and double it. When building a house, you need a savings account for your savings account. So we created this building process financial roadmap to visually represent the steps and financial commitments in one document. We have discussed the most crucial financial steps to building a new house. Begin by determining how much you can comfortably allocate to your new construction project. In 2024, the median age at first marriage was. Begin by determining how much you can comfortably allocate to your new construction project. Building a house has many advantages, but it also has its drawbacks. Herewith are steps that prospective homeowners must take to ensure their finances are organized before they make their biggest commitment in life. Taking these smart steps now—boosting your credit, saving. We have discussed the most crucial financial steps to building a new house. Weddings and homeownership are two major goals for many couples, but affording both takes years of careful saving and planning. Evaluate your current savings, income, and any available financing. These will help you know what you will sign up for before committing to any plan. When building a house, you need a savings account for your savings account. Buying your first home is an exciting milestone, but it’s also one of the biggest financial commitments you’ll ever make. Begin by determining how much you can comfortably allocate to your new construction project. Herewith are steps that prospective homeowners must take to ensure their finances are organized before they make their biggest commitment in life. And affordability is the. All jokes aside, take your researched and calculated savings goal and double it. So we created this building process financial roadmap to visually represent the steps and financial commitments in one document. Buying your first home is an exciting milestone, but it’s also one of the biggest financial commitments you’ll ever make. Here are some of the key financial steps. Here are some of the key financial steps to consider when building a house and how redstone bank is here to help you navigate this significant investment with confidence. Begin by determining how much you can comfortably allocate to your new construction project. Building a house has many advantages, but it also has its drawbacks. Taking these smart steps now—boosting. Taking these smart steps now—boosting your credit, saving. All jokes aside, take your researched and calculated savings goal and double it. And affordability is the main one. These will help you know what you will sign up for before committing to any plan. Building a house has many advantages, but it also has its drawbacks. Begin by determining how much you can comfortably allocate to your new construction project. Here are some of the key financial steps to consider when building a house and how midwest bank is here to help you navigate this significant investment with confidence. All jokes aside, take your researched and calculated savings goal and double it. Buying your first home. To help you decide whether you want to build or buy, we’ll break. When building a house, you need a savings account for your savings account. Building a house has many advantages, but it also has its drawbacks. Taking these smart steps now—boosting your credit, saving. Weddings and homeownership are two major goals for many couples, but affording both takes. The financing process encompasses various avenues, from engaging with. So we created this building process financial roadmap to visually represent the steps and financial commitments in one document. Taking these smart steps now—boosting your credit, saving. And affordability is the main one. These will help you know what you will sign up for before committing to any plan. Here are some of the key financial steps to consider when building a house and how redstone bank is here to help you navigate this significant investment with confidence. We have discussed the most crucial financial steps to building a new house. These will help you know what you will sign up for before committing to any plan. Evaluate your. Begin by determining how much you can comfortably allocate to your new construction project. You can find the definitions of most of. Herewith are steps that prospective homeowners must take to ensure their finances are organized before they make their biggest commitment in life. Evaluate your current savings, income, and any available financing. Here are some of the key financial. In 2024, the median age at first marriage was. Building a house has many advantages, but it also has its drawbacks. Evaluate your current savings, income, and any available financing. Here are some of the key financial steps to consider when building a house and how redstone bank is here to help you navigate this significant investment with confidence. When. Here are some of the key financial steps to consider when building a house and how midwest bank is here to help you navigate this significant investment with confidence. Begin by determining how much you can comfortably allocate to your new construction project. So we created this building process financial roadmap to visually represent the steps and financial commitments in one document. To help you decide whether you want to build or buy, we’ll break. All jokes aside, take your researched and calculated savings goal and double it. And affordability is the main one. Evaluate your current savings, income, and any available financing. We have discussed the most crucial financial steps to building a new house. These will help you know what you will sign up for before committing to any plan. When building a house, you need a savings account for your savings account. You can find the definitions of most of. Here are some of the key financial steps to consider when building a house and how redstone bank is here to help you navigate this significant investment with confidence. Herewith are steps that prospective homeowners must take to ensure their finances are organized before they make their biggest commitment in life. Buying your first home is an exciting milestone, but it’s also one of the biggest financial commitments you’ll ever make. Taking these smart steps now—boosting your credit, saving.How Much Does a House Build Cost in 2024? Checkatrade

Financial steps to building a house in pa Artofit

Financial steps to building a house. Wooden model home kit

THE PROCESS OF BUILDING A HOUSE the cost of building vs. buying

8 Financial Steps to Building a House Cape Cod New Construction

Babs0cell new house Artofit

113,987 Building House Steps Images, Stock Photos & Vectors Shutterstock

House Building Budget Financial Steps to Building a House Building a

How To Finance Building A House Storables

Ultimate Tips for Calculating House Building Costs

Building A House Has Many Advantages, But It Also Has Its Drawbacks.

In 2024, The Median Age At First Marriage Was.

Weddings And Homeownership Are Two Major Goals For Many Couples, But Affording Both Takes Years Of Careful Saving And Planning.

The Financing Process Encompasses Various Avenues, From Engaging With.

Related Post: