How Long Does It Take To Build Business Credit

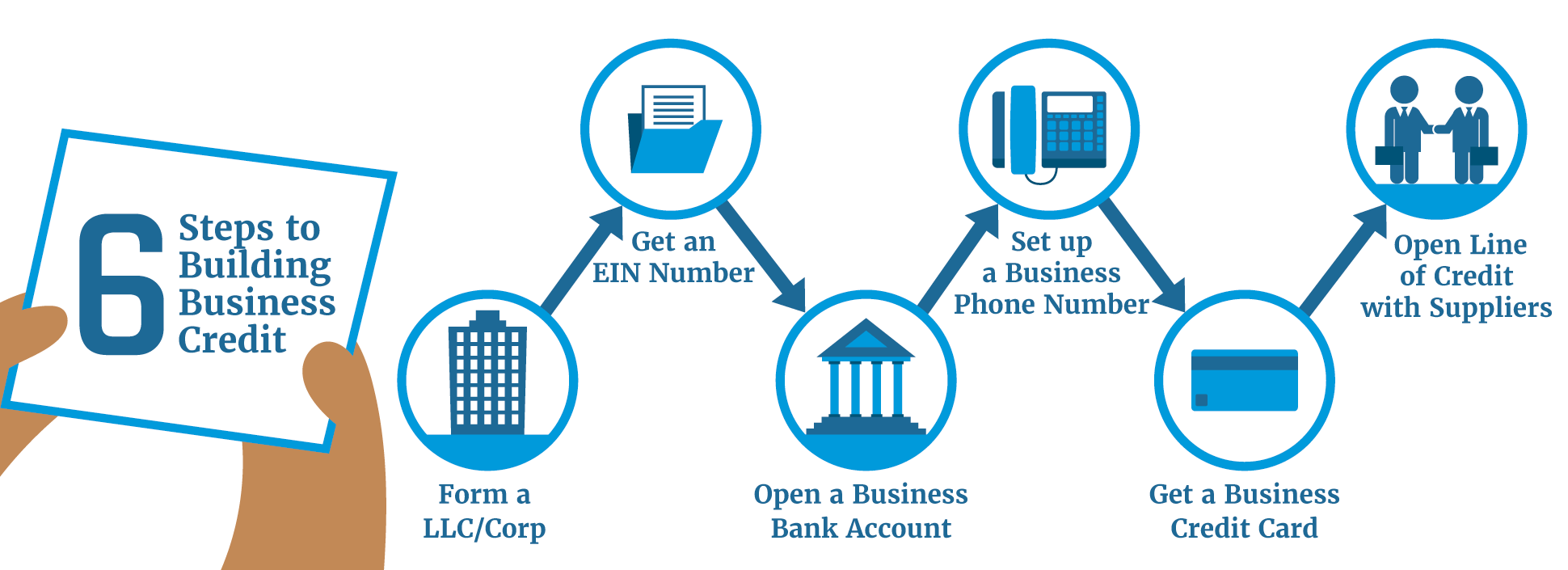

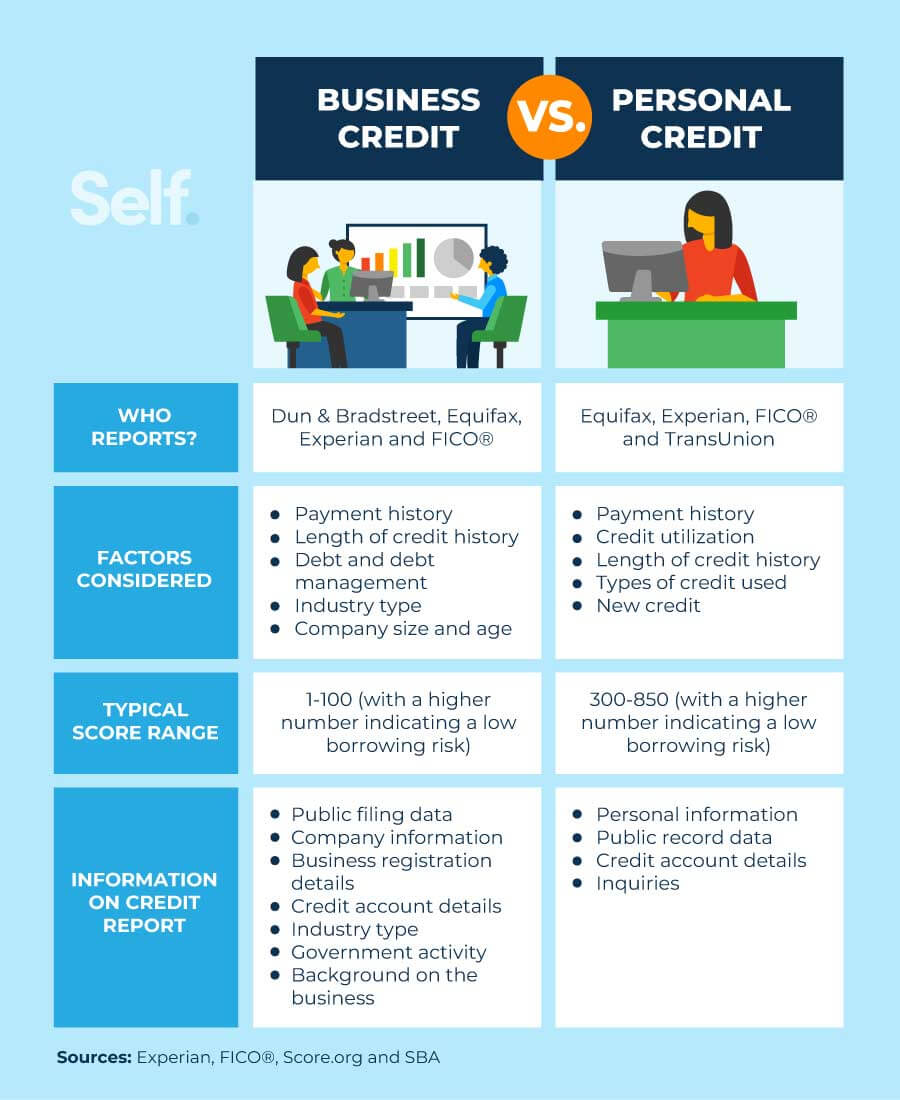

How Long Does It Take To Build Business Credit - Unlike personal credit, which can be established relatively quickly, business credit typically. Establishing and managing business credit can help your company secure financing when you need it and with better terms. To build business credit, you’ve got to know how to get on those bureaus’ radar. Building your business credit will take time. The steps above are important, but there are many. And, as with your personal credit, it can take time to build good business credit scores. Budget for quarterly or monthly. However, many small business owners don’t know where to start or assume they need years of history to build good credit. However, we know that registering your business, applying for business credit cards and opening tradelines with vendors can help build your business credit. Subscription services available for regular monitoring; This information can show others how you have managed. Lenders and vendors won’t extend credit to a business that doesn’t have a formal. Building your business credit will take time. These contain your company’s credit history. Business credit can be built under various legal structures, including sole proprietorships,. In this article, we’ll explore how to. The first step in building business credit is legally establishing your company as an llc. And, as with your personal credit, it can take time to build good business credit scores. You likely won’t build perfect credit scores overnight,. Building business credit can take anywhere from a few months to a few years. You likely won’t build perfect credit scores overnight,. And, as with your personal credit, it can take time to build good business credit scores. As your business grows, you’ll be able to develop and strengthen relationships with partners, vendors, and lenders—and it’s. Here are the eleven steps in our challenge:. Business credit can be built under various legal structures, including. How long does it take to build business credit? Unlike personal credit, which can be established relatively quickly, business credit typically. There’s no standard amount of time for establishing a business credit file. To build business credit, you’ve got to know how to get on those bureaus’ radar. Business credit is a term that describes several tools lenders, creditors and. How long does it take to build business credit? Subscription services available for regular monitoring; Building business credit can be a little more complicated than building personal credit. While it takes about 12 months to build solid business credit and as many as three years to build a comprehensive credit profile, you can start building at least some business. There’s. While building excellent business credit takes time, you can lay the groundwork for a stronger credit profile in just 30 days. Subscription services available for regular monitoring; And, as with your personal credit, it can take time to build good business credit scores. Building your business credit will take time. Unlike personal credit, which can be established relatively quickly, business. The steps above are important, but there are many. As your business grows, you’ll be able to develop and strengthen relationships with partners, vendors, and lenders—and it’s. Unlike personal credit, which can be established relatively quickly, business credit typically. How long does it take to build business credit? You can build business credit fast—even. You likely won’t build perfect credit scores overnight,. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Unlike personal credit, which can be established relatively quickly, business credit typically. To build business credit, you’ve got to know how to get on those bureaus’ radar. Subscription services available for regular monitoring; These contain your company’s credit history. To build business credit, you’ve got to know how to get on those bureaus’ radar. While building excellent business credit takes time, you can lay the groundwork for a stronger credit profile in just 30 days. Building business credit can be a little more complicated than building personal credit. While it takes about 12. The steps above are important, but there are many. How long does it take to build business credit? And, as with your personal credit, it can take time to build good business credit scores. While building excellent business credit takes time, you can lay the groundwork for a stronger credit profile in just 30 days. Subscription services available for regular. However, we know that registering your business, applying for business credit cards and opening tradelines with vendors can help build your business credit. In this article, we’ll explore how to. Ultimately, the act of borrowing and repaying funds on a business credit card or line of credit will help build business credit—given that you’re paying on time (or early, if.. These contain your company’s credit history. Unlike personal credit, which can be established relatively quickly, business credit typically. There’s no standard amount of time for establishing a business credit file. Lenders and vendors won’t extend credit to a business that doesn’t have a formal. Establishing an llc and building strong business credit can help your business qualify for a wider. The first step in building business credit is legally establishing your company as an llc. The amount of credit your business is currently using compared to the credit limit extended to your business determines your utilisation. You likely won’t build perfect credit scores overnight,. It can also help you negotiate supply. Building business credit can take anywhere from a few months to a few years. How long does it take to build business credit? Unlike personal credit, which can be established relatively quickly, business credit typically. Establishing and managing business credit can help your company secure financing when you need it and with better terms. These contain your company’s credit history. Subscription services available for regular monitoring; A solid score can lead to lower rates, saving your business money in the long run. Building business credit can be a little more complicated than building personal credit. As your business grows, you’ll be able to develop and strengthen relationships with partners, vendors, and lenders—and it’s. In this article, we’ll explore how to. You can build business credit fast—even. However, many small business owners don’t know where to start or assume they need years of history to build good credit.How Long Does It Take To Build Business Credit? Self. Credit Builder.

How Long It Takes To Build Good Credit

How Long Does It Take To Build Business Credit? Self. Credit Builder.

How long does it take to build business credit? 5 steps to building

How Long Does It Take To Build Business Credit? Self. Credit Builder.

How to Build Business Credit for a Small Business

How long does it take to build Business Credit? YouTube

How Long Does It Take to Build Credit?

How Long Does it Take to Build Business Credit? YouTube

How to Build Business Credit (StepbyStep Guide) WealthFit

The Business Credit Umbrella Involves Two Terms:

The Steps Above Are Important, But There Are Many.

Keep In Mind It May Take 30 To 60 Days For New Accounts To Appear On Business Credit Reports, So The Sooner You Start, The Better!

While It Takes About 12 Months To Build Solid Business Credit And As Many As Three Years To Build A Comprehensive Credit Profile, You Can Start Building At Least Some Business.

Related Post:

/how-long-it-takes-to-build-good-credit-4767654_final-5b370f861f4f42e5975e63c6bbeb2784.gif)