Flex Credit Builder

Flex Credit Builder - Credit line amounts vary based on eligibility (graphics are illustrative only); Best for building credit with subscriptions: The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. By paying your rent through the line of credit flex offers you, your on time payments will be reported to. Every month, flex helps with paying your full rent directly to your property when it's due. Flex establishes a line of credit for you and your line of credit is utilized to send your rent payment to your landlord. Credit builder helps improve your credit score by focusing on the four main parts that matter most: To access a credit line, you are required to make. See if you're eligible today, with no impact on your credit score. I was just wondering if anyone had any. To access a credit line, you are required to make timely payments each month. Unsecured lines of credit are provided. The chime credit builder credit card can help you build credit with no annual fees, no interest 1, no large security deposits², and no credit checks necessary to apply. Every month, flex helps with paying your full rent directly to your property when it's due. Flex establishes a line of credit for you and your line of credit is utilized to send your rent payment to your landlord. Ive budgeted and saved enough to pay it in full on time every month, so i figured i might as well get some good payment history on my report. Flex is a monthly subscription service that simplifies rent payments by splitting them into two parts. An application and credit assessment are required for approval. Flex is a monthly subscription that helps you pay rent on time, improve cash flow and build your credit history. A credit builder card that can help you build your credit score over time. To access a credit line, you are required to make. Flex | pay rent on your own schedule. Ive budgeted and saved enough to pay it in full on time every month, so i figured i might as well get some good payment history on my report. Credit builder helps improve your credit score by focusing on the four main. Credit builder is flex’s newest product designed to help you build your credit score. By paying your rent through the line of credit flex offers you, your on time payments will be reported to. Managed correctly, any of these credit building credit cards will help. Unsecured lines of credit are provided. Flex lets you split your rent into smaller payments,. To access a credit line, you are required to make. Credit builder helps improve your credit score by focusing on the four main parts that matter most: Credit line amounts vary based on eligibility (graphics are illustrative only); It is a service that basically pays your rent at the first of the month and you repay it all month. A. On average it can help improve your credit score by 45 points in 3 months*. Credit builder uses a fully secured line of credit to pay your rent. Flex is a monthly subscription service that simplifies rent payments by splitting them into two parts. Unsecured lines of credit are provided. Credit line amounts vary based on eligibility (graphics are illustrative. See if you're eligible today, with no impact on your credit score. Managed correctly, any of these credit building credit cards will help. Flex is a monthly subscription that helps you pay rent on time, improve cash flow and build your credit history. Best for building credit with subscriptions: Ive budgeted and saved enough to pay it in full on. Flex is a monthly subscription that helps you pay rent on time, improve cash flow and build your credit history. Best for building credit with subscriptions: On average it can help improve your credit score by 45 points in 3 months*. Flex | pay rent on your own schedule. To access a credit line, you are required to make. Best for building credit with courses: Flex lets you split your rent into smaller payments, improving cash flow, and building your credit history with rent reporting. Credit builder uses a fully secured line of credit to pay your rent. Flex is a monthly subscription service that simplifies rent payments by splitting them into two parts. A credit builder card that. Flex is a monthly subscription that helps you pay rent on time, improve cash flow and build your credit history. Flex is a monthly subscription service that simplifies rent payments by splitting them into two parts. See if you're eligible today, with no impact on your credit score. Credit builder is a great option for those looking to improve their. To access a credit line, you are required to make. Best for building credit with courses: Flex lets you split your rent into smaller payments, improving cash flow, and building your credit history with rent reporting. I have a quick question to see if anyone here has had any experience with flex? See if you're eligible today, with no impact. Your payment history, how much of your available credit you are using, how long you've had. The chime credit builder credit card can help you build credit with no annual fees, no interest 1, no large security deposits², and no credit checks necessary to apply. Flex is a monthly subscription service that simplifies rent payments by splitting them into two. It is a service that basically pays your rent at the first of the month and you repay it all month. Credit line amounts vary based on eligibility (graphics are illustrative only); Your payment history, how much of your available credit you are using, how long you've had. To access a credit line, you are required to make timely payments each month. An application and credit assessment are required for approval. Best for building credit with courses: Flex lets you split your rent into smaller payments, improving cash flow, and building your credit history with rent reporting. Flex establishes a line of credit for you and your line of credit is utilized to send your rent payment to your landlord. I have a quick question to see if anyone here has had any experience with flex? Credit line amounts vary based on eligibility (graphics are illustrative only); See if you're eligible today, with no impact on your credit score. I was just wondering if anyone had any. Best for building credit with subscriptions: Managed correctly, any of these credit building credit cards will help. You simply pay your regular monthly rent through credit builder. On average it can help improve your credit score by 45 points in 3 months*.flexcreditogimage.png

Flex Spending Account 2024 Limit Per Day Maxi Stella

Chime Credit Builder Card Flexible Deposit YouTube

FLEX Completes Integration with CreditSnap FLEX Credit Union Technology

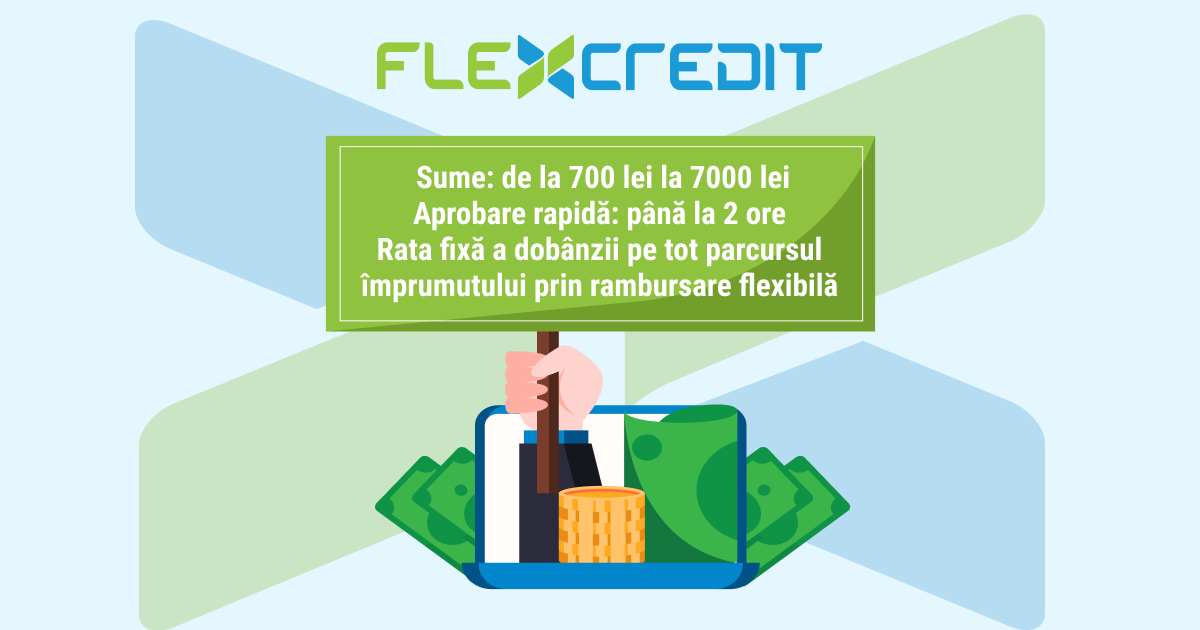

FlexCredit Credibill

Flex HELOC Special 2024 Community 1st Credit Union

Chase Launches The Chase Freedom Rise, A New Card For Credit Builders

FLEX Announces Integration Project with QCash Financial FLEX Credit

NEW Chase Freedom Flex Credit Card YouTube

Understanding Flex What Is Flex Credit On Pay Stub?

Credit Builder Uses A Fully Secured Line Of Credit To Pay Your Rent.

Credit Builder Is Flex’s Newest Product Designed To Help You Build Your Credit Score.

Ive Budgeted And Saved Enough To Pay It In Full On Time Every Month, So I Figured I Might As Well Get Some Good Payment History On My Report.

By Paying Your Rent Through The Line Of Credit Flex Offers You, Your On Time Payments Will Be Reported To.

Related Post: