Functional Building Valuation Vs Replacement Cost

Functional Building Valuation Vs Replacement Cost - Calculating your rcv is a process that requires. This allows them to either retire from the. • a specific limit is assigned to the. Explore how the cost approach to value determines replacement cost, factoring in construction expenses and depreciation for accurate property valuation. Functional replacement cost gives the building owner the option to not rebuild and to settle for the market value of the building. A look at replacement cost value. Functional replacement cost valuation provides a lower valuation than replacement cost, resulting in a reduction of the amount of insurance coverage required and thus lower premiums. The concept of functional replacement cost is different from both actual cash value (acv) and replacement cost value (rcv) policies, and understanding the distinctions is crucial for. Functional replacement cost estimates project the. Functional replacement cost takes into account the functional use of the property, while replacement cost insurance provides coverage for the actual cost of replacing the. This allows them to either retire from the. Functional replacement cost estimates project the. • a specific limit is assigned to the. Functional replacement cost • pays the cost to replace damaged property with something functionally equivalent. Explore how the cost approach to value determines replacement cost, factoring in construction expenses and depreciation for accurate property valuation. Functional replacement cost gives the building owner the option to not rebuild and to settle for the market value of the building. The total amount it will cost to replace and cover your losses is called the “replacement cost valuation” or “rcv”. Not the same, but just as functional: A look at replacement cost value. Iso offers two endorsements which allow insureds to value real and personal property at less than replacement cost, but in amounts adequate to rebuild or replace with. Functional replacement bases the cost to rebuild the. This allows them to either retire from the. The concept of functional replacement cost is different from both actual cash value (acv) and replacement cost value (rcv) policies, and understanding the distinctions is crucial for. A functional replacement cost provision or endorsement changes the valuation basis otherwise applicable (actual cash value (acv). This allows them to either retire from the. Performing a replacement cost valuation or analysis is a critical financial and strategic exercise that helps individuals, businesses, and organizations determine the cost of. Not the same, but just as functional: Functional replacement coverage can be used when a functionally equivalent building can replace the original building at a lower cost than. It is the amount it takes to replace damaged or destroyed property with new buildings, equipment, and equal kind and. Functional replacement cost valuation provides a lower valuation than replacement cost, resulting in a reduction of the amount of insurance coverage required and thus lower premiums. Functional replacement cost estimates project the. Explore how the cost approach to value determines. A functional replacement cost provision or endorsement changes the valuation basis otherwise applicable (actual cash value (acv) or replacement cost (rc) value) to valuation at the cost to. Functional replacement bases the cost to rebuild the. Functional replacement cost takes into account the functional use of the property, while replacement cost insurance provides coverage for the actual cost of replacing. This allows them to either retire from the. A functional replacement cost provision or endorsement changes the valuation basis otherwise applicable (actual cash value (acv) or replacement cost (rc) value) to valuation at the cost to. Functional replacement cost is available for homes built prior to 1986, with the most significant differences for homes built prior to 1940. Functional replacement. A look at replacement cost value. Functional replacement cost estimates project the. Functional replacement cost takes into account the functional use of the property, while replacement cost insurance provides coverage for the actual cost of replacing the. Iso offers two endorsements which allow insureds to value real and personal property at less than replacement cost, but in amounts adequate to. Replacement costs is a popular method of valuation. Calculating your rcv is a process that requires. Functional replacement cost is available for homes built prior to 1986, with the most significant differences for homes built prior to 1940. Functional replacement cost valuation provides a lower valuation than replacement cost, resulting in a reduction of the amount of insurance coverage required. The functional building valuation option may be better if the insured would want to replace his existing building with a less costly one. • a specific limit is assigned to the. The total amount it will cost to replace and cover your losses is called the “replacement cost valuation” or “rcv”. A look at replacement cost value. Functional replacement bases. Functional replacement cost valuation provides a lower valuation than replacement cost, resulting in a reduction of the amount of insurance coverage required and thus lower premiums. Functional replacement cost gives the building owner the option to not rebuild and to settle for the market value of the building. Replacement costs is a popular method of valuation. A look at replacement. Functional replacement coverage can be used when a functionally equivalent building can replace the original building at a lower cost than by an identical replacement. The concept of functional replacement cost is different from both actual cash value (acv) and replacement cost value (rcv) policies, and understanding the distinctions is crucial for. Functional replacement cost • pays the cost to. The functional building valuation option may be better if the insured would want to replace his existing building with a less costly one. Functional replacement cost • pays the cost to replace damaged property with something functionally equivalent. Functional replacement bases the cost to rebuild the. Functional replacement cost takes into account the functional use of the property, while replacement cost insurance provides coverage for the actual cost of replacing the. Functional replacement cost estimates project the. This allows them to either retire from the. Explore how the cost approach to value determines replacement cost, factoring in construction expenses and depreciation for accurate property valuation. Performing a replacement cost valuation or analysis is a critical financial and strategic exercise that helps individuals, businesses, and organizations determine the cost of. Functional replacement coverage can be used when a functionally equivalent building can replace the original building at a lower cost than by an identical replacement. Not the same, but just as functional: Functional replacement cost valuation provides a lower valuation than replacement cost, resulting in a reduction of the amount of insurance coverage required and thus lower premiums. Replacement costs is a popular method of valuation. A functional replacement cost provision or endorsement changes the valuation basis otherwise applicable (actual cash value (acv) or replacement cost (rc) value) to valuation at the cost to. • a specific limit is assigned to the. The total amount it will cost to replace and cover your losses is called the “replacement cost valuation” or “rcv”. Iso offers two endorsements which allow insureds to value real and personal property at less than replacement cost, but in amounts adequate to rebuild or replace with.Functional Replacement Cost

Replacement Cost Valuation Striking the Balance to Build or Buy

Functional Replacement Cost Property Insurance Coverage Law Blog

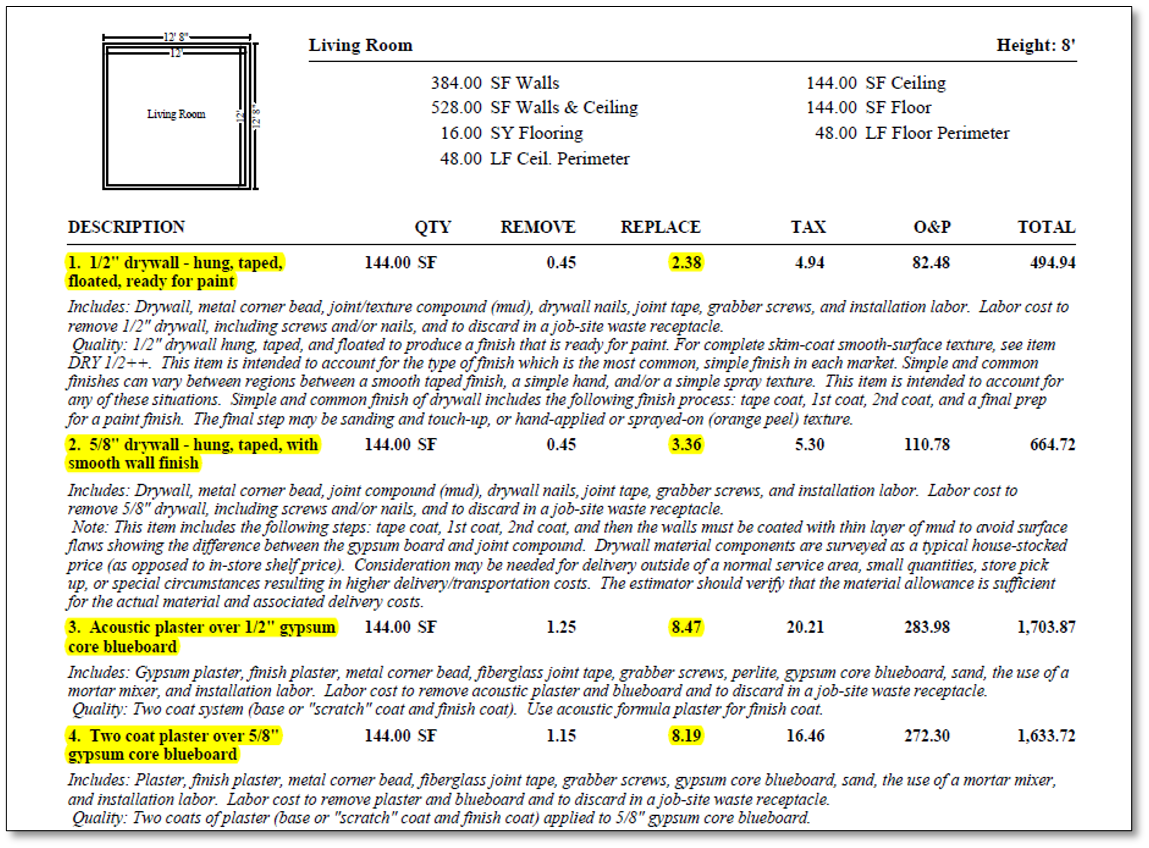

Building Valuation Everything You Need to Know

Methods Of Valuation Of A Building Daily Engineering

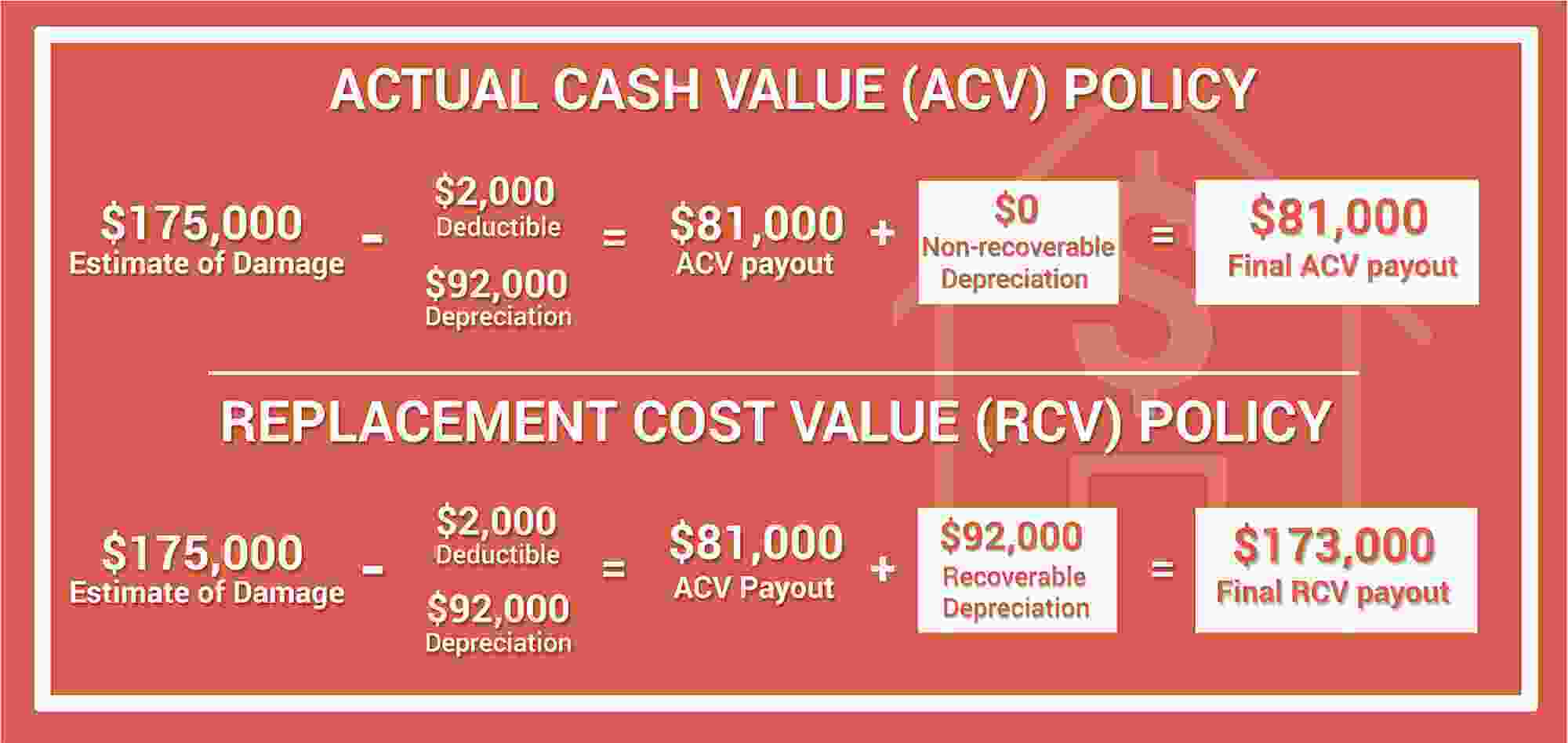

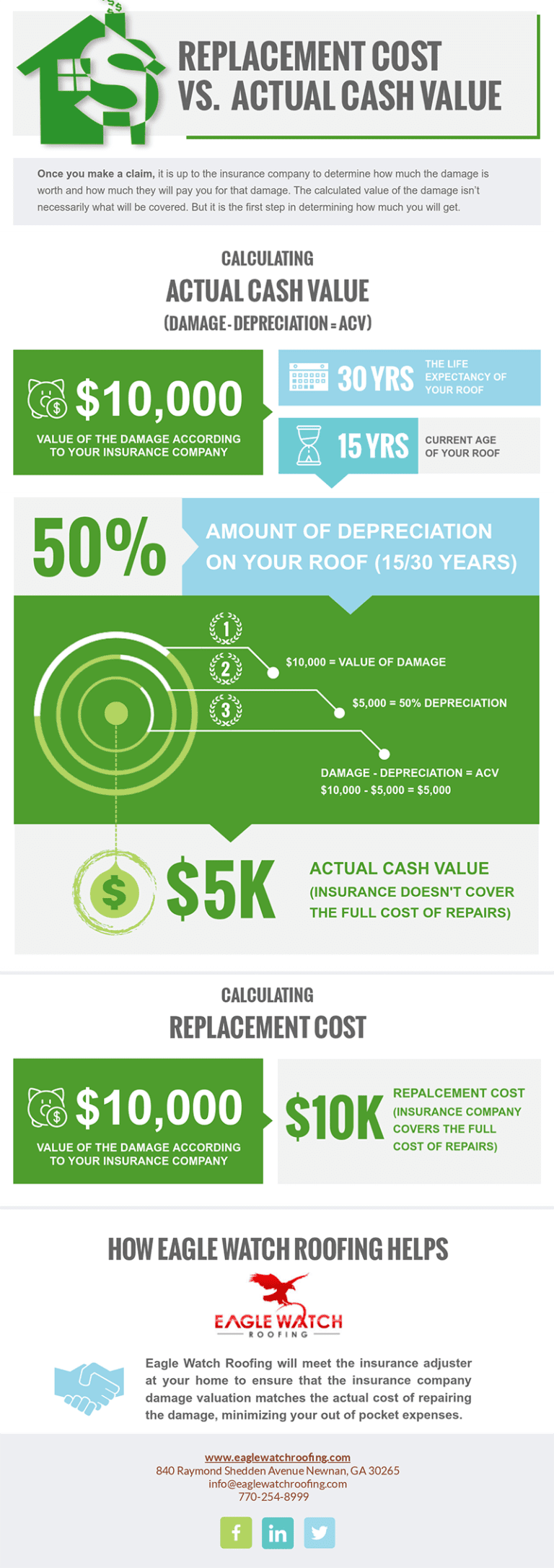

Replacement Cost Value(RCV) VS. Actual Cash Value(ACV)

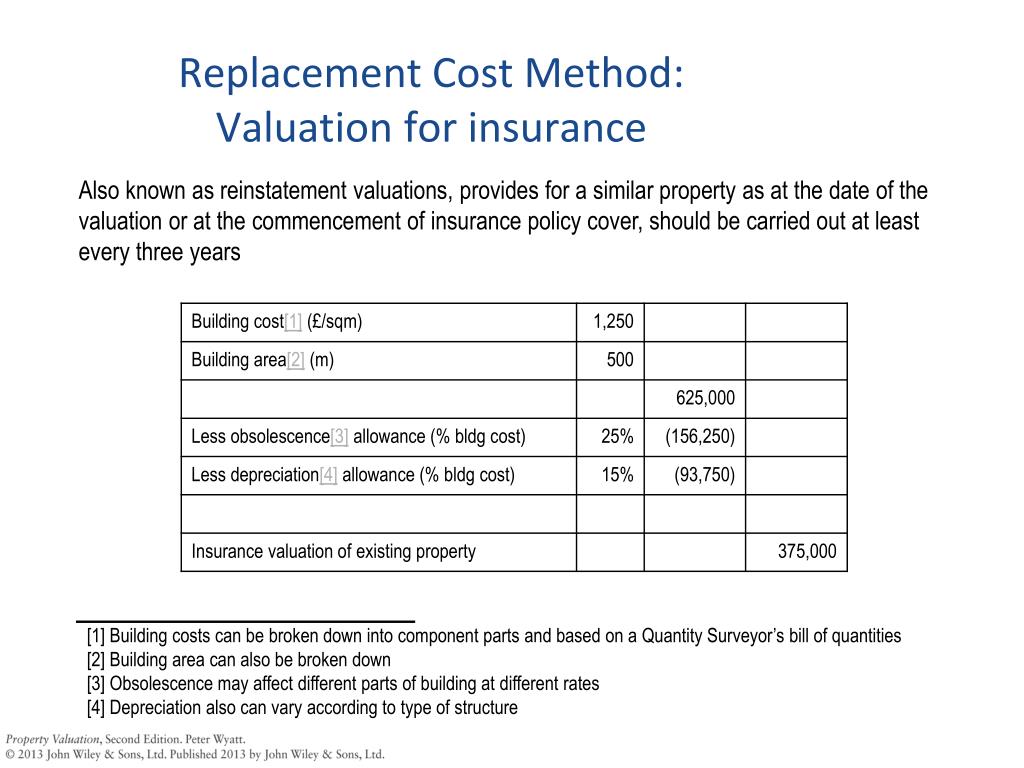

PPT Cost Method PowerPoint Presentation, free download ID6184263

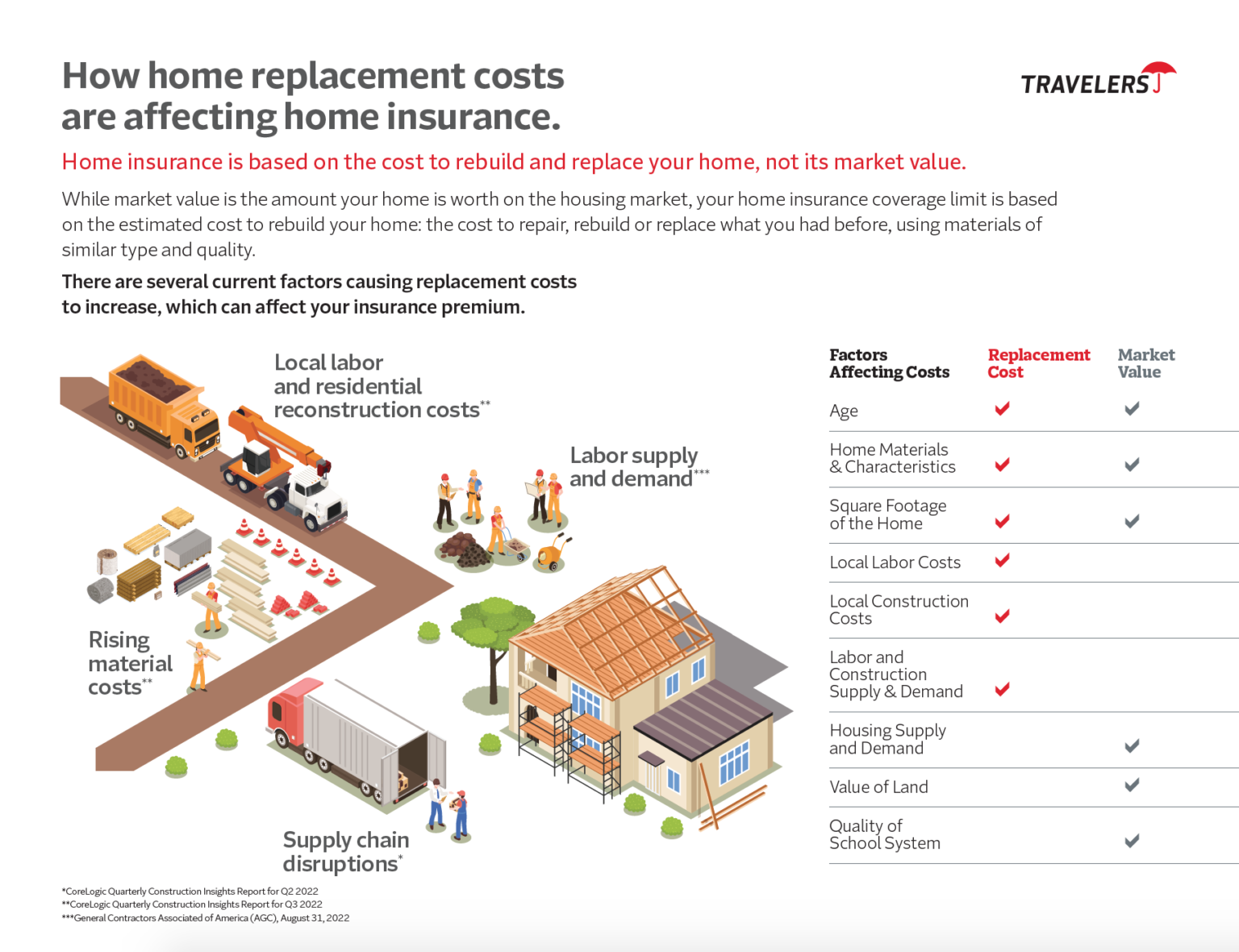

What’s the Difference Home Replacement Cost vs. Market Value

(PDF) MARKET VALUE Vs REPLACEMENT COST

Replacement Cost vs. Actual Cash Value Eagle Watch Roofing

Functional Replacement Cost Is Available For Homes Built Prior To 1986, With The Most Significant Differences For Homes Built Prior To 1940.

The Concept Of Functional Replacement Cost Is Different From Both Actual Cash Value (Acv) And Replacement Cost Value (Rcv) Policies, And Understanding The Distinctions Is Crucial For.

Calculating Your Rcv Is A Process That Requires.

Functional Replacement Cost Gives The Building Owner The Option To Not Rebuild And To Settle For The Market Value Of The Building.

Related Post: