How Can I Build Business Credit

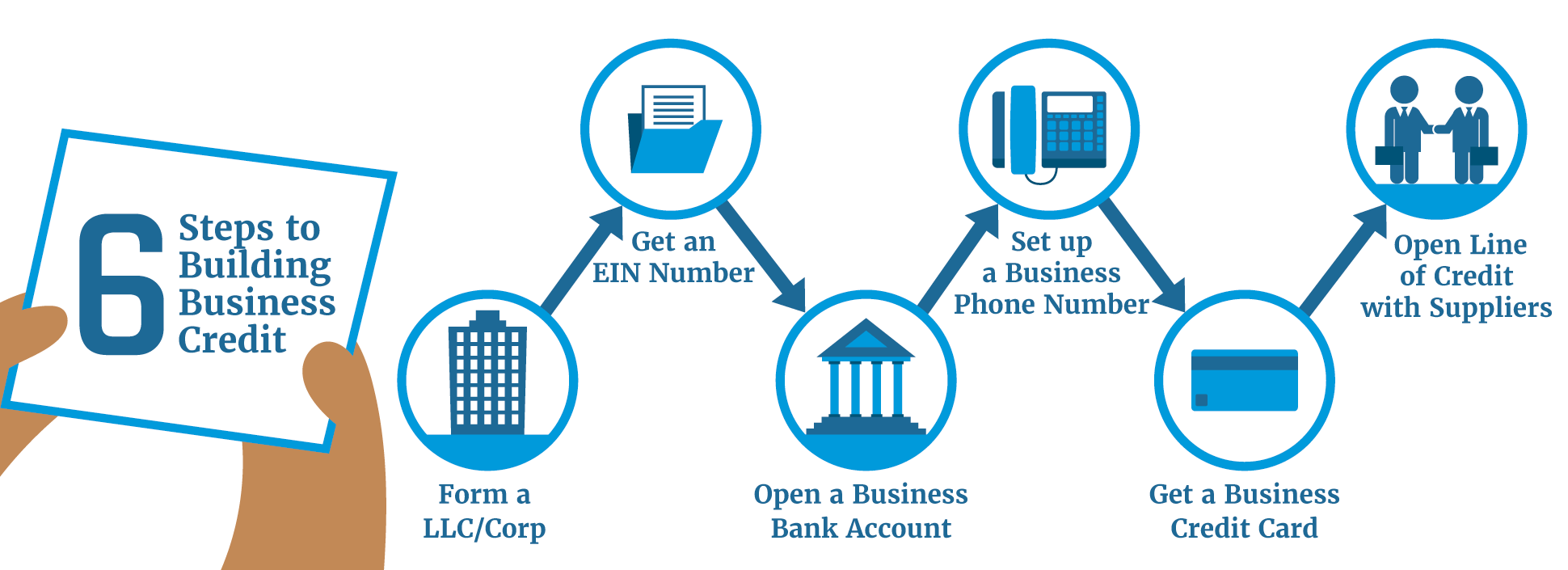

How Can I Build Business Credit - We’ll cover the basics of what business credit is, how it’s used, and tips on how you can build your business’s credit. Open a business banking account. It can give you access to. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. We explore how to build business credit with these proven tactics. In this article, we’ll explore how to. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. It’s not just about getting a loan when you’re in a pinch. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan options. Building business credit is a critical step for any business looking to secure future financing, manage cash flow effectively, and establish a trustworthy. Apply for a business duns number. Take these steps to establish and build a solid credit rating for your company. Apply for a business line of credit or loan once. We’ll cover the basics of what business credit is, how it’s used, and tips on how you can build your business’s credit. Here are six steps for how to build your business credit. Finding the perfect business credit card can improve how your company manages money, tracks expenses, and fuels growth. Building business credit is like laying the groundwork for future success. In this article, we’ll explore how to. Let’s look at the ten. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Here are eight steps to building business credit, including registering your business, opening a business bank account and applying for trade credit. Yet as the market expands with specialized options—from. Establishing and managing business credit can help your company secure financing when you need it and with better terms. We’ll cover the basics of what business credit is, how it’s. Here are the eleven steps in our challenge: Building business credit is a critical step for any business looking to secure future financing, manage cash flow effectively, and establish a trustworthy. It’s not just about getting a loan when you’re in a pinch. Establishing an llc and building strong business credit can help your business qualify for a wider range. It can give you access to. A solid business credit profile can open doors to. Follow these five steps to choose the right business structure,. New businesses don’t have an established financial history that lenders can use to verify their risk. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment. It’s not just about getting a loan when you’re in a pinch. A business credit card can help you separate your business and personal purchases, making expense tracking and tax preparation easier. Building business credit is like laying the groundwork for future success. Build strong business credit by registering your business, getting a duns number,. Learn how to improve your. Building business credit can benefit your small business in many ways. A business credit card can help you separate your business and personal purchases, making expense tracking and tax preparation easier. It can give you access to. Learn how to establish a credit file separate from you as an individual and improve your company's funding ability. We’ll cover the basics. It’s not just about getting a loan when you’re in a pinch. Make sure your business is legit. Establish a business address and phone number. A solid business credit profile can open doors to. Apply for a business line of credit or loan once. Here’s everything you need to know. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. Making sure your. Learn how to establish a credit file separate from you as an individual and improve your company's funding ability. Getting a business credit score can help your business establish itself. Here are six steps for how to build your business credit. Building business credit can benefit your small business in many ways. Here are eight steps to building business credit,. Before you can establish credit for. It’s not just about getting a loan when you’re in a pinch. In this article, we’ll explore how to. Let’s look at the ten. Here are the eleven steps in our challenge: Learn how to establish a credit file separate from you as an individual and improve your company's funding ability. Lenders will likely check your business credit score. Apply for a business duns number. It can also help you negotiate supply. Here are six steps for how to build your business credit. Yet as the market expands with specialized options—from. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. Establishing and managing business credit can help your company secure financing when you need it and with better terms. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. Learn how to improve your business credit score by setting up your. A solid business credit profile can open doors to. Building business credit is a critical step for any business looking to secure future financing, manage cash flow effectively, and establish a trustworthy. Establish a business address and phone number. Let’s look at the ten. Here are eight steps to building business credit, including registering your business, opening a business bank account and applying for trade credit. It can give you access to. Set yourself up for success with these simple steps to build business credit. It’s not just about getting a loan when you’re in a pinch. Finding the perfect business credit card can improve how your company manages money, tracks expenses, and fuels growth. Make small purchases on your business credit card and pay them off in full every month to build a solid credit history. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan options.How to Build Business Credit

7 Easy steps to build the business credit you need in 30 days Top

5 Tips to Build Your Business Credit

How To Build Credit For Your Business Behalfessay9

How to Build Business Credit 7 Easy Steps Franklin Capital

How to Build Business Credit Fast Credit Suite

How To Build Business Credit? GoKapital

How to build business credit in 10 steps QuickBooks

How to Build Business Credit for a Small Business

How to Build Business Credit (StepbyStep Guide) WealthFit

Building Business Credit Is Like Laying The Groundwork For Future Success.

It Can Also Help You Negotiate Supply.

The Better Your Business Credit Score, The More Likely You Are To Be Accepted For Financing And The More.

Building Business Credit Can Benefit Your Small Business In Many Ways.

Related Post: