Home Equity Loan To Build Addition

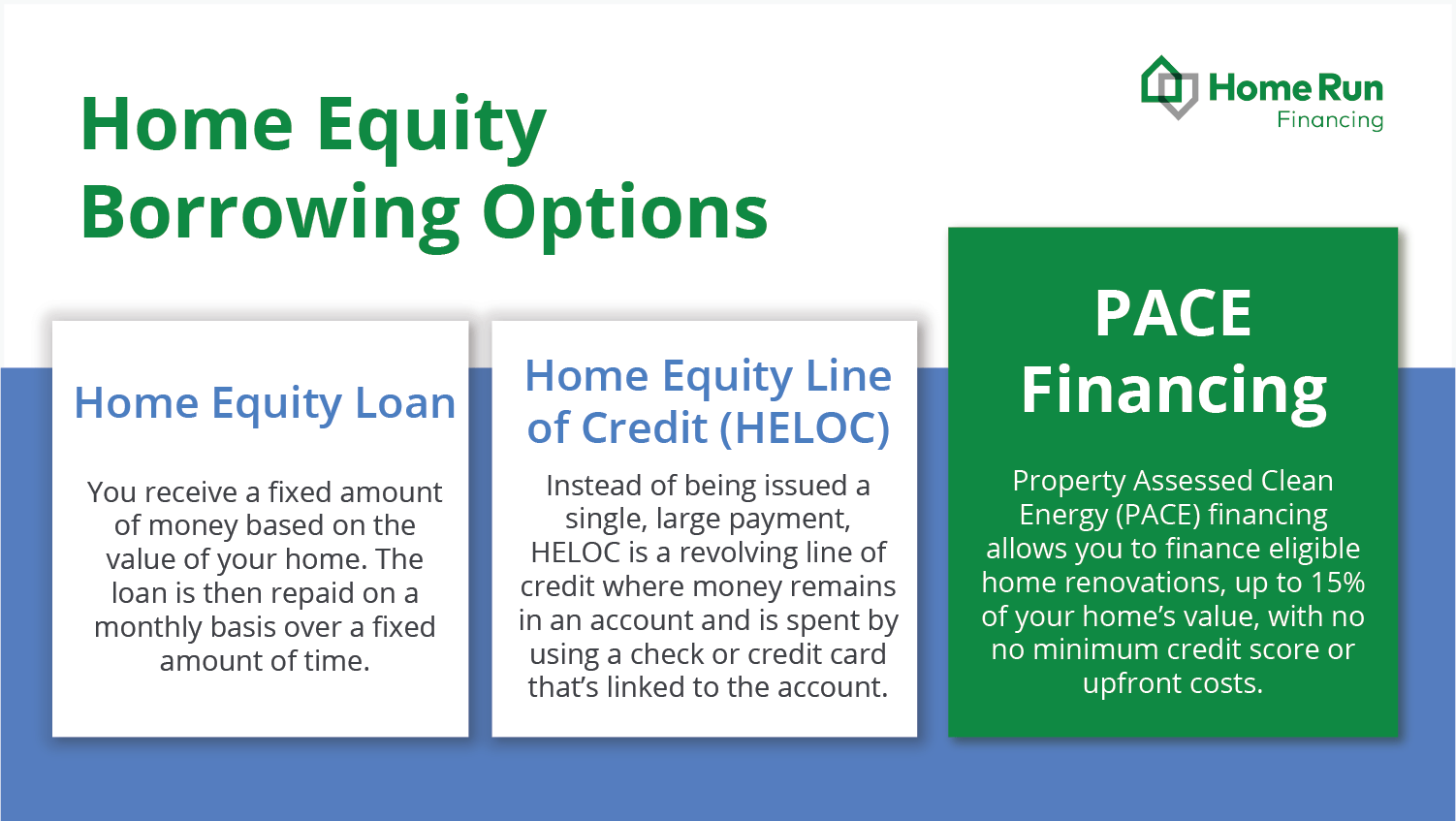

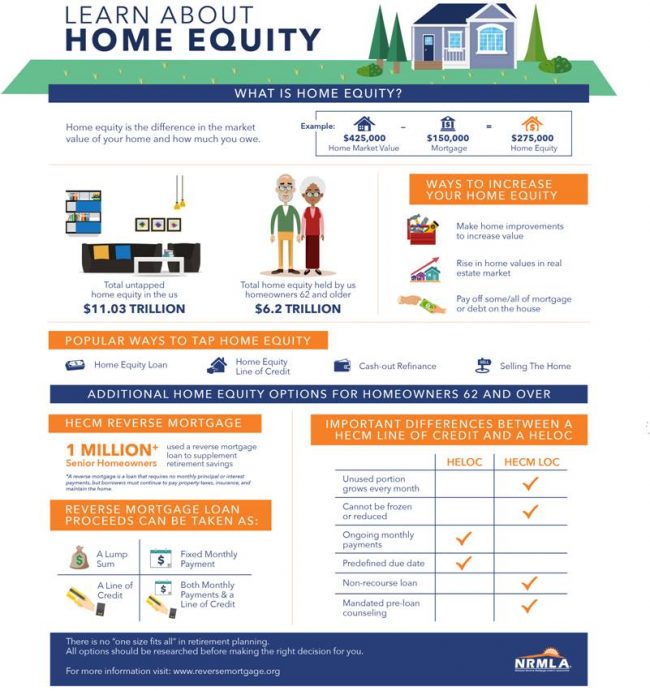

Home Equity Loan To Build Addition - So, if you have $80,000 worth of equity in your home, your lender will generally cap your home equity loan at $64,000 — or 80% of the $80,000 in equity. This type of loan is similar to a. On a $100,000 home equity loan, you could be. A home equity loan or line of credit (heloc) allows you to tap into any equity you have already amassed through paying off your mortgage to release a lump sum that can then be used to pay for your addition. The home equity contract market is relatively small, with its total volume estimated to be between $2 billion to $3 billion, but the industry predicts the market will continue to grow. And yes, we’re talking about another loan, but this one is for. Don't forget about the closing costs tied to home equity loans, which typically run between 2% and 5% of the loan amount. These options leverage your home’s value to secure. Here are the best ways to finance a home addition by tapping into your equity. Rather than paying off your home renovation debt over 30 years, a home equity loan (second mortgage) gives you a separate monthly bill to cover the costs of your home. This type of loan is similar to a. Don't forget about the closing costs tied to home equity loans, which typically run between 2% and 5% of the loan amount. Here are the best ways to finance a home addition by tapping into your equity. A home equity loan or line of credit (heloc) allows you to tap into any equity you have already amassed through paying off your mortgage to release a lump sum that can then be used to pay for your addition. When financing a home addition, start by determining the cost and assessing your finances. With a home equity loan or home equity line of credit, you may be able to borrow as much as 100% of your equity for your building project, although you will likely pay a higher interest rate. Homeowners can borrow against their existing equity and use it to finance the construction of an adu. $10,000 to $50,000+ best for: You are borrowing off of the equity built up in your property, essentially using your home as collateral for the loan. How much depends on a variety of factors, including. Home equity loans give people in need of money the chance to borrow a lump sum of cash using their home as collateral. This article explores financing options to turn your adu dream into a. A home equity loan or line of credit (heloc) allows you to tap into any equity you have already amassed through paying off your mortgage. Another option to finance a home addition is through a home equity loan or home equity line of credit (also known as heloc). $10,000 to $50,000+ best for: This article explores financing options to turn your adu dream into a. With a home equity loan or home equity line of credit, you may be able to borrow as much as. This guide will simplify the process and help you explore different loans,. The home equity contract market is relatively small, with its total volume estimated to be between $2 billion to $3 billion, but the industry predicts the market will continue to grow. $10,000 to $50,000+ best for: While home improvement loans typically cap at $50,000 to $100,000, you’re able. Home equity loans give people in need of money the chance to borrow a lump sum of cash using their home as collateral. Don't forget about the closing costs tied to home equity loans, which typically run between 2% and 5% of the loan amount. With a home equity loan or home equity line of credit, you may be able. Keep reading to learn about the various. 1 apply for a fixed home equity loan or home equity line of credit (heloc) from january 1, 2025, through june 30, 2025, and $20 will be donated after closing your loan. Financing a home addition can feel complicated, but it's important to find the right option to fit your project and budget.. This type of loan is similar to a. While home improvement loans typically cap at $50,000 to $100,000, you’re able to borrow up to 85% of your home's equity (primary mortgage and home equity loan combined). Home equity loans give people in need of money the chance to borrow a lump sum of cash using their home as collateral. Another. And yes, we’re talking about another loan, but this one is for. On a $100,000 home equity loan, you could be. When financing a home addition, start by determining the cost and assessing your finances. This article explores financing options to turn your adu dream into a. Financing a home addition can feel complicated, but it's important to find the. This article explores financing options to turn your adu dream into a. Here are the best ways to finance a home addition by tapping into your equity. How much depends on a variety of factors, including. You are borrowing off of the equity built up in your property, essentially using your home as collateral for the loan. Don't forget about. A home equity loan or line of credit (heloc) allows you to tap into any equity you have already amassed through paying off your mortgage to release a lump sum that can then be used to pay for your addition. Homeowners can borrow against their existing equity and use it to finance the construction of an adu. Rather than paying. Another option to finance a home addition is through a home equity loan or home equity line of credit (also known as heloc). The home equity contract market is relatively small, with its total volume estimated to be between $2 billion to $3 billion, but the industry predicts the market will continue to grow. Financing a home addition can feel. Keep reading to learn about the various. Another option to finance a home addition is through a home equity loan or home equity line of credit (also known as heloc). On a $100,000 home equity loan, you could be. How much depends on a variety of factors, including. Here are the best ways to finance a home addition by tapping into your equity. 1 apply for a fixed home equity loan or home equity line of credit (heloc) from january 1, 2025, through june 30, 2025, and $20 will be donated after closing your loan. So, if you have $80,000 worth of equity in your home, your lender will generally cap your home equity loan at $64,000 — or 80% of the $80,000 in equity. You are borrowing off of the equity built up in your property, essentially using your home as collateral for the loan. A fha construction loan is a home loan insured by the federal housing administration that allows qualified borrowers to finance the build or rehab of a new home. This guide will simplify the process and help you explore different loans,. While home improvement loans typically cap at $50,000 to $100,000, you’re able to borrow up to 85% of your home's equity (primary mortgage and home equity loan combined). When financing a home addition, start by determining the cost and assessing your finances. Home equity loans are the most similar to your initial mortgage. The home equity contract market is relatively small, with its total volume estimated to be between $2 billion to $3 billion, but the industry predicts the market will continue to grow. These options leverage your home’s value to secure. Financing a home addition can feel complicated, but it's important to find the right option to fit your project and budget.What Home Equity Is & How to Use It Home Run Financing

Requirements for a Home Equity Loan or HELOC in 2022

What Home Equity Is & How to Use It Home Run Financing

Infographic How Can You Use Home Equity? RISMedia's Housecall

Am I Eligible For A Home Equity Loan Home Rulend

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

What is a Home Equity Loan? The People's Federal Credit Union

How to Finance a Home Addition? 6 Ways to Fund Your Plans

What Is Home Equity and What Can It Do For You? Credible

Getting a Home Equity Loan What It Is and How It Works NerdWallet

A Home Equity Loan Or Line Of Credit (Heloc) Allows You To Tap Into Any Equity You Have Already Amassed Through Paying Off Your Mortgage To Release A Lump Sum That Can Then Be Used To Pay For Your Addition.

$10,000 To $50,000+ Best For:

This Article Explores Financing Options To Turn Your Adu Dream Into A.

This Type Of Loan Is Similar To A.

Related Post: