Home Builder Etfs

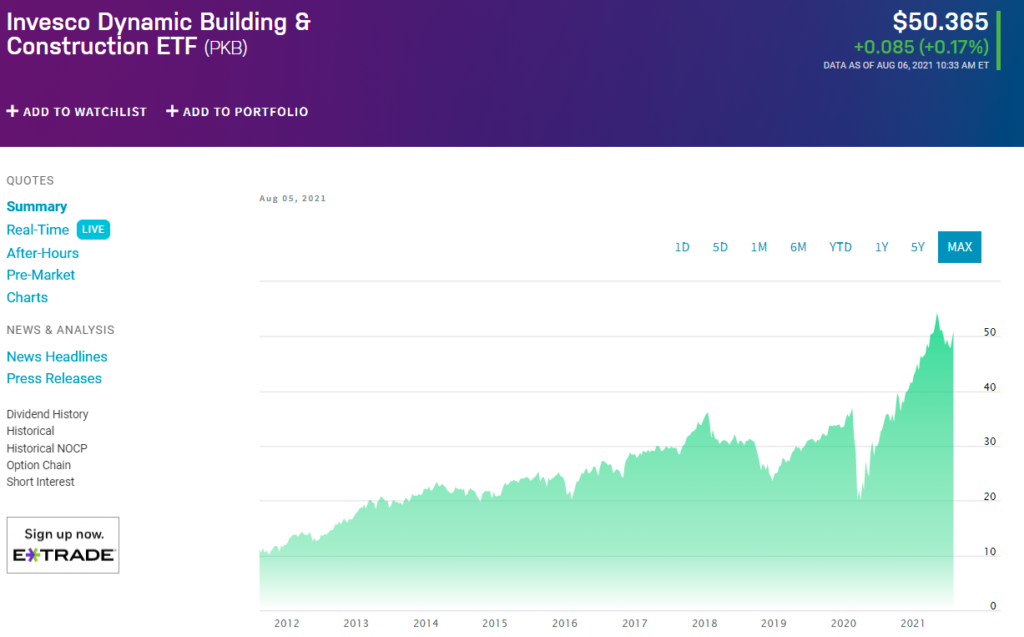

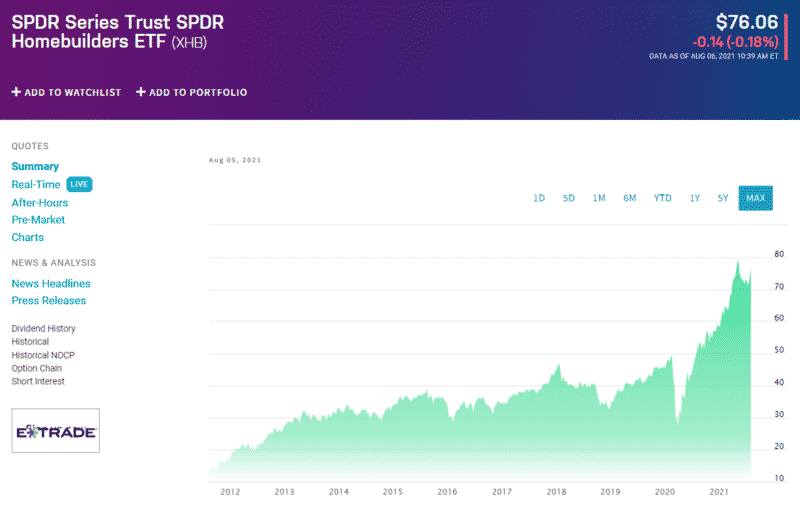

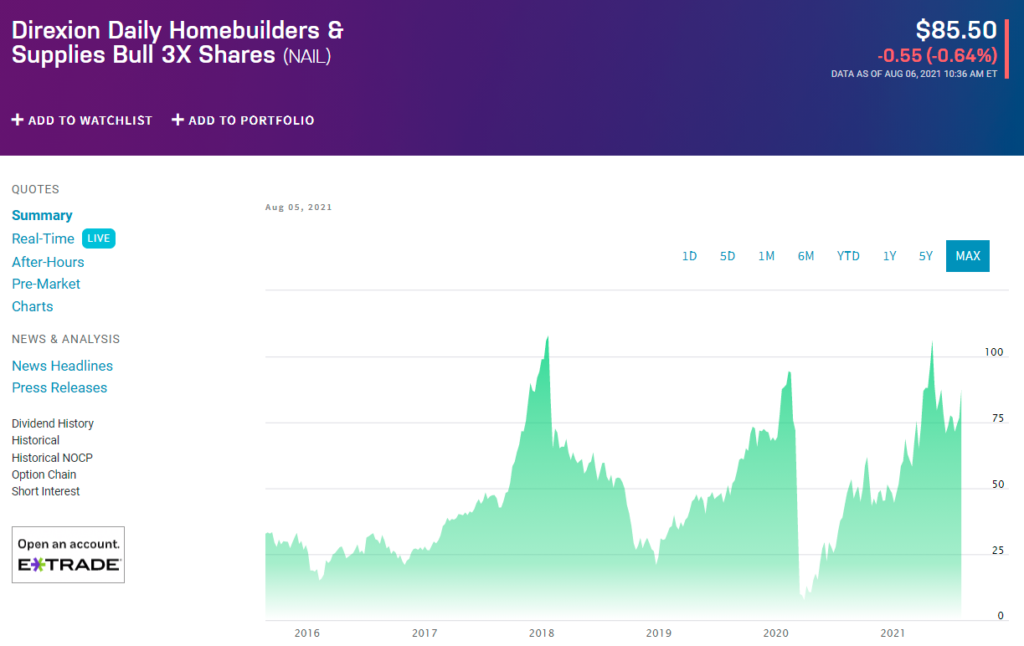

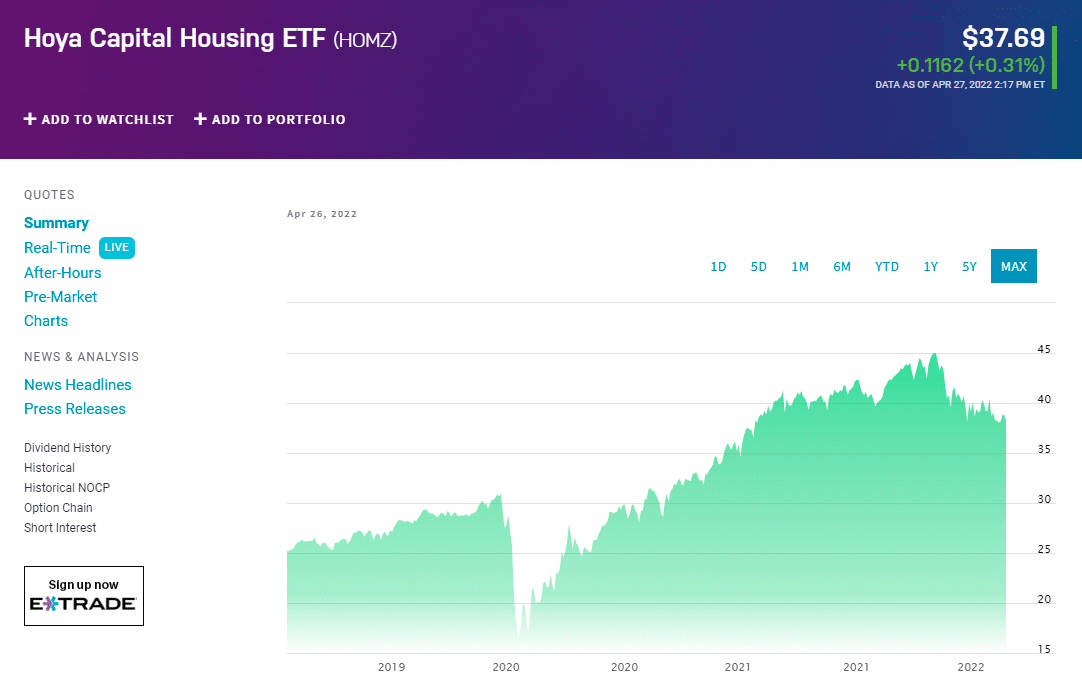

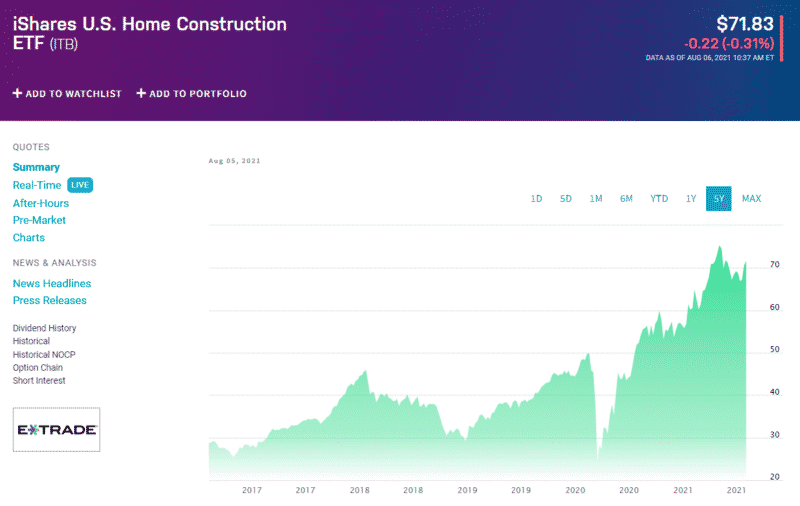

Home Builder Etfs - The expense ratio of pave is 0.47% compared to the median of all other etfs which is 0.49%. The sortable table below contains information. Homebuilders etfs invest in companies that operate in the residential home construction industry. In addition to pure play. The apps you bet on the super bowl with don’t offer odds on which crypto etfs will hit the market in 2025. Enroll in kaplan’s etfs & portfolio construction certificate program, offering financial advisors the essential tools, education, and resources to enhance client discussions about exchange. Prices range from $19,200 to $33,600, depending on your location, the garage size, height,. For comparison, a high of 90 was posted in november 2020 and the low of 8 was. Homebuilders etfs invest in companies that operate in the residential home construction industry. The cost to build a detached garage for two cars costs about $26,400 on average. Home construction etf (itb) and the spdr s&p homebuilders etf (xhb), returned 43.2% and 37.2%, respectively, year. The cost to build a detached garage for two cars costs about $26,400 on average. The sortable table below contains information. Equities in the home construction sector. Home construction etf (bats:itb) shed 26.3% of its value. Home construction etf (itb) seeks to track the investment results of an index composed of u.s. The average expense ratio for etfs in building and construction is 0.50%. Click on the tabs below to see more information on homebuilders etfs,. By building deep and lasting. Research performance, expense ratio, holdings,. Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. Seasoned strategiesdownside risk managementgrowth & income balance Home construction etf (bats:itb) shed 26.3% of its value. View webinarsstrategic active etfsinvest nowsubscribe to updates These chicago area custom home builders offer many options and guide clients through every step of. For comparison, a high of 90 was posted in november 2020 and the low of 8 was. The average expense ratio for etfs in building and construction is 0.50%. To help our customers plan for their dreams and recover from the unexpected by providing the perfect products according to individual needs. By building deep and lasting. Seasoned strategiesdownside risk managementgrowth. In addition to pure play. View webinarsstrategic active etfsinvest nowsubscribe to updates From sectors and smart beta to fixed income, spdr exchange traded funds (etfs) give you wide access to diverse investment opportunities. Seasoned strategiesdownside risk managementgrowth & income balance Learn everything you need to know about spdr® s&p homebuilders etf (xhb) and how it ranks compared to other funds. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. Enroll in kaplan’s etfs & portfolio construction certificate program, offering financial advisors the essential tools, education, and resources to enhance client discussions about exchange. From sectors and smart beta to fixed income, spdr exchange traded funds (etfs) give you. Seasoned strategiesdownside risk managementgrowth & income balance The expense ratio of pave is 0.47% compared to the median of all other etfs which is 0.49%. Click on the tabs below to see more information on homebuilders etfs,. Prices range from $19,200 to $33,600, depending on your location, the garage size, height,. Research performance, expense ratio, holdings,. Home construction etf (itb) and the spdr s&p homebuilders etf (xhb), returned 43.2% and 37.2%, respectively, year. These chicago area custom home builders offer many options and guide clients through every step of the process, from initial concept to final touches. Here are some of the top homebuilder etfs that could extend their already sizable gains this year. Research performance,. From sectors and smart beta to fixed income, spdr exchange traded funds (etfs) give you wide access to diverse investment opportunities. Research performance, expense ratio, holdings,. Homebuilders etfs invest in companies that operate in the residential home construction industry. The average expense ratio for etfs in building and construction is 0.50%. Equities in the home construction sector. Home construction etf (itb) seeks to track the investment results of an index composed of u.s. The average expense ratio for etfs in building and construction is 0.50%. Seasoned strategiesdownside risk managementgrowth & income balance Enroll in kaplan’s etfs & portfolio construction certificate program, offering financial advisors the essential tools, education, and resources to enhance client discussions about exchange. From. The two largest homebuilder etfs, the ishares u.s. Learn everything you need to know about spdr® s&p homebuilders etf (xhb) and how it ranks compared to other funds. Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. Enroll in kaplan’s etfs & portfolio construction certificate program, offering financial. Here are some of the top homebuilder etfs that could extend their already sizable gains this year. View webinarsstrategic active etfsinvest nowsubscribe to updates Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. Home construction etf (itb) and the spdr s&p homebuilders etf (xhb), returned 43.2% and 37.2%,. Here are some of the top homebuilder etfs that could extend their already sizable gains this year. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. View webinarsstrategic active etfsinvest nowsubscribe to updates The apps you bet on the super bowl with don’t offer odds on which crypto etfs will hit the market in 2025. The average expense ratio for etfs in building and construction is 0.50%. From sectors and smart beta to fixed income, spdr exchange traded funds (etfs) give you wide access to diverse investment opportunities. This etf is focused on the u.s. The sortable table below contains information. Homebuilders etfs invest in companies that operate in the residential home construction industry. Learn everything you need to know about spdr® s&p homebuilders etf (xhb) and how it ranks compared to other funds. The gmo beyond china etf will hold a portfolio of up to about 100 stocks, focusing on countries such as vietnam, mexico, india, thailand, and indonesia, which are well. The cost to build a detached garage for two cars costs about $26,400 on average. In addition to pure play. The spdr s&p homebuilders etf (nysearca:xhb) lost 28.9% for the year, while the ishares u.s. Home construction etf (itb) seeks to track the investment results of an index composed of u.s. Research performance, expense ratio, holdings,.Best 5 Homebuilder ETFs ETFHead

Home Builder ETF Top 3 to Hold Investcrown

Homebuilder ETFs surge to alltime highs as Treasury yields fall after

Best 5 Homebuilder ETFs ETFHead

Best Homebuilder ETFs

Unprecedented Housing Demand Spotlights Homebuilder ETFs

Best 5 Homebuilder ETFs ETFHead

Traderstewie on Twitter "Home builders' sector, hitting new 52 week

Best 5 Homebuilder ETFs ETFHead

Best 5 Homebuilder ETFs ETFHead

These Chicago Area Custom Home Builders Offer Many Options And Guide Clients Through Every Step Of The Process, From Initial Concept To Final Touches.

Click On The Tabs Below To See More Information On Homebuilders Etfs,.

5 Beds, 3.5 Baths ∙ 4930 S Martin Luther King Dr, Chicago, Il 60653 ∙ $1,099,000 ∙ Mls# 12289697 ∙ The Ultimate, Exceptional,.

The Expense Ratio Of Pave Is 0.47% Compared To The Median Of All Other Etfs Which Is 0.49%.

Related Post:

:max_bytes(150000):strip_icc()/GettyImages-83520744-32e354c258e24127810f5216fb9b58d5.jpg)