How Much Building Property Coverage Do I Need For Condo

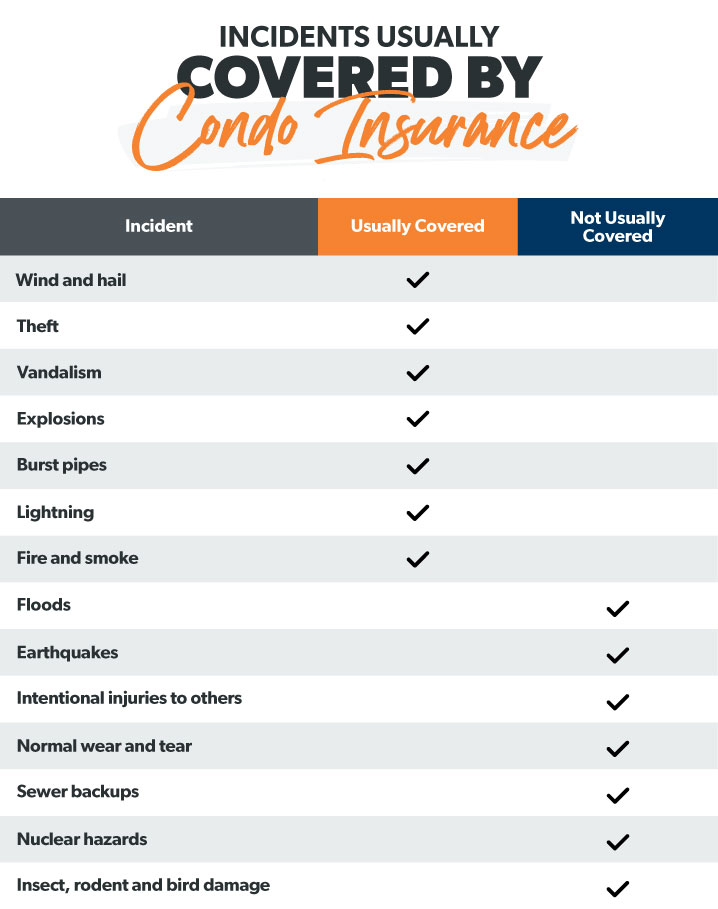

How Much Building Property Coverage Do I Need For Condo - Determining the right amount of building property coverage for your condo requires careful consideration of several factors, including the age and condition of the building, location,. To get started, you should have an idea of how much coverage you need to estimate how much condo insurance you should buy. What your h o a’s policy covers. Your own rate will differ depending on where you live and how much coverage you need. Between the master policy of your condo. However, this can be misleading given that construction costs vary depending on. This average is based on a standard policy that includes $60,000 in personal property. As a rule of thumb, dwelling coverage should account for 20% of your condo’s value. It's important to consider several factors, including the value of your condo, the cost to replace. Is $455 per year, according to. Determining the right amount of condo insurance coverage can be a complex process. Condo insurance costs vary based on the amount and value of the personal possessions you own. How much dwelling coverage do you need? Condo insurance can also help cover legal costs if you’re found responsible for a. Ensure it can cover the full cost of rebuilding your condo. However, this can be misleading given that construction costs vary depending on. Between the master policy of your condo. What are you responsible for vs. To calculate the amount of dwelling coverage needed for your condo, consider factors such as the square footage of your unit, the cost of rebuilding or repairing structural. Determining the right amount of building property coverage for your condo requires careful consideration of several factors, including the age and condition of the building, location,. It's important to consider several factors, including the value of your condo, the cost to replace. The average cost of condo insurance in the u.s. On average, condo insurance costs about $656 per year or roughly $55 per month. Condo insurance costs vary based on the amount and value of the personal possessions you own. What are you responsible for. Your own rate will differ depending on where you live and how much coverage you need. To calculate the amount of dwelling coverage needed for your condo, consider factors such as the square footage of your unit, the cost of rebuilding or repairing structural. To determine the right amount of dwelling coverage for your condo, follow these steps: What are. Your own rate will differ depending on where you live and how much coverage you need. Is $455 per year, according to. The average cost of insuring a new condo is between $100 and $400 a. Navigating the complexities of insurance coverage for homeowner associations (hoas) and condominium associations can be daunting. To calculate the amount of dwelling coverage needed. As a rule of thumb, dwelling coverage should account for 20% of your condo’s value. How much dwelling coverage do you need? Before you buy, take the following 5 things into consideration when estimating your condo insurance needs: The average cost of insuring a new condo is between $100 and $400 a. Read on to find out how to calculate. Ensure it can cover the full cost of rebuilding your condo. The average cost of insuring a new condo is between $100 and $400 a. Read on to find out how to calculate how much condo insurance you need and what factors play into pricing while you review your estimated condo insurance rates. Determining the right amount of building property. How much dwelling coverage do you need? It's important to consider several factors, including the value of your condo, the cost to replace. Before you buy, take the following 5 things into consideration when estimating your condo insurance needs: Determining the right amount of building property coverage for your condo requires careful consideration of several factors, including the age and. This average is based on a standard policy that includes $60,000 in personal property. To get started, you should have an idea of how much coverage you need to estimate how much condo insurance you should buy. Condo insurance costs vary based on the amount and value of the personal possessions you own. How much dwelling coverage do you need?. The average cost of condo insurance in the u.s. As a rule of thumb, dwelling coverage should account for 20% of your condo’s value. Should be enough to replace all your belongings. Ensure it can cover the full cost of rebuilding your condo. Between the master policy of your condo. What are you responsible for vs. Before you buy, take the following 5 things into consideration when estimating your condo insurance needs: It's important to consider several factors, including the value of your condo, the cost to replace. This average is based on a standard policy that includes $60,000 in personal property. The amount you need depends on the type. This average is based on a standard policy that includes $60,000 in personal property. As a rule of thumb, dwelling coverage should account for 20% of your condo’s value. Read on to find out how to calculate how much condo insurance you need and what factors play into pricing while you review your estimated condo insurance rates. Find the average. To determine the right amount of dwelling coverage for your condo, follow these steps: Find the average rebuild cost: As a rule of thumb, dwelling coverage should account for 20% of your condo’s value. It's important to consider several factors, including the value of your condo, the cost to replace. Should be enough to replace all your belongings. Condo insurance can also help cover legal costs if you’re found responsible for a. Read on to find out how to calculate how much condo insurance you need and what factors play into pricing while you review your estimated condo insurance rates. The average cost of insuring a new condo is between $100 and $400 a. Navigating the complexities of insurance coverage for homeowner associations (hoas) and condominium associations can be daunting. Is $455 per year, according to. Your own rate will differ depending on where you live and how much coverage you need. Ensure it can cover the full cost of rebuilding your condo. The average cost of condo insurance in the u.s. Condo insurance costs vary based on the amount and value of the personal possessions you own. What your h o a’s policy covers. This average is based on a standard policy that includes $60,000 in personal property.Do Condos Need Homeowners Insurance? Real Estate Info Guide

Condo insurance coverage guide Condo insurance, Homeowners insurance

Average Condo Insurance Costs Trusted Choice

What Does Dwelling Mean In Condo Insurance at Amber Learned blog

How Condo Insurance Protects You & Why You Need It

Your Guide to Condo (HO6) Insurance Ramsey

How Much Condo Insurance Do I Need? Ramsey

How Much Dwelling Coverage Do I Need for A Condo? (2021)

How Much Condo Insurance Do I Need? Ramsey

How Much Coverage Do I Need for Condo Insurance? The Ostic Group

Determining The Right Amount Of Building Property Coverage For Your Condo Requires Careful Consideration Of Several Factors, Including The Age And Condition Of The Building, Location,.

What Are You Responsible For Vs.

Condo Insurance Covers The Property In Your Condo Unit, Like Your Belongings And Appliances.

To Get Started, You Should Have An Idea Of How Much Coverage You Need To Estimate How Much Condo Insurance You Should Buy.

Related Post: