How Long Does It Take To Build Equity In Home

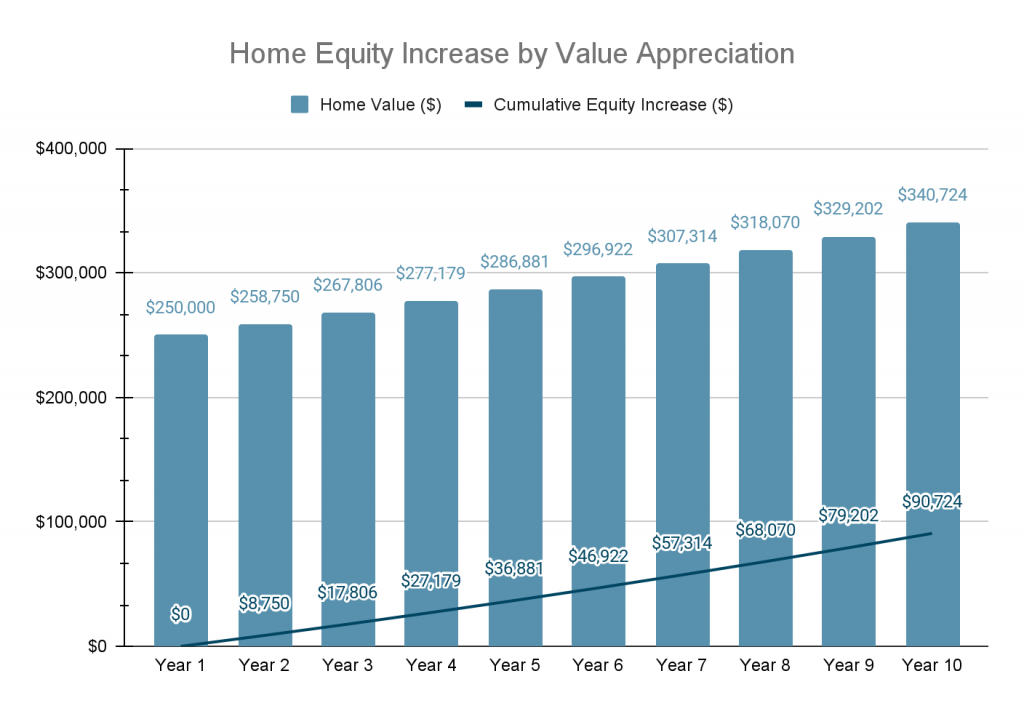

How Long Does It Take To Build Equity In Home - When property values climb higher, you will gain equity simply because your home or condo will be worth more. The length of time it takes to build equity in your home varies depending on factors such as the size of your down payment,. The truth is, it takes time and there are factors that you can’t control —. In this case, the home equity percentage is 22% ($55,000 ÷ $250,000 = 0.22). It can take five to seven years to begin paying down. Building equity takes time, but there are steps you can take to speed things along. Maybe you want to borrow from that equity to make a big purchase, pay off debt or improve. Building equity in your home is important for your financial future. For example, if your home was worth. Building equity increases the amount of money homeowners have in their homes that they may be able to use now or in the future. Learn how home equity is your net worth in a property and how it grows over time. Maybe you want to borrow from that equity to make a big purchase, pay off debt or improve. It is a transformative experience for families, bringing stability, building equity, and producing intergenerational wealth. Knowing how to build equity in. You can borrow from your equity as a loan, invest it, build long. Find out how to pay off your loan faster, benefit from home price appreciation and boost your home's value. How long does it take to build equity in your home? Home equity is a powerful financial tool that can help you build a solid foundation for your family’s wealth that can be passed on for generations. It’s as simple as that. Building equity in your home is important for your financial future. The home equity contract market is relatively small, with its total volume estimated to be between $2 billion to $3 billion, but the industry predicts the market will continue to grow. It’s as simple as that. You can borrow from your equity as a loan, invest it, build long. When property values climb higher, you will gain equity simply because. You can get rich in real estate. Plus, it usually takes four to five years for your home to increase in value enough to make it worth selling. You may not be able to control how the real estate market and home values rise and fall, but there are some steps you can take to build your home equity faster.. How long does it take to build equity in your home? How long does it take to build equity? It’s as simple as that. There are some things you can do, however, to build home equity a little. Find out how to pay off your loan faster, benefit from home price appreciation and boost your home's value. How long does it take to build equity? The truth is, it takes time and there are factors that you can’t control —. The length of time it takes to build equity in your home varies depending on factors such as the size of your down payment,. The first is to increase the value of your home, which you can. There are some things you can do, however, to build home equity a little. Learn how home equity is your net worth in a property and how it grows over time. However, home equity builds slowly, which means it can take a while before you have enough equity to qualify for a loan. It is a transformative experience for families,. It can take five to seven years to begin paying down. Plus, it usually takes four to five years for your home to increase in value enough to make it worth selling. You can borrow from your equity as a loan, invest it, build long. For example, if your home was worth. Home equity is a powerful financial tool that. How long does it take to build equity in your home? Knowing how to build equity in. It’s as simple as that. There are two primary ways that you can build equity. Building equity in your home is important for your financial future. Plus, it usually takes four to five years for your home to increase in value enough to make it worth selling. You may not be able to control how the real estate market and home values rise and fall, but there are some steps you can take to build your home equity faster. From maximizing your down payment to exploring. It is a transformative experience for families, bringing stability, building equity, and producing intergenerational wealth. To build equity requires strategic thinking, careful planning and patience. Find out how to pay off your loan faster, benefit from home price appreciation and boost your home's value. Maybe you want to borrow from that equity to make a big purchase, pay off debt. From maximizing your down payment to exploring ways to pay off your mortgage faster, we’ll share. Building equity increases the amount of money homeowners have in their homes that they may be able to use now or in the future. It can take five to seven years to begin paying down. The first is to increase the value of your. The home equity contract market is relatively small, with its total volume estimated to be between $2 billion to $3 billion, but the industry predicts the market will continue to grow. You can also divide home equity by the market value to determine your home equity percentage. It can take five to seven years to begin paying down. To build equity requires strategic thinking, careful planning and patience. There are some things you can do, however, to build home equity a little. Building equity in your home is important for your financial future. It is a transformative experience for families, bringing stability, building equity, and producing intergenerational wealth. How long does it take to build equity in your home? How long does it take to build equity? You can get rich in real estate. There are two primary ways that you can build equity. Knowing how to build equity in. Plus, it usually takes four to five years for your home to increase in value enough to make it worth selling. Find out how to pay off your loan faster, benefit from home price appreciation and boost your home's value. However, home equity builds slowly, which means it can take a while before you have enough equity to qualify for a loan. You may not be able to control how the real estate market and home values rise and fall, but there are some steps you can take to build your home equity faster.5 Things to Know About Equity in the Home

How Long Does It Take to Get a Home Equity Loan? SuperMoney

How Long Does the Home Equity Loan Approval Process Take? lwgzurn

How to Build Equity in a Home Axia Home Loans

Can You Use Home Equity to Invest? LendingTree

Know the ABC's of Home Equity North Country Savings Bank

How To Build Equity in a Home

How to Build Equity in Your Home Blog

What Home Equity Is & How to Use It Home Run Financing

Home Equity What It Is and How You Can Use It

Home Equity Is A Powerful Financial Tool That Can Help You Build A Solid Foundation For Your Family’s Wealth That Can Be Passed On For Generations.

The Homefirst Down Payment Assistance Program Will.

For Example, If Your Home Was Worth.

The Truth Is, It Takes Time And There Are Factors That You Can’t Control —.

Related Post:

:max_bytes(150000):strip_icc()/build-equity-315654_final-d5821108aaf04887820e3c0c9b176188.jpg)