Home Builder Loan Rates

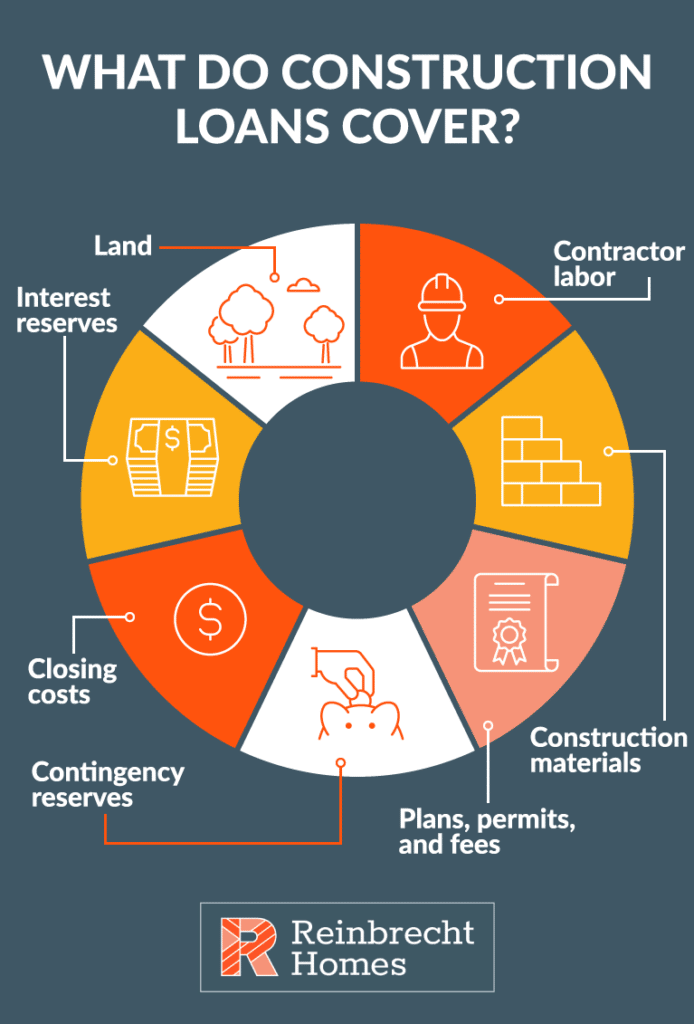

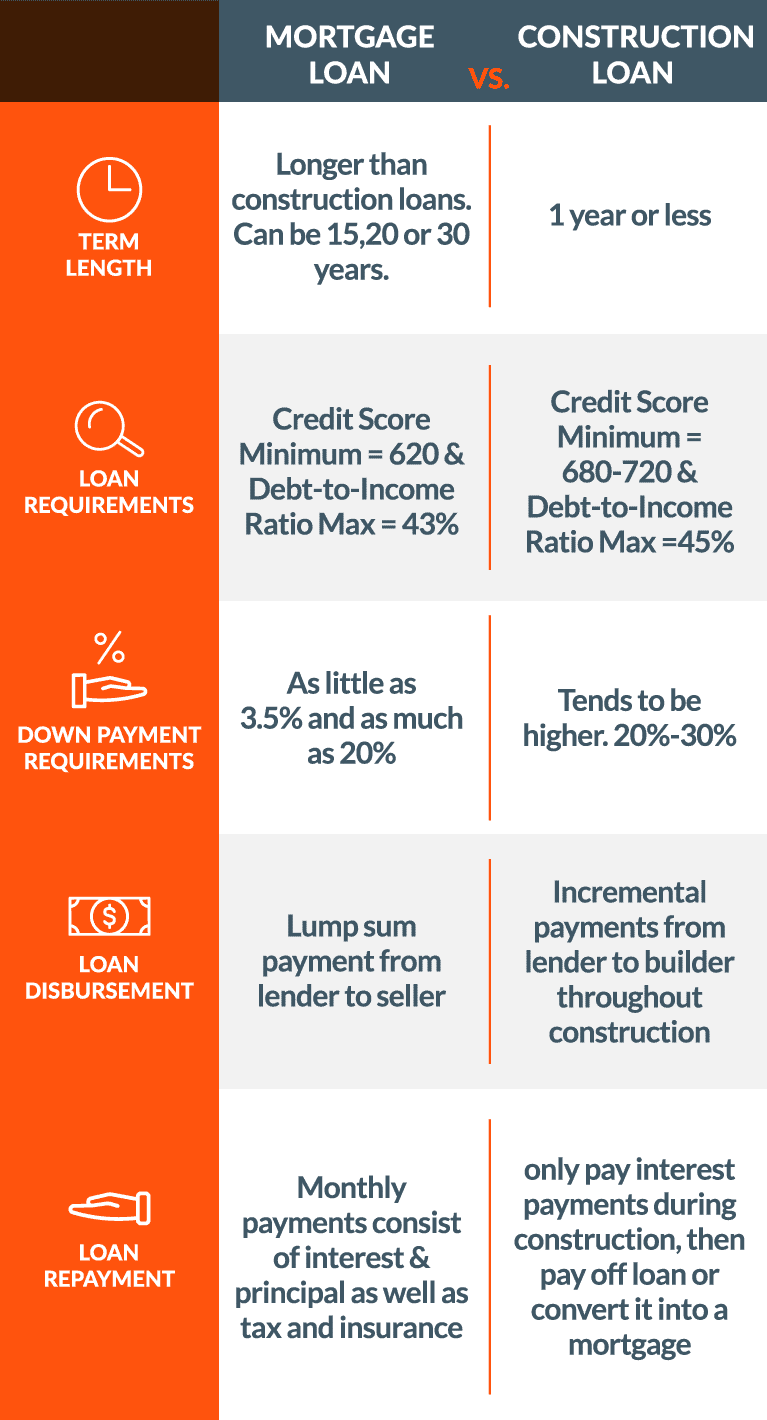

Home Builder Loan Rates - Current construction loan rates can fluctuate based on market conditions, the borrower’s financial history, and the project specifics. Mortgage rates fell for the fourth week in a row, offering a glimmer of hope for home buyers as the u.s. This fintech company requires a minimum credit score of. Happy money offers the best personal loan for borrowers with bad credit, earning a moneygeek score of 94 out of 100. As of 2024, studies show that the. Fifth third bank offers new construction loans to make your vision for a custom home a reality. Unlike traditional mortgages, these loans have. Learn more about deciding if you should use your homebuilder’s preferred lender. Housing market approaches the busiest period of the year. These loans typically require a 20% down payment and a strong credit score. Like any mortgage, you want to ensure your. Our construction loans are available for your primary residence at fixed or adjustable interest. Construction loan rates typically vary between 4% and 12%, depending on your credit score, the project’s details, and market conditions. If you decide to buy a home with no down payment, it’s important to consider the downsides as well: Cnbc select has picked the best lenders for construction loans in various categories. Interest rates on construction loans are variable, meaning they can change throughout the loan term. Joshua tadian at rate (nmls #1842112) chicago, il 60613 assists you with low cost home purchase, mortgage refinance and fast closings. Borrowers should consider interest rates, loan terms, and fees to find the most affordable mortgage option for their financial needs. In this case, you will receive your original rate, loan terms, and rate lock expiration date. Housing market approaches the busiest period of the year. Joshua tadian at rate (nmls #1842112) chicago, il 60613 assists you with low cost home purchase, mortgage refinance and fast closings. Happy money offers the best personal loan for borrowers with bad credit, earning a moneygeek score of 94 out of 100. Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a. Simply enter your home location, property value and loan amount to compare the best rates. If you borrowed 100% of your home’s value,. Home building loan rates 🏦 feb 2025. Borrowers should consider interest rates, loan terms, and fees to find the most affordable mortgage option for their financial needs. Cnbc select has picked the best lenders for construction loans. As of 2024, studies show that the. Happy money offers the best personal loan for borrowers with bad credit, earning a moneygeek score of 94 out of 100. Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. Unlike traditional mortgages, these loans have. If you borrowed 100% of your home’s. Apply online for expert recommendations with real interest rates and payments. Called home builder financing or preferred lending, getting a mortgage this way can mean a speedier closing, discounts and special perks for borrowers. Learn more about deciding if you should use your homebuilder’s preferred lender. Joshua tadian at rate (nmls #1842112) chicago, il 60613 assists you with low cost. Learn more about deciding if you should use your homebuilder’s preferred lender. Unlike traditional mortgages, these loans have. These loans typically require a 20% down payment and a strong credit score. Mortgage rates fell for the fourth week in a row, offering a glimmer of hope for home buyers as the u.s. Housing market approaches the busiest period of the. In this case, you will receive your original rate, loan terms, and rate lock expiration date. It’s important to have a good grasp of construction loan rates when you’re going through the home construction process. Our construction loans are available for your primary residence at fixed or adjustable interest. You also can often use this money to purchase. If you. Construction loan rates typically vary between 4% and 12%, depending on your credit score, the project’s details, and market conditions. Cnbc select has picked the best lenders for construction loans in various categories. As of 2024, studies show that the. Housing market approaches the busiest period of the year. This fintech company requires a minimum credit score of. Home construction loans are generally tougher to qualify for than traditional mortgages. Interest rates on construction loans are variable, meaning they can change throughout the loan term. Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. It’s important to have a good grasp of construction loan rates when you’re going. Learn more about deciding if you should use your homebuilder’s preferred lender. Aside from the various costs that can be included in the loan and the repayment timeline, there. This fintech company requires a minimum credit score of. Mortgage rates fell for the fourth week in a row, offering a glimmer of hope for home buyers as the u.s. If. Home construction loans are generally tougher to qualify for than traditional mortgages. Unlike traditional mortgages, these loans have. If you borrowed 100% of your home’s value,. Cnbc select has picked the best lenders for construction loans in various categories. You also can often use this money to purchase. Housing market approaches the busiest period of the year. But in general, construction loan rates are typically around 1 percent. Joshua tadian at rate (nmls #1842112) chicago, il 60613 assists you with low cost home purchase, mortgage refinance and fast closings. Home construction loans are generally tougher to qualify for than traditional mortgages. For a more advanced search, you can filter your results by loan type for 30 year fixed,. Borrowers should consider interest rates, loan terms, and fees to find the most affordable mortgage option for their financial needs. Our construction loans are available for your primary residence at fixed or adjustable interest. Aside from the various costs that can be included in the loan and the repayment timeline, there. Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. Mortgage rates fell for the fourth week in a row, offering a glimmer of hope for home buyers as the u.s. Contact your home mortgage consultant or private mortgage banker for information regarding. Simply enter your home location, property value and loan amount to compare the best rates. Construction loan rates typically vary between 4% and 12%, depending on your credit score, the project’s details, and market conditions. Learn more about deciding if you should use your homebuilder’s preferred lender. In this case, you will receive your original rate, loan terms, and rate lock expiration date. Home building loan rates 🏦 feb 2025.From landscaping to lighting, a lot goes into a newconstruction home

Our lender's construction rates are the BEST! 10 down options

Construction Loans 101 Everything You Need To Know

Construction Loan Rates Builders Capital

Buying a home is an exciting prospect. Home loans and mortgages can

Construction Loans 101 Everything You Need To Know

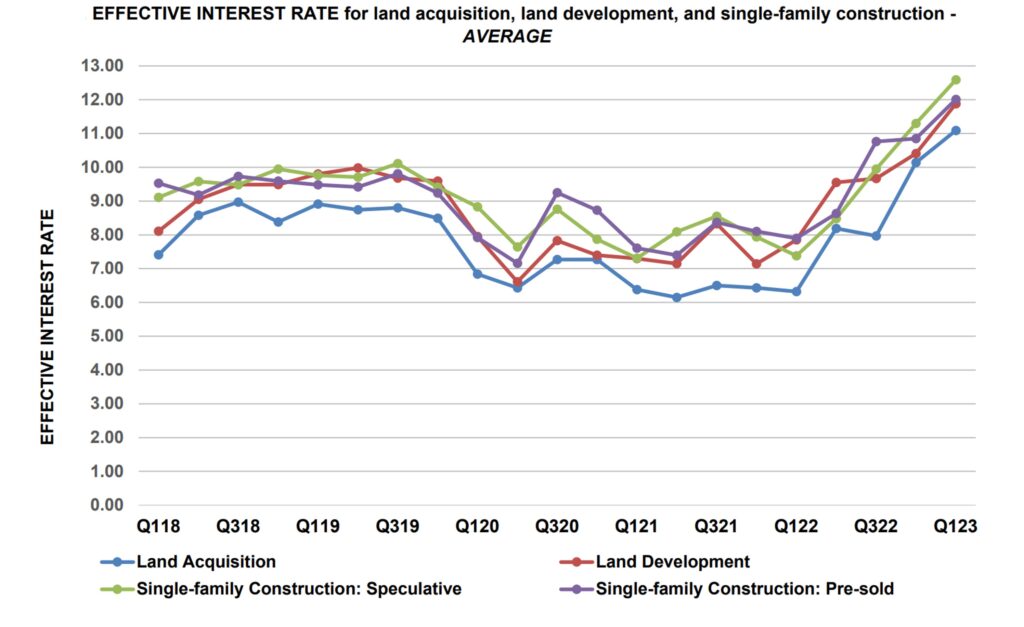

Rates on Development and Construction Loans Continue to Climb

2 Basic Financing Options Mortgages Vs. Construction Loans

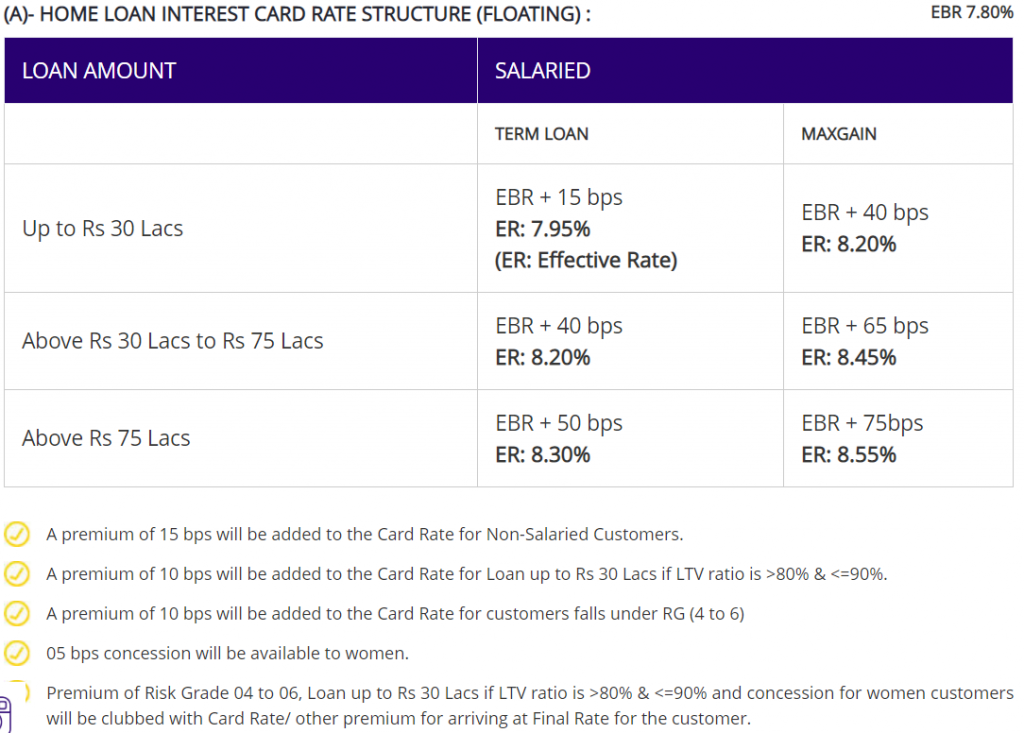

Home Loan Interest Rates Low Home Loan Rates What You Need to Know

Find the Best Construction Loan for Building Your Home and Save

If You Decide To Buy A Home With No Down Payment, It’s Important To Consider The Downsides As Well:

Apply Online For Expert Recommendations With Real Interest Rates And Payments.

Cnbc Select Has Picked The Best Lenders For Construction Loans In Various Categories.

Current Construction Loan Rates Can Fluctuate Based On Market Conditions, The Borrower’s Financial History, And The Project Specifics.

Related Post: