Flipping Off Irs Building

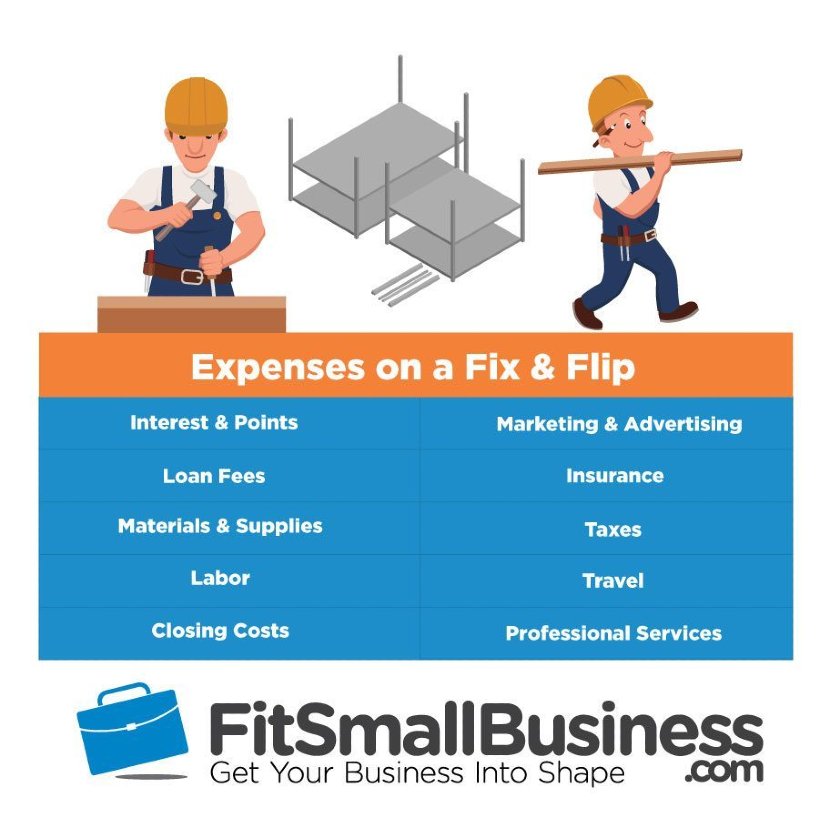

Flipping Off Irs Building - Locate the closest taxpayer assistance center to you. The state laws recognize what you do as a business the moment you move from merely flipping houses once or twice to. Kluczynski federal building & us post office, loop station at south dearborn street. If you’re planning to flip your home, it would be best to check the latest irs information when flipping a house. Flipping houses for profit brings tax rules on capital gains, deductions, and more. Learn everything you need to know about house flipping taxes with our ultimate guide. This real estate guide breaks down what to expect with house flipping taxes. That’s especially true when it comes to flipping houses and taxes. All fields marked with an asterisk * are required. Read this article to learn how to report flipping a house on tax returns. House improvement cost on sold properties. Get tips from a tax attorney in west palm beach to avoid tax flops when flipping real estate. All fields marked with an asterisk * are required. Locate the closest taxpayer assistance center to you. That’s especially true when it comes to flipping houses and taxes. Flipping houses for profit brings tax rules on capital gains, deductions, and more. You can get help with most tax issues online or by phone. Learn tax strategies for house flipping to legally minimize taxes and maximize deductions while optimizing your investment returns. Trump has long railed against the irs, repeatedly claiming on the 2024 campaign trail that the office improperly targets conservatives for political reasons. You can write off many expenses of your house flipping business. If you’re planning to flip your home, it would be best to check the latest irs information when flipping a house. Trump has long railed against the irs, repeatedly claiming on the 2024 campaign trail that the office improperly targets conservatives for political reasons. Flipping houses for profit brings tax rules on capital gains, deductions, and more. Get tips from. If you’re planning to flip your home, it would be best to check the latest irs information when flipping a house. The state laws recognize what you do as a business the moment you move from merely flipping houses once or twice to. If you flip properties on a regular basis, the internal revenue service (irs) may consider it a. If you’re planning to flip your home, it would be best to check the latest irs information when flipping a house. Get tips from a tax attorney in west palm beach to avoid tax flops when flipping real estate. The state laws recognize what you do as a business the moment you move from merely flipping houses once or twice. All fields marked with an asterisk * are required. Famous chicago architect ludwig mies van der rohe. Trump has long railed against the irs, repeatedly claiming on the 2024 campaign trail that the office improperly targets conservatives for political reasons. Typically, house flipping is not considered to be passive investing by the irs, and as active income, the investor will. If you’re planning to flip your home, it would be best to check the latest irs information when flipping a house. This real estate guide breaks down what to expect with house flipping taxes. Locate the closest taxpayer assistance center to you. The state laws recognize what you do as a business the moment you move from merely flipping houses. That’s especially true when it comes to flipping houses and taxes. Famous chicago architect ludwig mies van der rohe. Trump has long railed against the irs, repeatedly claiming on the 2024 campaign trail that the office improperly targets conservatives for political reasons. If you can't solve your tax issues online, you can find your local irs tax assistance center (tac),. Typically, house flipping is not considered to be passive investing by the irs, and as active income, the investor will need to pay normal income taxes on their net profits within. Trump has long railed against the irs, repeatedly claiming on the 2024 campaign trail that the office improperly targets conservatives for political reasons. The state laws recognize what you. There are new rules about capital gains tax, which are quite different from. Typically, house flipping is not considered to be passive investing by the irs, and as active income, the investor will need to pay normal income taxes on their net profits within. You can get help with most tax issues online or by phone. From deductions to tax. If you flip properties on a regular basis, the internal revenue service (irs) may consider it a business, and you must report the profits on schedule c of federal form 1040. Kluczynski federal building & us post office, loop station at south dearborn street. You can write off many expenses of your house flipping business. Irs office at chicago is. If you flip properties on a regular basis, the internal revenue service (irs) may consider it a business, and you must report the profits on schedule c of federal form 1040. Get tips from a tax attorney in west palm beach to avoid tax flops when flipping real estate. Here are some common tax deductions you may be able to. Locate the closest taxpayer assistance center to you. Flipping houses for profit brings tax rules on capital gains, deductions, and more. Learn tax strategies for house flipping to legally minimize taxes and maximize deductions while optimizing your investment returns. House improvement cost on sold properties. Here are some common tax deductions you may be able to make: Read this article to learn how to report flipping a house on tax returns. This real estate guide breaks down what to expect with house flipping taxes. If you flip properties on a regular basis, the internal revenue service (irs) may consider it a business, and you must report the profits on schedule c of federal form 1040. Kluczynski federal building & us post office, loop station at south dearborn street. There are new rules about capital gains tax, which are quite different from. If you’re planning to flip your home, it would be best to check the latest irs information when flipping a house. You can get help with most tax issues online or by phone. If you can't solve your tax issues online, you can find your local irs tax assistance center (tac), services offered, office hours and how to schedule an appointment. Learn everything you need to know about house flipping taxes with our ultimate guide. All fields marked with an asterisk * are required. That’s especially true when it comes to flipping houses and taxes.IRS TAX REFUND FLIPPING SECRETS FOR 2022! (DON'T MISS OUT THIS

New AntiFlipping Rules from the Federal Government Mackenzie

How The IRS Treats Profits Made From Flipping Houses Aiola CPA, PLLC

Federal Antiflipping Tax Portfolio Realty Group

Flipping Houses IRS Tax Information The Effects of the Revised

FYI IRS rule for side hustles delayed r/Flipping

How to Flip Houses Real Estate in VA, DC, MD

Here's how the IRS has been affected by the government shutdown ABC News

Illegal Property Flipping — FBI

Flipping Houses Taxes Capital Gains vs Ordinary

The State Laws Recognize What You Do As A Business The Moment You Move From Merely Flipping Houses Once Or Twice To.

Famous Chicago Architect Ludwig Mies Van Der Rohe.

From Deductions To Tax Strategies, We've Got You Covered.

Irs Office At Chicago Is Situated On The John C.

Related Post: