Home Building Etf

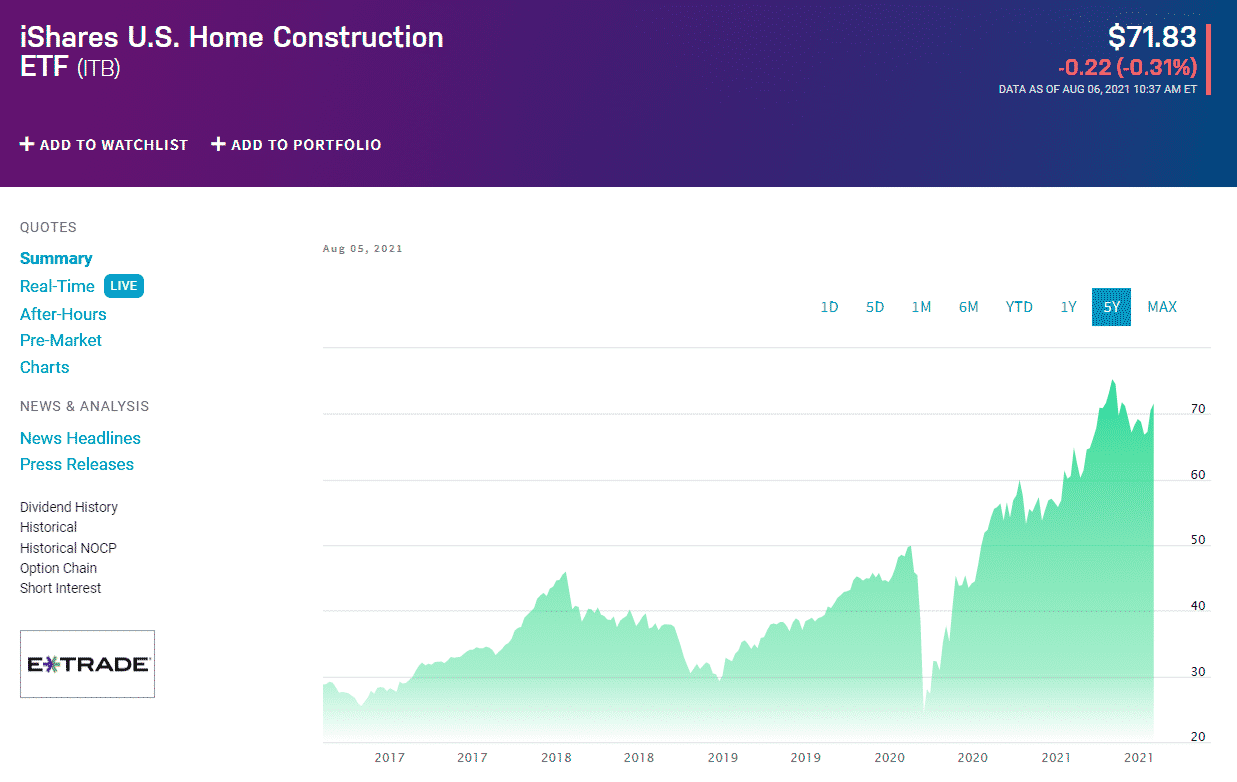

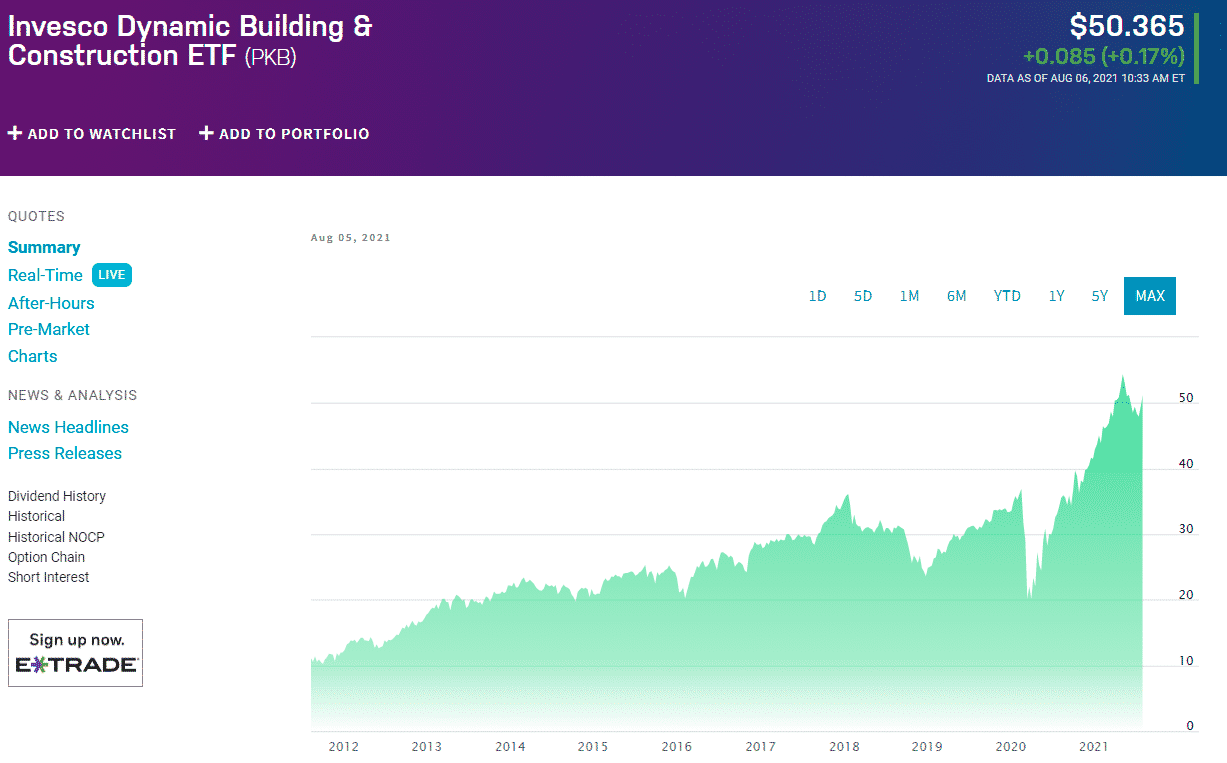

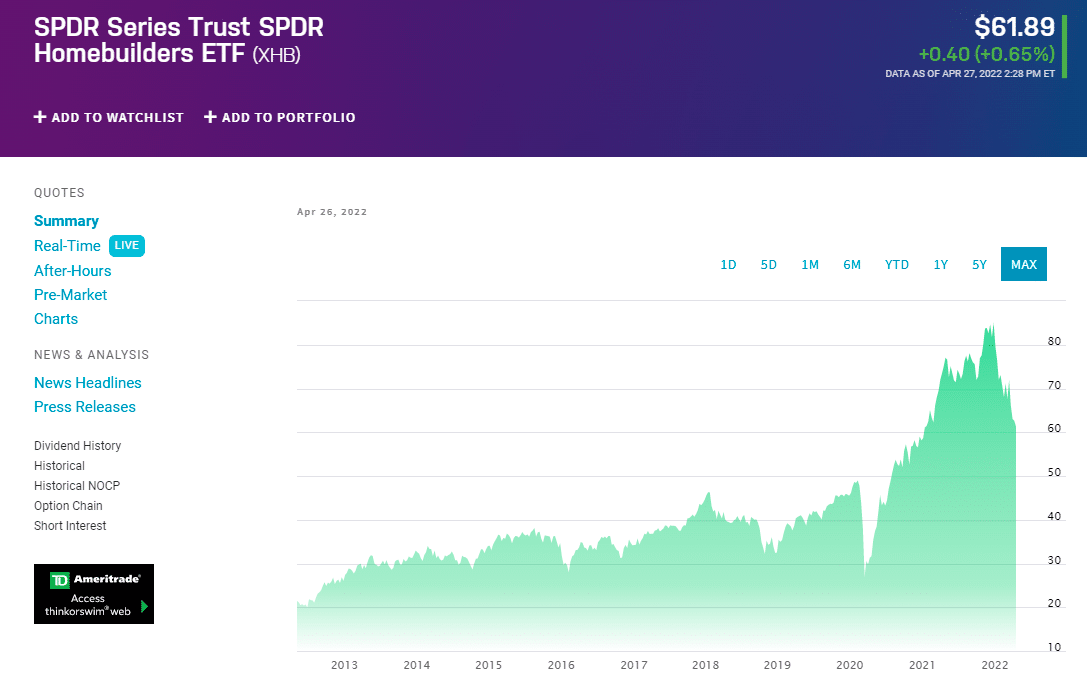

Home Building Etf - To help our customers plan for their dreams and recover from the unexpected by providing the perfect products according to individual needs. This etf offers exposure to the u.s. The s&p homebuilders select industry® index represents the homebuilders segment of the s&p total market index (“s&p tmi”). Itb | a complete ishares u.s. Home construction etf (bats:itb) shed 26.3% of its value. The sortable table below contains information. Under normal market conditions, the trust invests at least 80% of its managed assets in taxable municipal securities, which include build america bonds. Click on the tabs below to see more information on homebuilders etfs,. The spdr s&p homebuilders etf (nysearca:xhb) lost 28.9% for the year, while the ishares u.s. College for financial planning—a kaplan company launches etfs & portfolio construction certificate program in collaboration w/ishares® by blackrock. Click on the tabs below to see more information on homebuilders etfs,. View the latest etf prices and news for better etf investing. In addition to pure play. This etf offers exposure to the u.s. The sortable table below contains information. Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. Learn everything you need to know about ishares us home construction etf (itb) and how it ranks compared to other funds. Homebuilders etfs invest in companies that operate in the residential home construction industry. The spdr s&p homebuilders etf (nysearca:xhb) lost 28.9% for the year, while the ishares u.s. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. Click on the tabs below to see more information on homebuilders etfs,. The s&p homebuilders select industry® index represents the homebuilders segment of the s&p total market index (“s&p tmi”). Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. Home construction etf (itb) seeks to track the investment. This etf offers exposure to the u.s. Investments in core infrastructure businesses throughout the united states and canada. Home construction etf (bats:itb) shed 26.3% of its value. Investments in construction and permanent first mortgages in commercial real estate projects. To help our customers plan for their dreams and recover from the unexpected by providing the perfect products according to individual. In addition to pure play. To help our customers plan for their dreams and recover from the unexpected by providing the perfect products according to individual needs. Learn everything you need to know about ishares us home construction etf (itb) and how it ranks compared to other funds. Here are some of the top homebuilder etfs that could extend their. Investments in core infrastructure businesses throughout the united states and canada. Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. To help our customers plan for their dreams and recover from the unexpected by providing the perfect products according to individual needs. Homebuilders etfs invest in companies that. 0.43% per year, or $43 on a $10,000 investment. In addition to pure play. View the latest etf prices and news for better etf investing. Here are some of the top homebuilder etfs that could extend their already sizable gains this year. The sortable table below contains information. Homebuilders etfs invest in companies that operate in the residential home construction industry. Click on the tabs below to see more information on homebuilders etfs,. (nasdaq:incy) is a biotechnology company in the health care sector of the economy.i last wrote about incy in july 2022, and i was bullish on. In addition to industry expertise, iron mountain will provide mena. Home construction etf (bats:itb) shed 26.3% of its value. Itb | a complete ishares u.s. By building deep and lasting. To help our customers plan for their dreams and recover from the unexpected by providing the perfect products according to individual needs. View the latest etf prices and news for better etf investing. 4 etfs are placed in the building & construction category. Upon completion of this program, you will be able to: The sortable table below contains information. Under normal market conditions, the trust invests at least 80% of its managed assets in taxable municipal securities, which include build america bonds. Equities in the home construction sector. Home construction etf exchange traded fund overview by marketwatch. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. This etf is focused on the u.s. The s&p homebuilders select industry® index represents the homebuilders segment of the s&p total market index (“s&p tmi”). Compare and contrast etfs to. Homebuilders etfs invest in companies that operate in the residential home construction industry. Learn everything you need to know about ishares us home construction etf (itb) and how it ranks compared to other funds. Home construction etf exchange traded fund overview by marketwatch. In addition to pure play. To help our customers plan for their dreams and recover from the. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. (nasdaq:incy) is a biotechnology company in the health care sector of the economy.i last wrote about incy in july 2022, and i was bullish on. Home construction etf exchange traded fund overview by marketwatch. Click on the tabs below to see more information on homebuilders etfs, including historical performance, dividends, holdings, expense ratios, technical indicators,. This etf is focused on the u.s. Click to see returns, expenses, dividends, holdings, taxes, technicals and more. Homebuilders etfs invest in companies that operate in the residential home construction industry. By building deep and lasting. Investments in construction and permanent first mortgages in commercial real estate projects. In addition to industry expertise, iron mountain will provide mena digital hub with specialized advice in the design, construction and daily operations of data centers to meet. To help our customers plan for their dreams and recover from the unexpected by providing the perfect products according to individual needs. College for financial planning—a kaplan company launches etfs & portfolio construction certificate program in collaboration w/ishares® by blackrock. In addition to pure play. Investments in core infrastructure businesses throughout the united states and canada. The home equity contract market is relatively small, with its total volume estimated to be between $2 billion to $3 billion, but the industry predicts the market will continue to grow. Compare and contrast etfs to other pooled investment vehicles.Building Permits Fall 1.5 in April dshort Advisor Perspectives

Home Builder ETF Top 3 to Hold Investcrown

Deciphering the Bearish Case Is it Time to Short ITB?

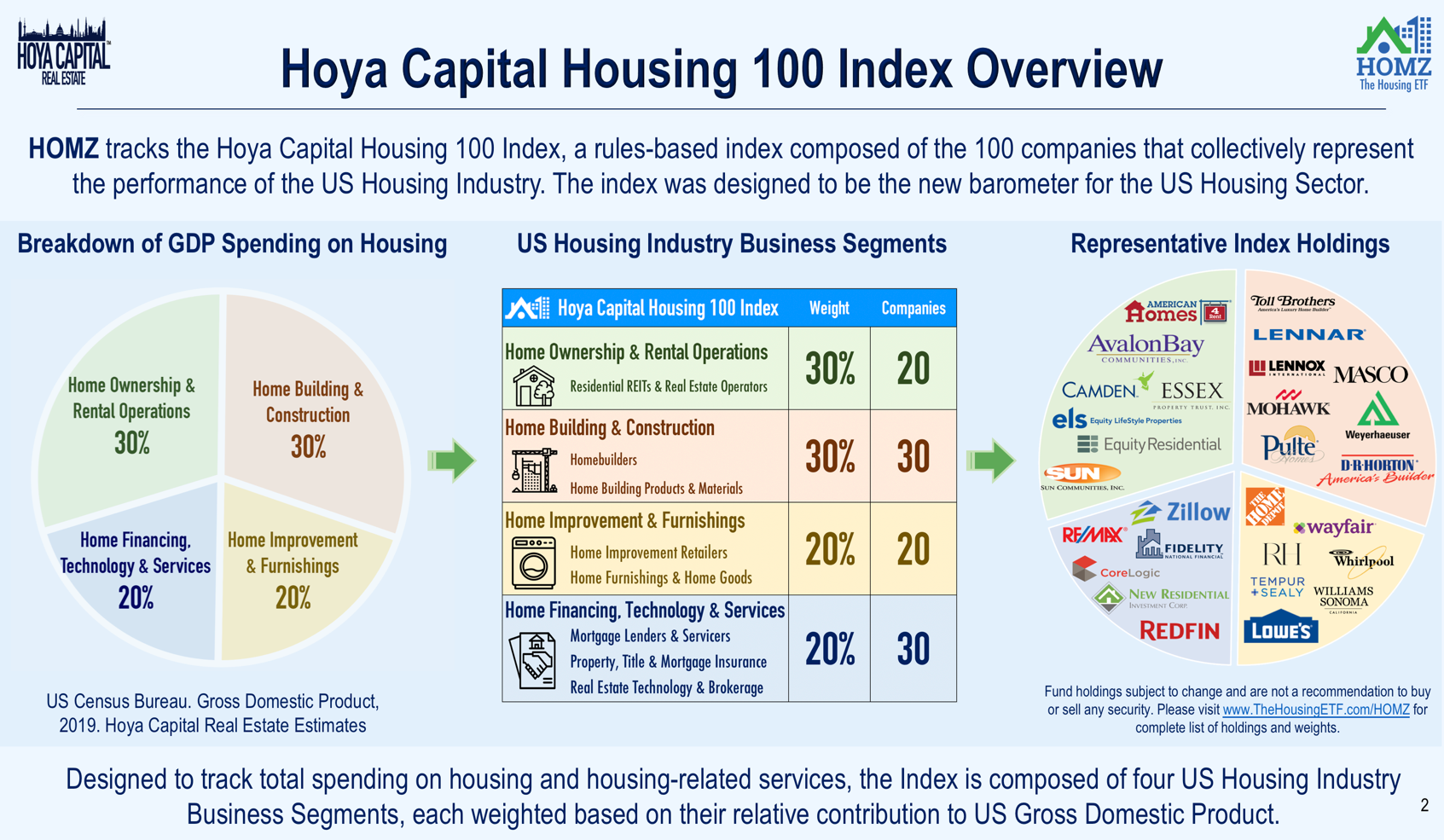

HOMZ This HighGrowth Real Estate ETF Is A Home Run (NYSEARCAHOMZ

Homebuilding Stocks ETF Holds Support The Market Oracle

Best Homebuilder ETFs

Etfs Stock Illustrations 288 Etfs Stock Illustrations, Vectors

Best 5 Homebuilder ETFs ETFHead

Best 5 Homebuilder ETFs ETFHead

iShares U.S. Home Construction ETF (ITB) Why We Believe It's The Best

Home Construction Etf (Bats:itb) Shed 26.3% Of Its Value.

Under Normal Market Conditions, The Trust Invests At Least 80% Of Its Managed Assets In Taxable Municipal Securities, Which Include Build America Bonds.

Click On The Tabs Below To See More Information On Homebuilders Etfs,.

View The Latest Etf Prices And News For Better Etf Investing.

Related Post:

:max_bytes(150000):strip_icc()/GettyImages-83520744-32e354c258e24127810f5216fb9b58d5.jpg)