How Do You Build Credit For A Business

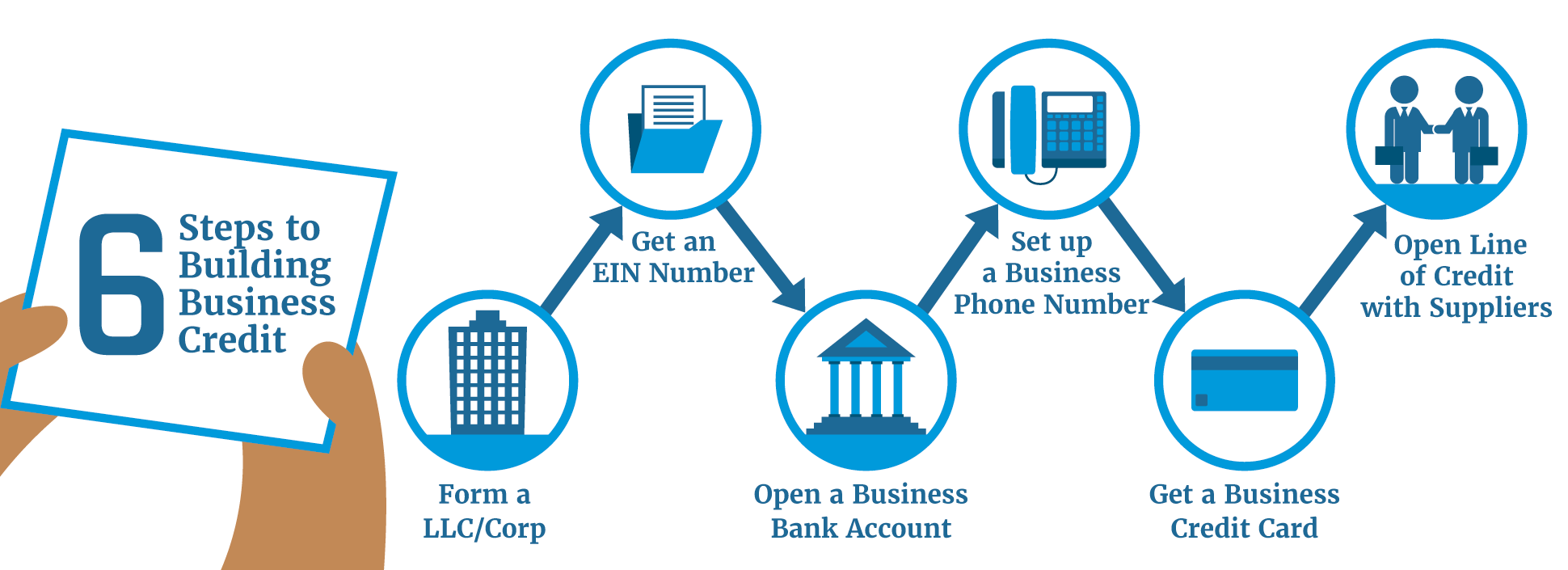

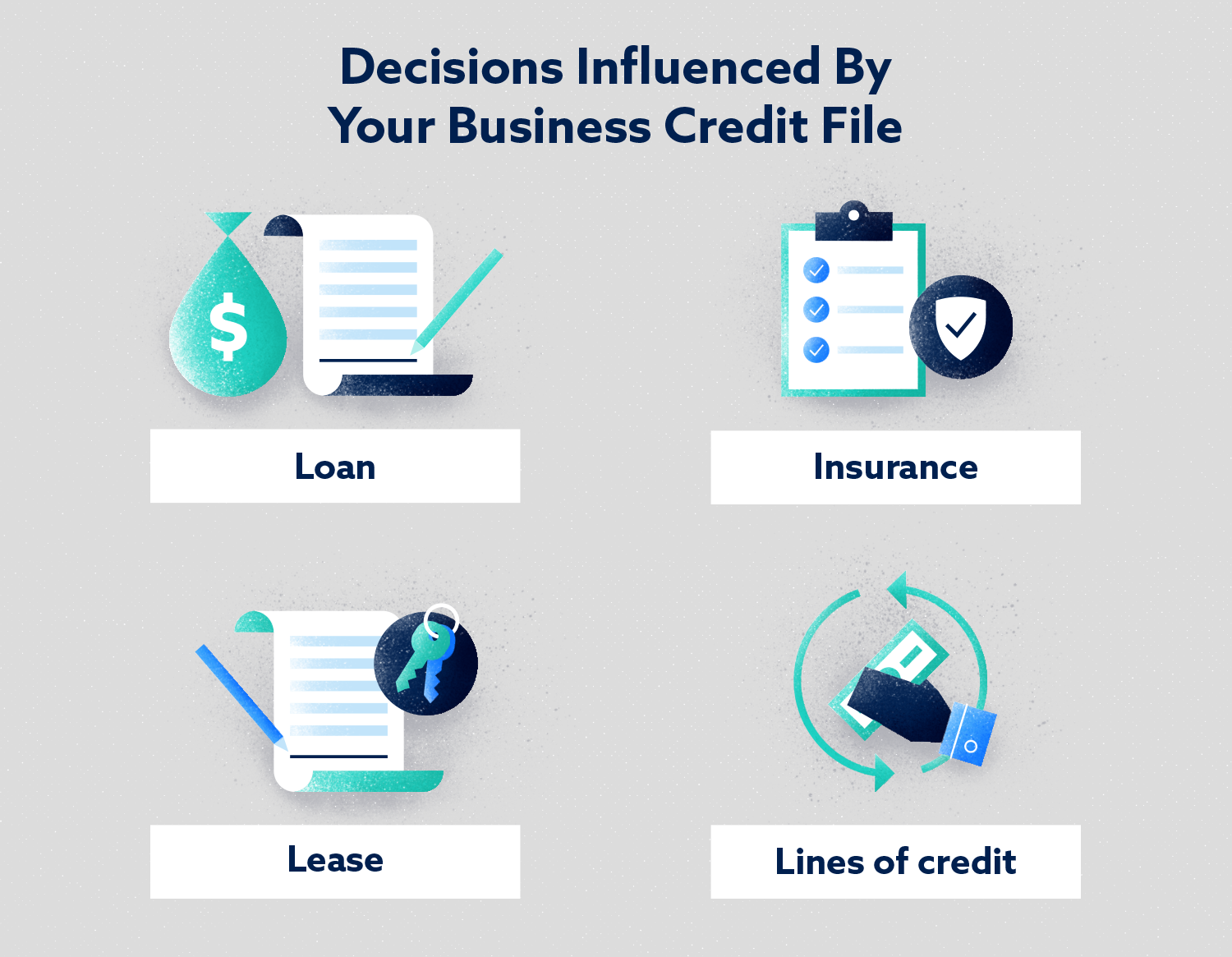

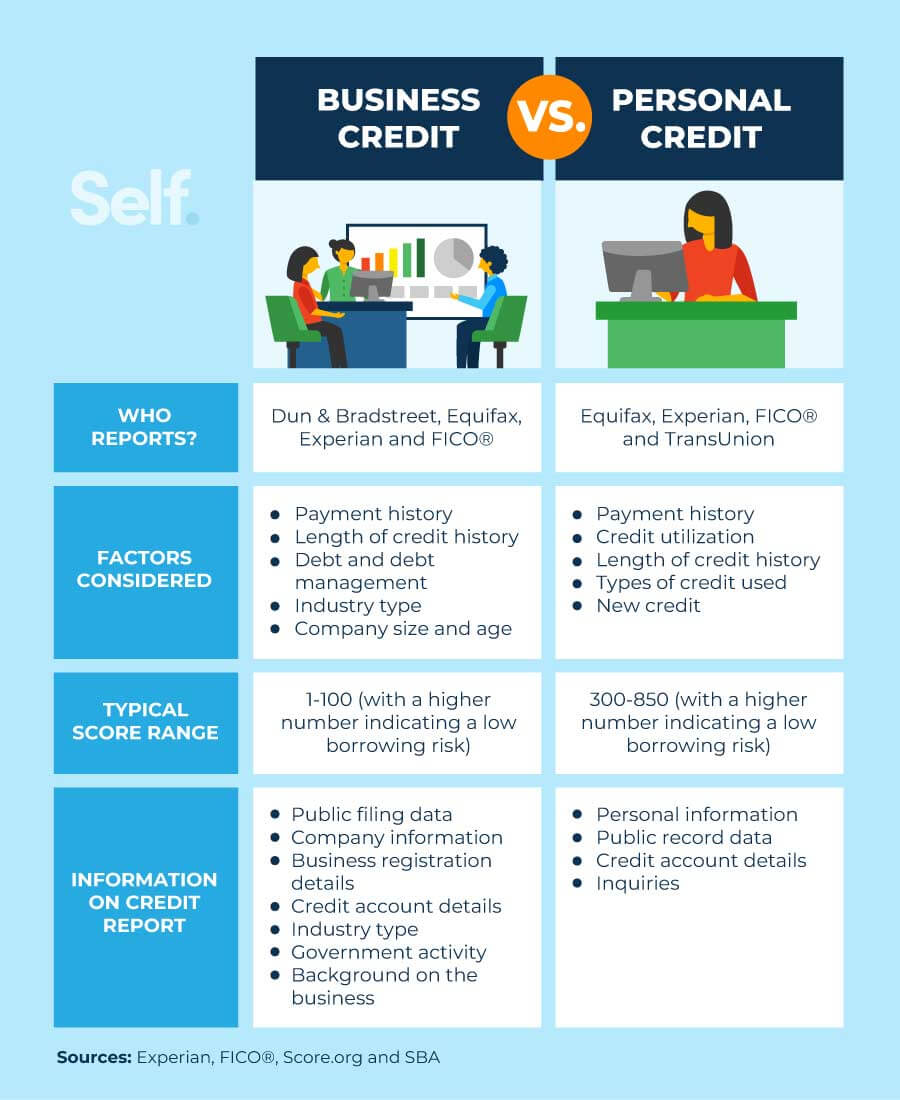

How Do You Build Credit For A Business - Building business credit is like laying the groundwork for future success. To keep your business and personal finances separate, the first step is to start building credit in your company’s name. This article provides a concise guide outlining the key steps on how to build. Iwoca is a leading uk business loan provider that empowers sme. Here are 10 steps on how to get business credit. Registering your business as a separate entity is the first step to building business credit. Here are eight steps to building business credit, including registering your business, opening a business bank account and applying for trade credit. Establishing and managing business credit can help your company secure financing when you need it and with better terms. While this step does not automatically give you a business credit score, formally starting. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your business grow. Open a business banking account. Establish trade lines and vendor credit. These are the first steps you need to take to establish business credit for your business. When you apply for a business line of credit, lenders want to make sure that you can manage the debt responsibly. It can also help you negotiate supply. Iwoca is a leading uk business loan provider that empowers sme. Here are eight steps to building business credit, including registering your business, opening a business bank account and applying for trade credit. Four steps you can take to ensure creditors can validate your business information. Once registered, your llc’s credit activity will start being tracked, helping you build a business credit score. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Register your business as a separate entity. When you apply for a business line of credit, lenders want to make sure that you can manage the debt responsibly. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. To keep your business and personal finances separate,. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your business grow. When you apply for a business line of credit, lenders want to make sure that you can manage the debt responsibly. Register your business as a separate entity. The first step toward. Here are 10 steps on how to get business credit. Set yourself up for success with these simple steps to build business credit. Getting a business credit score can help your business establish itself. When you apply for a business line of credit, lenders want to make sure that you can manage the debt responsibly. Establishing an llc and building. Before you establish business credit for the first time, the first step is to structure your business as a separate legal entity. Building business credit can benefit your small business in many ways. Once registered, your llc’s credit activity will start being tracked, helping you build a business credit score. It can also help you negotiate supply. Register your business. Iwoca is a leading uk business loan provider that empowers sme. Establishing and managing business credit can help your company secure financing when you need it and with better terms. To keep your business and personal finances separate, the first step is to start building credit in your company’s name. Your business must be a corporation or limited liability company. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan options. Getting a business credit score can help your business establish itself. Establish a business address and phone number. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and. Next, you will need to apply for a tax identification. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. It’s not just about getting a loan when you’re in a pinch. Your business must be a corporation or limited. Getting a business credit score can help your business establish itself. Register your business as a separate entity. Open a business banking account. The business entity you picked when starting your company can play a critical. Strong business credit can make it easier or less expensive to get certain types of financing, business. Set yourself up for success with these simple steps to build business credit. Strong business credit can make it easier or less expensive to get certain types of financing, business. These are the first steps you need to take to establish business credit for your business. Establishing an llc and building strong business credit can help your business qualify for. Iwoca is a leading uk business loan provider that empowers sme. This article provides a concise guide outlining the key steps on how to build. Set yourself up for success with these simple steps to build business credit. Here are 10 steps on how to get business credit. The first step toward building business credit is to establish your business. To qualify for the best business financing, you need to have a solid. Your business must be a corporation or limited liability company (llc) to be assigned a business. Without business credit, you may have to personally guarantee all business expenses, putting your personal assets at risk. A solid business credit profile can open doors to. Build strong business credit by registering your business, getting a duns number,. Here are 10 steps on how to get business credit. Establish trade lines and vendor credit. This article provides a concise guide outlining the key steps on how to build. While this step does not automatically give you a business credit score, formally starting. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan options. Register your business as a separate entity. Establish a business address and phone number. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. If you want to build business credit quickly here are. A good business credit score can help provide better access to commercial loans and lines of credit, lower interest rates and even cheaper business insurance premiums. The first step toward building business credit is to establish your business legally as.How to Build Business Credit Fast Credit Suite

How to Build Business Credit for a Small Business

5 Tips to Build Your Business Credit

How to Build Business Credit the Right Way Lexington Law

How to Build Business Credit 7 Easy Steps Franklin Capital

How to Build Business Credit Fast The 10 Best Ways AMP Advance

How To Build Credit For Your Business Behalfessay9

How to Build Business Credit 7 Expert Tips to Build Credit Fast (2024)

How to Build Business Credit (StepbyStep Guide) WealthFit

How Long Does It Take To Build Business Credit? Self. Credit Builder.

It Can Also Help You Negotiate Supply.

Understanding How To Build Business Credit Is Vital As It Can Be Used To Secure Loans, Lines Of Credit, And Other Financial Assistance To Help Your Business Grow.

Getting A Business Credit Score Can Help Your Business Establish Itself.

The First Step In Effectively Building Your Business Credit Is Understanding The Factors That Impact Credit Scores And How To Manage And Improve Them.

Related Post: