How To Build A Dcf Model

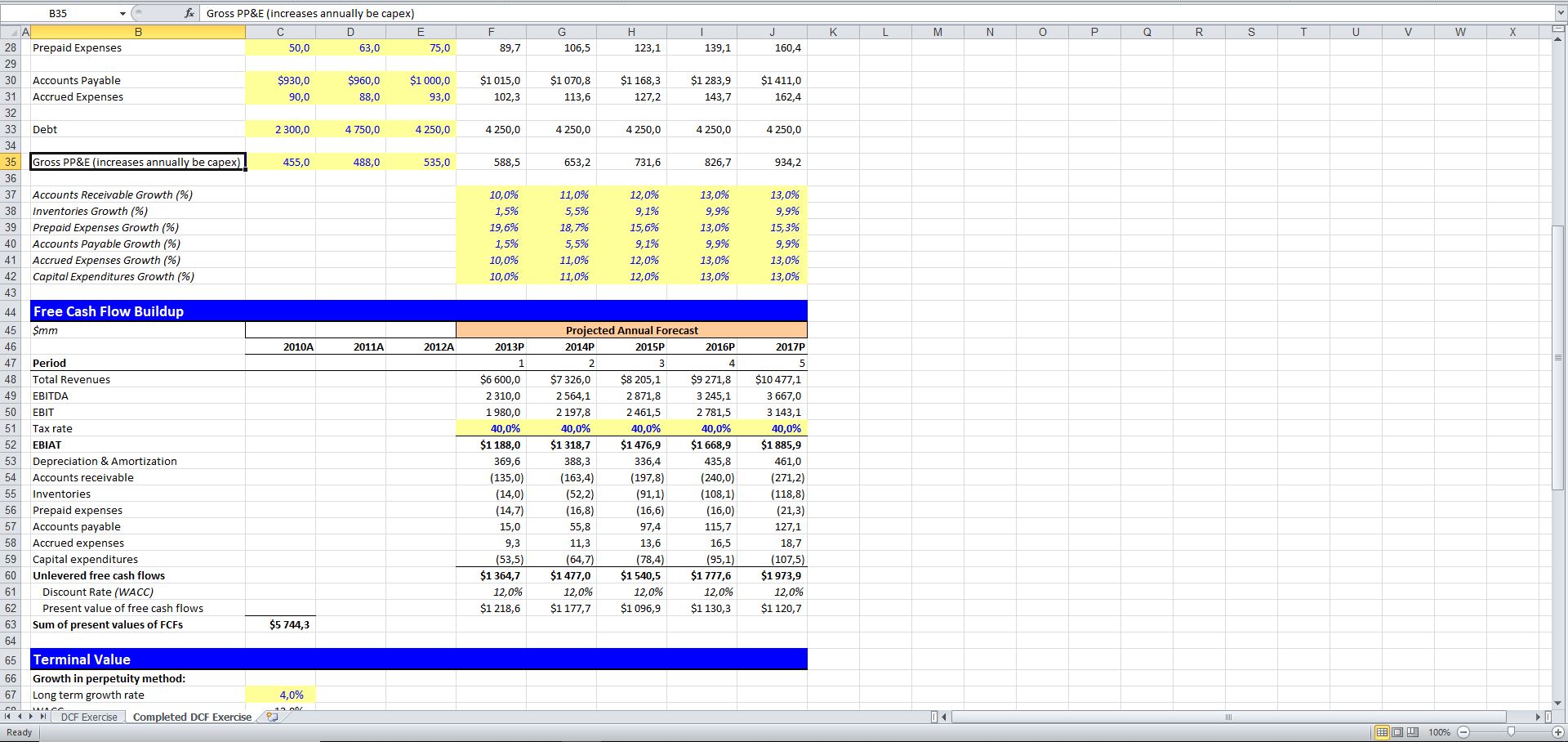

How To Build A Dcf Model - In these coming 8 steps, you will be able to perform your own dcf analysis. A discounted cash flow model (“dcf model”) is a specific type of financial model used to value a business. Dcf models are generally created by investors or analysts to determine if the company’s stock is overvalued or undervalued at its current market price. Constructing a real estate dcf model involves forecasting cash flows, discounting them to present value, and summarizing the valuation. Since companies or projects are often expected to generate cash flows indefinitely, the dcf model accounts for the value of these future cash flows beyond the. It values a company by forecasting. Up to 3.2% cash back the basic building block of a dcf model is the 3 statement financial model, which links the financial statements together. While building a dcf model can be complex, understanding each step thoroughly can help you accurately assess a company's intrinsic value. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. This template allows you to build your own discounted cash flow model with different assumptions. This dcf model training guide will take. Excel will calculate the present value for you, making it easy to see how much. Making appropriate assumptions and drivers 4. A discounted cash flow model (“dcf model”) is a specific type of financial model used to value a business. While building a dcf model can be complex, understanding each step thoroughly can help you accurately assess a company's intrinsic value. Constructing a real estate dcf model involves forecasting cash flows, discounting them to present value, and summarizing the valuation. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. Since companies or projects are often expected to generate cash flows indefinitely, the dcf model accounts for the value of these future cash flows beyond the. In this guide, we'll provide you with. We can express this formulaically as the following (we denote the. Download wso's free discounted cash flow (dcf) model template below! Begin by opening a new worksheet and labelling it properly. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. We will explain the concept behind and give you a step by step. A discounted cash flow (dcf) model is a financial model used to value companies by discounting their future cash flow to the present value. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. How to set up your model. This template allows. Excel will calculate the present value for you, making it easy to see how much. Download wso's free discounted cash flow (dcf) model template below! We will explain the concept behind and give you a step by step walkthrough on how to set up your spreadsheet and formulas to calculate the value of a business. This dcf model training guide. It values a company by forecasting. Begin by opening a new worksheet and labelling it properly. This dcf model training guide will take. Constructing a real estate dcf model involves forecasting cash flows, discounting them to present value, and summarizing the valuation. A discounted cash flow model (“dcf model”) is a specific type of financial model used to value a. Create sections for historical financial data, projections,. The dcf approach requires that we forecast a company’s future cash flows and discount them to the present to arrive at a present value for the company. In this guide, we'll take you. ### insights from different perspectives. Begin by opening a new worksheet and labelling it properly. How to set up your model. Download wso's free discounted cash flow (dcf) model template below! Since companies or projects are often expected to generate cash flows indefinitely, the dcf model accounts for the value of these future cash flows beyond the. A discounted cash flow model (“dcf model”) is a specific type of financial model used to value a. Apply this formula to each year in your spreadsheet under the discounted cash flow column. A discounted cash flow model (“dcf model”) is a specific type of financial model used to value a business. In these coming 8 steps, you will be able to perform your own dcf analysis. Create sections for historical financial data, projections,. Excel will calculate the. Create sections for historical financial data, projections,. Since companies or projects are often expected to generate cash flows indefinitely, the dcf model accounts for the value of these future cash flows beyond the. Excel will calculate the present value for you, making it easy to see how much. Download wso's free discounted cash flow (dcf) model template below! Dcf modeling. Dcf models are generally created by investors or analysts to determine if the company’s stock is overvalued or undervalued at its current market price. While building a dcf model can be complex, understanding each step thoroughly can help you accurately assess a company's intrinsic value. This dcf model training guide will take. Making appropriate assumptions and drivers 4. Download wso's. Constructing a real estate dcf model involves forecasting cash flows, discounting them to present value, and summarizing the valuation. ### insights from different perspectives. This template allows you to build your own discounted cash flow model with different assumptions. Making appropriate assumptions and drivers 4. Dcf modeling helps us quantify this time value and assess whether an investment is undervalued. Constructing a real estate dcf model involves forecasting cash flows, discounting them to present value, and summarizing the valuation. That present value is the amount investors should be willing to pay (the company’s value). Begin by opening a new worksheet and labelling it properly. Dcf modeling helps us quantify this time value and assess whether an investment is undervalued or overvalued. Since companies or projects are often expected to generate cash flows indefinitely, the dcf model accounts for the value of these future cash flows beyond the. Making appropriate assumptions and drivers 4. This template allows you to build your own discounted cash flow model with different assumptions. In these coming 8 steps, you will be able to perform your own dcf analysis. How a dcf model works? It values a company by forecasting. ### insights from different perspectives. We can express this formulaically as the following (we denote the. While building a dcf model can be complex, understanding each step thoroughly can help you accurately assess a company's intrinsic value. We will explain the concept behind and give you a step by step walkthrough on how to set up your spreadsheet and formulas to calculate the value of a business. A discounted cash flow (dcf) model is a financial model used to value companies by discounting their future cash flow to the present value. A discounted cash flow model (“dcf model”) is a specific type of financial model used to value a business.Discounted Cash Flow Model Template, Below is a preview of the dcf

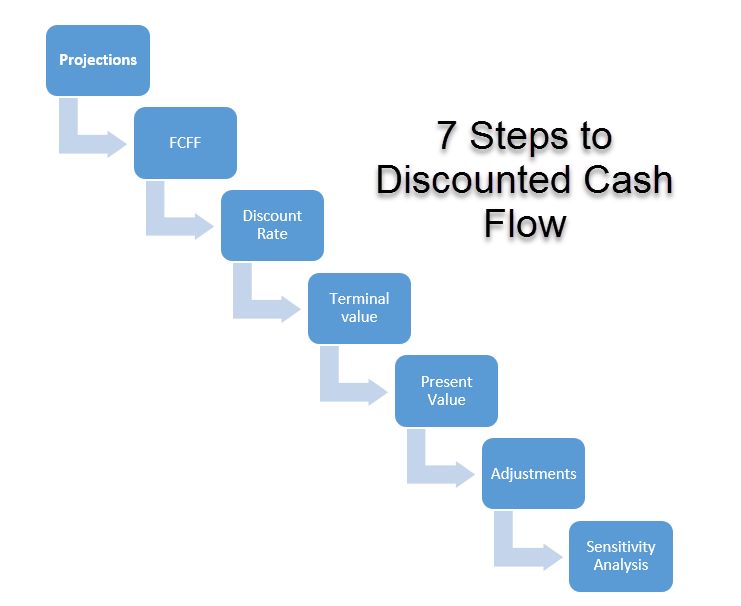

Discounted Cash Flow DCF Valuation Model (7 Steps)

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

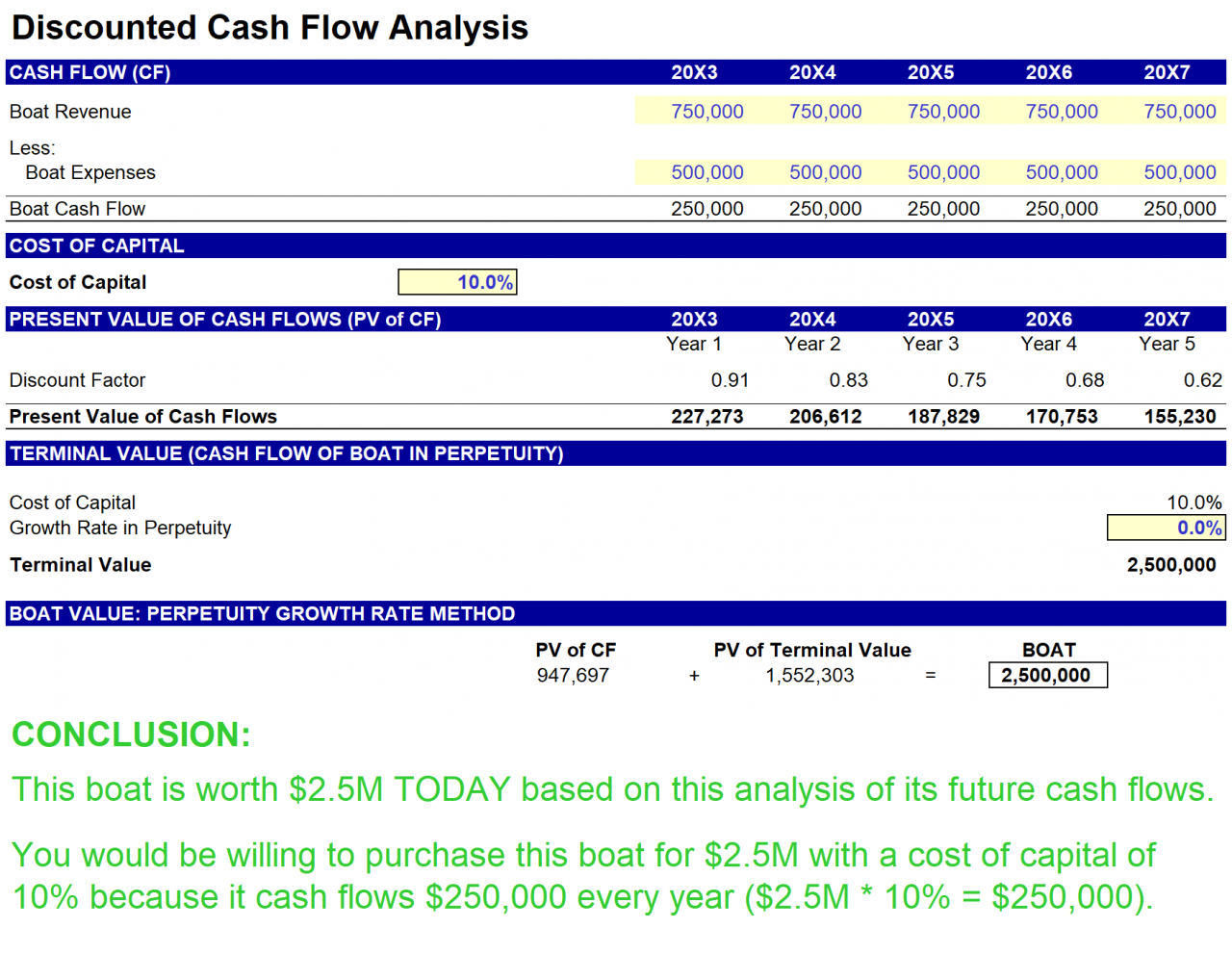

DCF model tutorial with free Excel

Discounted Cash Flow Model Template, Below is a preview of the dcf

DCF Model The Complete Guide to Building a Discounted Cash Flow Model

Discounted Cash Flow Model A Simple Model

DCF Model Training The Ultimate Free Guide to DCF Models

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

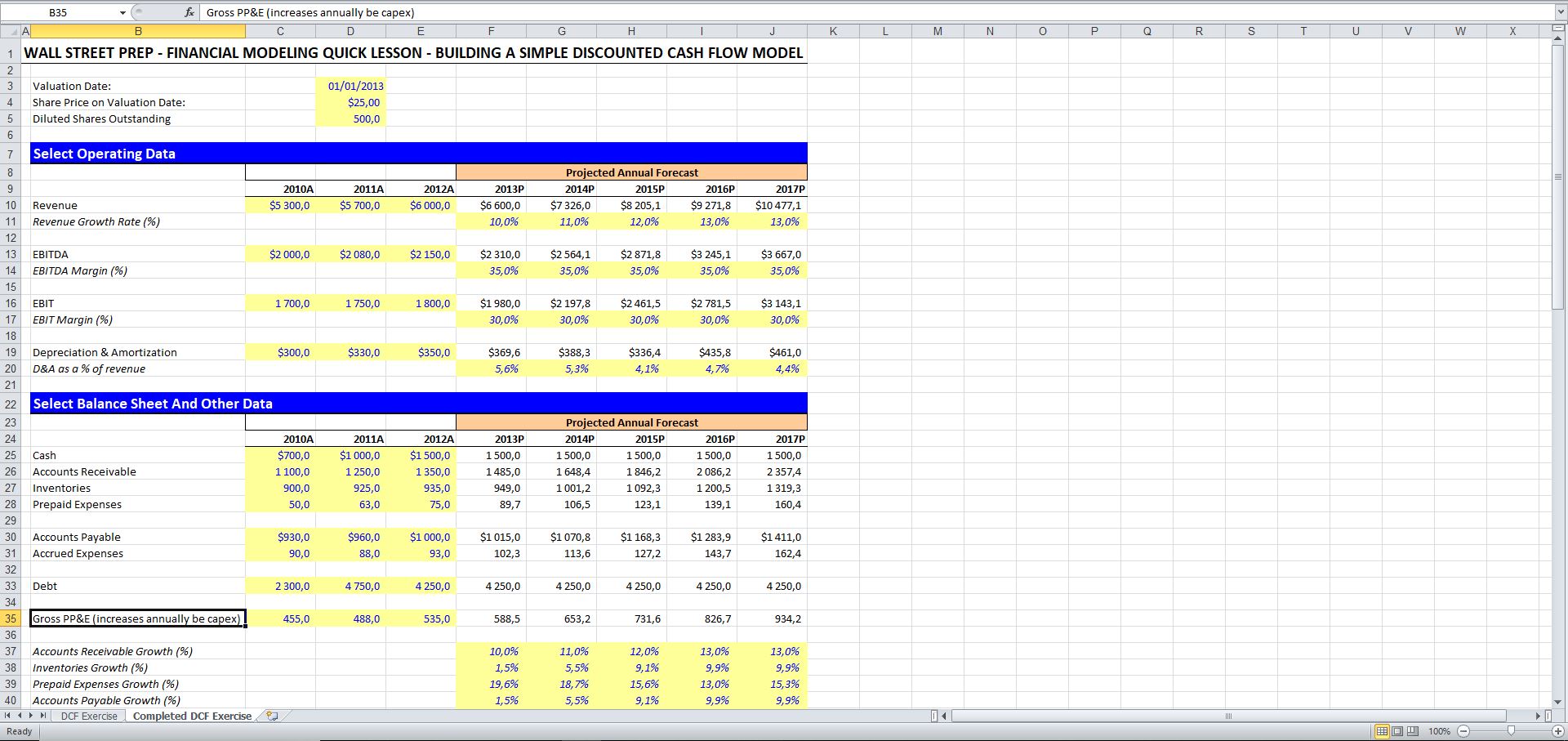

Financial Modeling Quick Lesson Building a Discounted Cash Flow (DCF

Calculating Historical Financial Ratios 3.

What Is Dcf Financial Model?

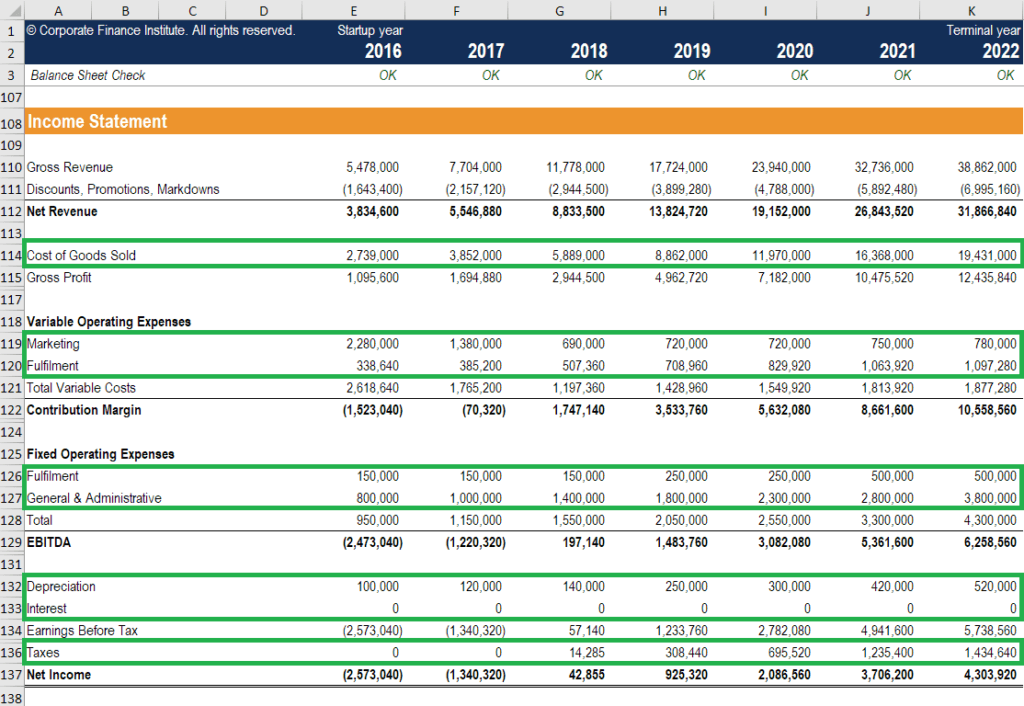

Create Sections For Historical Financial Data, Projections,.

How To Set Up Your Model.

Related Post: