Generational Wealth How To Build

Generational Wealth How To Build - Generational wealth is only for the ultrarich. while it's true that wealthy families may have more resources, anyone—regardless of income level—can start the. There are three foundational components needed for you to begin a conversation with your professional team of advisers to create and implement a generational plan. Before you consider generational wealth creation, it is critically important to ensure your own retirement savings plan and other financial goals are secured. Many people believe that buying a home is the best way to build generational wealth, especially if you have a limited income — but money expert jaspreet singh says that this isn’t the case. Have life insurance and an estate plan. Generational wealth is created like regular wealth: Generational wealth is about building foundations. Generational wealth is occasionally built with ideas that turn into public companies, unique creative abilities, or superior talents. Building wealth requires a combination of. For some individuals, it’s about giving the gift of greater financial security or freedom — strengthening a foundation that already exists. Generational wealth goes beyond just. To build generational wealth you can pass on, you need to acquire assets or save money you won’t need to spend in retirement. Building generational wealth requires careful planning and consideration of how assets will transfer to future generations. After you have taken care of all. Here’s a guide to understanding and establishing wealth that lasts. Build and protect generational wealth. Teach financial skills to younger family members. Generational wealth is occasionally built with ideas that turn into public companies, unique creative abilities, or superior talents. You then pass down the money and assets to children or. Building wealth requires a combination of. Smart investing, asset building, frugal living, and all the other essential components for financial security. Here are some of the most effective strategies to. Create your estate plan or file for. Uncover where all your money goes each month. Generational wealth is achieved when you have accumulated enough assets and investments that can pay for your family’s expenses and retain. Smart investing, asset building, frugal living, and all the other essential components for financial security. To build generational wealth you can pass on, you need to acquire assets or save money you won’t need to spend in retirement. Generational wealth is only for the ultrarich. while it's true that wealthy families may have more resources, anyone—regardless of income level—can start. Here’s a guide to understanding and establishing wealth that lasts. Building generational wealth requires careful planning and consideration of how assets will transfer to future generations. There are three foundational components needed for you to begin a conversation with your professional team of advisers to create and implement a generational plan. Before you consider generational wealth creation, it is critically. Many people believe that buying a home is the best way to build generational wealth, especially if you have a limited income — but money expert jaspreet singh says that this isn’t the case. Building generational wealth is a crucial goal for many families, as it provides a financial foundation that can support future generations. Have life insurance and an. Many people believe that buying a home is the best way to build generational wealth, especially if you have a limited income — but money expert jaspreet singh says that this isn’t the case. Generational wealth is about building foundations. Generational wealth is created like regular wealth: Generational wealth, or family wealth, is a goal that many people aspire to. Create your estate plan or file for. Building generational wealth requires careful planning and consideration of how assets will transfer to future generations. Uncover where all your money goes each month. Building wealth requires a combination of. Generational wealth is important because it gives you the freedom of choice. There are three foundational components needed for you to begin a conversation with your professional team of advisers to create and implement a generational plan. Generational wealth is created like regular wealth: To start building generational wealth from scratch, do a deep dive into your current financial situation. Building generational wealth requires careful planning and consideration of how assets will. Generational wealth, or family wealth, is a goal that many people aspire to have. For some individuals, it’s about giving the gift of greater financial security or freedom — strengthening a foundation that already exists. There are three foundational components needed for you to begin a conversation with your professional team of advisers to create and implement a generational plan.. Learn the benefits of generational wealth and how to start building it. Create your estate plan or file for. Your plan should go one step further than a standard household budget, focusing on strategies that allow you to pay down debt while increasing your savings. Build and protect generational wealth. Estate planning documents, trust arrangements, and. Generational wealth is the process of passing down financial resources, knowledge, and opportunities to future generations. Generational wealth is created like regular wealth: Building generational wealth requires careful planning and consideration of how assets will transfer to future generations. There are three foundational components needed for you to begin a conversation with your professional team of advisers to create and. Uncover where all your money goes each month. Teach financial skills to younger family members. Generational wealth goes beyond just. There are three foundational components needed for you to begin a conversation with your professional team of advisers to create and implement a generational plan. Learn the benefits of generational wealth and how to start building it. For some individuals, it’s about giving the gift of greater financial security or freedom — strengthening a foundation that already exists. Building wealth requires a combination of. Generational wealth is important because it gives you the freedom of choice. Have life insurance and an estate plan. You then pass down the money and assets to children or. Here are some of the most effective strategies to. But more often it is built over years of. To build generational wealth you can pass on, you need to acquire assets or save money you won’t need to spend in retirement. Building generational wealth requires careful planning and consideration of how assets will transfer to future generations. Create your estate plan or file for. Your plan should go one step further than a standard household budget, focusing on strategies that allow you to pay down debt while increasing your savings.How to build generational wealth Artofit

7 Ways to Build Generational Wealth The Frugal Expat

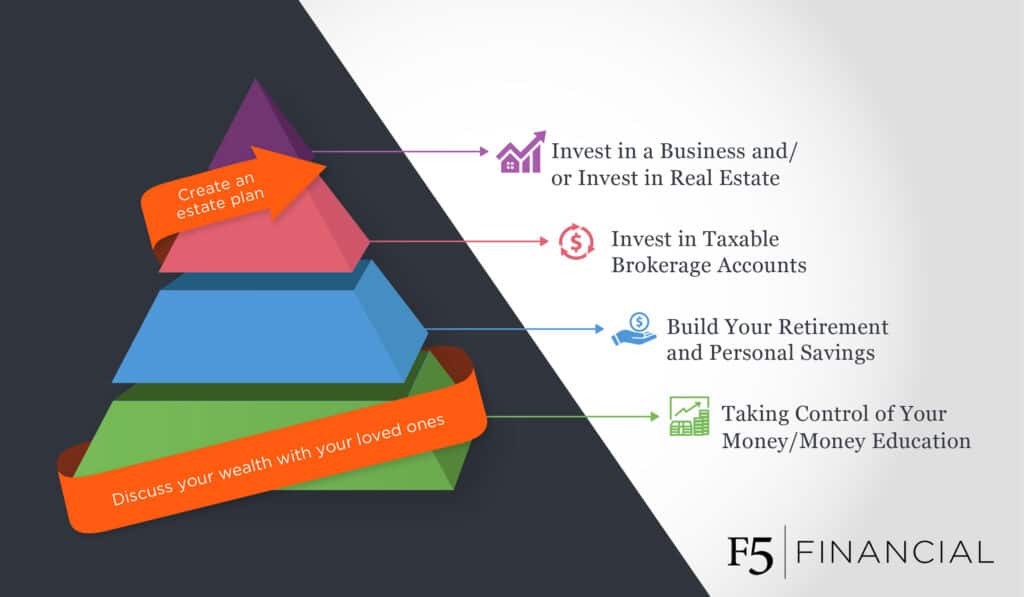

GUIDE How to Build Generational Wealth F5 Financial

How to Build Generational Wealth? Financially Fabulous Females

How to Build Generational Wealth Adapt Your Dollars

How To Build Generational Wealth Physician on FIRE

How to Build Generational Wealth Leave a Lifetime Legacy Paradigm Life

How To Build Generational Wealth Financial Pilgrimage

Generational wealth what it is why it matters and how to build it Artofit

How to Build Generational Wealth Here's How You Can! Wealth Factory

Generational Wealth Is Achieved When You Have Accumulated Enough Assets And Investments That Can Pay For Your Family’s Expenses And Retain That Amount For Years.

Generational Wealth, Or Family Wealth, Is A Goal That Many People Aspire To Have.

Generational Wealth Is About Building Foundations.

Generational Wealth Is Occasionally Built With Ideas That Turn Into Public Companies, Unique Creative Abilities, Or Superior Talents.

Related Post: