How Long To Build Business Credit

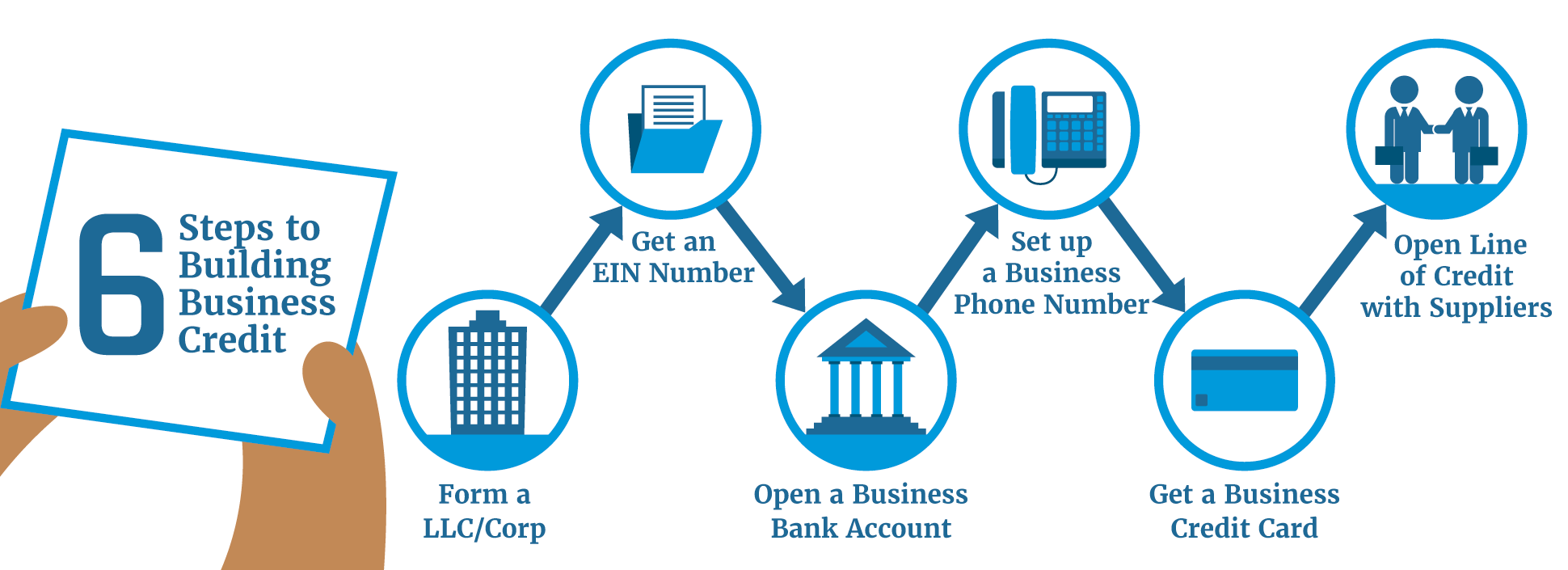

How Long To Build Business Credit - Building business credit can also help you unlock more competitive rates and terms while protecting your personal credit score. Building your credit means developing a track record of positive financial. It may only take a few months for your business to begin generating a. (or you can space them out and cover them in 22 days — just don’t let them get put on. Typically, it will take a business about three years to establish a level of credit that will support their operations for ninety days. In general, though, you can expect to need a. Once you have established your business as its own legal entity, you can start taking steps to build up its credit. A solid score can lead to lower rates, saving your business money in the long run. Establish your business as a legal entity. Building business credit might sound like a big task, but it’s really about taking a few smart steps. Establish your business as a legal entity. The first step in building business credit is to officially establish your business as a distinct legal. Once you have established your business as its own legal entity, you can start taking steps to build up its credit. Once you’ve established your business and taken out a few tradelines, you can build business credit. (or you can space them out and cover them in 22 days — just don’t let them get put on. 7 steps to build business credit. While it takes about 12 months to build solid business credit and as many as three years to build a comprehensive credit profile, you can start building at least some business. You can build business credit fast—even. Dun & bradstreet paydex score: A solid score can lead to lower rates, saving your business money in the long run. Businesses with low expenses and tactical credit. (or you can space them out and cover them in 22 days — just don’t let them get put on. We’re going to make it easy for you by giving you 11 tasks to accomplish in 11 days. Once you’ve established your business and taken out a few tradelines, you can build business. Businesses with low expenses and tactical credit. Since growing your business credit can take. In general, though, you can expect to need a. 7 steps to build business credit. Building business credit can also help you unlock more competitive rates and terms while protecting your personal credit score. Establish your business as a legal entity. Business owners can generally start to build their company’s business credit in as little as six months or as much as three years. Once you have established your business as its own legal entity, you can start taking steps to build up its credit. You can build business credit fast—even. Building business credit. Remember that building business credit takes time, so be patient and consistent in your efforts. A solid score can lead to lower rates, saving your business money in the long run. Once you’ve established your business and taken out a few tradelines, you can build business credit. Dun & bradstreet paydex score: (or you can space them out and cover. Monitor and maintain your business credit score for. The amount of credit your business is currently using compared to the credit limit extended to your business determines your utilisation. Building business credit might sound like a big task, but it’s really about taking a few smart steps. It may only take a few months for your business to begin generating. Building business credit might sound like a big task, but it’s really about taking a few smart steps. We’re going to make it easy for you by giving you 11 tasks to accomplish in 11 days. It may only take a few months for your business to begin generating a. Establishing business credit is a pretty straightforward process of following. Business owners can generally start to build their company’s business credit in as little as six months or as much as three years. (or you can space them out and cover them in 22 days — just don’t let them get put on. Monitor and maintain your business credit score for. Building your credit means developing a track record of. Typically, it will take a business about three years to establish a level of credit that will support their operations for ninety days. By following these steps and establishing a positive credit history, your llc will. A solid score can lead to lower rates, saving your business money in the long run. Establishing business credit is a pretty straightforward process. In general, though, you can expect to need a. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. (or you can space them out and cover them in 22 days — just don’t let them get put on. You. Once you have established your business as its own legal entity, you can start taking steps to build up its credit. First things first, you need to. Since growing your business credit can take. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do. Remember that building business credit takes time, so be patient and consistent in your efforts. First things first, you need to. Business owners can generally start to build their company’s business credit in as little as six months or as much as three years. The first step in building business credit is to officially establish your business as a distinct legal. Businesses with low expenses and tactical credit. By following these steps and establishing a positive credit history, your llc will. Here’s how i got started: Once you’ve established your business and taken out a few tradelines, you can build business credit. Building business credit can also help you unlock more competitive rates and terms while protecting your personal credit score. However, many small business owners don’t know where to start or assume they need years of history to build good credit. You can build business credit fast—even. Building your credit means developing a track record of positive financial. In general, though, you can expect to need a. Building business credit might sound like a big task, but it’s really about taking a few smart steps. We’re going to make it easy for you by giving you 11 tasks to accomplish in 11 days. A solid score can lead to lower rates, saving your business money in the long run.Detailed step by step of how to build business credit Paper & Party

How to Build Business Credit for Lowest Cost of Capital BNC Finance

How to Build Business Credit (StepbyStep Guide) WealthFit

How Long Does It Take To Build Business Credit? Self. Credit Builder.

How Long Does it Take to Build Business Credit? YouTube

How to build business credit in 10 steps QuickBooks

How to Build Business Credit for a Small Business

How Long Does It Take To Build Business Credit? Self. Credit Builder.

How To Build Credit For Your Business Behalfessay9

How Long It Takes To Build Good Credit

Establish Your Business As A Legal Entity.

While It Takes About 12 Months To Build Solid Business Credit And As Many As Three Years To Build A Comprehensive Credit Profile, You Can Start Building At Least Some Business.

Generally Speaking, Businesses Take Around Three Years To Build A Comprehensive Credit Profile And About One Year For Solid.

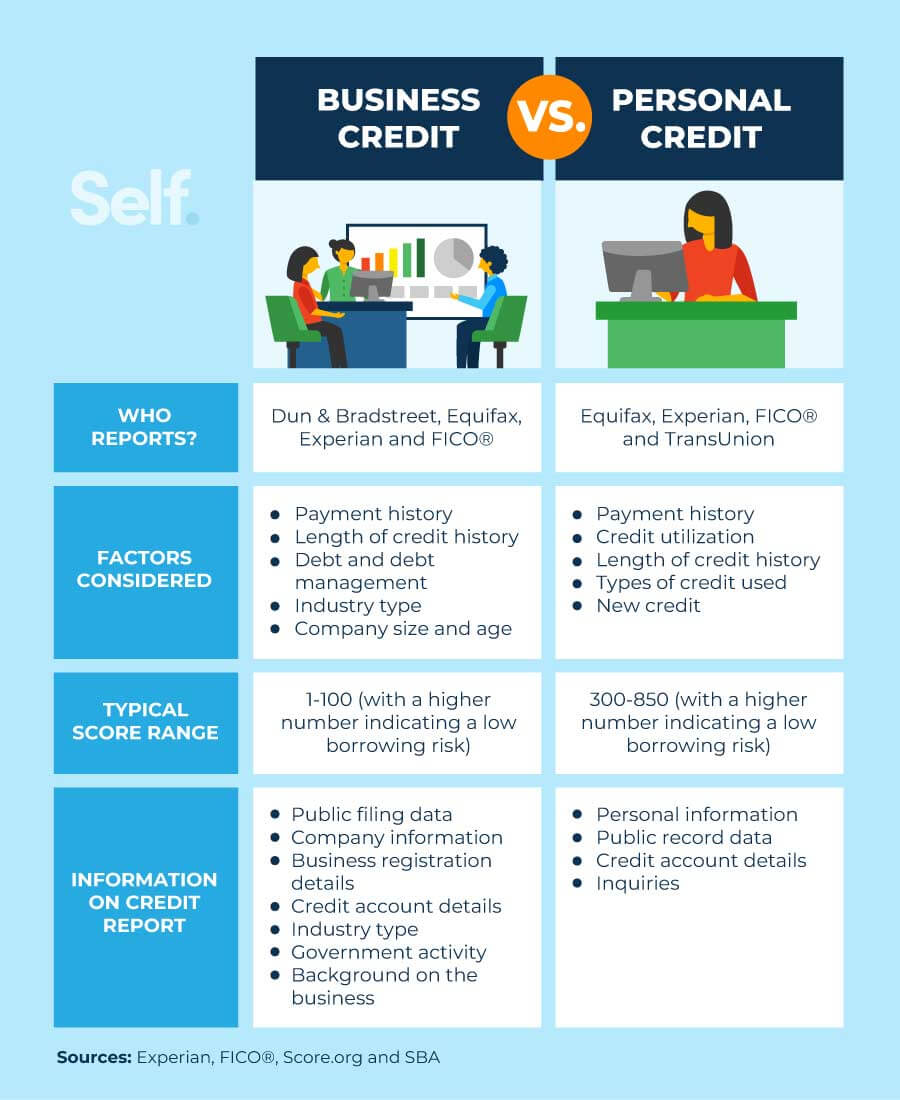

The Major Business Credit Bureaus Offer Unique Scoring Models:

Related Post:

/how-long-it-takes-to-build-good-credit-4767654_final-5b370f861f4f42e5975e63c6bbeb2784.gif)