High Risk Building Insurance

High Risk Building Insurance - Builder’s risk insurance provides developers and contractors an important risk management tool that can help keep projects on budget and on schedule. Commercial property insurance helps protect your owned or rented building, plus the tools and equipment you use to operate your business. You don’t need to be a property owner to get commercial. Builder’s risk insurance provides financial coverage for buildings under construction, renovation, or repair. Commercial property insurance has a median cost of $67 per month or about $800 a year, according to insureon. It protects the insurable interest that midsized and large construction companies have in materials, fixtures. A version of this article appears in print on , section a, page 23 of the new york edition with the headline: Builders risk insurance is a vital coverage solution for any construction project. Progressive is best for homeowners with poor credit, while state farm is best for homes in. Insuring a vacant property often costs more than standard property insurance due to the increased risks: Commercial property insurance has a median cost of $67 per month or about $800 a year, according to insureon. Builder’s risk insurance provides developers and contractors an important risk management tool that can help keep projects on budget and on schedule. A version of this article appears in print on , section a, page 23 of the new york edition with the headline: It protects the insurable interest that midsized and large construction companies have in materials, fixtures. This policy protects against risks that can occur at a job site, ensuring that any. Serving clients in the western united states from our seven ca offices. We help find coverage for high risk general liability coverage. Progressive is best for homeowners with poor credit, while state farm is best for homes in. Insuring a vacant property often costs more than standard property insurance due to the increased risks: You don’t need to be a property owner to get commercial. Builder’s risk insurance provides financial coverage for buildings under construction, renovation, or repair. Serving clients in the western united states from our seven ca offices. We help find coverage for high risk general liability coverage. Builders risk insurance is a vital coverage solution for any construction project. A version of this article appears in print on , section a, page. It protects the insurable interest that midsized and large construction companies have in materials, fixtures. A version of this article appears in print on , section a, page 23 of the new york edition with the headline: Commercial property insurance has a median cost of $67 per month or about $800 a year, according to insureon. Builders risk insurance is. It covers losses from many sources,. Commercial property insurance helps protect your owned or rented building, plus the tools and equipment you use to operate your business. This policy protects against risks that can occur at a job site, ensuring that any. We help find coverage for high risk general liability coverage. Insuring a vacant property often costs more than. This policy protects against risks that can occur at a job site, ensuring that any. Progressive is best for homeowners with poor credit, while state farm is best for homes in. Builder’s risk insurance provides developers and contractors an important risk management tool that can help keep projects on budget and on schedule. Builder’s risk insurance provides financial coverage for. Commercial property insurance has a median cost of $67 per month or about $800 a year, according to insureon. Progressive is best for homeowners with poor credit, while state farm is best for homes in. This policy protects against risks that can occur at a job site, ensuring that any. We help find coverage for high risk general liability coverage.. Commercial property insurance has a median cost of $67 per month or about $800 a year, according to insureon. Commercial property insurance helps protect your owned or rented building, plus the tools and equipment you use to operate your business. Serving clients in the western united states from our seven ca offices. Builder’s risk insurance provides developers and contractors an. Commercial property insurance helps protect your owned or rented building, plus the tools and equipment you use to operate your business. Builders risk insurance is a vital coverage solution for any construction project. This policy protects against risks that can occur at a job site, ensuring that any. Progressive is best for homeowners with poor credit, while state farm is. You don’t need to be a property owner to get commercial. Commercial property insurance has a median cost of $67 per month or about $800 a year, according to insureon. Builders risk insurance is a vital coverage solution for any construction project. Serving clients in the western united states from our seven ca offices. This policy protects against risks that. It covers losses from many sources,. Insuring a vacant property often costs more than standard property insurance due to the increased risks: This policy protects against risks that can occur at a job site, ensuring that any. A version of this article appears in print on , section a, page 23 of the new york edition with the headline: We. Builders risk insurance is a vital coverage solution for any construction project. Builder’s risk insurance provides developers and contractors an important risk management tool that can help keep projects on budget and on schedule. Progressive is best for homeowners with poor credit, while state farm is best for homes in. Insuring a vacant property often costs more than standard property. This policy protects against risks that can occur at a job site, ensuring that any. It covers losses from many sources,. A version of this article appears in print on , section a, page 23 of the new york edition with the headline: Builder’s risk insurance provides financial coverage for buildings under construction, renovation, or repair. Commercial property insurance helps protect your owned or rented building, plus the tools and equipment you use to operate your business. Insuring a vacant property often costs more than standard property insurance due to the increased risks: Serving clients in the western united states from our seven ca offices. Builder’s risk insurance provides developers and contractors an important risk management tool that can help keep projects on budget and on schedule. Builders risk insurance is a vital coverage solution for any construction project. Progressive is best for homeowners with poor credit, while state farm is best for homes in. It protects the insurable interest that midsized and large construction companies have in materials, fixtures.House Buildings Insurance for Risk Property [Fast & Free Quote Online]

What Is A Builders Risk Insurance Policy earthbase

12 Intriguing Facts You Should Know About Builders Risk Insurance

Builder's Risk Insurance How it Works, Costs And Coverage

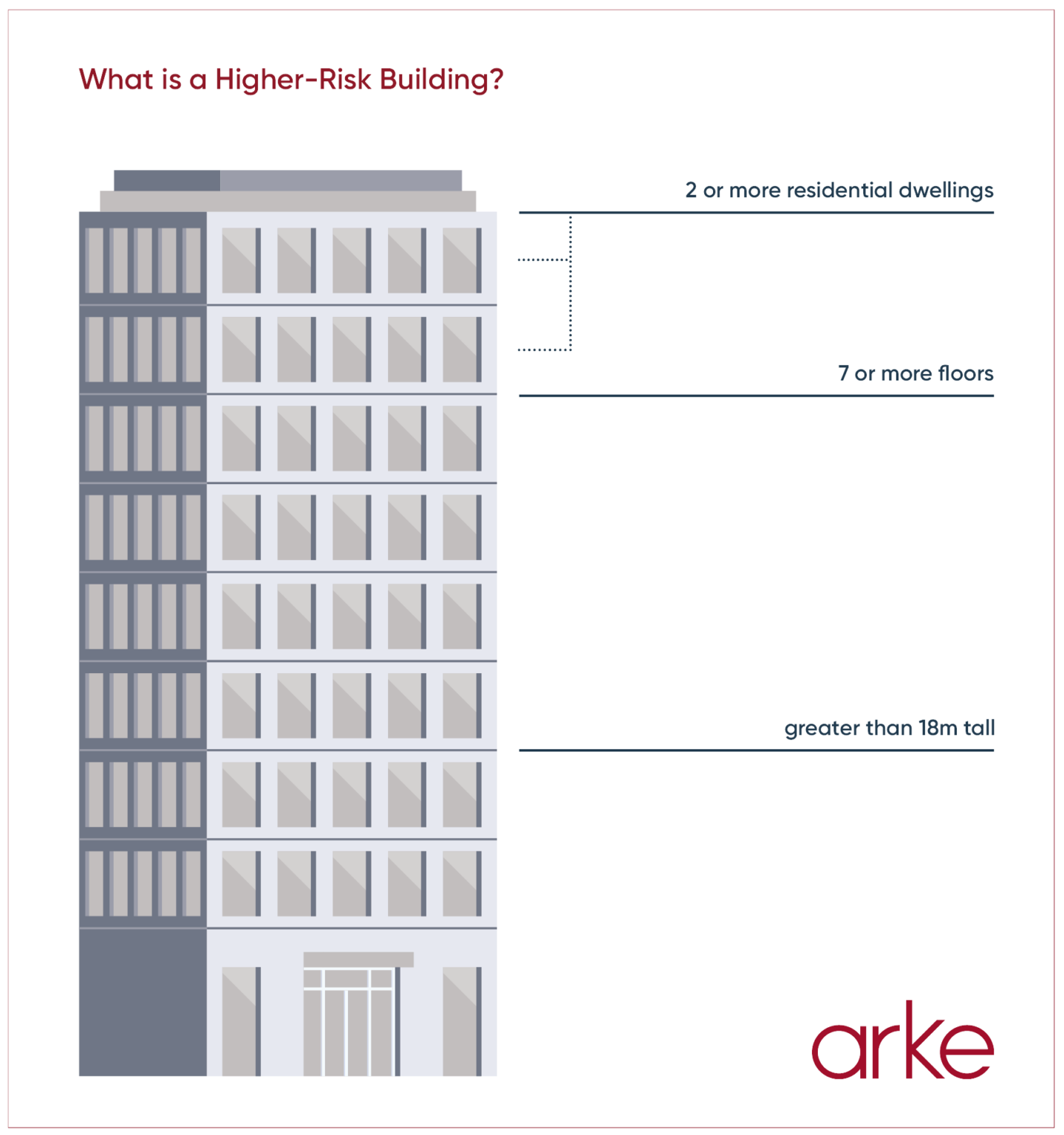

HigherRisk Buildings Arke Creative

The Basics of Builders Risk Insurance GDI Insurance Agency, Inc.

Construction Insurance, Construction All Risks Insurance

Builder's Risk Coverage Form What it is, How it Works

HighRisk Insurance What Is It & How Does It Work? Ribot NYC

Geico Residential Builders Risk Insurance Financial Report

You Don’t Need To Be A Property Owner To Get Commercial.

Commercial Property Insurance Has A Median Cost Of $67 Per Month Or About $800 A Year, According To Insureon.

We Help Find Coverage For High Risk General Liability Coverage.

Related Post:

![House Buildings Insurance for Risk Property [Fast & Free Quote Online]](https://gethomeownersinsurance.net/wp-content/uploads/2021/01/House-Buildings-Insurance-1.png)

:max_bytes(150000):strip_icc()/BRCF-3-2-6c268d55a762453ab9fe333e143c33c3.jpg)