Home Builder Etf List

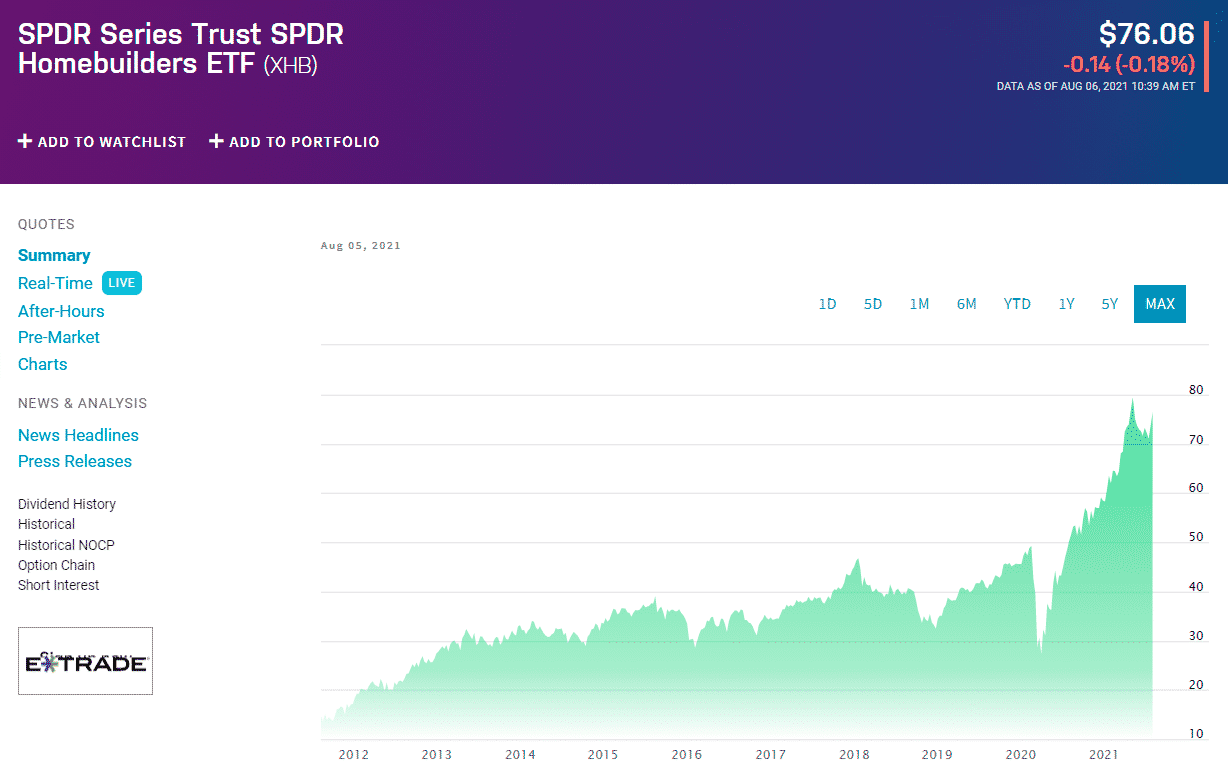

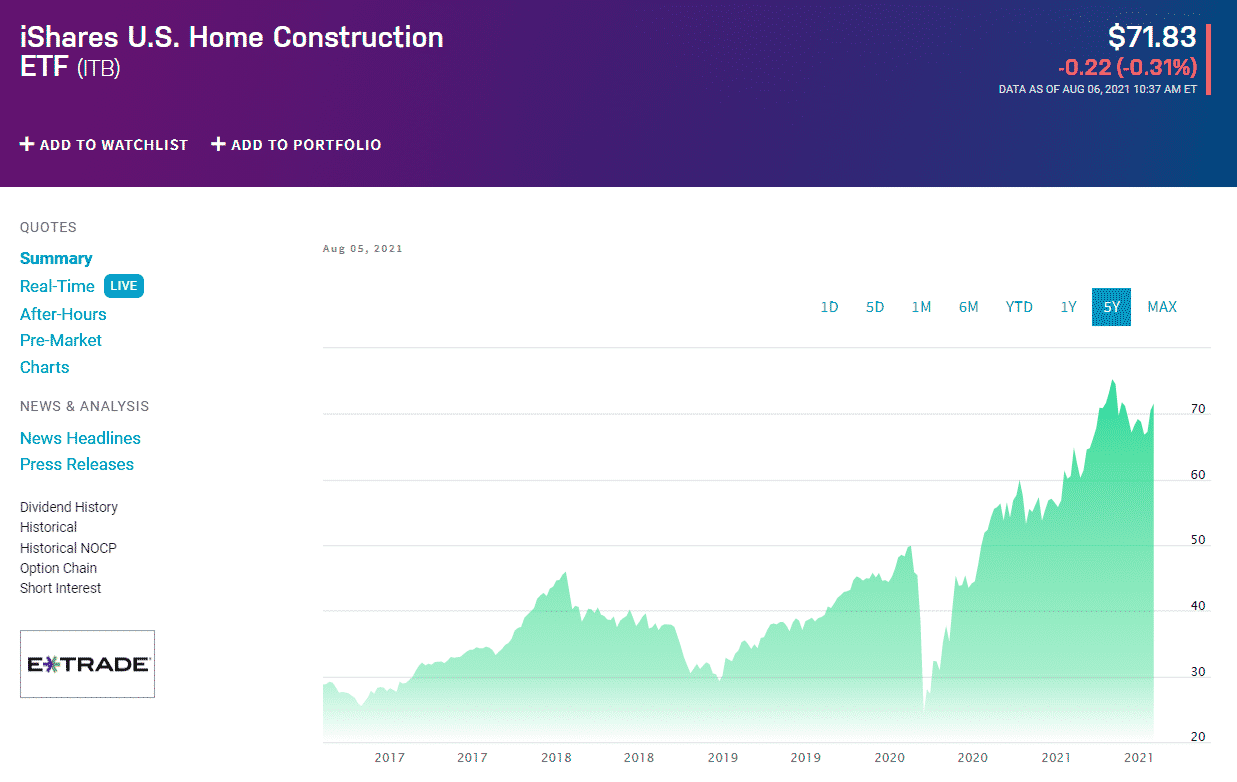

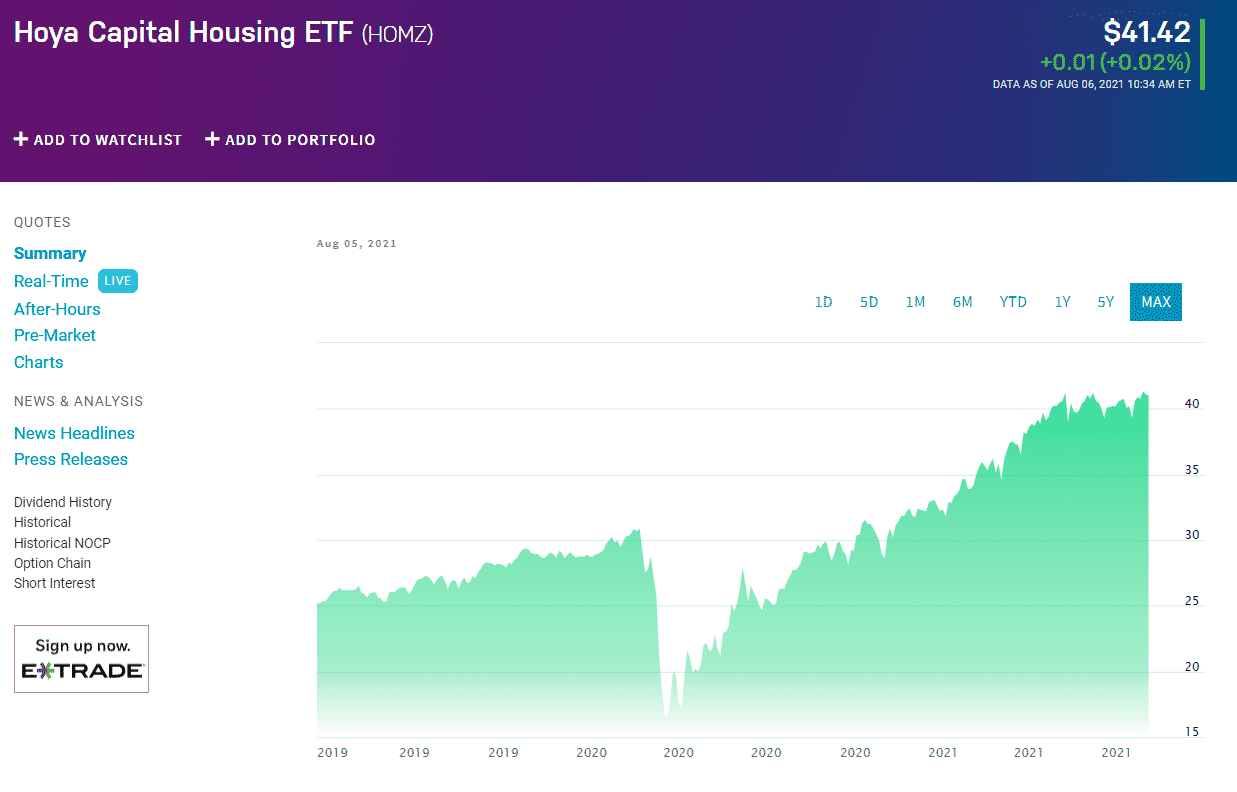

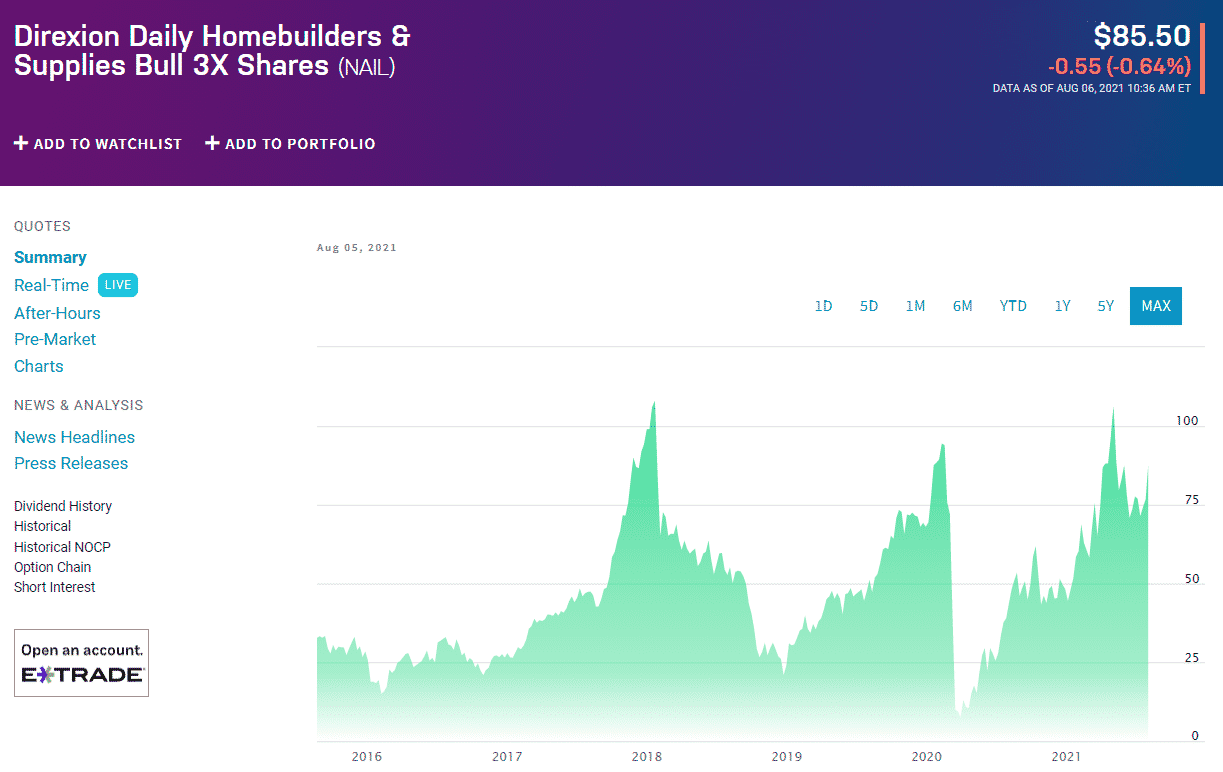

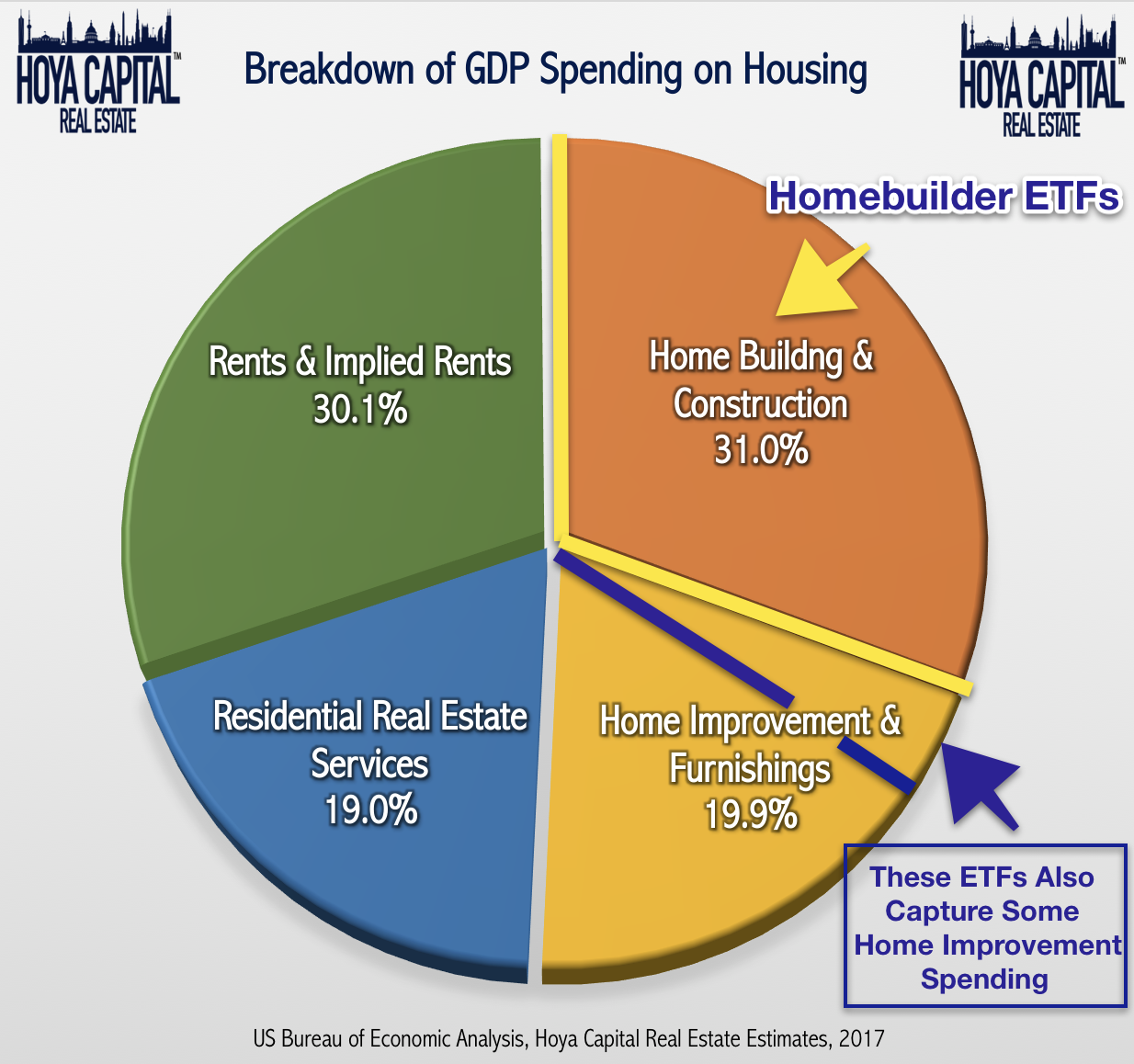

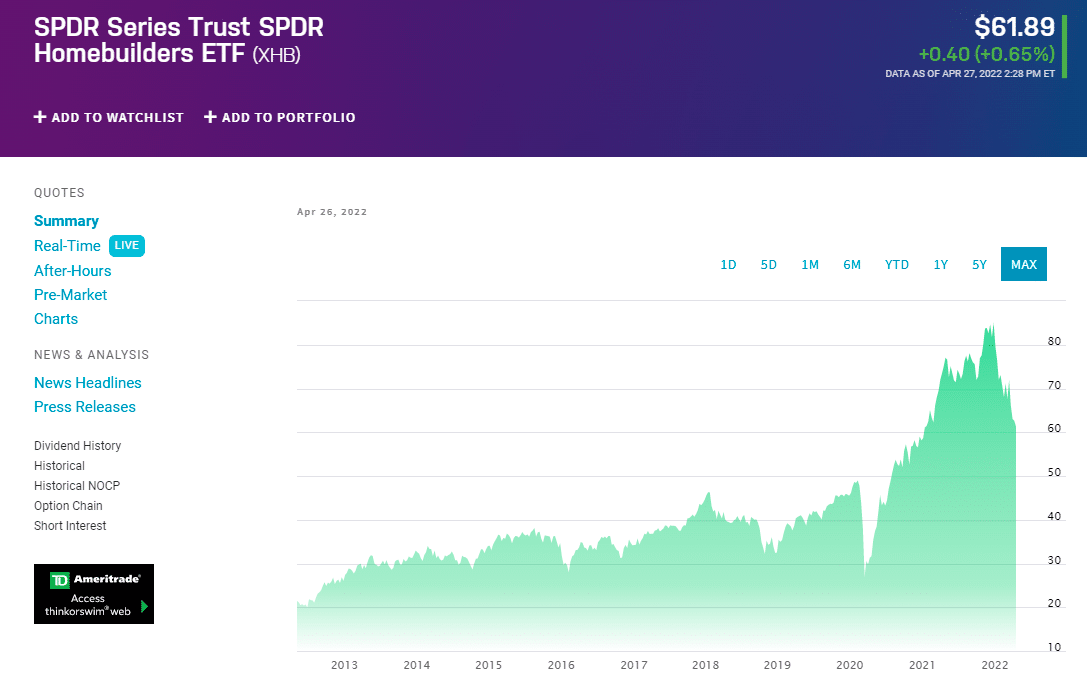

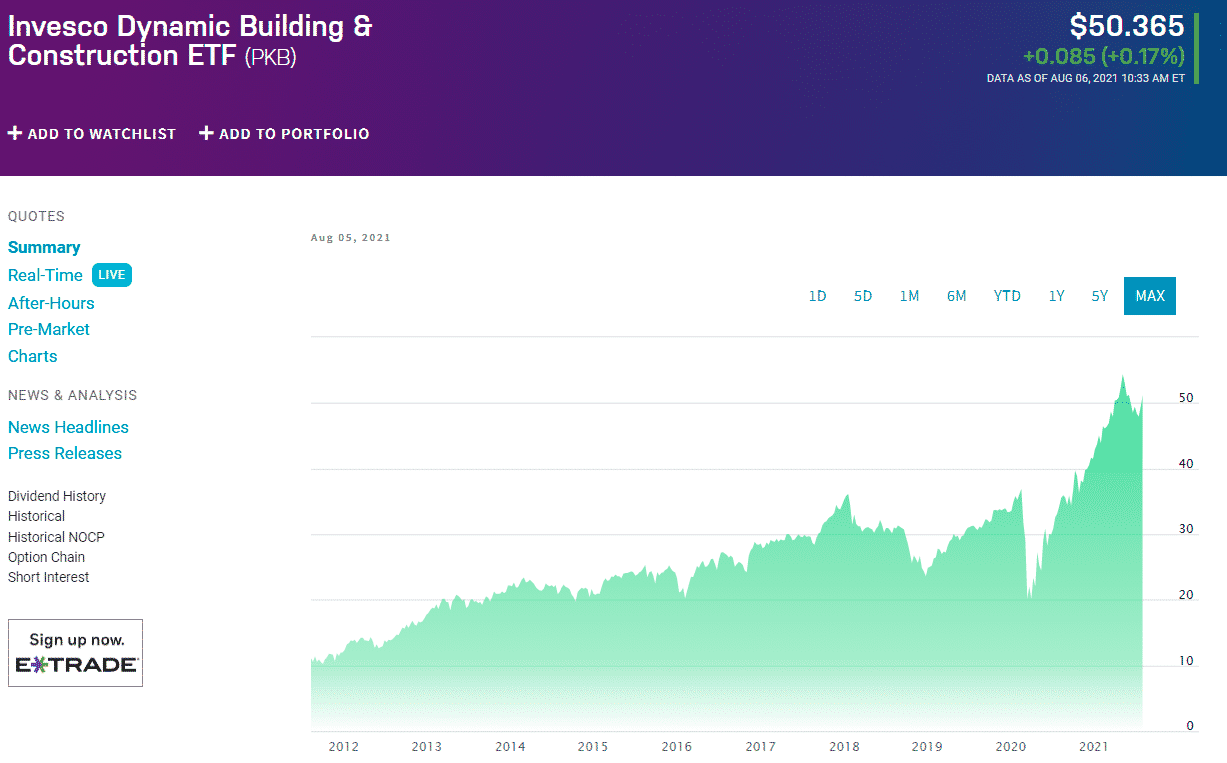

Home Builder Etf List - Here are some of the top homebuilder etfs that could extend their already sizable gains this year. Compare and contrast the five etfs in this. A homebuilders etf may be a smart way to invest in the home construction industry without owning physical assets. Among the etfs in figure 1, global x mlp etf (mlpa) ranks first overall, invesco kbw property & casualty insurance etf (kbwp) ranks second, and ishares u.s. They are responsible for the design, construction, and sale of new homes, as well. Housing starts rose 10.3% to a seasonally adjusted annualized rate of 1,521,000, whereas. A list of home builders etfs. Undervalued stocks, promising subsectors, and why first trust materials alphadex® fund etf outshines xlb. Home builders are companies that specialize in the construction of new homes. For comparison, a high of 90 was posted in november 2020 and the low of 8 was. Among the etfs in figure 1, global x mlp etf (mlpa) ranks first overall, invesco kbw property & casualty insurance etf (kbwp) ranks second, and ishares u.s. To find the perfect home and community for you and your family, you need far more than a list of home builders in chicago. Thestreet tesla ceo elon musk, vp of finance address allegations of tax fraud:. Learn the basics of these funds before investing. They are responsible for the design, construction, and sale of new homes, as well. Multiplies the most recent dividend payout amount by its. With more than 229 homebuilders in chicago,. For comparison, a high of 90 was posted in november 2020 and the low of 8 was. Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. 0.43% per year, or $43. Multiplies the most recent dividend payout amount by its. Homebuilders etfs invest in companies that operate in the residential home construction industry. In addition to pure play. A list of home builders etfs. The lists also include the firms’ gross revenue from home. Homebuilders etfs invest in companies that operate in the residential home construction industry. 38 rows a list of holdings for xhb (spdr s&p homebuilders etf) with details about each stock and its percentage weighting in the etf. Home builders are companies that specialize in the construction of new homes. The lists also include the firms’ gross revenue from home. Thestreet. A list of home builders etfs. Learn the basics of these funds before investing. Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. A homebuilders etf may be a smart way to invest in the home construction industry without owning physical assets. For comparison, a high of 90. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. These chicago area custom home builders offer many options and guide clients through every step of the process, from initial concept to final touches. To find the perfect home and community for you and your family, you need far. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. In addition to pure play. Multiplies the most recent dividend payout amount by its. Here are some of the top homebuilder etfs that could extend their already sizable gains this year. Undervalued stocks, promising subsectors, and why first trust. Homebuilders etfs invest in companies that operate in the residential home construction industry. They are responsible for the design, construction, and sale of new homes, as well. Click for my fxz update. Housing starts rose 10.3% to a seasonally adjusted annualized rate of 1,521,000, whereas. Home builders’ etfs comprise equities in the residential housing provision space, and all organizations generate. Click for my fxz update. Learn the basics of these funds before investing. They are responsible for the design, construction, and sale of new homes, as well. Multiplies the most recent dividend payout amount by its. Undervalued stocks, promising subsectors, and why first trust materials alphadex® fund etf outshines xlb. In addition to pure play. Home builders are companies that specialize in the construction of new homes. A homebuilders etf may be a smart way to invest in the home construction industry without owning physical assets. Compare and contrast the five etfs in this. The lists also include the firms’ gross revenue from home. The gmo beyond china etf will hold a portfolio of up to about 100 stocks, focusing on countries such as vietnam, mexico, india, thailand, and indonesia, which are well. A homebuilders etf may be a smart way to invest in the home construction industry without owning physical assets. For comparison, a high of 90 was posted in november 2020 and. A list of home builders etfs. Learn the basics of these funds before investing. With more than 229 homebuilders in chicago,. Among the etfs in figure 1, global x mlp etf (mlpa) ranks first overall, invesco kbw property & casualty insurance etf (kbwp) ranks second, and ishares u.s. Homebuilding industry, and as such offers exposure to a corner of the. To find the perfect home and community for you and your family, you need far more than a list of home builders in chicago. These chicago area custom home builders offer many options and guide clients through every step of the process, from initial concept to final touches. Compare and contrast the five etfs in this. The gmo beyond china etf will hold a portfolio of up to about 100 stocks, focusing on countries such as vietnam, mexico, india, thailand, and indonesia, which are well. The nasdaq composite gained 30% in 2024, while ark innovation etf returned 8.4%. Undervalued stocks, promising subsectors, and why first trust materials alphadex® fund etf outshines xlb. Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. For comparison, a high of 90 was posted in november 2020 and the low of 8 was. A homebuilders etf may be a smart way to invest in the home construction industry without owning physical assets. Homebuilders etfs invest in companies that operate in the residential home construction industry. Learn the basics of these funds before investing. Housing starts rose 10.3% to a seasonally adjusted annualized rate of 1,521,000, whereas. Thestreet tesla ceo elon musk, vp of finance address allegations of tax fraud:. With more than 229 homebuilders in chicago,. It includes homebuilders, home improvement stores, home and office. Among the etfs in figure 1, global x mlp etf (mlpa) ranks first overall, invesco kbw property & casualty insurance etf (kbwp) ranks second, and ishares u.s.Best 5 Homebuilder ETFs ETFHead

Best 5 Homebuilder ETFs ETFHead

Traderstewie on Twitter "Home builders' sector, hitting new 52 week

Best 5 Homebuilder ETFs ETFHead

Best 5 Homebuilder ETFs ETFHead

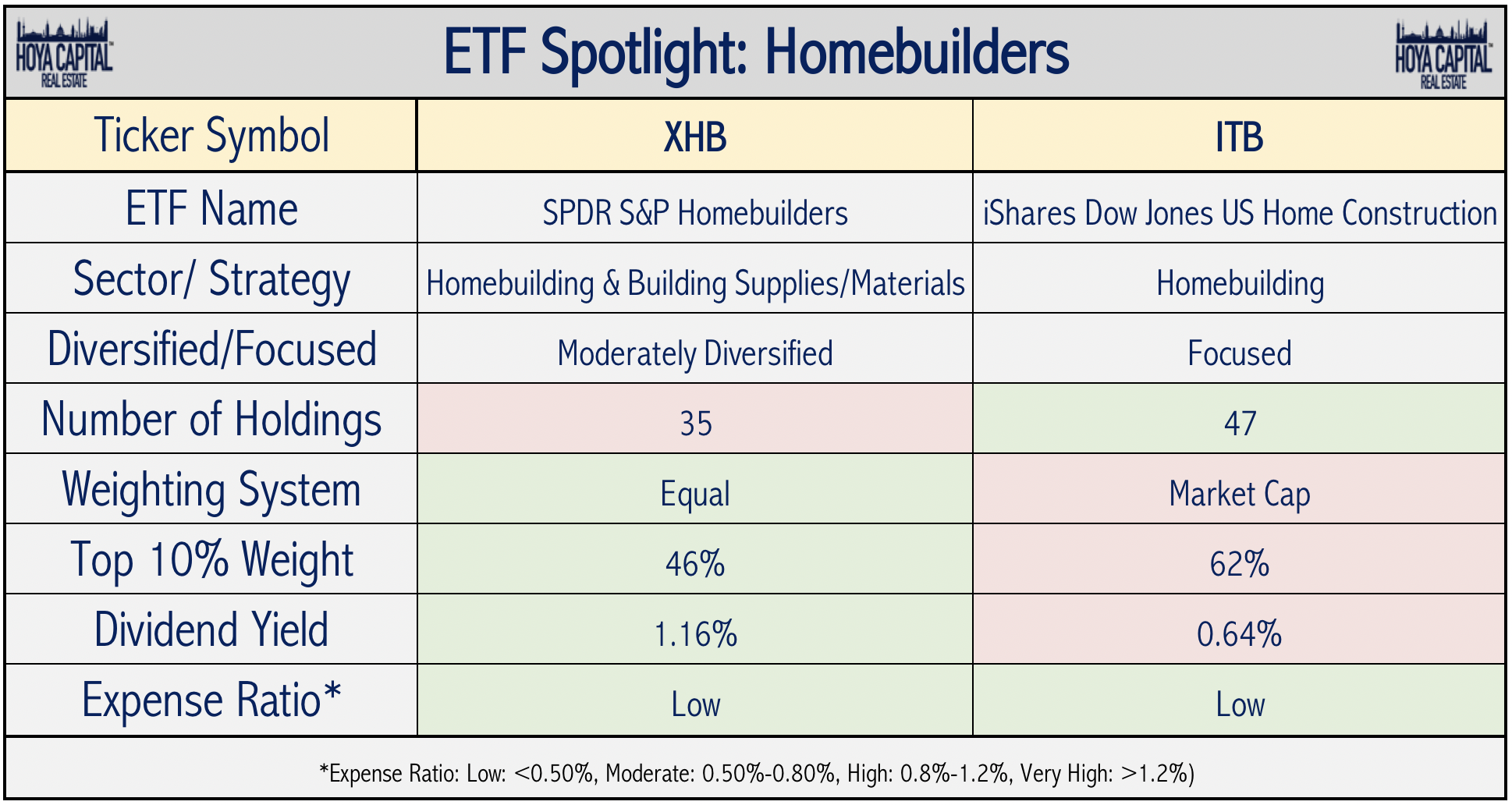

XHB Vs. ITB The Homebuilder ETF Open House (BATSITB) Seeking Alpha

XHB Vs. ITB The Homebuilder ETF Open House (BATSITB) Seeking Alpha

Home Builder ETF Top 3 to Hold Investcrown

Best 5 Homebuilder ETFs ETFHead

Which homebuilder ETF nearly doubled this year?

Click For My Fxz Update.

Home Builders Are Companies That Specialize In The Construction Of New Homes.

Home Builders’ Etfs Comprise Equities In The Residential Housing Provision Space, And All Organizations Generate Significant Revenues From Providing Ancillary Services To This.

Companies In The Funds May Include Homebuilders And Construction Companies.

Related Post: