First Time Home Buyer Building Loan

First Time Home Buyer Building Loan - Here’s a look at the new. First time home builder loans are a type of loan that is specifically for people who are looking to build their first home. They often require as little as 3.5% down, and the credit score thresholds can be more forgiving. To take advantage of these perks, you’ll need to. Buying an existing home may feel easier,. Fha might be just what you need. If you’re keen to build a house, here’s what you need to know about planning and financing it. As a first time home buyer, you do have a few construction loan options available to you when building a home. Affordable homeownership opportunities are created through various programs and listed on this page as they become available for sale. These loans can be used to cover the cost of materials, labor, and other. The typical monthly mortgage payment for a starter home in new hampshire is now $2,600, assuming a 10% down payment, which would require an income of $103,985 to. Here’s a look at the new. Learn how new home construction loans work, their benefits, and tips to secure one. First time home builder loans are a type of loan that is specifically for people who are looking to build their first home. You may qualify for more than one of the loan options so we. Your down payment can be as low as 3.5% of the purchase price. To take advantage of these perks, you’ll need to. In addition, every state offers. Buying an existing home may feel easier,. As a first time home buyer, you do have a few construction loan options available to you when building a home. As a first time home buyer, you do have a few construction loan options available to you when building a home. Build the home of your dreams with confidence. They often require as little as 3.5% down, and the credit score thresholds can be more forgiving. Compare the benefits and drawbacks of different types of. The building neighborhoods and affordable. These loans can be used to cover the cost of materials, labor, and other. Are you 62 or older? Affording the down payment and closing costs are among the biggest barriers to becoming a homeowner. Fha might be just what you need. Compare the benefits and drawbacks of different types of. Here’s a look at the new. As a first time home buyer, you do have a few construction loan options available to you when building a home. To take advantage of these perks, you’ll need to. But there’s a key difference. The building neighborhoods and affordable homes. They often require as little as 3.5% down, and the credit score thresholds can be more forgiving. As a first time home buyer, you do have a few construction loan options available to you when building a home. But there’s a key difference. Zillow has 10 photos of this $328,990 3 beds, 2 baths, 1,672 square feet single family home. Backed by the federal housing administration. Fha might be just what you need. You may qualify for more than one of the loan options so we. As a first time home buyer, you do have a few construction loan options available to you when building a home. Build the home of your dreams with confidence. To take advantage of these perks, you’ll need to. Buying an existing home may feel easier,. If you’re keen to build a house, here’s what you need to know about planning and financing it. Outdoor space and parking in the back for 3 cars. Build the home of your dreams with confidence. Your down payment can be as low as 3.5% of the purchase price. Build the home of your dreams with confidence. Affordable homeownership opportunities are created through various programs and listed on this page as they become available for sale. To take advantage of these perks, you’ll need to. They often require as little as 3.5% down, and the credit. The typical monthly mortgage payment for a starter home in new hampshire is now $2,600, assuming a 10% down payment, which would require an income of $103,985 to. To take advantage of these perks, you’ll need to. Buying an existing home may feel easier,. In addition, every state offers. But there’s a key difference. Learn how new home construction loans work, their benefits, and tips to secure one. Backed by the federal housing administration. In addition, every state offers. Build the home of your dreams with confidence. First time home builder loans are a type of loan that is specifically for people who are looking to build their first home. Compare the benefits and drawbacks of different types of. Here’s a look at the new. The building neighborhoods and affordable homes. First time home builder loans are a type of loan that is specifically for people who are looking to build their first home. These loans can be used to cover the cost of materials, labor, and other. To take advantage of these perks, you’ll need to. Buying an existing home may feel easier,. Build the home of your dreams with confidence. Compare the benefits and drawbacks of different types of. Enjoy the benefits of being close to a park for outdoor activities. Are you 62 or older? These loans can be used to cover the cost of materials, labor, and other. They often require as little as 3.5% down, and the credit score thresholds can be more forgiving. First time home builder loans are a type of loan that is specifically for people who are looking to build their first home. The typical monthly mortgage payment for a starter home in new hampshire is now $2,600, assuming a 10% down payment, which would require an income of $103,985 to. Backed by the federal housing administration. Fha might be just what you need. Outdoor space and parking in the back for 3 cars. If you’re keen to build a house, here’s what you need to know about planning and financing it. Learn how new home construction loans work, their benefits, and tips to secure one. Construction:durable brick exterior, combining style with low maintenance.Construction Loans Financing Solutions for Your Projects

First Time Home Buyer Loan Benefits Things to Know

FirstTime Home Buyer; the Mortgage Loan Programs you Need to Know

What’s the Best Loan for a Firsttime Home Buyer? NFCC National

First Time Home Buyer Loans A Brief Overview Garden State Home Loans

Guide First Time Home Buyer Loans (How to Qualify) GoLoans

What are the loan Process for First Time Home Buyers? So here is your

real estate infographics FirstTime Home Buyer Loans How to Qualify

First Home Buyer Loans Mortgage Services Ozweb Finance

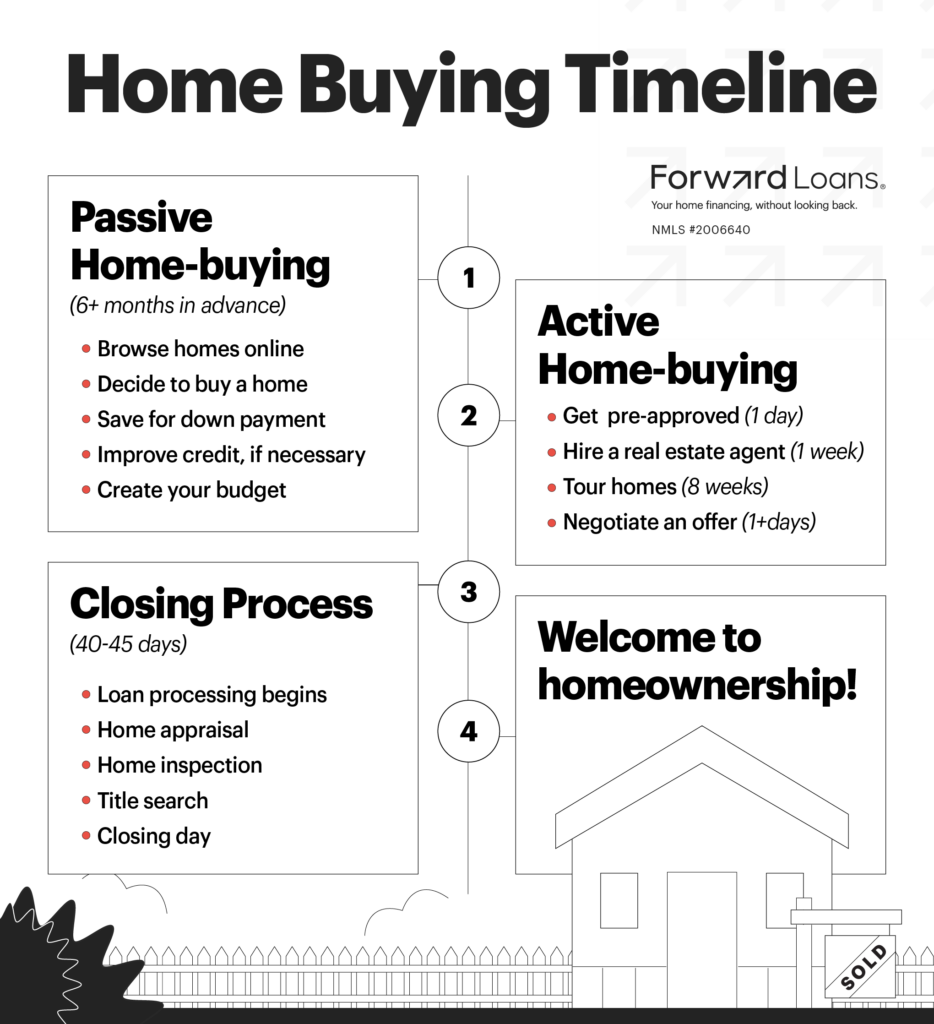

FirstTime Home Buyer Guide Forward Loans

In Addition, Every State Offers.

As A First Time Home Buyer, You Do Have A Few Construction Loan Options Available To You When Building A Home.

Zillow Has 10 Photos Of This $328,990 3 Beds, 2 Baths, 1,672 Square Feet Single Family Home Located At 64 Melogold Dr, Ormond Beach, Fl 32174 Mls #1209054.

The Building Neighborhoods And Affordable Homes.

Related Post: