How Do You Pay To Build A House

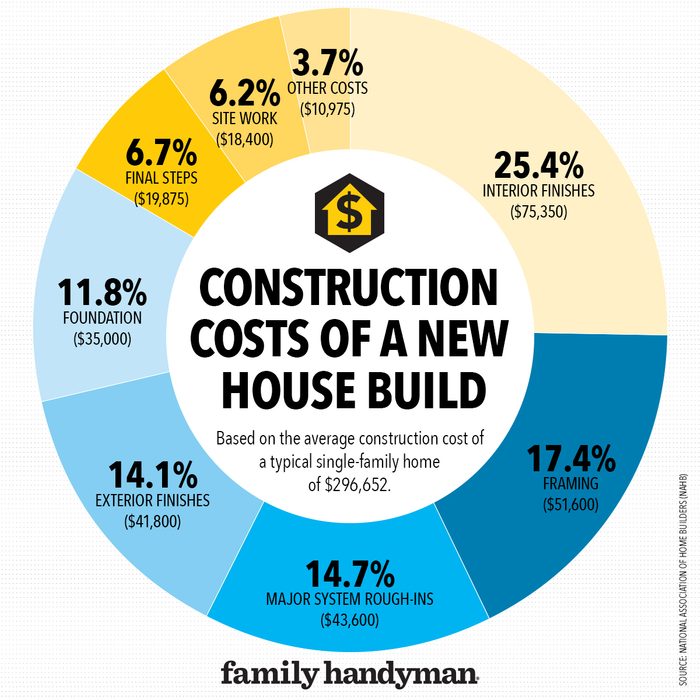

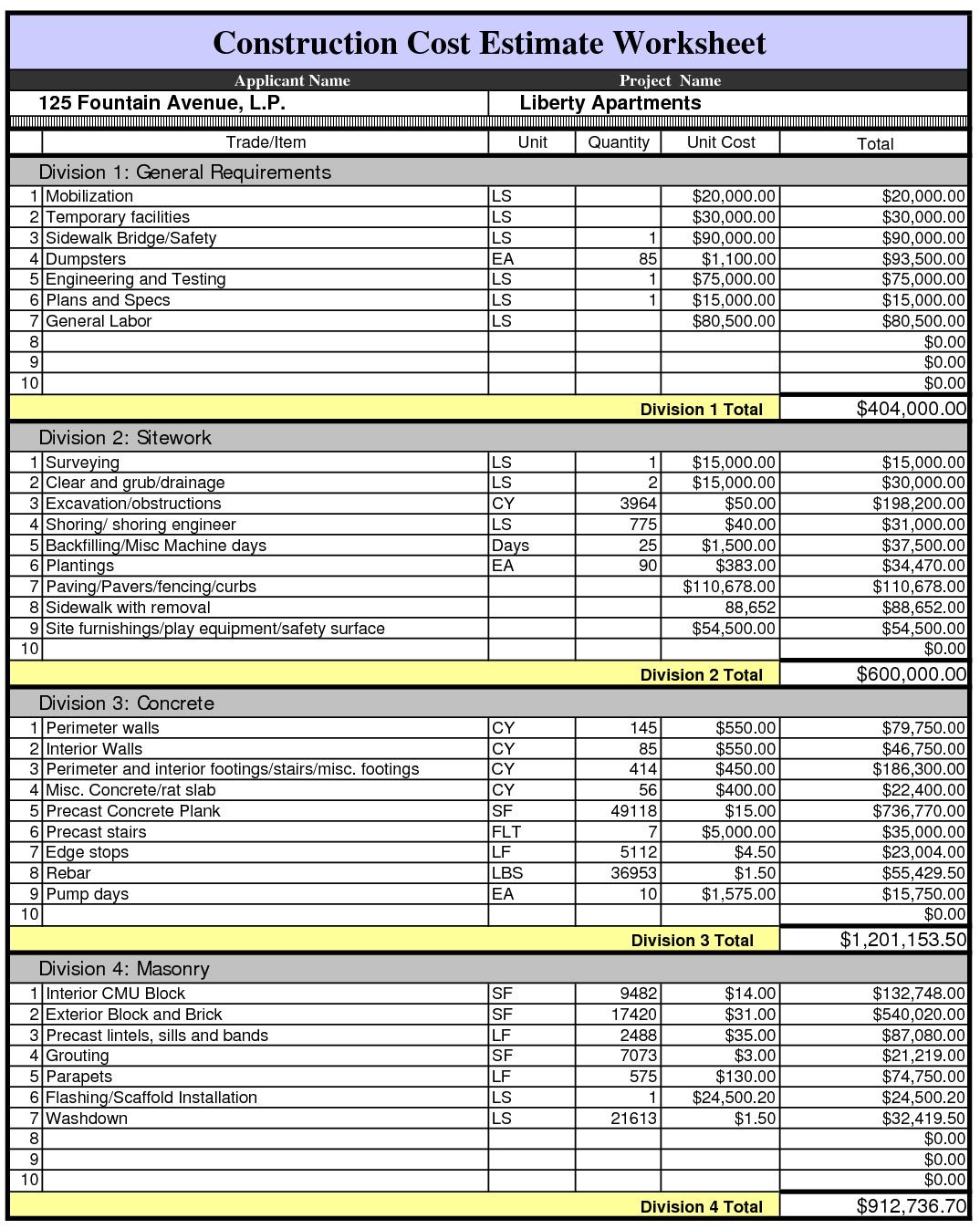

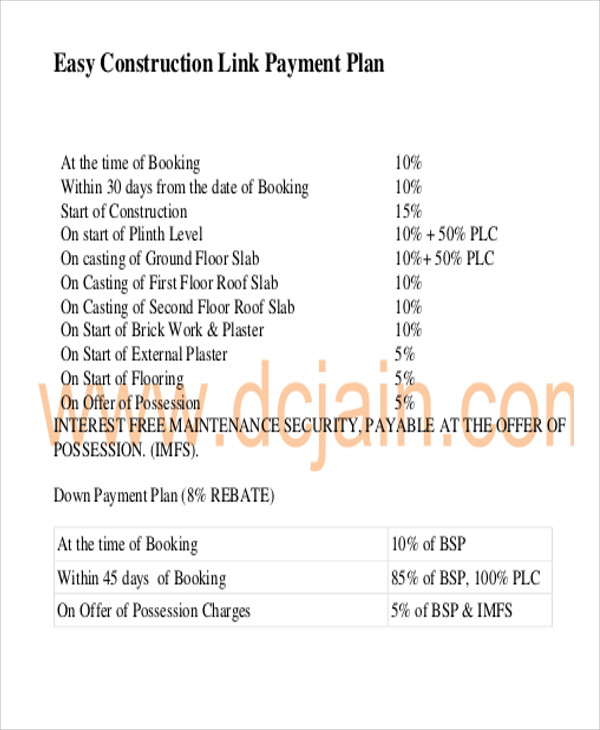

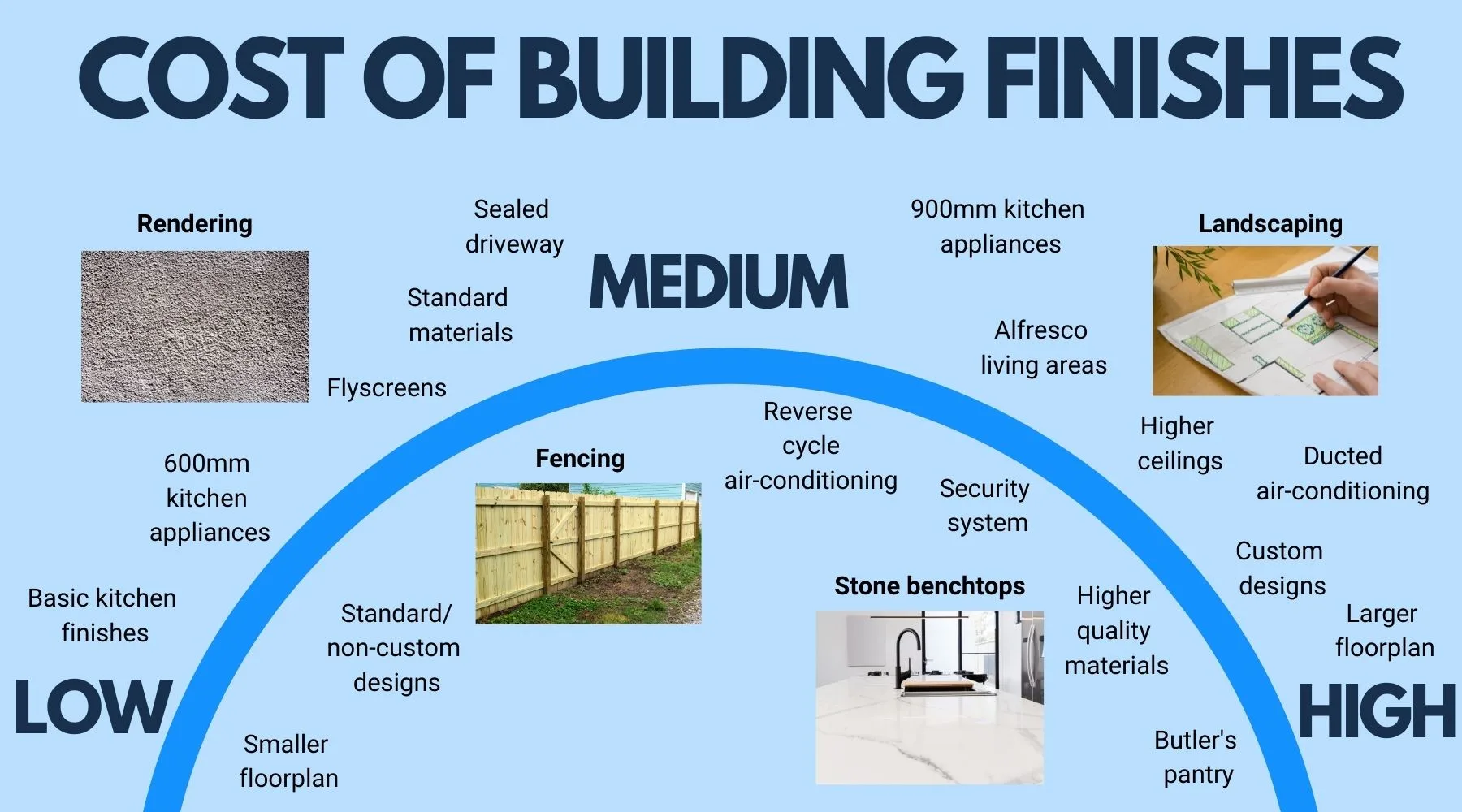

How Do You Pay To Build A House - But, depending on location and home features, the cost of building a house is comparable to buying an existing home. New home construction costs $100 to $155 per square foot on average with most homeowners paying $155,000 to $416,250, in addition to the cost of your land. This is the amount you pay upfront toward your home purchase. The idea of building a new home might scare you because you believe it’s the pricier option. The average new home costs $296,652 to build, according to the national association of home builders’. You want to borrow $200,000 at an annual interest rate of 6% for 30 years. The amount of money you borrowed. In other words, if you pay $2,000 each month in debt services and you make $4,000 each month, your ratio is 50%—half of your monthly income is used to pay the debt. Building practices, the cost of labor, the cost of land, and to some extent the cost of materials can vary from place to place and depend on the nature of. Location, home size, materials, permits, and finishes all play a role. However, that excludes the cost of buying. The average new home costs $296,652 to build, according to the national association of home builders’. In 2022, a new home in the u.s. The traditional monthly mortgage payment calculation includes: Under certain loan programs, a down payment amount. Cost $392,241 to build on average, according to the national association of home builders (nahb). Construction costs typically account for around 75 to 80 percent of the total cost of a home build. Typically, the recommended amount is 20% of your purchase price. You want to borrow $200,000 at an annual interest rate of 6% for 30 years. New home construction costs $100 to $155 per square foot on average with most homeowners paying $155,000 to $416,250, in addition to the cost of your land. When determining the overall construction costs of building a new home, there are several factors to consider. Under certain loan programs, a down payment amount. You start paying for a new construction home after the closing of the deal and starting your mortgage. Typically, the recommended amount is 20% of your purchase price. Real estate agents may also provide a. The 6% annual becomes 0.5% monthly (0.005 as a. Under certain loan programs, a down payment amount. You start paying for a new construction home after the closing of the deal and starting your mortgage. Typically, the recommended amount is 20% of your purchase price. This complete guide explores the factors. Under certain loan programs, a down payment amount. But, depending on location and home features, the cost of building a house is comparable to buying an existing home. When determining the overall construction costs of building a new home, there are several factors to consider. You want to borrow $200,000 at an annual interest rate of 6% for 30 years.. Read on to learn how home construction loans work, how they differ from conventional mortgages, what you need to qualify, and what happens once your home build is complete. The amount of money you borrowed. Labor and materials make up the. The cost of the loan. You start paying for a new construction home after the closing of the deal. This is the amount you pay upfront toward your home purchase. In 2022, a new home in the u.s. New home construction costs $100 to $155 per square foot on average with most homeowners paying $155,000 to $416,250, in addition to the cost of your land. When determining the overall construction costs of building a new home, there are several. Typically, the recommended amount is 20% of your purchase price. However, that excludes the cost of buying. This is the amount you pay upfront toward your home purchase. You start paying for a new construction home after the closing of the deal and starting your mortgage. Real estate agents may also provide a home warranty as part of a thank. The cost of the loan. Real estate agents may also provide a home warranty as part of a thank you for the sale and to welcome the new owners to the house. The cost of purchasing the land, preparing the lot (including septic and sewer. When do you start paying for a new construction home? Cost $392,241 to build on. The 6% annual becomes 0.5% monthly (0.005 as a. This is the amount you pay upfront toward your home purchase. Use this calculator to quickly determine what type of loan you might qualify for and what you can. Under certain loan programs, a down payment amount. The idea of building a new home might scare you because you believe it’s. Building practices, the cost of labor, the cost of land, and to some extent the cost of materials can vary from place to place and depend on the nature of. Building a house can be a thrilling but costly venture, and the total cost varies based on location, materials, and the home’s size. The cost of purchasing the land, preparing. First, convert the interest rate to a monthly rate. Construction costs typically account for around 75 to 80 percent of the total cost of a home build. This complete guide explores the factors. The average new home costs $296,652 to build, according to the national association of home builders’. But, depending on location and home features, the cost of building. First, convert the interest rate to a monthly rate. The cost of the loan. Building a house can be a thrilling but costly venture, and the total cost varies based on location, materials, and the home’s size. New home construction costs $100 to $155 per square foot on average with most homeowners paying $155,000 to $416,250, in addition to the cost of your land. In other words, if you pay $2,000 each month in debt services and you make $4,000 each month, your ratio is 50%—half of your monthly income is used to pay the debt. Building practices, the cost of labor, the cost of land, and to some extent the cost of materials can vary from place to place and depend on the nature of. Construction costs typically account for around 75 to 80 percent of the total cost of a home build. Use this calculator to quickly determine what type of loan you might qualify for and what you can. You start paying for a new construction home after the closing of the deal and starting your mortgage. Cost $392,241 to build on average, according to the national association of home builders (nahb). Under certain loan programs, a down payment amount. However, that excludes the cost of buying. Although a great incentive, they also. Real estate agents may also provide a home warranty as part of a thank you for the sale and to welcome the new owners to the house. When determining the overall construction costs of building a new home, there are several factors to consider. The amount of money you borrowed.How To Get Money To Build A House How To Buy A House With No Money

Cost to build house Builders Villa

When Building A Home, When Do You Pay Storables

How Much Does It Cost to Build a House? The Family Handyman

Average cost to build your own home kobo building

Floor Plans And Estimated Cost To Build floorplans.click

22+ Payment Plan Templates Word, PDF

How much does it cost to build an average house kobo building

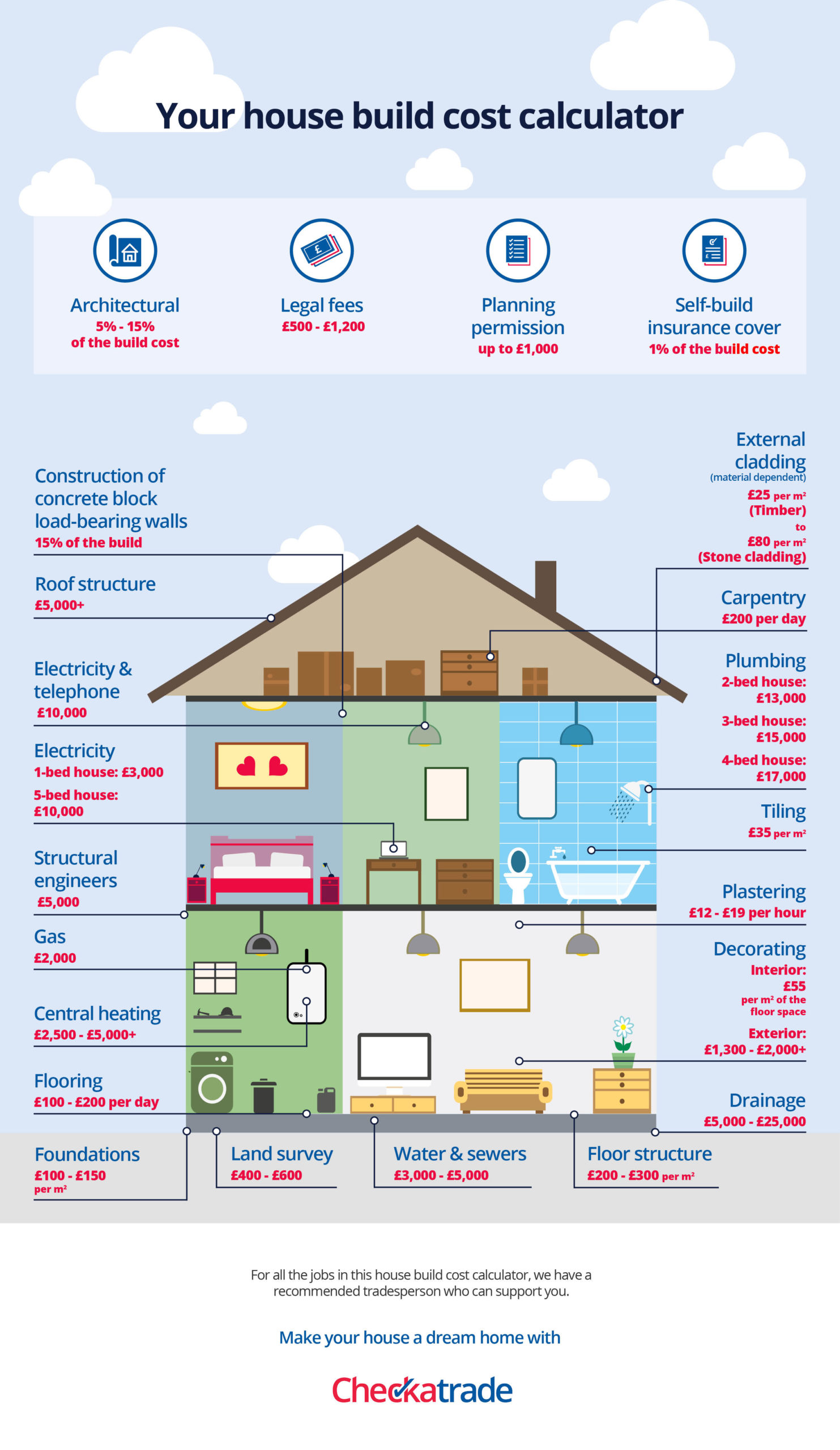

How Much Does a House Build Cost in 2024? Checkatrade

How to Build a House and Pay as You Go Building a house, Build your

Labor And Materials Make Up The.

The 6% Annual Becomes 0.5% Monthly (0.005 As A.

This Complete Guide Explores The Factors.

But, Depending On Location And Home Features, The Cost Of Building A House Is Comparable To Buying An Existing Home.

Related Post: