Home Builder Etf

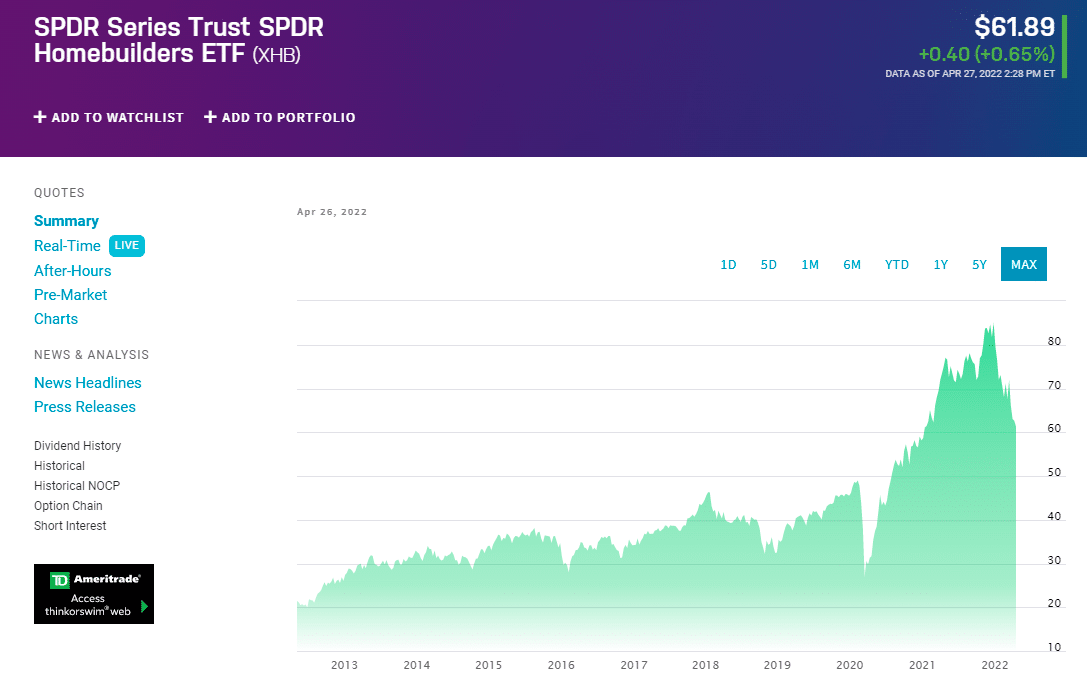

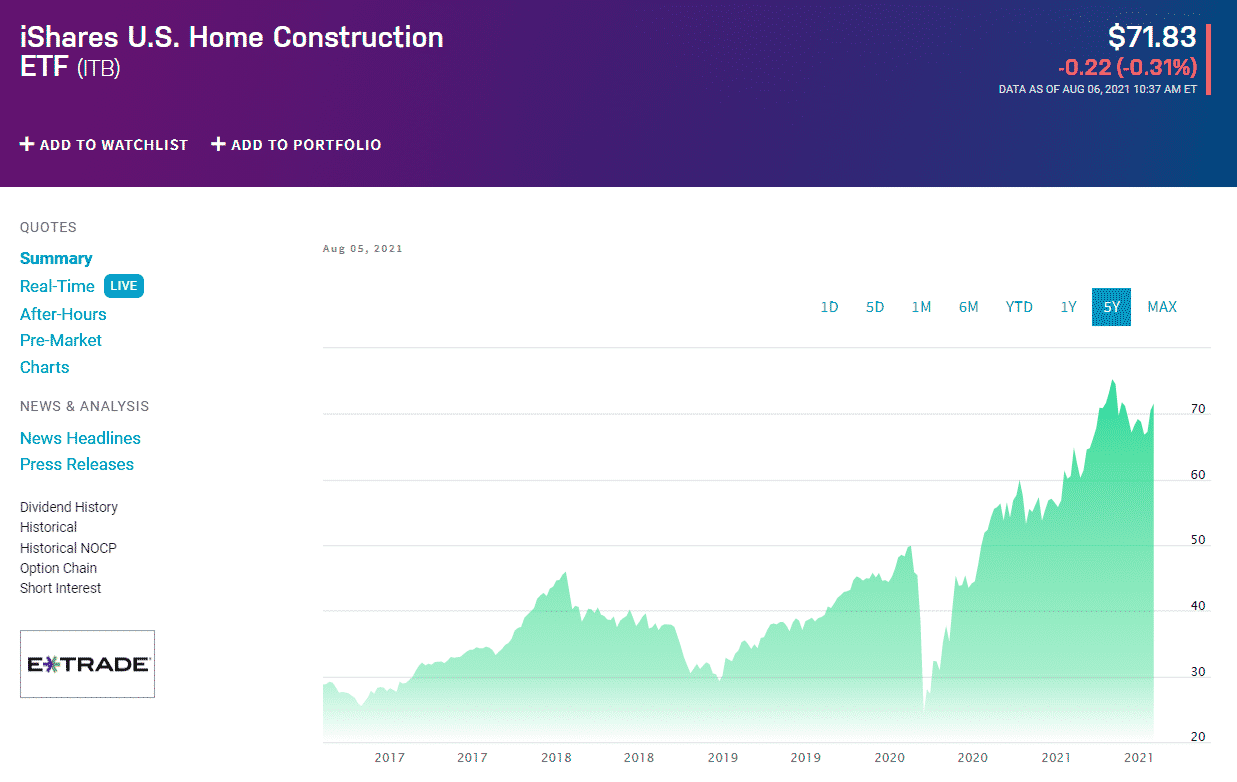

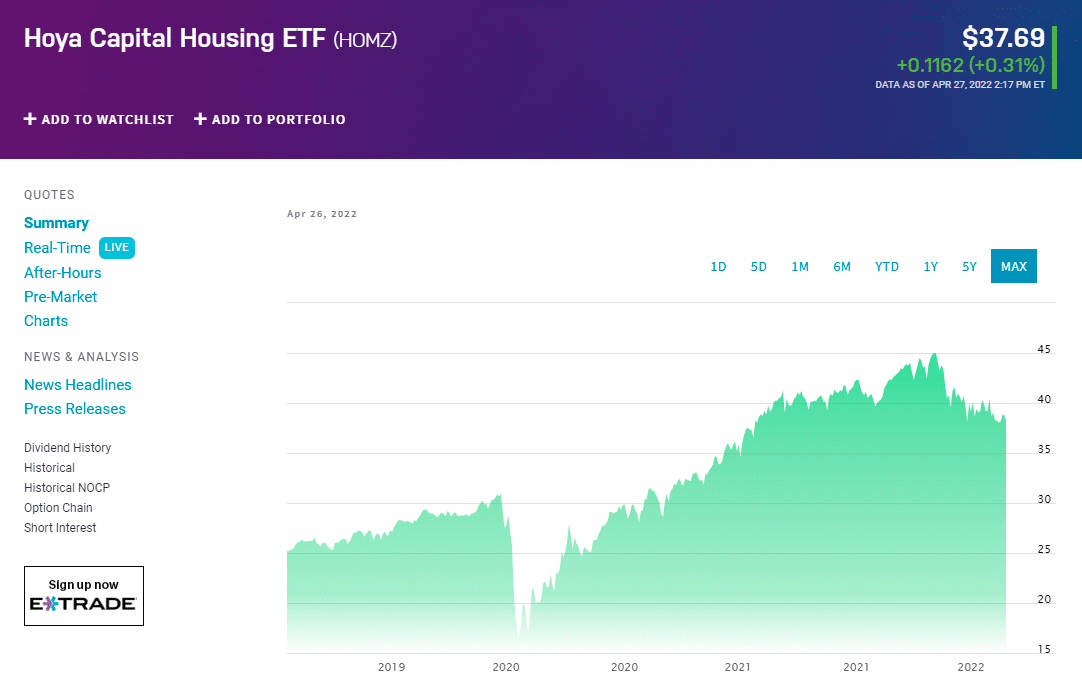

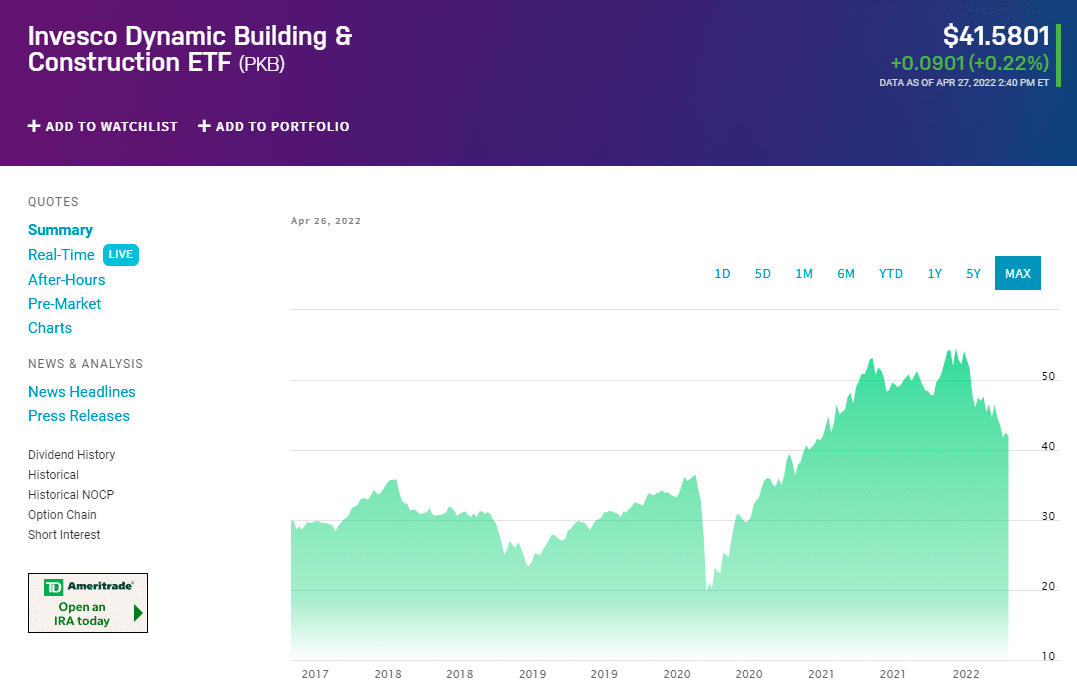

Home Builder Etf - The average expense ratio for etfs in building and construction is 0.50%. Enjoy breathtaking homes in chicago. These chicago area custom home builders offer many options and guide clients through every step of the process, from initial concept to final touches. Compare the performance, expense ratio, and top holdings of three homebuilder etfs: For that, many look to bloomberg intelligence analysts james seyffart. The expense ratio of pave is 0.47% compared to the median of all other etfs which is 0.49%. Horton, one of the top new home builders in chicago, illinois, brings you style & convenience in premier locations. Spdr ® s&p homebuilders etf earns an average process pillar rating. Homebuilders etfs invest in companies that operate in the residential home construction industry. The two largest homebuilder etfs, the ishares u.s. Home construction etf (itb) and the spdr s&p homebuilders etf (xhb), returned 43.2% and 37.2%, respectively, year. Homebuilders etfs invest in companies that operate in the residential home construction industry. In addition to industry expertise, iron mountain will provide mena digital hub with specialized advice in the design, construction and daily operations of data centers to meet. This etf offers exposure to the u.s. In addition to pure play. Equities in the home construction sector. Xhb | a complete spdr s&p homebuilders etf exchange traded fund overview by marketwatch. Under normal market conditions, the trust invests at least 80% of its managed assets in taxable municipal securities, which include build america bonds. The cost to build a detached garage for two cars costs about $26,400 on average. Find and compare homebuilders etfs traded in the usa, including historical performance, dividends, holdings, expenses, ratings and more. In addition to pure play. Xhb | a complete spdr s&p homebuilders etf exchange traded fund overview by marketwatch. The cost to build a detached garage for two cars costs about $26,400 on average. Find and compare homebuilders etfs traded in the usa, including historical performance, dividends, holdings, expenses, ratings and more. Equities in the home construction sector. For that, many look to bloomberg intelligence analysts james seyffart. Spdr ® s&p homebuilders etf earns an average process pillar rating. In addition to industry expertise, iron mountain will provide mena digital hub with specialized advice in the design, construction and daily operations of data centers to meet. In addition to pure play. Compare the performance, expense ratio, and top. The sortable table below contains information. The apps you bet on the super bowl with don’t offer odds on which crypto etfs will hit the market in 2025. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. See the latest data and. Home construction industry, but have underperformed. Home construction industry, but have underperformed the broader market in the past year. Under normal market conditions, the trust invests at least 80% of its managed assets in taxable municipal securities, which include build america bonds. Click on the tabs below to see more information on homebuilders etfs,. Homebuilding industry, and as such offers exposure to a corner of the. Housing market headed in 2025? Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. View the latest etf prices and news for better etf investing. Click on the tabs below to see more information on homebuilders etfs,. Homebuilding industry, and as such offers exposure to a corner of. Home construction etf (itb) and the spdr s&p homebuilders etf (xhb), returned 43.2% and 37.2%, respectively, year. In addition to pure play. Research performance, expense ratio, holdings,. This etf offers exposure to the u.s. For that, many look to bloomberg intelligence analysts james seyffart. Spdr ® s&p homebuilders etf earns an average process pillar rating. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. In addition to pure play. According to etf.com data, there are now more than 4,000 etfs trading in the u.s., a total bolstered by a record 650 etf. Research performance, expense ratio, holdings,. According to etf.com data, there are now more than 4,000 etfs trading in the u.s., a total bolstered by a record 650 etf debuts last year, which beat the previous year’s record for. These chicago area custom home builders offer many options and guide clients through every step of the process, from initial concept to. Spdr ® s&p homebuilders etf earns an average process pillar rating. Homebuilders etfs invest in companies that operate in the residential home construction industry. In addition to pure play. In addition to industry expertise, iron mountain will provide mena digital hub with specialized advice in the design, construction and daily operations of data centers to meet. Enjoy breathtaking homes in. Xhb | a complete spdr s&p homebuilders etf exchange traded fund overview by marketwatch. Morningstar's algorithmically assigned passive process ratings are first formulated by. Both housing starts and building permits rebounded in february, according to the latest data. The average expense ratio for etfs in building and construction is 0.50%. The sortable table below contains information. The sortable table below contains information. Learn everything you need to know about spdr® s&p homebuilders etf (xhb) and how it ranks compared to other funds. In addition to industry expertise, iron mountain will provide mena digital hub with specialized advice in the design, construction and daily operations of data centers to meet. The expense ratio of pave is 0.47% compared to the median of all other etfs which is 0.49%. Horton, one of the top new home builders in chicago, illinois, brings you style & convenience in premier locations. Home construction etf (itb) seeks to track the investment results of an index composed of u.s. This etf offers exposure to the u.s. According to etf.com data, there are now more than 4,000 etfs trading in the u.s., a total bolstered by a record 650 etf debuts last year, which beat the previous year’s record for. View the latest etf prices and news for better etf investing. Etf and options trades with access to powerful tools to. Morningstar's algorithmically assigned passive process ratings are first formulated by. The two largest homebuilder etfs, the ishares u.s. These chicago area custom home builders offer many options and guide clients through every step of the process, from initial concept to final touches. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. See the latest data and. This etf is focused on the u.s.Traderstewie on Twitter "Home builders' sector, hitting new 52 week

Home Construction ETF Breaks and a Home Builder Sets up for Further

US Home builders ETF predicting drop in US housing prices. Stock market

Home Builder Stocks ETF In Powerpoint And Google Slides Cpb

Home Builder ETF Top 3 to Hold Investcrown

Best 5 Homebuilder ETFs ETFHead

Home Builders Index Etf In Powerpoint And Google Slides Cpb PPT Slide

Home Builder ETF Top 3 to Hold Investcrown

HOME BUILDERS ETF ABOUT TO MAKE A BIG MOVE YouTube

Home Builder ETF Top 3 to Hold Investcrown

Spdr ® S&P Homebuilders Etf Earns An Average Process Pillar Rating.

Homebuilders Etfs Invest In Companies That Operate In The Residential Home Construction Industry.

Enjoy Breathtaking Homes In Chicago.

Founded By Orren Pickell Nearly Five Decades Ago, The Orren Pickell Building Group Is A Custom Home Builder Known Throughout Chicago And The North Shore For Our Unparalleled Luxury And.

Related Post: