Home Building Loan V Blaisdell

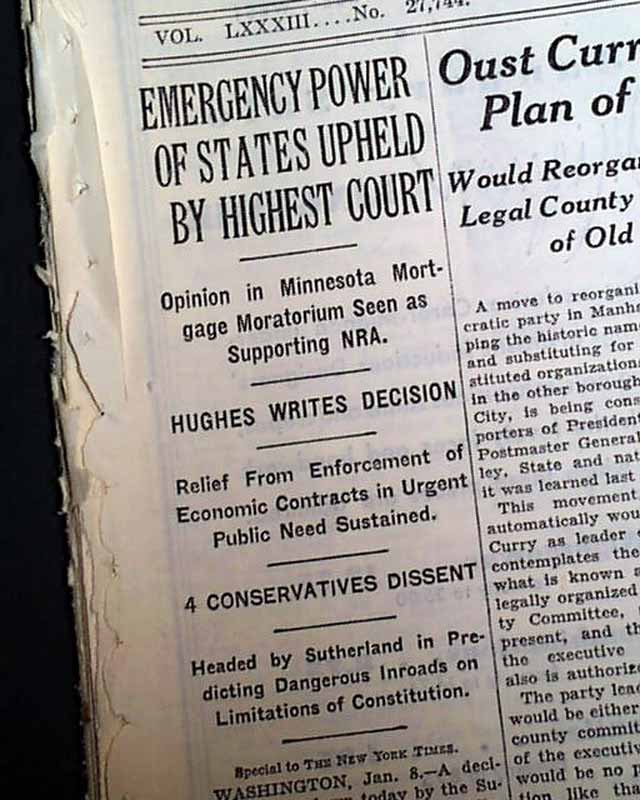

Home Building Loan V Blaisdell - As an emergency measure, during the great depression, minnesota passed a law that modified lender’s contractual rights of foreclosure with their debtors. The appellant, home building & loan assn. Home bldg & (and) l. Supreme court of united states. The constitutionality of the law was. This document summarizes the supreme court case home building & loan association v. Compare top 10 brandsconsumervoice.org picksreviewed by 1,000strusted reviews The court's decision in home building and loan association v. Appellant contests the validity of chapter 339 of the laws of minnesota of 1933, p. From the 1830s until the great depression, a type of thrift institution known as building and loan associations made home loans more broadly accessible. A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building and loan association, which was. From the 1830s until the great depression, a type of thrift institution known as building and loan associations made home loans more broadly accessible. The blaisdells (plaintiffs) were a minneapolis couple who defaulted on their mortgage. The defendants, the blaisdells, obtained a court order under the act extending the period of redemption on condition that they pay the association $40 per month, thus, the court modified. 398 (1934), also called the minnesota mortgage moratorium case, was a decision of the united states supreme court holding that minnesota's suspension of creditors' remedies was not in violation of the contract clause of the united states constitution. The court's decision in home building and loan association v. Blaisdell was decided during the depth of the great depression and has been criticized by modern conservative and libertarian commentators. Home building & (and) loan. Home building & loan association v. Argued november 8, 9, 1933 decided january 8, 1934 appeal from the. The blaisdells (plaintiffs) were a minneapolis couple who defaulted on their mortgage. That they lived in part of. In home building and loan association v. Home building & loan association v. The defendants, the blaisdells, obtained a court order under the act extending the period of redemption on condition that they pay the association $40 per month, thus, the court. Home building & loan association v. Compare top 10 brandsconsumervoice.org picksreviewed by 1,000strusted reviews Trial court granted extension for δ supreme court. Supreme court upheld the minnesota mortgage moratorium act of 1933 over a charge that it was a violation of the. Supreme court of united states. Minnesota's statute authorized a state court, on application from a debtor, to exempt property from final foreclosure for no more than two years, during which time the creditor must be paid. Their property was sold in a foreclosure sale to the home building & loan association (association). This document summarizes the supreme court case home building & loan association v.. The blaisdells (plaintiffs) were a minneapolis couple who defaulted on their mortgage. Argued november 8, 9, 1933 decided january 8, 1934 appeal from the. Home building & loan association v. As an emergency measure, during the great depression, minnesota passed a law that modified lender’s contractual rights of foreclosure with their debtors. Home building & loan association v. View home equity ratescalculate rate & paymentview 30 year fixed ratesview rates Argued november 8, 9, 1933 decided january 8, 1934 appeal from the. The court's decision in home building and loan association v. The blaisdells (plaintiffs) were a minneapolis couple who defaulted on their mortgage. Minnesota's statute authorized a state court, on application from a debtor, to exempt property. Supreme court upheld the minnesota mortgage moratorium act of 1933 over a charge that it was a violation of the. Trial court granted extension for δ supreme court. Home building & (and) loan. Blaisdell was important not only because it upheld a critical state law passed during the great depression but also because it. The constitutionality of the law was. Blaisdell was decided during the depth of the great depression and has been criticized by modern conservative and libertarian commentators. The court's decision in home building and loan association v. That they lived in part of. Home bldg & (and) l. View home equity ratescalculate rate & paymentview 30 year fixed ratesview rates The court's decision in home building and loan association v. The defendants, the blaisdells, obtained a court order under the act extending the period of redemption on condition that they pay the association $40 per month, thus, the court modified. View home equity ratescalculate rate & paymentview 30 year fixed ratesview rates A court granted an extension to the blaisdells. This document summarizes the supreme court case home building & loan association v. Supreme court of united states. Their property was sold in a foreclosure sale to the home building & loan association (association). As an emergency measure, during the great depression, minnesota passed a law that modified lender’s contractual rights of foreclosure with their debtors. Blaisdell was important not. 398, see flags on bad law, and search casetext’s comprehensive legal database From the 1830s until the great depression, a type of thrift institution known as building and loan associations made home loans more broadly accessible. Blaisdell, which upheld the minnesota mortgage moratorium law passed in 1933 during the. The constitutionality of the law was. As an emergency measure, during. The appellant, home building & loan assn. View home equity ratescalculate rate & paymentview 30 year fixed ratesview rates This document summarizes the supreme court case home building & loan association v. As an emergency measure, during the great depression, minnesota passed a law that modified lender’s contractual rights of foreclosure with their debtors. Blaisdell was important not only because it upheld a critical state law passed during the great depression but also because it. Minnesota's statute authorized a state court, on application from a debtor, to exempt property from final foreclosure for no more than two years, during which time the creditor must be paid. Home building & loan association v. Blaisdell, which upheld the minnesota mortgage moratorium law passed in 1933 during the. Blaisdell is a landmark supreme court case from 1934 that addressed the contract clause of the constitution, particularly in the context of economic. A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building and loan association, which was. Argued november 8, 9, 1933 decided january 8, 1934 appeal from the. Appellant contests the validity of the minnesota mortgage moratorium law, as being repugnant to the contract clause. In a proceeding under the statute, it appeared that the applicants, man and wife, owned a lot in a closely built section of a large city on which were a house and garage; Trial court granted extension for δ supreme court. Home bldg & (and) l. Their property was sold in a foreclosure sale to the home building & loan association (association).Chapter 4 The President ’ s National Security Powers. ppt download

Home Building & Loan Ass'n v. Blaisdell (1934) Overview LSData Case

Home Building & Loan Ass'n v. Blaisdell...

Home Building Loan Assn. v. Blaisdell PDF Mortgage Law Contract

Home Building & Loan Ass'n v. Blaisdell...

Home Building & Loan Ass'n v. Blaisdell...

Home Building & Loan Ass'n v. Blaisdell...

Home Building & Loan Ass'n v. Blaisdell...

604 House Building Loan Assoc. V Blaisdell (Alfaro) PDF

Home Building & Loan Ass'n v. Blaisdell HOME BUILDING & LOAN ASS’N v

The Defendants, The Blaisdells, Obtained A Court Order Under The Act Extending The Period Of Redemption On Condition That They Pay The Association $40 Per Month, Thus, The Court Modified.

Appellant Contests The Validity Of Chapter 339 Of The Laws Of Minnesota Of 1933, P.

514, Approved April 18, 1933, Called The Minnesota Mortgage Moratorium Law, As Being Repugnant To The.

398 (1934), Also Called The Minnesota Mortgage Moratorium Case, Was A Decision Of The United States Supreme Court Holding That Minnesota's Suspension Of Creditors' Remedies Was Not In Violation Of The Contract Clause Of The United States Constitution.

Related Post: