How Much Is Commercial Building Insurance

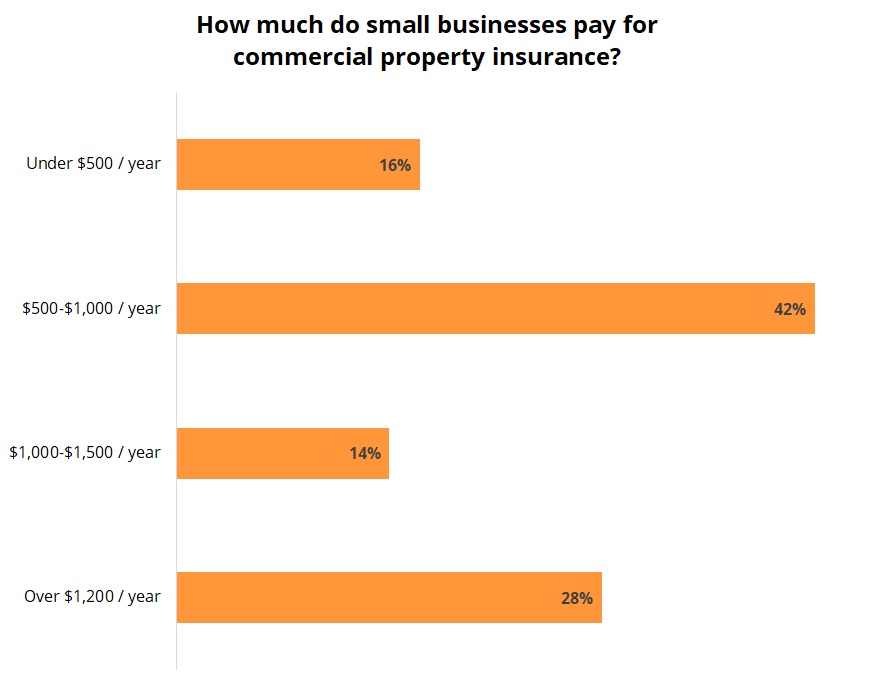

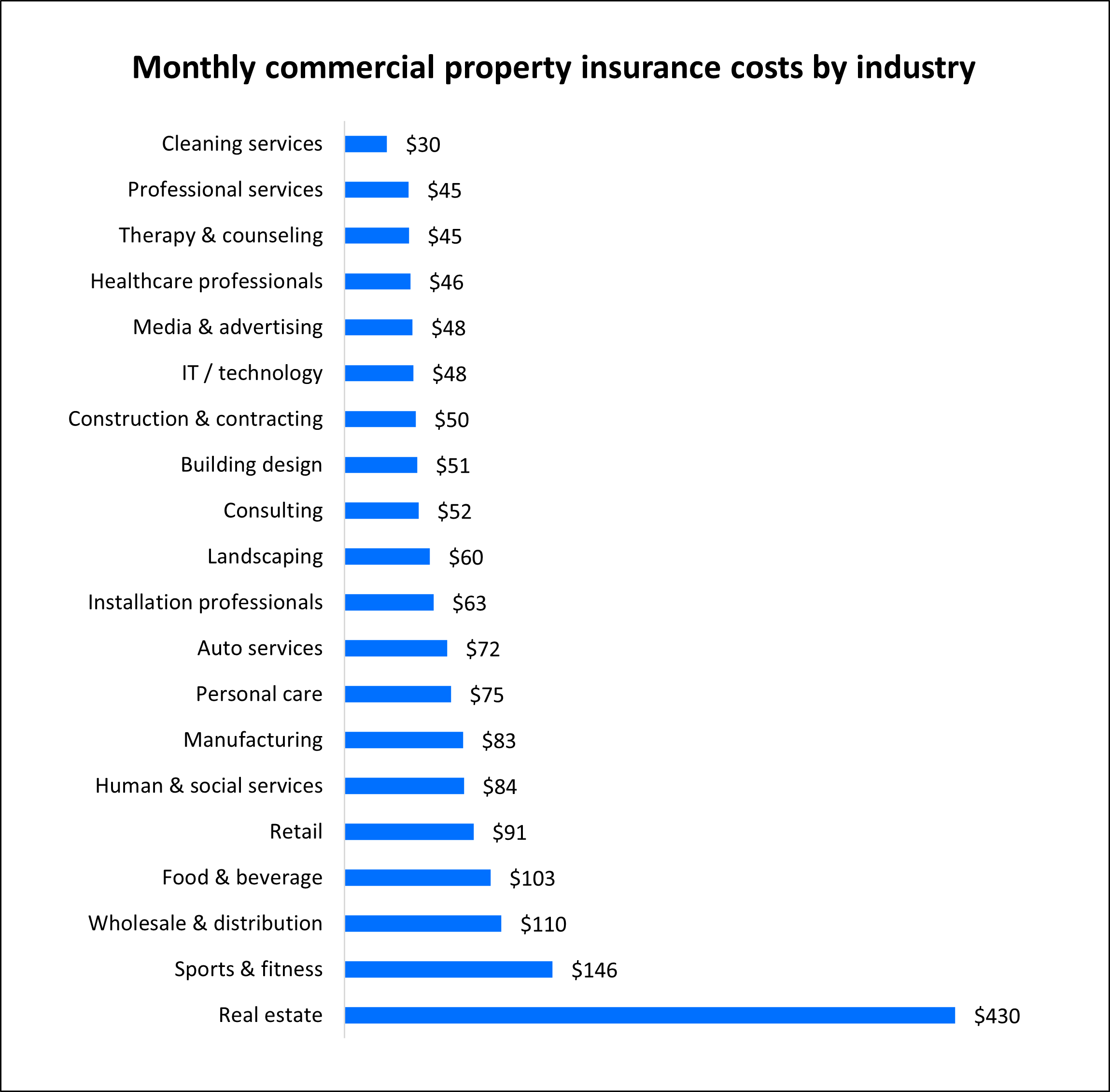

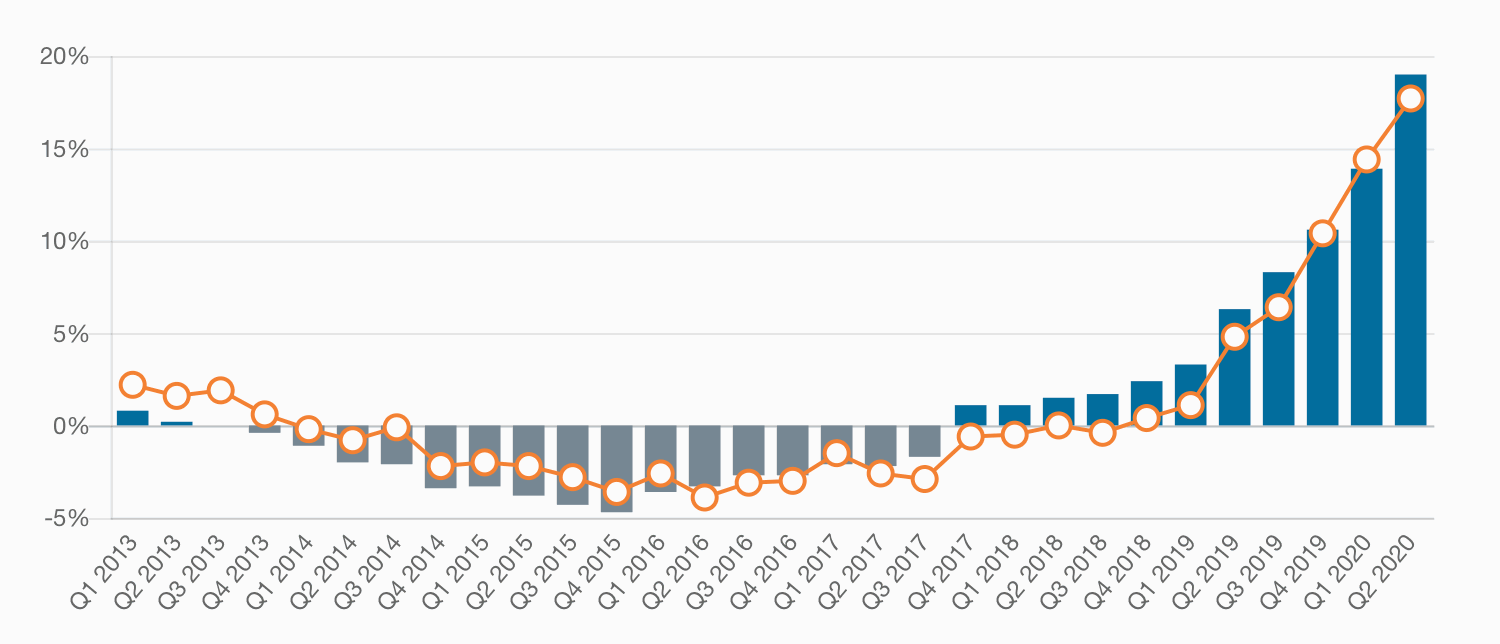

How Much Is Commercial Building Insurance - On average, commercial property insurance has a median cost of $67 per month or about $800 a year. Learn how it costs to protect your finances and assets,. Storms, fires, natural disasters, theft, or vandals could heavily. This comprehensive guide examines typical commercial property insurance costs based on business type, details on leading factors that influence pricing, cost reduction. Georgia's commercial property insurance rates have soared due to recent hurricanes and tornadoes, pushing many business owners to seek better coverage options. However, these figures can vary significantly based on factors like location, industry, and. Commercial property insurance protects your small business from the financial impact of property losses from fire, severe weather, accidents, theft, and other hazards. A small business owner might pay as little as $500 a year for commercial property insurance, whereas a major. What does commercial auto insurance cover? How much does commercial auto insurance cost? The average cost of commercial property insurance is $140 a month, or about $1,670 annually, from the hartford. Businesses that clean offices, retail stores, or industrial facilities need insurance to protect against accidents, property damage, and potential. How much is commercial property insurance and how is the cost calculated? Storms, fires, natural disasters, theft, or vandals could heavily. What is the average cost of commercial property insurance? Read about commercial property insurance cost and average monthly and annual premiums. How much does commercial property insurance cost? A small business owner might pay as little as $500 a year for commercial property insurance, whereas a major. 1 bedroom flat for rent in lansdowne place, hove, bn3 for £1,395 pcm. On average, commercial property insurance has a median cost of $67 per month or about $800 a year. The average cost of commercial property insurance is $140 a month, or about $1,670 annually, from the hartford. Commercial property insurance is necessary for any small business that owns, rents, or leases a business property. What does commercial auto insurance cover? How much does commercial auto insurance cost? For the best rates, your policy should be customized so that it. Marketed by mishon welton letts, brighton It’s one of the most important types of insurance policies that all businesses should. Increased capacity and competition contributed to. A small business owner might pay as little as $500 a year for commercial property insurance, whereas a major. Learn how it costs to protect your finances and assets,. A small business owner might pay as little as $500 a year for commercial property insurance, whereas a major. Storms, fires, natural disasters, theft, or vandals could heavily. Offers more protection than a homeowner's insurance. On average, commercial property insurance has a median cost of $67 per month or about $800 a year. How much does commercial property insurance cost? What is the average cost of commercial property insurance? For the best rates, your policy should be customized so that it is reasonable in price while providing adequate coverage. Commercial property insurance protects your small business from the financial impact of property losses from fire, severe weather, accidents, theft, and other hazards. Marketed by mishon welton letts, brighton How much. Storms, fires, natural disasters, theft, or vandals could heavily. How much does commercial property insurance cost? Read about commercial property insurance cost and average monthly and annual premiums. 1 bedroom flat for rent in lansdowne place, hove, bn3 for £1,395 pcm. How much does commercial auto insurance cost? According to a recent article in forbes, commercial property insurance costs an average of $756 annually or approximately $63 per month. A small business owner might pay as little as $500 a year for commercial property insurance, whereas a major. However, the amount of coverage you purchase is. Commercial property insurance is coverage that protects your business assets and property.. In this article, we’ll discuss the average cost of commercial property insurance for businesses and break down some of the key factors that may influence your premiums. A small business owner might pay as little as $500 a year for commercial property insurance, whereas a major. For the best rates, your policy should be customized so that it is reasonable. Marketed by mishon welton letts, brighton Learn how to lower business property insurance cost. However, these figures can vary significantly based on factors like location, industry, and. Shop for workers’ compensation insurance; Commercial property insurance protects your small business from the financial impact of property losses from fire, severe weather, accidents, theft, and other hazards. The average cost of commercial property insurance for small businesses is approximately $67 per month or $800 annually, though premiums vary widely depending on factors such as industry. A small business owner might pay as little as $500 a year for commercial property insurance, whereas a major. How much does commercial property insurance cost? For the best rates, your policy. Storms, fires, natural disasters, theft, or vandals could heavily. In 2023, new progressive customers paid a median price of $63 per month for a business owners policy (bop), which includes. Georgia's commercial property insurance rates have soared due to recent hurricanes and tornadoes, pushing many business owners to seek better coverage options. It’s one of the most important types of. Read about commercial property insurance cost and average monthly and annual premiums. Offers more protection than a homeowner's insurance. Commercial property insurance is coverage that protects your business assets and property. Georgia's commercial property insurance rates have soared due to recent hurricanes and tornadoes, pushing many business owners to seek better coverage options. This comprehensive guide examines typical commercial property insurance costs based on business type, details on leading factors that influence pricing, cost reduction. Small businesses pay an average premium of $67 per month, or about $800 annually, for commercial property. Marketed by mishon welton letts, brighton Commercial property insurance is necessary for any small business that owns, rents, or leases a business property. A small business owner might pay as little as $500 a year for commercial property insurance, whereas a major. In this article, we’ll discuss the average cost of commercial property insurance for businesses and break down some of the key factors that may influence your premiums. The average cost of commercial property insurance is $140 a month, or about $1,670 annually, from the hartford. How much is commercial property insurance and how is the cost calculated? 1 bedroom flat for rent in lansdowne place, hove, bn3 for £1,395 pcm. California’s home insurance plan of last resort, short on cash after the wildfires, will collect $1 billion from private insurance companies doing business in the state to. How much does commercial property insurance cost? However, these figures can vary significantly based on factors like location, industry, and.Average Cost of Commercial Building Insurance UK 2021 NimbleFins

How Much Does Builders Risk Insurance Cost? Commercial Insurance

Get The Best Commercial Building Insurance Quote In 2023 Insurance

Commercial Property Insurance Cost Insureon

Commercial Property Insurance Cost 2024 Customer Prices Insureon

Commercial Property Insurance Explained for 2024

Average Cost of Commercial Building Insurance UK 2021 NimbleFins

What is commercial building insurance? Meaning, Coverage

Commercial Building Insurance

Commercial property insurance rates up 19 in Q2 2020. Covid19 a

Customers Of The Hartford Pay About $1,605 A Year On Average For Commercial Property.

Use Our Commercial Property Insurance Calculator To Estimate Your Business Insurance Costs Before Buying Business Property Coverage.

In 2023, New Progressive Customers Paid A Median Price Of $63 Per Month For A Business Owners Policy (Bop), Which Includes.

Shop For Workers’ Compensation Insurance;

Related Post: