Home Builder Stocks

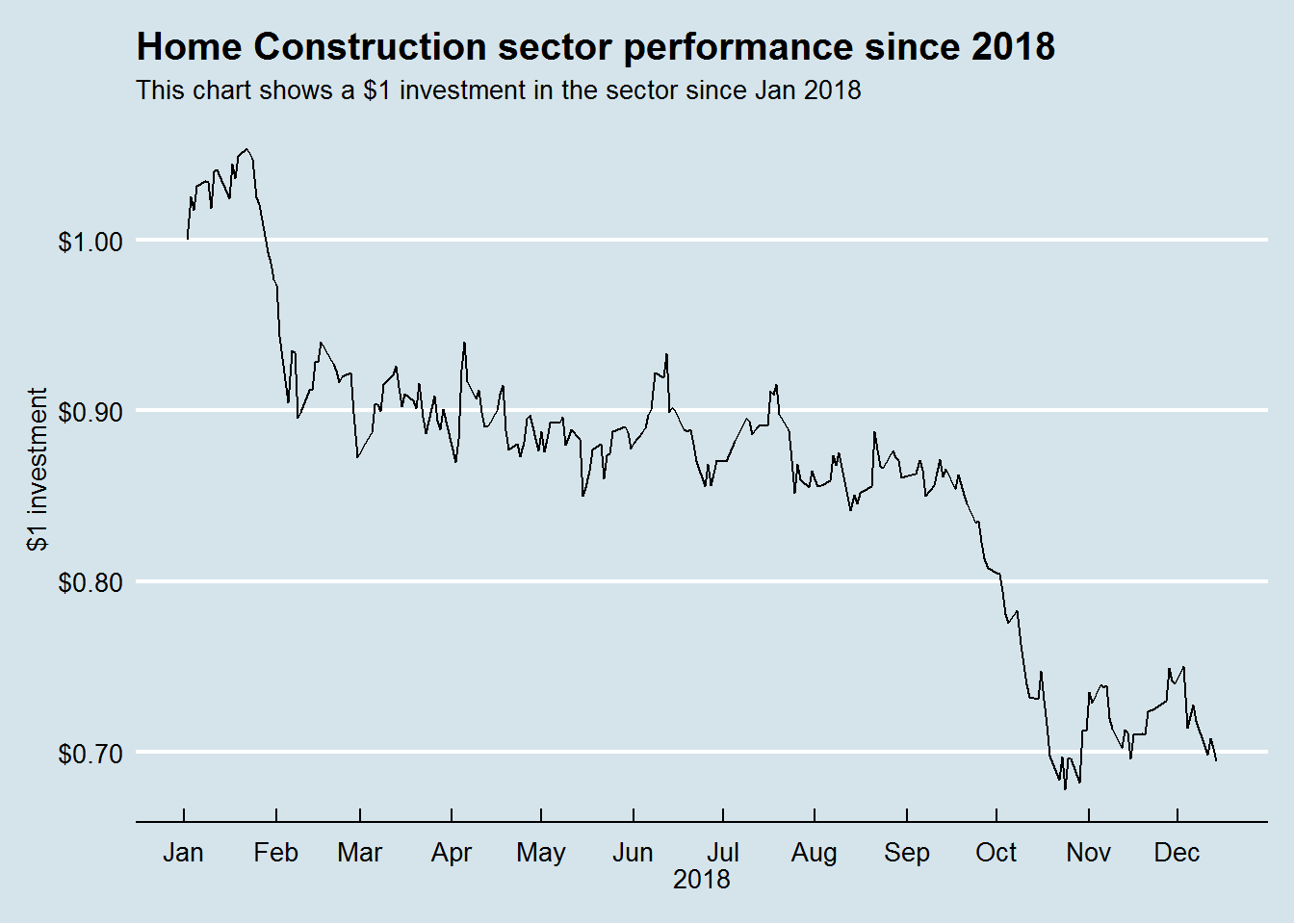

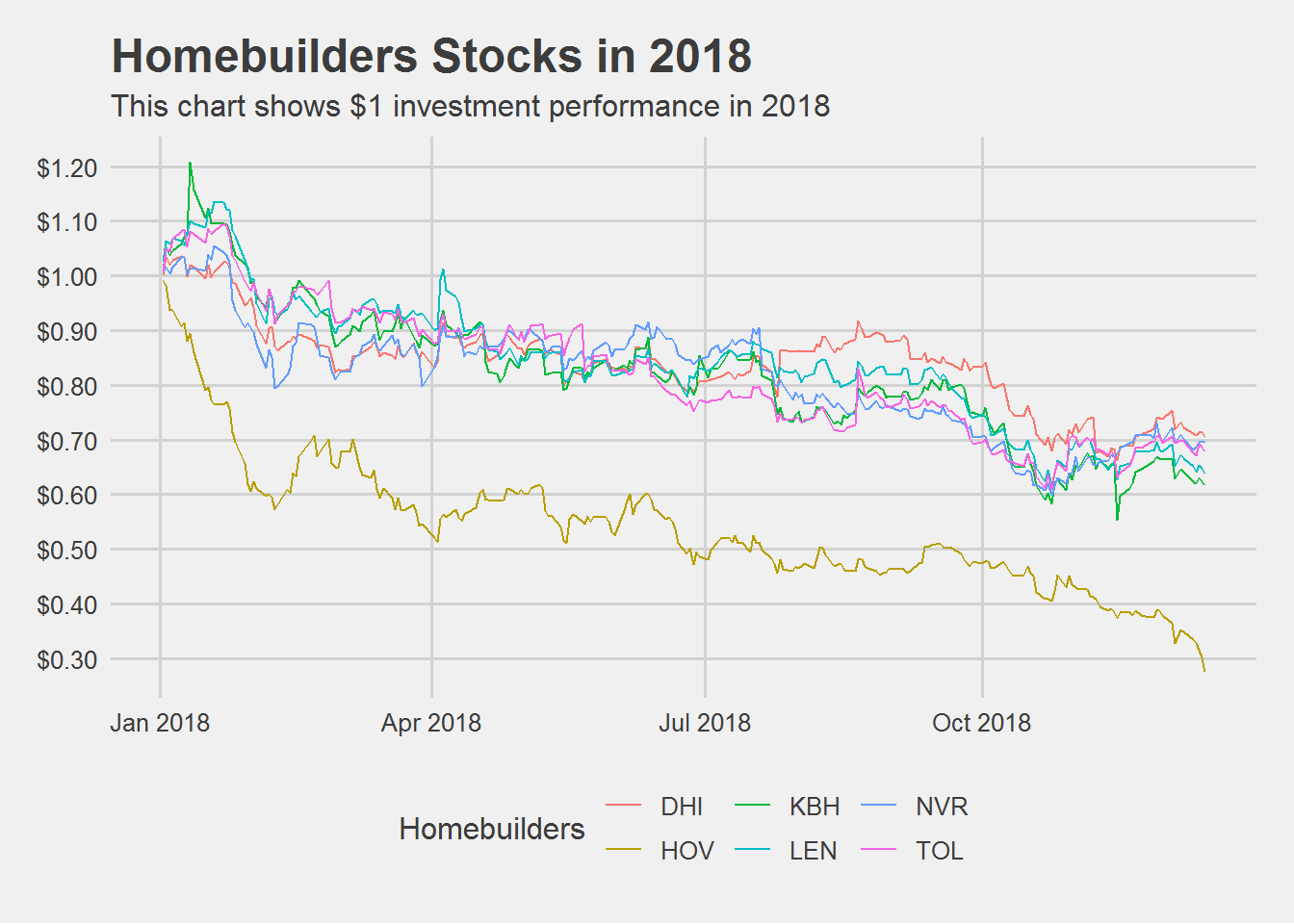

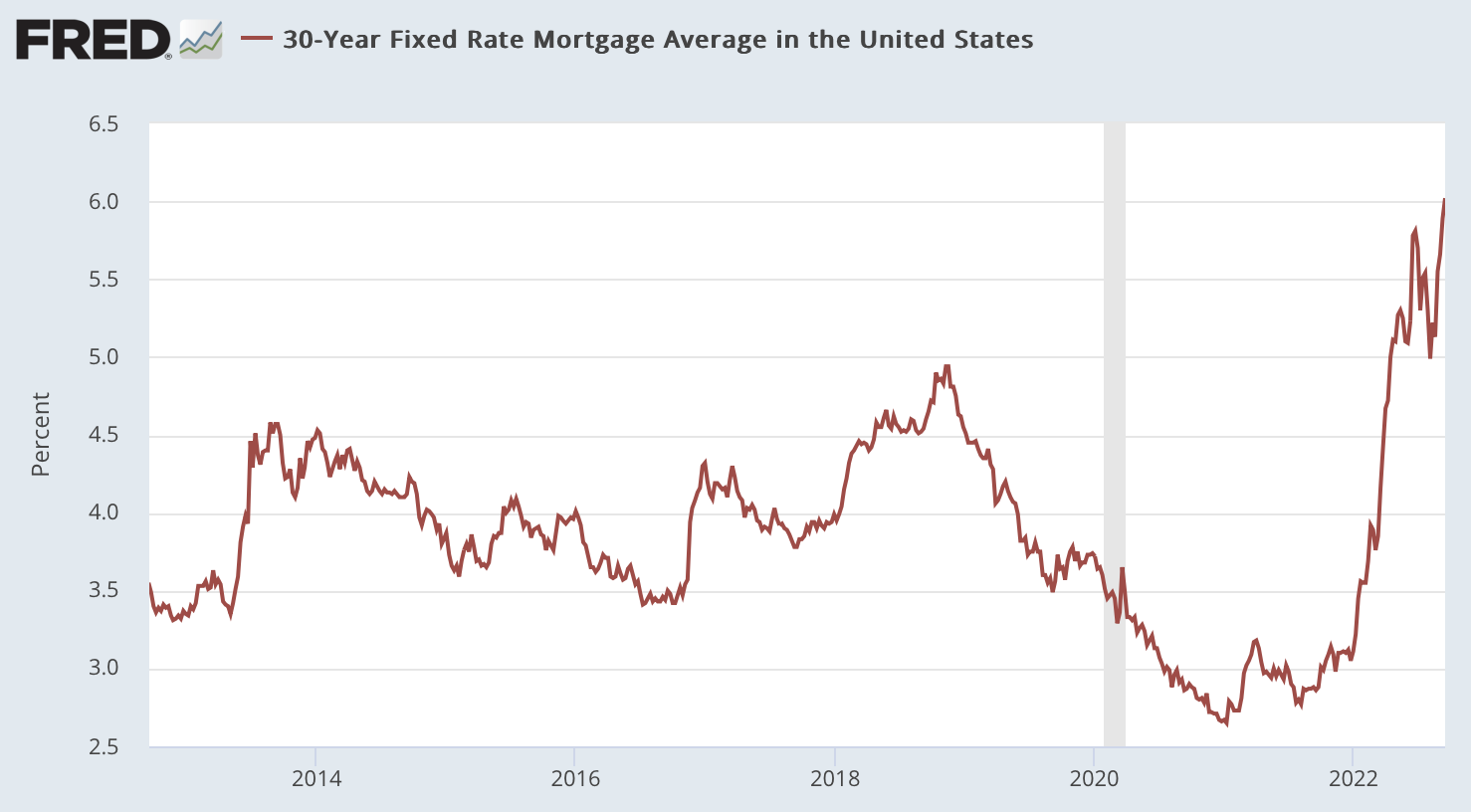

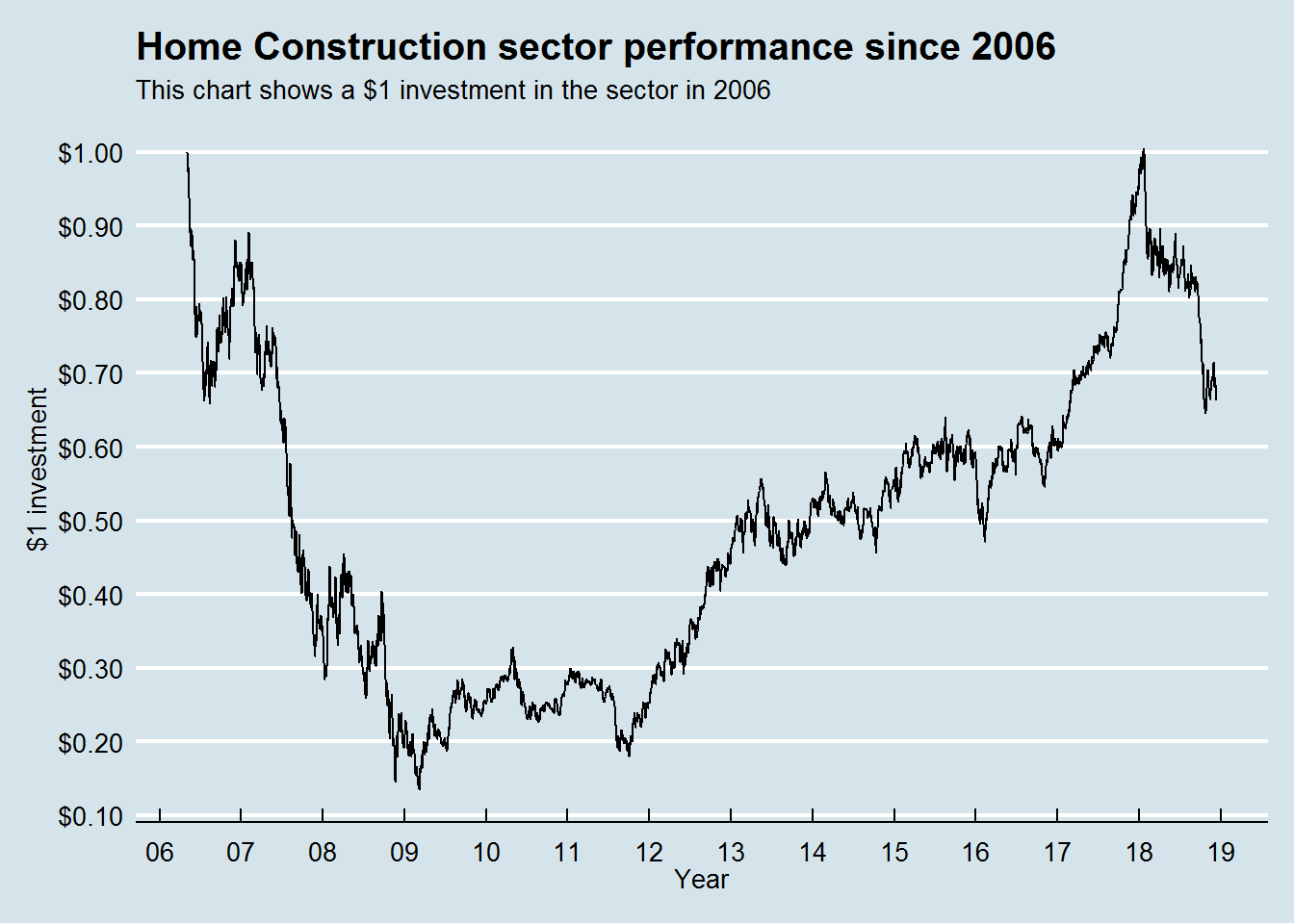

Home Builder Stocks - These chicago area custom home builders offer many options and guide clients through every step of the process, from initial concept to final touches. Demand for new homes has been strong,. Toll brothers, inc., a fortune 500 company, is the nation’s leading builder of luxury homes. Builders warehouse provides top quality roofing, siding, and sheet metal building materials at competitive prices, with spectacular customer service. Our annual builder 100 and next 100 lists look at the top 200 home builders across the united states, ranked by closings. Here are total returns for the 16 home builders since oct. The lists also include the firms’ gross revenue from home. Five stocks we like better than taylor morrison home. Meanwhile, the s&p 500 has jumped 22.4% in the said period. An already undersupplied housing market is seeing strong demand especially for. ().since then, mho has lost. The average cost to remodel a garage is around $18,000, ranging from $1,500 to $50,000, depending on size, materials, location, and other factors like plumbing and. We selected the best home builder stocks based on positive analyst coverage, strong business fundamentals, and growth prospects once the housing market gains momentum. The list is sorted by market. Stocks in this industry have collectively gained 81.8% compared with the broader sector’s 10.9% rally. Housing market is just getting over the hump of a recent scare. An already undersupplied housing market is seeing strong demand especially for. Five stocks we like better than taylor morrison home. Homebuilders have been controlling construction costs by designing homes efficiently and obtaining construction materials and labor at competitive prices. Investors and home builders have a unique chance to purchase seven lots in the fuller park area of chicago, either in bulk or separately from the same owners. Find out the best homebuilding and housing stocks to buy in 2024,. Housing market is just getting over the hump of a recent scare. Investors and home builders have a unique chance to purchase seven lots in the fuller park area of chicago, either in bulk or separately from the same owners. Homebuilder stocks are charging higher in 2023, as. Homebuilder stocks are charging higher in 2023, as the u.s. Meanwhile, the s&p 500 has jumped 22.4% in the said period. 11 (the date for which we pulled data for the previous article) along with forward p/e ratios. Here are total returns for the 16 home builders since oct. Homebuilders have been controlling construction costs by designing homes efficiently and. Find out the best homebuilding and housing stocks to buy in 2024,. These five are expected to grow profits rapidly through 2025. Here are total returns for the 16 home builders since oct. Toll brothers, inc., a fortune 500 company, is the nation’s leading builder of luxury homes. The company was founded 58 years ago in 1967 and became a. Find out the best homebuilding and housing stocks to buy in 2024,. Housing market is just getting over the hump of a recent scare. Stocks in this industry have collectively gained 81.8% compared with the broader sector’s 10.9% rally. 11 (the date for which we pulled data for the previous article) along with forward p/e ratios. The lists also include. Adding some homebuilding stocks to your portfolio seems to be a judicious move at this point, given the solid demand. Homebuilder stocks are charging higher in 2023, as the u.s. Five stocks we like better than taylor morrison home. ().since then, mho has lost. The list is sorted by market. Housing market is just getting over the hump of a recent scare. The list is sorted by market. An already undersupplied housing market is seeing strong demand especially for. Meanwhile, the s&p 500 has jumped 22.4% in the said period. Last june, i warned investors that economic data indicated the homebuilding cycle had peaked, creating a specific risk for the. These chicago area custom home builders offer many options and guide clients through every step of the process, from initial concept to final touches. Meanwhile, the s&p 500 has jumped 22.4% in the said period. Five stocks we like better than taylor morrison home. Toll brothers, inc., a fortune 500 company, is the nation’s leading builder of luxury homes. ().since. Our annual builder 100 and next 100 lists look at the top 200 home builders across the united states, ranked by closings. 11 (the date for which we pulled data for the previous article) along with forward p/e ratios. An already undersupplied housing market is seeing strong demand especially for. Homebuilder stocks are charging higher in 2023, as the u.s.. The company was founded 58 years ago in 1967 and became a public company in 1986. Home builders’ stocks have soared since we said they were cheap. Investors and home builders have a unique chance to purchase seven lots in the fuller park area of chicago, either in bulk or separately from the same owners. Five stocks we like better. Our annual builder 100 and next 100 lists look at the top 200 home builders across the united states, ranked by closings. An already undersupplied housing market is seeing strong demand especially for. Horton and pultegroup have outperformed, with solid earnings and strategic positioning that could drive further gains as mortgage rates dip and. The list is sorted by market.. The average cost to remodel a garage is around $18,000, ranging from $1,500 to $50,000, depending on size, materials, location, and other factors like plumbing and. Homebuilders have been controlling construction costs by designing homes efficiently and obtaining construction materials and labor at competitive prices. Horton and pultegroup have outperformed, with solid earnings and strategic positioning that could drive further gains as mortgage rates dip and. The list is sorted by market. Meanwhile, the s&p 500 has jumped 22.4% in the said period. Toll brothers, inc., a fortune 500 company, is the nation’s leading builder of luxury homes. Five stocks we like better than taylor morrison home. Stocks in this industry have collectively gained 81.8% compared with the broader sector’s 10.9% rally. Home builders’ stocks have soared since we said they were cheap. We selected the best home builder stocks based on positive analyst coverage, strong business fundamentals, and growth prospects once the housing market gains momentum. The company was founded 58 years ago in 1967 and became a public company in 1986. Last june, i warned investors that economic data indicated the homebuilding cycle had peaked, creating a specific risk for the builder m/i homes, inc. 11 (the date for which we pulled data for the previous article) along with forward p/e ratios. The lists also include the firms’ gross revenue from home. Demand for new homes has been strong,. With the help of the zacks stock screener, we have zeroed.The 3 Top Home Builder Stocks to Buy in April 2024 InvestorPlace

Chris Ciovacco on Twitter "Some notable difference between financial

10 Best Home Builder Stocks To Buy Now Insider Monkey

Home builders stocks Long Short Strategies

Home builders stocks Long Short Strategies

10 Best Home Builder Stocks To Buy Now

Homebuilder stocks take a broad beating as 10year yield’s breakout

3 Best Home Builder Stocks for Ongoing Housing Shortage

Best Real Estate Stocks To BUY NOW! Home Builder Stocks HUGE Growth

Home builders stocks Long Short Strategies

Here Are Total Returns For The 16 Home Builders Since Oct.

Housing Market Is Just Getting Over The Hump Of A Recent Scare.

Find Out The Best Homebuilding And Housing Stocks To Buy In 2024,.

An Already Undersupplied Housing Market Is Seeing Strong Demand Especially For.

Related Post: