Georgia Real Estate Lot Vs Building Value

Georgia Real Estate Lot Vs Building Value - Shell out for a solid appraisal where a pro separates the land and building values. Counties are required to establish a value as of january 1 of each year that. Under georgia law, all property is to be returned and assessed at fair market value every year (o.c.g.a. There are several significant differences to consider when purchasing a lot rather than a house. In georgia’s diverse real estate market, properties can vary significantly in value based on factors such as location, property condition, and current market trends. Under georgia law, all property is to be returned and assessed at fair market value every year (o.c.g.a. Get insights on average georgia property tax rates and exemptions across georgia counties to navigate your real estate tax obligations effectively. Explore the latest on georgia property tax. Zoning laws, which dictate how properties in specific areas can be used, significantly impact property value, potential usage, and future development. From property taxes to resale value, here are a few points to consider. Peek at your insurance quote to suss out replacement value. Under georgia law, all property is to be returned and assessed at fair market value every year (o.c.g.a. Millage rates, set by each taxing authority, determine. In georgia’s diverse real estate market, properties can vary significantly in value based on factors such as location, property condition, and current market trends. How quickly can the value of the building, land improvements and. Counties are required to establish a value as of january 1 of each year. Georgia’s property taxes are relatively low compared to other states. The average property rate paid per home value in georgia is 0.92%, ranking the state no. Shell out for a solid appraisal where a pro separates the land and building values. What portion of the property's value is attributable to land rather than the building? Georgia land taxes are based on 40% of the fair market value of the property, as determined by the county tax assessor. Zoning laws, which dictate how properties in specific areas can be used, significantly impact property value, potential usage, and future development. Georgia land values vary significantly based on location, physical characteristics, zoning, and market demand. How quickly can. Georgia land taxes are based on 40% of the fair market value of the property, as determined by the county tax assessor. What portion of the property's value is attributable to land rather than the building? How quickly can the value of the building, land improvements and. The median real estate tax payment in georgia is $2,048 per year, which. Georgia title attorney explains ad valorem taxes, closing prorations, property tax exemptions and the georgia property tax return. Georgia land taxes are based on 40% of the fair market value of the property, as determined by the county tax assessor. Counties are required to establish a value as of january 1 of each year that. Get insights on average georgia. Georgia land taxes are based on 40% of the fair market value of the property, as determined by the county tax assessor. Under georgia law, all property is to be returned and assessed at fair market value every year (o.c.g.a. From property taxes to resale value, here are a few points to consider. The median real estate tax payment in. Analyzing recent comparable sales, assessing your land's unique. Get insights on average georgia property tax rates and exemptions across georgia counties to navigate your real estate tax obligations effectively. From property taxes to resale value, here are a few points to consider. Shell out for a solid appraisal where a pro separates the land and building values. In georgia’s diverse. The median real estate tax payment in georgia is $2,048 per year, which is around $1,000 less than the $3,057 national mark. Georgia land taxes are based on 40% of the fair market value of the property, as determined by the county tax assessor. Counties are required to establish a value as of january 1 of each year. The average. Under georgia law, all property is to be returned and assessed at fair market value every year (o.c.g.a. Shell out for a solid appraisal where a pro separates the land and building values. Counties are required to establish a value as of january 1 of each year. Explore the latest on georgia property tax. Property tax is a charge levied. Get a market analysis (cma) to. Counties are required to establish a value as of january 1 of each year. Property tax is a charge levied on real estate based on its assessed value, usually yearly. Analyzing recent comparable sales, assessing your land's unique. Peek at your insurance quote to suss out replacement value. Get insights on average georgia property tax rates and exemptions across georgia counties to navigate your real estate tax obligations effectively. Shell out for a solid appraisal where a pro separates the land and building values. Analyzing recent comparable sales, assessing your land's unique. Georgia land taxes are based on 40% of the fair market value of the property, as. The median real estate tax payment in georgia is $2,048 per year, which is around $1,000 less than the $3,057 national mark. Explore the latest on georgia property tax. Georgia title attorney explains ad valorem taxes, closing prorations, property tax exemptions and the georgia property tax return. The average effective property tax rate is 0.83%. Zoning laws, which dictate how. Get insights on average georgia property tax rates and exemptions across georgia counties to navigate your real estate tax obligations effectively. Zoning laws, which dictate how properties in specific areas can be used, significantly impact property value, potential usage, and future development. There are several significant differences to consider when purchasing a lot rather than a house. How quickly can the value of the building, land improvements and. Counties are required to establish a value as of january 1 of each year that. What portion of the property's value is attributable to land rather than the building? Georgia title attorney explains ad valorem taxes, closing prorations, property tax exemptions and the georgia property tax return. Property in georgia is assessed at 40% of the fair market value unless otherwise specified by law. Georgia land taxes are based on 40% of the fair market value of the property, as determined by the county tax assessor. Under georgia law, all property is to be returned and assessed at fair market value every year (o.c.g.a. Millage rates, set by each taxing authority, determine. Peek at your insurance quote to suss out replacement value. Explore the latest on georgia property tax. Property tax is a charge levied on real estate based on its assessed value, usually yearly. Counties are required to establish a value as of january 1 of each year. The average property rate paid per home value in georgia is 0.92%, ranking the state no.What is your Home worth? Land value + Building Value Black Real

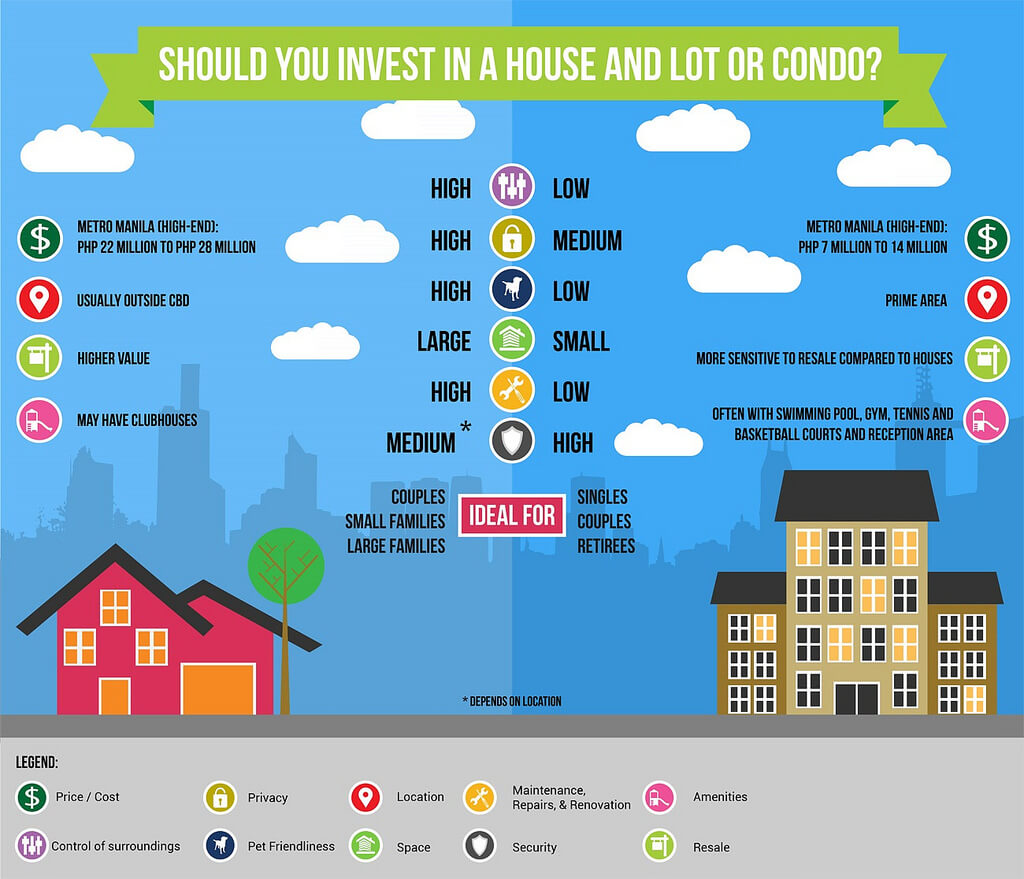

Condo vs House vs Townhouse Which Type of Real Estate Should You

Building vs. Buying a Home Which is Right for You?

How to allocate land vs. building values for commercial or investment

How to Earn 6,600+Per Month (in Passive

HUGE Real Estate Report For November

Decisions, Decisions buying vs renting in Moreira Team Mortgage

What Size House Will Fit On My Lot? Designing Idea

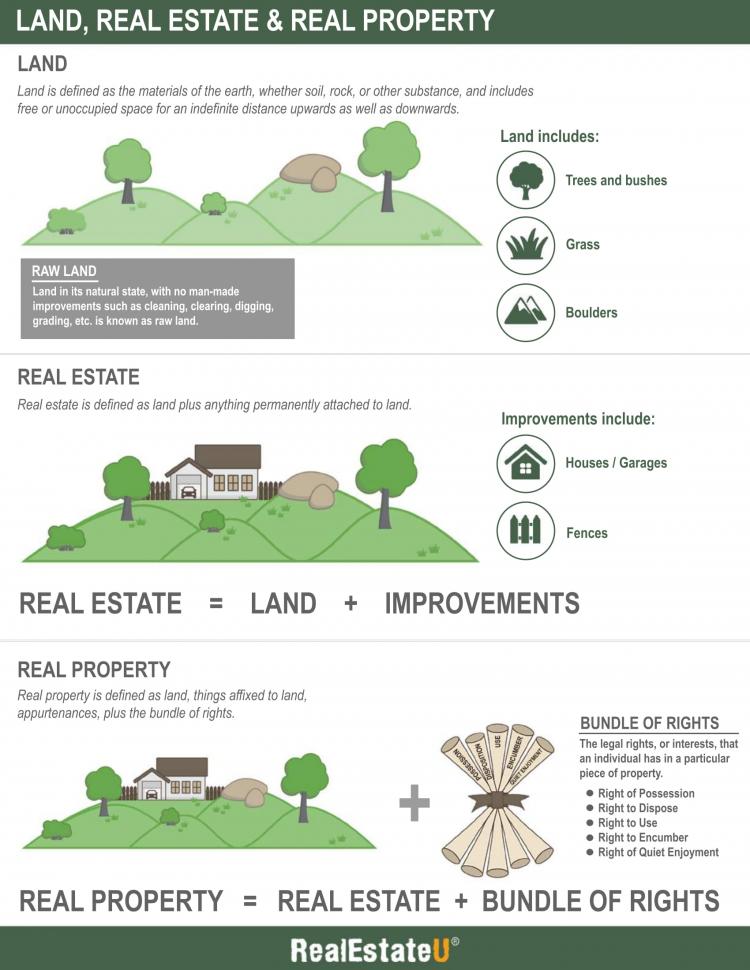

Real Property Vs Land at Esther Sloan blog

Battle of Better Real Estate Investment 2023 Condo vs House and Lot

The Median Real Estate Tax Payment In Georgia Is $2,048 Per Year, Which Is Around $1,000 Less Than The $3,057 National Mark.

Analyzing Recent Comparable Sales, Assessing Your Land's Unique.

The Average Effective Property Tax Rate Is 0.83%.

Get A Market Analysis (Cma) To.

Related Post: