Future Builder 401K

Future Builder 401K - In 2001, the home depot future builder, a 401k and stock ownership plan allocates $85,668,814.00 to match its employees' contributions, providing an employer match. Up to $80 cash back capitalize can help you roll over your the home depot 401 (k) instead, saving you from tax implications and penalties. And how much does home depot match? Once you’ve found your old 401 (k) accounts, consider rolling them over into your current employer’s 401 (k) plan or an individual retirement account (ira). Take control of your financial future and explore a world of possibilities tailored to your unique needs. The home depot offers the home. Employer match in the home depot futurebuilder. Updated jan 28, 20253092 employees reported this benefit. We would like to show you a description here but the site won’t allow us. Find plan contact info, plan expenses, investment options, rollover your old plan, or learn how to select investments on your 401k plan. Build a custom model portfolio using our asset strategic or tactical strategies, tailored to a 401(k) plan or for a brokerage account. It covers 3 major asset classes and 10 minor asset classes. Is the futurebuilder 401k a roth 401k plan? Rollover into a new 401 (k) or ira: Some of these links will open a new tab in. And how much does home depot match? In 2001, the home depot future builder, a 401k and stock ownership plan allocates $85,668,814.00 to match its employees' contributions, providing an employer match. Through the plan, you can generally save anywhere from 1% to 50% of your pay, subject to certain limitations. Once you’ve found your old 401 (k) accounts, consider rolling them over into your current employer’s 401 (k) plan or an individual retirement account (ira). For 2015, the irs considers an associate who earned $115,000 in 2014 to. Rollover into a new 401 (k) or ira: The future builder 401(k) plan allows individuals to save for retirement while benefiting from tax savings. Employer match in the home depot futurebuilder. Take control of your financial future and explore a world of possibilities tailored to your unique needs. Find plan contact info, plan expenses, investment options, rollover your old plan,. Updated jan 28, 20253092 employees reported this benefit. Build a custom model portfolio using our asset strategic or tactical strategies, tailored to a 401(k) plan or for a brokerage account. Take control of your financial future and explore a world of possibilities tailored to your unique needs. Up to $80 cash back capitalize can help you roll over your the. And how much does home depot match? Take control of your financial future and explore a world of possibilities tailored to your unique needs. Up to $80 cash back capitalize can help you roll over your the home depot 401 (k) instead, saving you from tax implications and penalties. The future builder 401(k) plan allows individuals to save for retirement. Futurebuilder retirement savings (401k) the futurebuilder plan allows you to save for your future while taking advantage of tax savings and features like company matching. Up to $80 cash back capitalize can help you roll over your the home depot 401 (k) instead, saving you from tax implications and penalties. Through the futurebuilder plan you get: Find plan contact info,. Future builder 401(k) retirement savings plan that allows you to save for your future while taking advantage of tax savings and company matching contributions. Through the futurebuilder plan you get: Is the futurebuilder 401k a roth 401k plan? I have a couple questions about the futurebuilders plan. Take control of your financial future and explore a world of possibilities tailored. Looking for a (forgotten) 401(k)? And how much does home depot match? Is the futurebuilder 401k a roth 401k plan? Once you’ve found your old 401 (k) accounts, consider rolling them over into your current employer’s 401 (k) plan or an individual retirement account (ira). The future builder 401(k) plan allows individuals to save for retirement while benefiting from tax. For 2015, the irs considers an associate who earned $115,000 in 2014 to. The future builder 401(k) plan allows individuals to save for retirement while benefiting from tax savings. Future builder 401(k) retirement savings plan that allows you to save for your future while taking advantage of tax savings and company matching contributions. Once you’ve found your old 401 (k). Through the futurebuilder plan you get: The future builder 401(k) plan allows individuals to save for retirement while benefiting from tax savings. It covers 3 major asset classes and 10 minor asset classes. Looking for a (forgotten) 401(k)? Employer match in the home depot futurebuilder. Use our benefit plans, programs, and resources to help you live an ideal, healthy life. Up to $80 cash back capitalize can help you roll over your the home depot 401 (k) instead, saving you from tax implications and penalties. Future builder 401(k) retirement savings plan that allows you to save for your future while taking advantage of tax savings. Use our benefit plans, programs, and resources to help you live an ideal, healthy life. Up to $80 cash back capitalize can help you roll over your the home depot 401 (k) instead, saving you from tax implications and penalties. I have a couple questions about the futurebuilders plan. Take control of your financial future and explore a world of. Some of these links will open a new tab in. Updated jan 28, 20253092 employees reported this benefit. Employer match in the home depot futurebuilder. Future builder 401(k) retirement savings plan that allows you to save for your future while taking advantage of tax savings and company matching contributions. Use the 401(k) savings calculator to determine how much your contributions will accumulate over time. The major asset classes it covers are us equity, foreign equity and fixed income. Futurebuilder retirement savings (401k) the futurebuilder plan allows you to save for your future while taking advantage of tax savings and features like company matching. The home depot offers the home. We would like to show you a description here but the site won’t allow us. Once you’ve found your old 401 (k) accounts, consider rolling them over into your current employer’s 401 (k) plan or an individual retirement account (ira). I have a couple questions about the futurebuilders plan. Up to $80 cash back capitalize can help you roll over your the home depot 401 (k) instead, saving you from tax implications and penalties. Take control of your financial future and explore a world of possibilities tailored to your unique needs. Rollover into a new 401 (k) or ira: For 2015, the irs considers an associate who earned $115,000 in 2014 to. Is the futurebuilder 401k a roth 401k plan?How to Build a 401k Prospect Pipeline Process

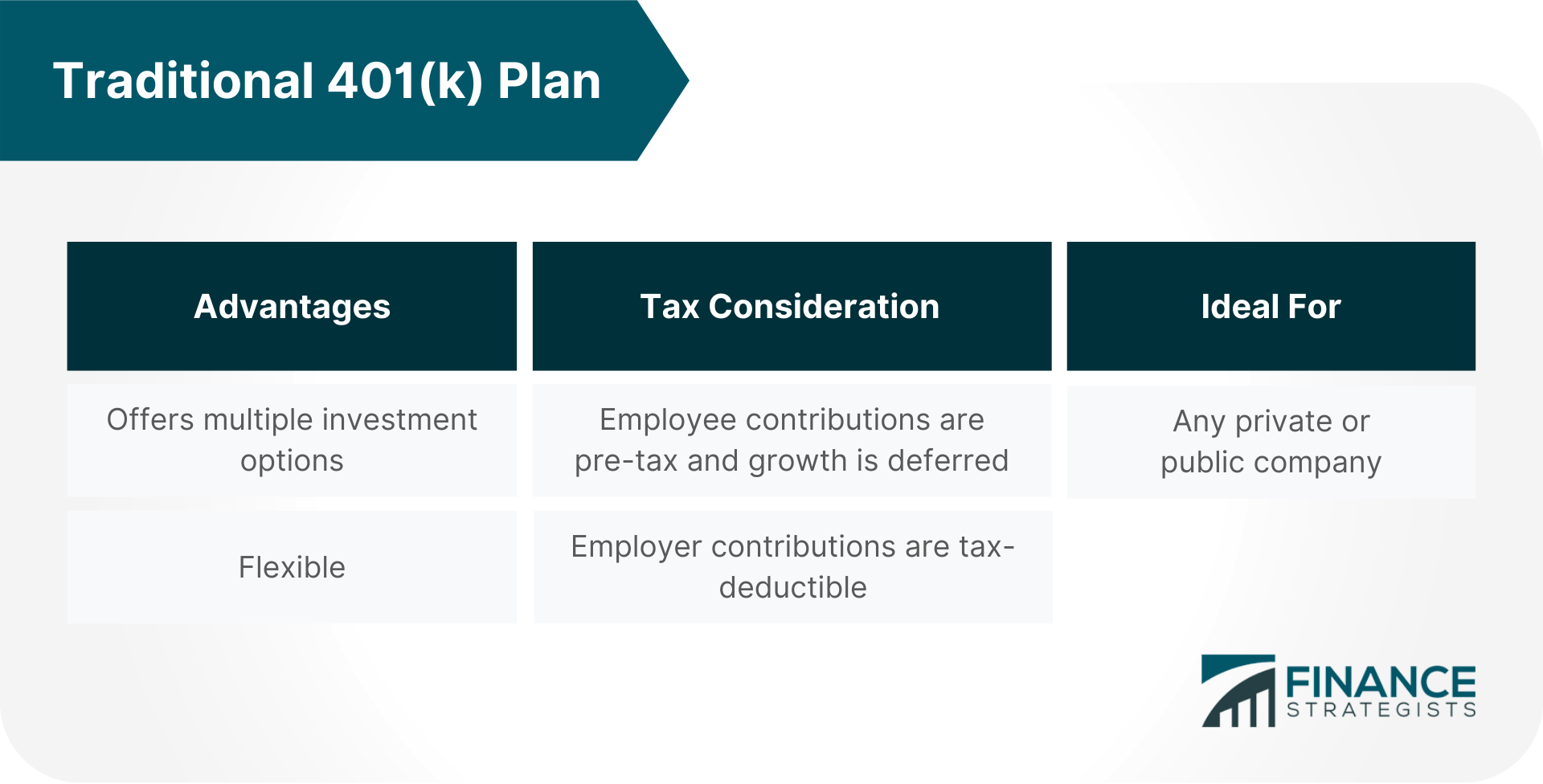

What Are the Types of 401(k) Plans? Definition and Advantages

Building a Winning 401k Plan A Case Study

Understanding 401(k) Plans PEFCU Blog

Building a Secure Future The Basics of 401(k) Retirement Plans

How to build your 401k plan Babylon Wealth Management

Navigating The 401(k) Landscape A Guide To Contribution Limits In 2025

Current 401k Contribution Limits 2024 Employer Match Bell Marika

My Retirement Paycheck Smart Money Blog

Here are our top five tips to help you better manage your 401k so that

Find Plan Contact Info, Plan Expenses, Investment Options, Rollover Your Old Plan, Or Learn How To Select Investments On Your 401K Plan.

And How Much Does Home Depot Match?

It Covers 3 Major Asset Classes And 10 Minor Asset Classes.

Looking For A (Forgotten) 401(K)?

Related Post: